Ways to Finance and Organize Your Farm Business: How to Choose!

August 17, 1995

PAER-1995-08

Michael Boehlje, Professor

Most farm businesses are organized as sole proprietorships or partnerships and financed with debt from traditional lenders and equity from contributions of family members and retained earnings. But the number of options for organizing and financing a farm business has increased considerably in recent years as innovations in legal structures and financial arrangements have been developed to meet the varied needs of business managers.

Managers need to develop a strategic plan that captures the best financial and organizational structure for their business. This need is dictated by the increased number of options available, the opportunities to lower cost and reduce risk through the proper plan, and the conflicting goals and objectives that should be satisfied in making this strategic choice.

The Alternatives

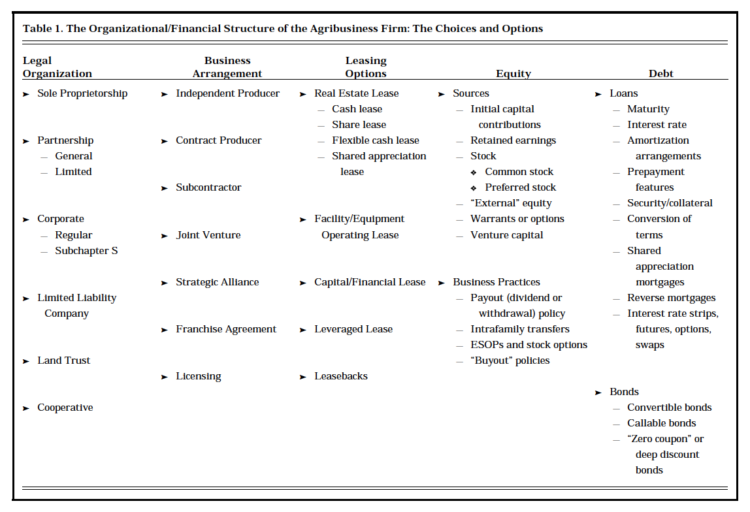

Numerous options and alternatives are available to finance and organize farms in terms of (1) business/legal arrangements, (2) asset control strategies, and (3) financing instruments/options. Table 1 summarizes these options. For example alternative legal organizations include: the sole proprietorship, a general or limited partnership, a regular or sub-chapter S corporation, a limited liability company, a land trust or a cooperative. These legal alternatives can be combined with various business arrangements such as independent production, contract production, a subcontractor, a joint venture, a strategic alliance, a franchise agreement or a licensing agreement.

Resources to carry out the farming activities can be acquired in various ways. One strategy is to purchase them with debt and equity funds. If debt is used, key decisions must be made concerning loan maturity, interest rate, amortization arrangement, pre-payment features, security/collateral offered, and conversion of terms. New debt instruments such as shared appreciation mortgages, reverse mortgages, and deep dis-count debt might be used. With respect to equity different sources are available including initial capital contributions, retained earnings, common or preferred stock, external equity warrants or options and venture capital. Business practices that will influence equity capital availability are the payment, dividend or withdrawal policy, use of stock options and buyout policies. An alternative to buying resources is to lease them. Leasing options include cash, share, flexible or shared appreciation real estate leases, facility leases, leveraged leases and sale-leasebacks.

How Do You Choose?

There are four key criteria that should be considered when choosing a financial and organizational structure. The importance of each of these criteria will influence which alternative fits best.

Control — The objective of maintaining control dominates organizational and financial decisions in many small businesses developed by a single entrepreneur. This objective is linked to the desire for independence and the focus on individual decision making. This fundamental objective may be one of the reasons for the dominance of internal equity funded sole proprietorships in the farm sector.

Returns — This objective focuses on which options will allow access to resources and funds at

the lowest cost, and emphasizes the set of economic activities and enterprises that maximizes profits. Costs to be considered include administrative and legal costs (including taxes, licensing fees, etc.) as well as the more traditional costs of acquiring inputs and doing business. The tax treatment and resulting tax burden of various alternatives are critically important, as are the direct costs (interest, fees, etc.) of the various ways of sourcing funds. This objective focuses on organizing and financing the business in such a way as to meet the strategic objective of generating the highest net returns possible.

