Weakening Farm Income Prospects Weigh On Farmer Sentiment

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer August results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

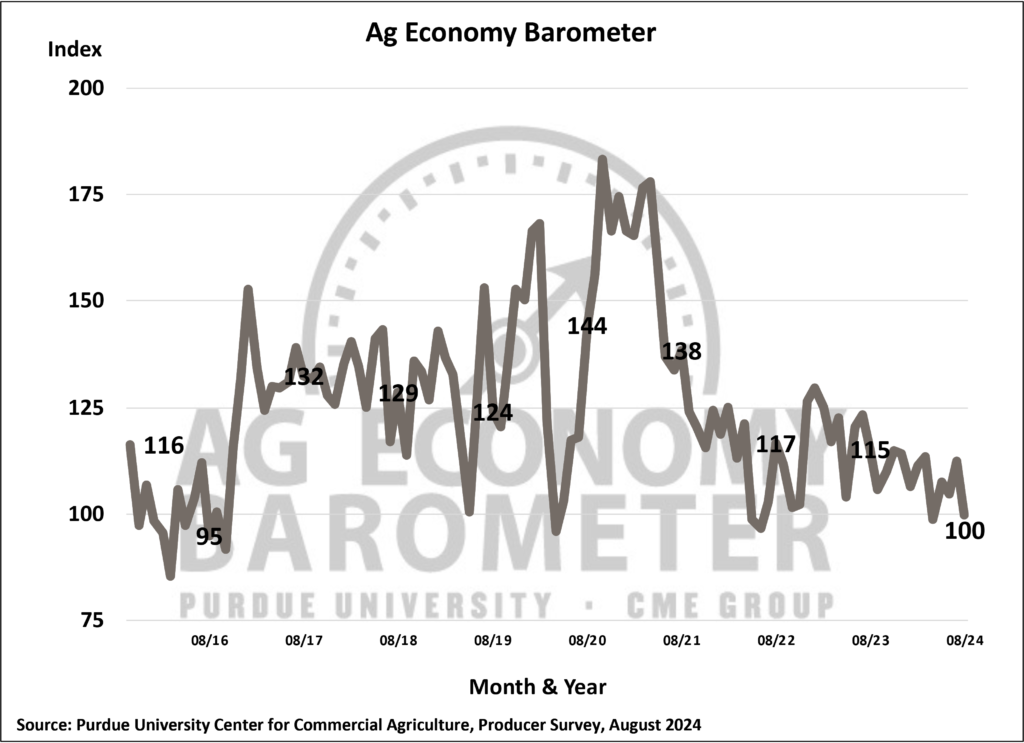

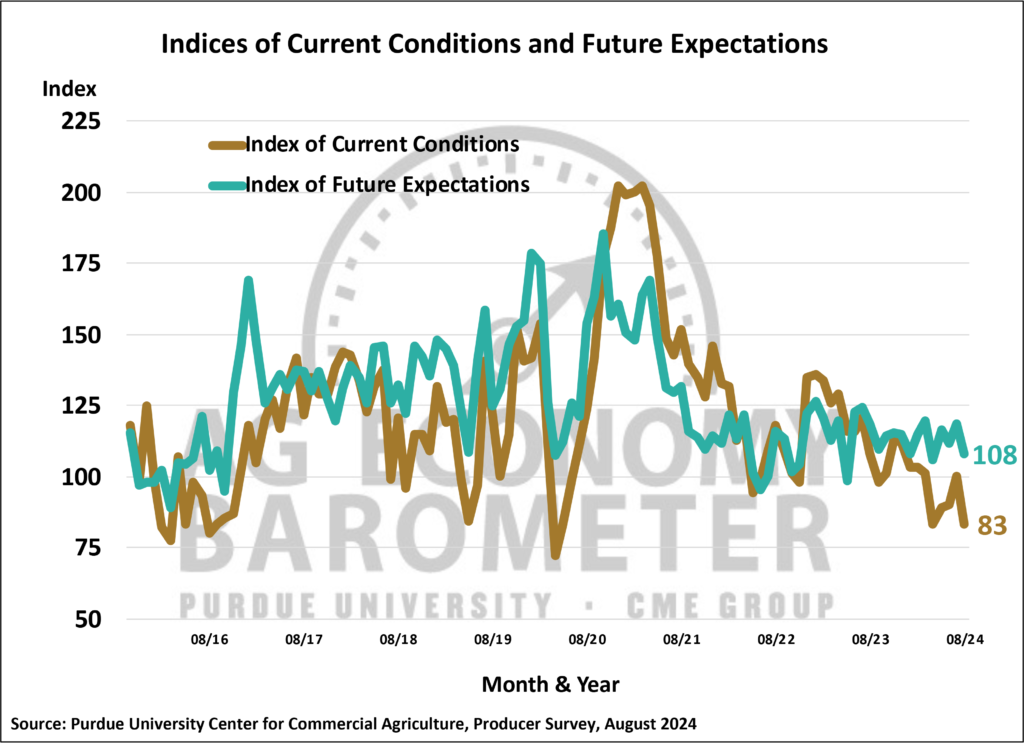

In a sharp turnaround from July, farmer sentiment nose-dived in August. The August Purdue University-CME Group Ag Economy Barometer fell 13 points vs. July, leaving the index at 100, while the Index of Current Conditions fell 17 points to 83, and the Index of Futures Expectations shed 11 points to a reading of 108. Weakening farm income prospects weighed on farmer sentiment as the outlook for a bountiful fall harvest were more than offset by declining crop prices. This month’s decline in the barometer takes farmer sentiment back to the average level observed from fall 2015 to winter 2016, a period when farm incomes were declining sharply. The weakness in farmer sentiment could indicate that farmers expect this year’s farm income downturn to last for an extended period. Data collection for the August survey took place from August 12-16, 2024.

