Upward Trend in Land Values Continues

August 1, 1989

PAER-1989-1

Authors: J.H. Atkinson, Professor of Agricultural Economics, and Kim Cook

Note: The charts in this article were taken from physical copy scans – as the original documents no longer exist. These versions are very blurry – we apologize in advance for the quality.

During the early years of the 1981-87 decline in Indiana land values, there were reports of decreasing numbers of sales and increasing amounts of land for sale. This situation was reversed about 1987 and continues today as indicated by a majority of Purdue land values survey respondents who believe there is Jess land on the market now than a year ago and that sales have picked up. The same or less land on the market and an increase in the number of land transfers are the conditions that tend to accompany an increase in land values. The June 1989 Purdue survey indicates that land values have continued to increase.

Statewide Land Prices

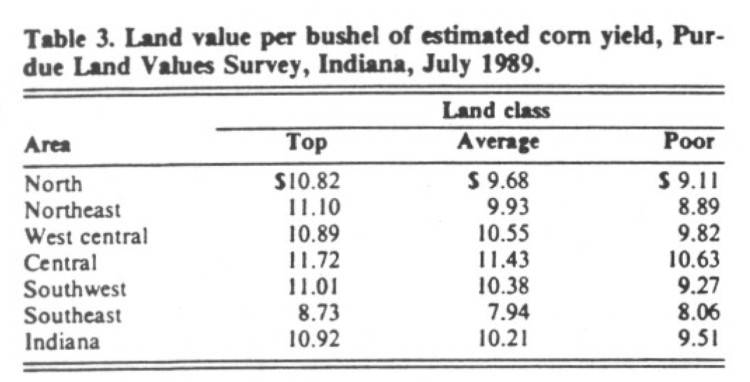

The survey showed statewide average increases for the 6 months ending in June 1989 of 5.3 percent on top land, 4.8 percent on average land, and 4.5 percent on poor land (Table 1). These increases are slightly less than were reported for the same period a year ago. Two-thirds of the respondents reported that most classes of land increased during the 6-month period, under 3 percent reported declines, and about 30 percent felt there was no change in land values. Last year, 70 percent of the respondents indicated increases in land values and 24 percent thought they had been stable.

Table 1. Average estimated land value per acre (tillable, bare land) and percentage change by geographic area and land class, selected time periods; Purdue Land Survey, Indiana, July 1989

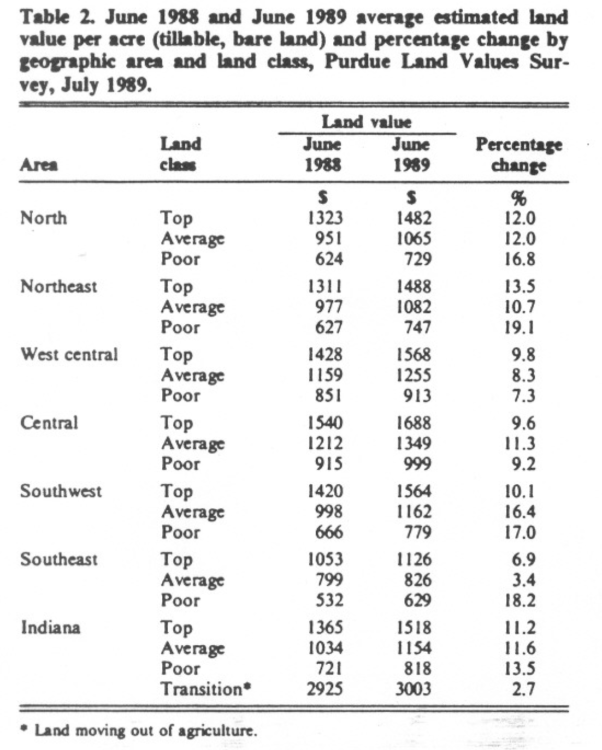

The statewide increase in value for the year ending in June 1989 was 11.2 percent on top land, 11.6 percent on average land, and 13.5 percent on poor land (Table 2). Like the 6-month increases, top and average land increases this year were a few percentage points less than last year; however, poor land was a little stronger this year than last.