Risk — The risk of financial loss involves four dimensions.

Table 1. The Organizational/Financial Structure of the Agribusiness Firm: The Choices and Options

➤ Claims of various parties on income or revenues: Because of legal structure, contract agreement, or financial arrangement, various parties have different claims on the income or revenues of the business. For example, debt holders have a different form of claim on income of the business than do equity holders. Characteristics of these claims, including amount, certainty (as contrasted with uncertain or con-tingent), and priority, will deter-mine their impact on income risk.

➤ Claim on assets: Various legal and financial arrangements carry specific claims on assets of the business. These claims are frequently conditional in nature and contingent on specific financial or economic performance. For example, a debt holder may have secured a loan with a pledge of collateral — assets that can be claimed if the debt is not repaid. The amount, general vs. specific, and conditional nature of these claims will determine their impact on asset risk.

➤ Bankruptcy/legal liability: The risk of financial loss from bankruptcy and legal liability depends heavily on the financial and organizational structure. If all the assets one owns are included in one legal entity, they may all be vulnerable to bankruptcy claims. The use of multiple legal entities may help protect the assets of one entity from liability or bankruptcy claims of a separate entity. Personal liability exposure can also be significantly impacted by the financial and organizational structure. Vulnerability under liability and bankruptcy rules is the fundamental dimension of bankruptcy/liability risk.

➤Failure: The success or failure of the business is influenced in part by the financial and organizational structure. Failure may result in losses in value or other consequences for related business ventures as well as loss of self-esteem, prestige, and respectability of the owners.

Maturity/Permanence/Liquidity- The permanence or longevity of the arrangement or option is a fourth major criteria for choosing among financial/organizational options. In some cases an organizational structure or financing arrangement is needed for only a short period, or it may be a transition to a longer term, more permanent financial/organizational structure. Some arrangements or agreements are difficult or costly to dissolve once set up (i.e., a corporate or partnership business arrangement with no buy/sell agreements) or are long-term in nature (a 30-year mortgage with prepayment penal-ties), whereas other arrangements are more flexible or have a shorter maturity (a convertible bond or a short-term lease, contract or loan). This time dimension is critical in choosing among various organizational and financial options.

Some Final Observations

The options and alternatives avail-able to finance and organize farm firms are much broader than traditionally has been perceived. Combining various organizing and financing options into a complex structure that matches the business and personal objectives of the owner is likely preferred to the more traditional (and relatively simple) organizational/financial structure used in most farm and agribusiness firms (i.e., the sole proprietorship using internally generated equity and bank or other debt).

If the dominant concern in the choice of the financial/organizational structure is ownership/control/autonomy, then the options available are severely limited. Many of the more flexible financing and organizing options increase the interdependence and reduce autonomy and control within the firm. Historically, autonomy and control appear to have been the dominant concern in much of Midwest agriculture.

A more diversified financial/organizational structure will typically (but not always) increase the flexibility and reduce the financial risk of the business venture. In fact, diversified financing is an alternative and possibly more effective strategy to reduce risk in many farm and agri-business firms than diversifying in production enterprises, product lines, and/or business ventures. Con-sideration of a broader set of options for financing and organizing the business may provide the opportunity to reduce the cost of capital (i.e., the cost of financing) and most likely will increase the availability of funds to finance growth and expansion.

Developing an appropriate organizational/financial structure requires skills in understanding financial markets, instruments and options, legal arrangements, financial analysis, and negotiation. The choice of the right organizational/financial structure is an important strategic decision that can have a significant impact on the cost, competitive position, and survivability of the business.

Many of these alternative ways to financing and organize the farm business (or maybe even the words) may be new to you. Would you like to know more? A publication entitled “Alternative Financial/Organizational Structures of Farm and Agribusiness Firms,” is available. Send a check for $1.50 made to “Purdue University” (Indiana residents need to send $1.58 to cover Indiana Sales Tax), to Media Distribution Center, 301 South 2nd Street, Lafayette, IN 47901-1232. Ask for NCR-568, and include your mail address. This publication describes these alternatives in more detail and explains the circumstances under which the various alternatives might be useful.