What to Plant in 2012?—More Corn!

October 23, 2011

PAER-2011-17

Alan Miller

Returns for crop production in 2012 should be favorable due to relatively high crop prices, although costs of production are expected to increase as well. Overall, variable crop production costs are expected to be up 10% to 16% in 2012. Fertilizer prices, fuel prices, seed prices, and crop insurance premiums are expected to be among the drivers of higher production costs in 2012.

Total costs per bushel for 2012 are expected to be around $4.68 for corn, $10.86 for soybeans, and $7.21 for wheat. These estimated costs include all the variable costs to produce the crop as well as machinery depreciation, cash rent, and family living expenses. However, the cash rent is based on cash rental rates reported in the Purdue Cash rent survey conducted in June 2011. And cash rents are expected to increase significantly this fall in Indiana for many farmers. Overall, fixed costs per acre could increase 10% to15% in 2012 in Indiana due primarily to higher cash rents.

If commodity prices stay above our forecast total costs per bushel, as they are currently, producers have the opportunity to earn an “economic profit” (returns above all costs) once again in 2012. This is the fifth year out of the last six years we have forecast an economic profit for producers of rotation corn and beans on average quality Indiana land.

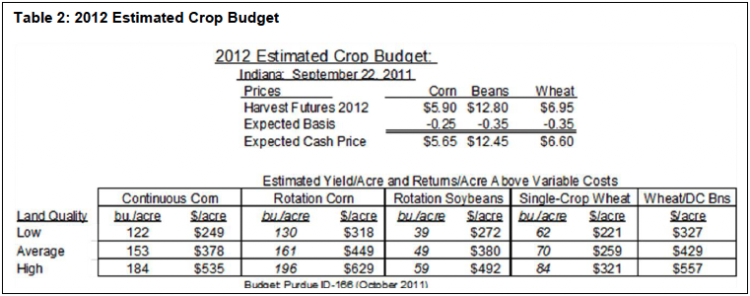

As shown in Table 2, corn market revenue per acre and corn contribution margin per acre (market revenue minus variable costs) are both high. Using 2012 expected harvest cash prices based on futures market prices from September 22, 2011, the forecast returns above variable costs from a corn-soybean rotation on average land is $420 per acre (($460+$380)/2).

Table 2: 2012 Estimated Crop Budget

Rotation corn on average yield land shows a $69 per acre advantage over rotation soybeans, signaling that the market continues to encourage higher corn acreage for next year. Single crop wheat has a much lower contribution margin than rotation corn and soybeans. This tends to suggest that single-crop wheat has a much lower return in the northern-half of Indiana unless you have a strong added return for straw. On the other hand, wheat and double-crop soybeans in the southern half of Indiana may be fully competitive with rotation corn and soybeans.

Continuous corn has a contribution margin about equal to rotation beans on average quality soils. This implies that corn returns on average quality land are not strong enough to bring corn into the crop mix if one has to move from a corn-beans rotation to corn-on-corn. Since Indiana’s corn/soybean acreage mix is already 53%/47%, the corn price may not be high enough to encourage more corn on rotation acres for average quality soils. However, on the high quality Indiana soils, continuous corn may be more competitive versus rotation soybeans. These numbers suggest a small movement toward added corn acres in Indiana for 2012, and that will be on high quality soils that are moving to a corn-corn-soybean rotation or toward continuous corn.

There is a lot of financial risk per acre if prices or yield outcomes drop from these budgeted results. Crop profitability would change a much greater percentage than would the falling prices or yields. For example, the $420 budgeted return above variable costs used above minus $120 for machinery overhead and $200 an acre for cash rent leaves a profit margin potential of $100 per acre. A 10 % drop in the price of corn and soybeans reduces economic profit for the average yield corn–soybean rotation from $100 per acre to just $21 per acre, a reduction of over 79% in profit margin.

You need to run your own budgets and update them regularly. Crop prices will vary sharply over time, costs can vary significantly from farm to farm, and relative yield potential for corn, soybeans, and wheat varies by farm.