“What to Watch” in Dairy Markets in 2025

January 31, 2025

PAER-2025-09

Author: Nicole Olynk Widmar, Professor & Interim Department Head in Agricultural Economics

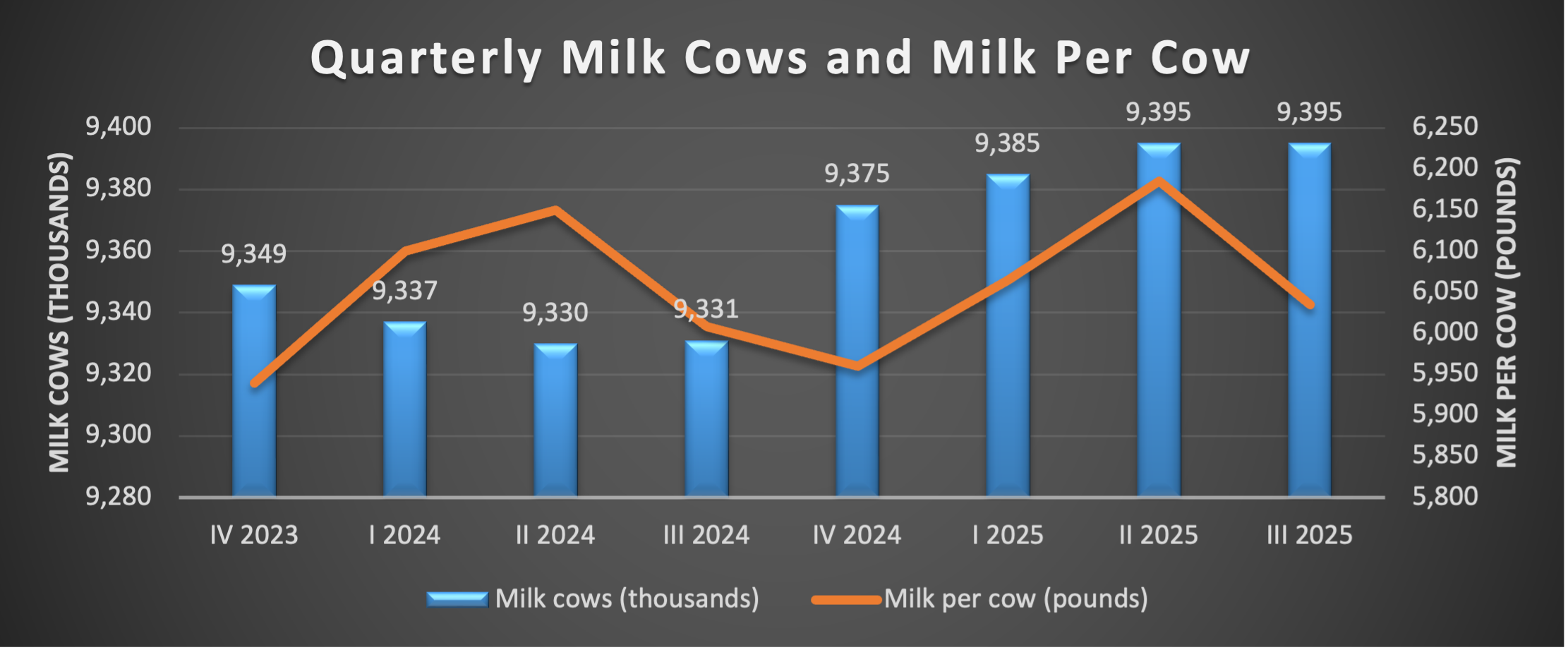

Total milk production for 2024 was forecasted (in December 2024) at 226.3 billion pounds, which was up slightly. Upward movement in dairy cattle numbers and milk per cow fueled this increase, which is expected to continue in 2025 when milk production is forecasted to reach 228 billion pounds.

The dairy herd size was reported at 9.365 million head in October 2023; it had been gradually increasing since August. Simultaneously, the average milk production per cow in October 2024 was around 3 pounds higher than in 2023. With both a larger dairy herd and higher milk per cow, it follows that milk production is higher (and expected higher yet in 2025 if growth in cow numbers continues as expected).

Graph developed using data from the ERS-USDA Livestock, Poultry, and Dairy Outlook December 2024.

Source data and report available at: https://www.ers.usda.gov/publications/pub-details?pubid=110629

The dairy markets are currently projected to be reasonably stable, both in demand for products and in prices. The 2024 all-milk price forecast was lowered in the December 2024 Outlook from ERS-USDA to $22.65 per hundredweight (cwt). For 2025, the all-milk price forecast was $22.55 per cwt. Based on what was known at the end of 2024, strong domestic demand was expected to continue into 2025, which would draw down stocks of dairy products and support continued stability in prices.

Highly Pathogenic Avian Influenza (HPAI) was first confirmed in a dairy herd in the U.S. in March of 2024. As of December, there was HPAI in dairy herds confirmed in 16 states and 832 dairy herds, per the ERS-USDA December Outlook report. The Animal Plant and Health Inspection Service (APHIS) of the USDA reported 925 cases in 16 states as of January 14th, 2025; the number of confirmed cases in cattle, by state, is reported by APHIS here. April 1st, 2024, saw the first report from the Centers for Disease Control (CDC) of a human case of HPAI after being exposed to dairy cattle presumed to have been infected with the virus; additional cases in humans after contracting with infected cattle have been reported since. Infected dairy cattle can show clinical signs, including reductions in milk production, decreased feed consumption, abnormal feces, lethargy, dehydration, and fever, but most dairy cattle are able to recover. In April 2024, the USDA released a federal order, accessible here, requiring testing of lactating dairy cows prior to interstate shipment and reporting any positive results. Then, in December 2024, USDA issued another federal order, available here, requiring additional testing and reporting of raw milk, “… Federal Order requires testing of raw (unpasteurized) milk to detect and provide data for the control and eradication of HPAI. Samples will be collected at facilities that ship, receive, or transfer bulk raw (unpasteurized) cow’s milk intended for pasteurization.” The CDC, USDA, FDA, and state veterinarians and livestock associations are actively collaborating to protect livestock, as well as humans, and the continued safety and security of the U.S. milk supply. HPAI remains a concern for domestic livestock producers, including dairy, and remains closely watched by public health officials, given the cases in humans and transmission across species.

There are also several factors originating outside of dairy markets which could impact consumer confidence and spending. Inflation was top-of-mind for many people over recent years and is being talked about as an ongoing concern, although it is yet to be seen how much of a concern. Indeed, households have been challenged in recent years by increasing housing, food/grocery, and household consumable prices. The increases in grocery prices have altered the product mix for many households over the past several years, and further adjustments could be anticipated depending on the relative prices of competing products.

There is uncertainty inherent in the marketplace in 2025 under a new administration. Individuals are closely watching interest rates and performance in financial markets. While the variety of factors at play in these markets are beyond the scope of this outlook, we must remember that the confidence amongst households and consumers matters quite a bit for how households spend. For dairy, we’ll be watching for how households spend on food away from home versus food for at-home cooking and consumption. If households get nervous financially and pull back on spending at restaurants and take-out, then we begin to think about cheese usage for pizza versus purchases of yogurt and fluid milk for at-home use. Whilst not necessarily problematic as a single change in purchasing behavior, pulling back on spending by households may result in softening of demand on products that may be considered non-essential (such as convenience or single-serve packaged products).

Finally, there are a variety of factors in international markets worth watching, including the potential for tariffs or other trade disputes to impact the trade of dairy and related products. However, it is too soon to tell how those conversations will develop or how dairy product flows may be impacted (or not).