Table 2. June 1988 and June 1989 average estimated area land value per acre (tillable, bare land) and percentage change by geographic area and land class, Purdue Land Survey, July 1989

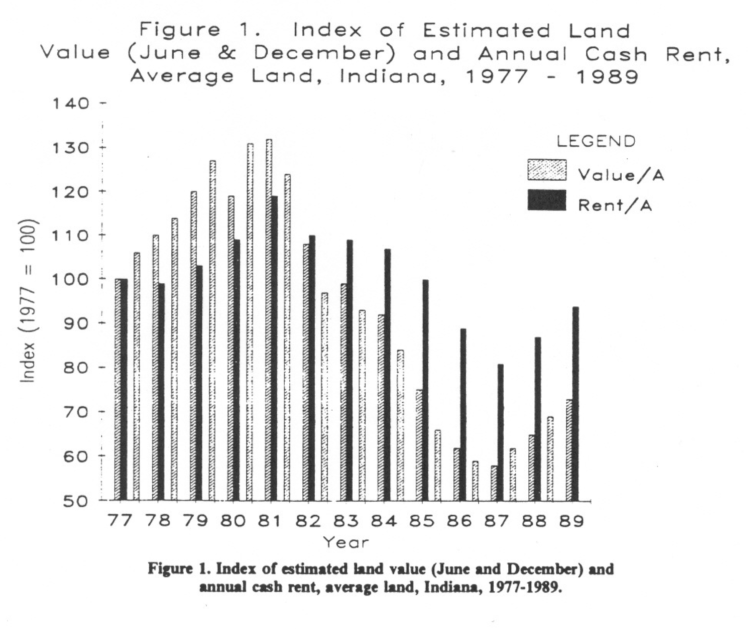

Figure 1. Index of estimated land value (June and December) and annual cash rent, average land, Indiana, 1977-1989.

This is the second year of a recovery in land values from the recent low levels of 1987. Purdue survey figures indicated that average land values in June 1989 were 26 percent above the levels of 1987. The percentage increase was about the same for top and poor land. Average land values are now about 55 percent of their 1981 peak (Figure 1). From 1977 to 1981, land values increased 32 percent while cash rents went up only 19 percent. The statewide decline in land values from the peak to 1987 was 56 percent (average land) versus 32 percent for cash rent. Since 1987, rent has increased 16 percent, and land has gone up 26 percent.

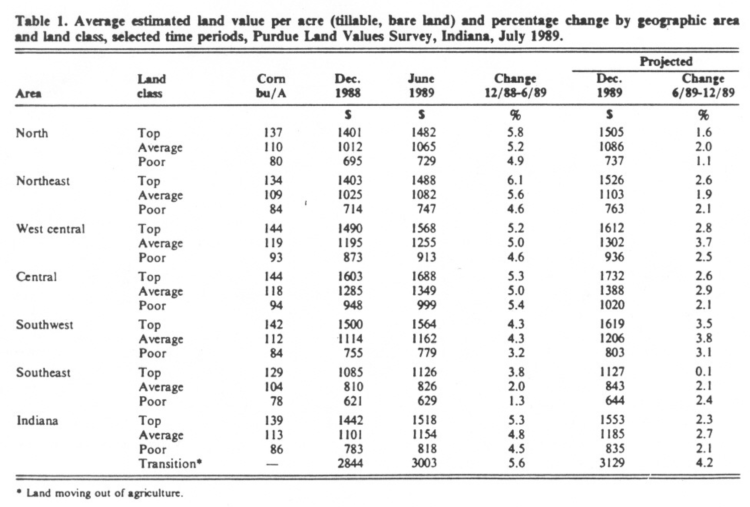

Statewide, land with an estimated long term corn yield of 139 bushels per acre had an average estimated value of $1,518 per acre (Table 1) or $10.92 per bushel (Table 3). Average land (113-bushel yield) was valued at $1,154 per acre, while the 86-bushel poor land was estimated to be worth $818 per acre. Land values per bushel-of-yield estimate were $10.21 on average land and $9.51 on poor land. These per bushel figures have increased in each of the past 2 years by around a dollar a bushel.