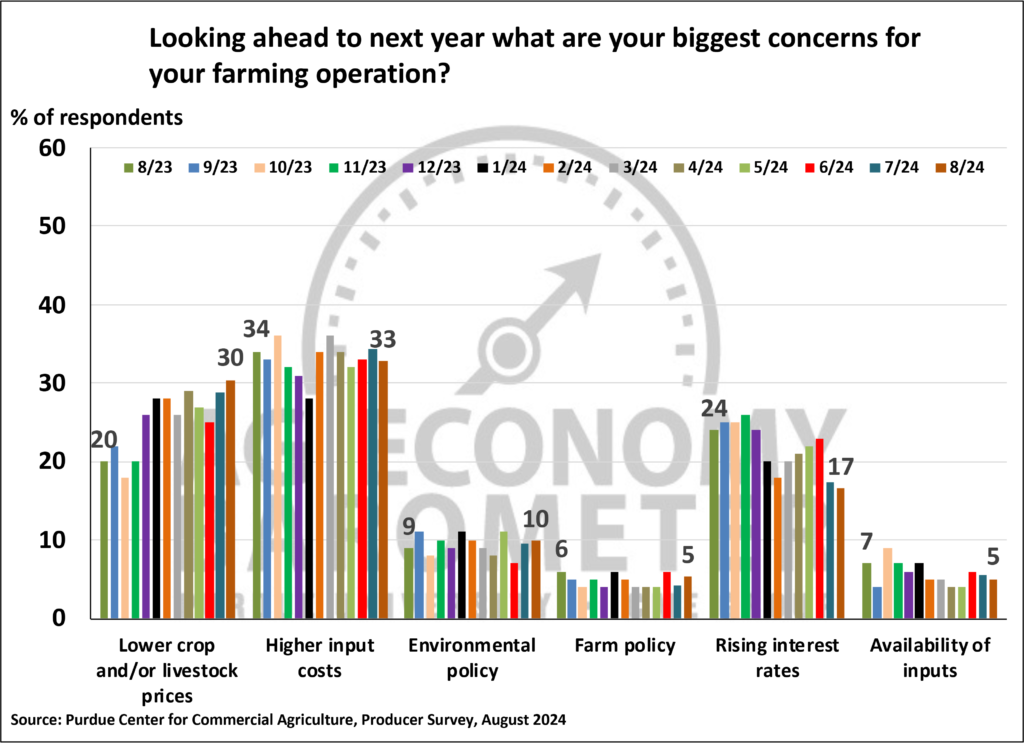

Over the last several months, farmers’ concerns about weakening commodity prices have become more evident in barometer surveys. In the August survey, producers’ concerns about commodity prices nearly eclipsed what has consistently been their top concern: high input prices. This month, 30% of respondents picked lower commodity prices as a top concern compared to 33% who chose high input costs. This was a marked departure from a year earlier when just 20% of survey respondents pointed to weak commodity prices as a top concern for their farm operation. At the same time, fewer respondents chose rising interest rates as a top concern. This month, 17% of respondents pointed to interest rates as a top issue, down from 24% a year ago. In a related question, two-thirds (68%) of respondents said they expect interest rates to fall during the upcoming year, while only 19% said they look for rates to rise.

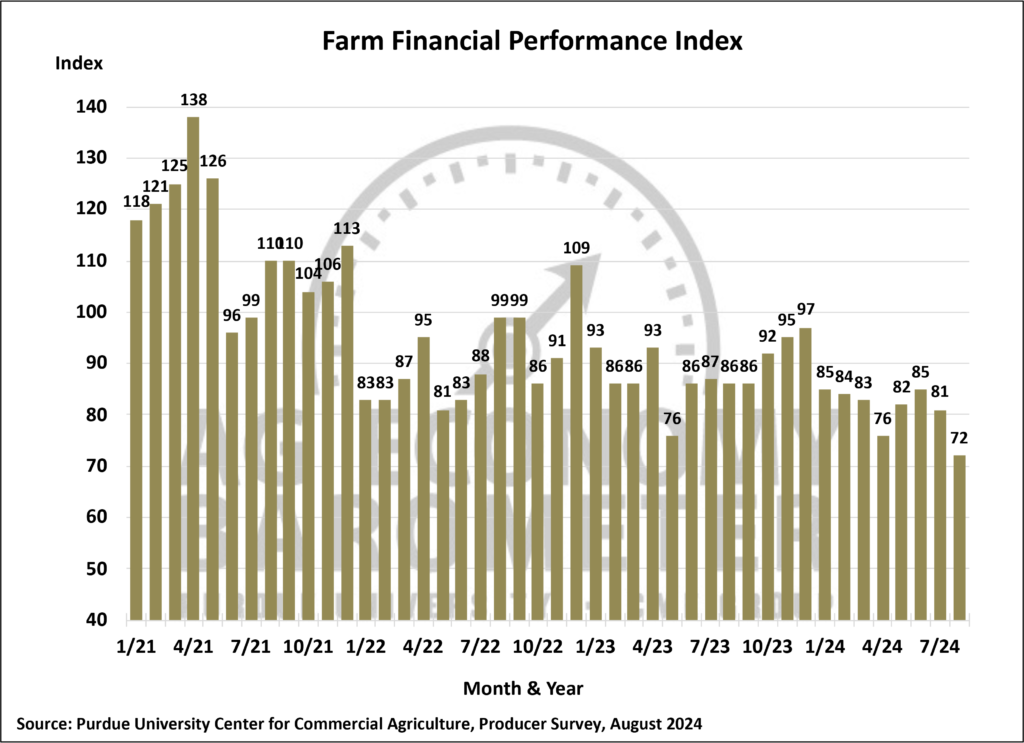

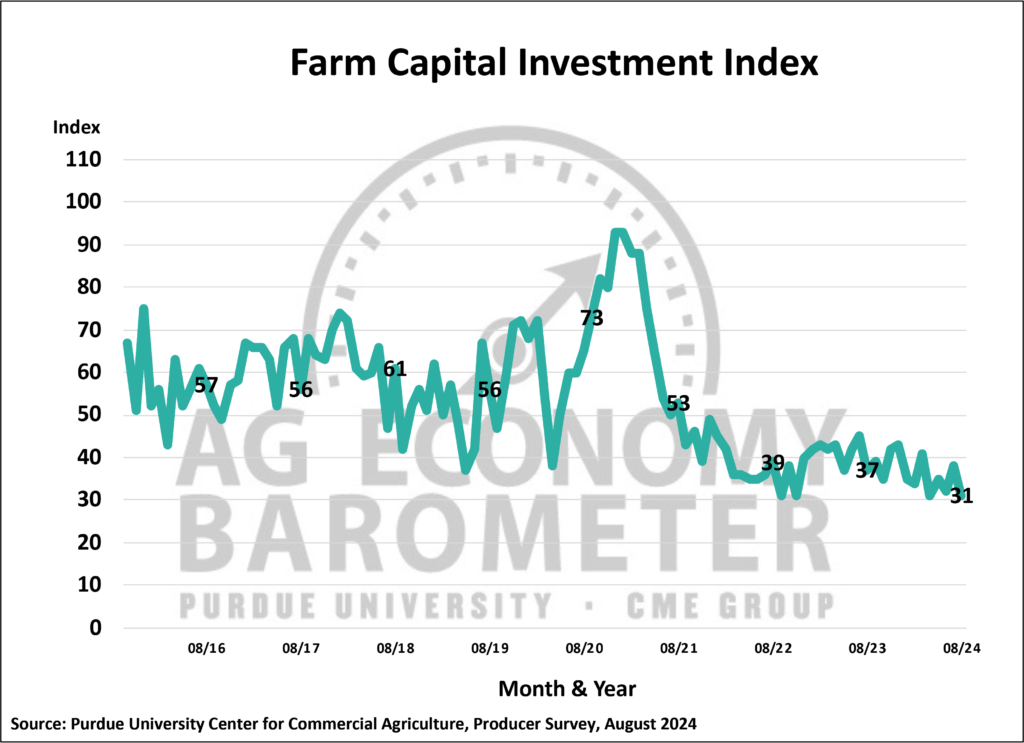

The August Farm Financial Performance Index fell 9 points below a month earlier and was 14 points lower than a year ago. This month’s reading was the weakest response to the financial performance question since July 2020, when COVID-related lockdowns still dominated the headlines. Consistent with expectations for weak financial conditions, producers again signaled that the investment climate in production agriculture is also poor as