Transition land (that moving into nonfarm uses) was estimated to have a value of $3,003 per acre in June 1989, up 5.6 percent for the 6 months ending in June (Table 1). The 6-month change probably is a better indication of the strength in these land values than the 2.7 percent increase for the 12-month period (Table 2). Only 43 percent of the respondents report on transition land values, the range in estimates is quite wide, and the reliability of the averages is not as good as with farmland.

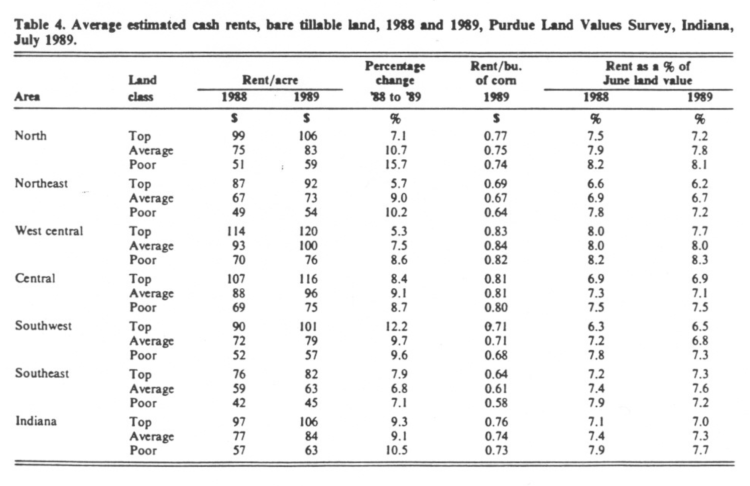

Statewide Rents Increase

Cash rents increased statewide from 1988 to 1989 by about 9 percent on top and average land and nearly 10.5 percent on poor land (Table 4). The estimate for average land was $84 per acre. Rent per bushel of estimated yield was 76¢, 74c and 73¢ respectively for top, average, and poor land or 5¢ to 7¢ more than the 1988 estimates. Cash rents were still 21 percent below 1981 levels.

Table 4: Average estimated cash rents, bare tillable land, 1988 and 1989, Land Values Survey, Indiana, July 1989

Cash rent as a percent of estimated land value declined slightly for the second year in a row (Table 4). This state average figure is 7 percent for top land, 7.3 percent for average land, and 7.7 percent for poor quality land. Ten years ago, the $88 rent reported for average cropland was only 4.8 percent of the estimated value of that quality land.

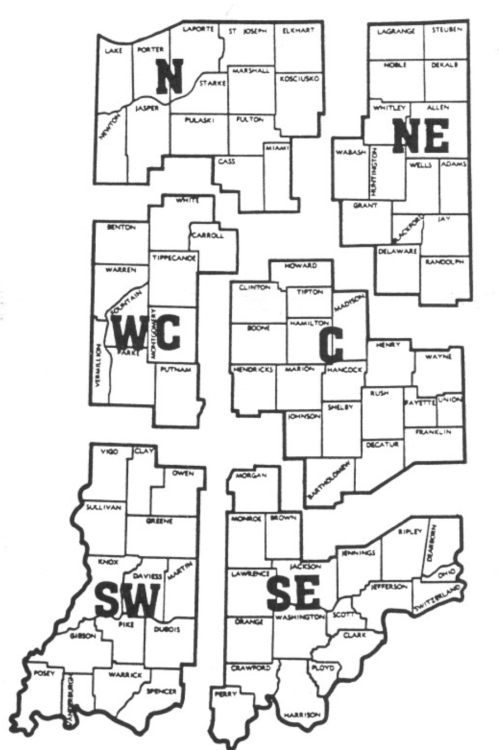

Area Estimates

Farmland value increases from December 1988 to June 1989 were mostly 5 percent to 6 percent in the north and the two central areas (Figure 2) and 4.3 percent or less in the southern areas.

For the year ending June 1989, top and average quality land in the north, northeast, and both central areas increased in a range of 8.3 to 13.5 percent (Table 2). Top land in the southwest was within this range, but average and poor lands were up much more sharply, 16 to 17 percent. Increases of this magnitude were reported for poor land in several other areas. But in the central and west central areas, poor land increased less than the better land, perhaps because of the effects of the 1988 drought. The percentage increase from the low land values of 1987 has been somewhat greater for poor than for top quality land in all areas of the state except the southeast.

The central area again had the highest land values per acre as well as per bushel of estimated yield (Table 3). Top land, with an estimated long-term yield of 144 bushels of corn per acre, was valued at an average of $1,688 per acre in the central area or $11.72 per bushel. In the other areas except the southeast, top land was valued at around $11 per bushel of estimated yield. Average land was around $1.15 per bushel less than top land in the north and northeast, under 35¢ in the two central areas, and 63¢ and 79¢ in the southwest and southeast.

Cash rents increased in all areas of the state, but the increases varied considerably by area and land quality (Table 4). Average area increases on top land were in the range of 5.3 percent to 8.4 percent except in the southwest. Increases on average and poor land were greater than on top land except in the two southern areas.

Although land values were highest in the central area, cash rents were highest in the west central area, $120 per acre on top quality land or 83¢ per bushel. In the north, west central, and central areas rents on top and average land were 75¢ to 84c. The range in other areas was 61¢ to 71¢.

There was little difference in the rent per bushel on top and average land although budget analysis indicates that a difference of 10¢ per bushel or more could be justified in many situations between average and top quality land.

Cash rent as a percentage of the value of top and average land tended to fall slightly in all areas although in several cases there was no change or a slight increase. These area average percentages fell in the range of 6.2 percent to 8.3 percent with the higher figures being in the north and west central areas and the lower ones in the northeast and-southwest.

What of the Future!

Survey respondents were more optimistic than they were a year ago. This year, the percentage of respondents expecting higher land prices by December jumped to 58 percent from 42 percent last year. Only 5 percent expect lower land values, and 36 percent think there will be no change.

The group average expected increase in land values was 2.7 percent statewide on average land, and a little less on top and poor land. (Table 1). Increases were expected in all areas with averages under 1 percent on top land in the southeast to nearly 4 percent on average land in the southwest and west central areas.

Ninety percent of the 1989 respondents expect land values to be higher 5 years hence. The group average change was 15 percent this year, the same as last year. This is an annual average compound rate of only about 2.8 percent.

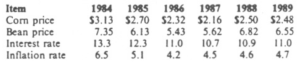

Respondents were asked to estimate annual averages over the next 5 years for corn and soybean prices, farm mortgage interest rates, and the rate of inflation. The projections they made in each year since 1984 are shown below:

Except for less optimism about soybean prices, these expectations show little change from last year; however, note that the gradual increase from 1986 in inflation expectations continued.

Whether eastern Corn Belt land values continue to increase the rest of this year and into 1990 depends upon such factors as the extent of crop losses in some areas caused by excessive spring rains and whether crop size and utilization projections indicate the likelihood of an increase in stocks to burdensome levels.

The land values survey was made possible by the cooperation of professional managers, appraisers, brokers, bankers, and persons representing the Farm Credit System, the Farmers Home Administration, ASCS county offices and insurance companies. Their daily work requires that they keep well-informed about land values and cash rent in Indiana. To these friends of Purdue and Indiana agriculture, sincere thanks are expressed. They provided more than 300 responses representing most of Indiana’s counties.

Appreciation is also expressed to Julie Gable of the Department of Agricultural Economics for her help in conducting the survey.