the Farm Capital Investment Index fell 7 points to 31. This month’s investment index was also 6 points lower than a year earlier and matched the index’s all-time lowest reading.

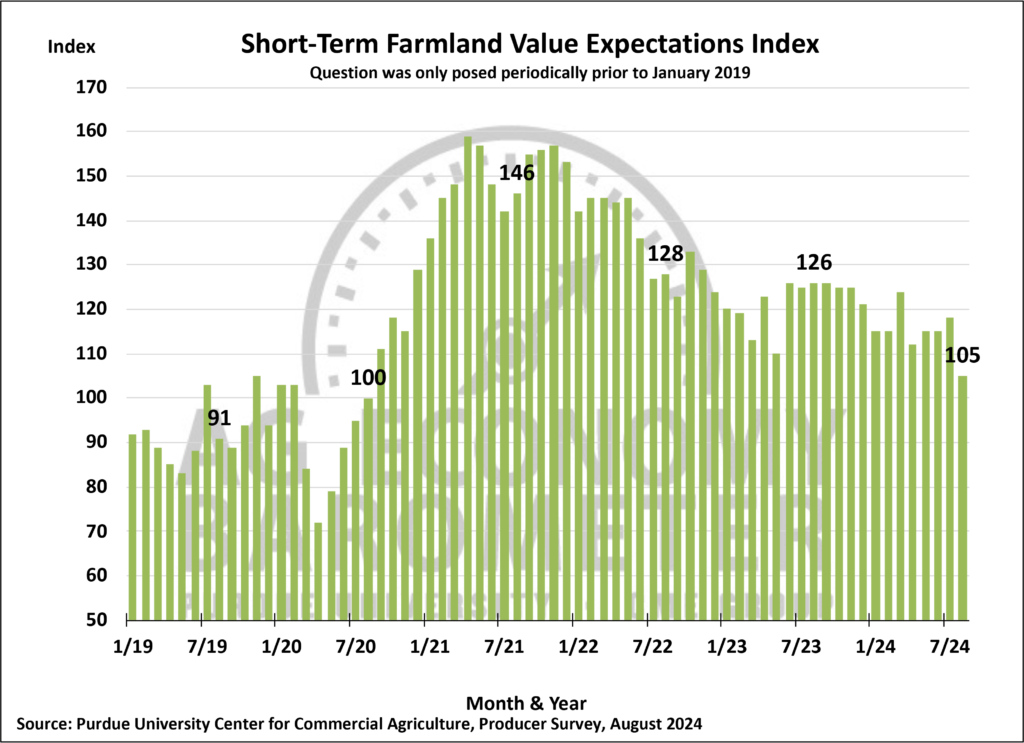

Producers’ perspective on farmland values weakened considerably in August compared to July as the Short-Term Farmland Value Expectations Index fell 13 points to 105. This month’s decline left the investment index 21 points below a year ago and 41 points below three years ago when the index was near its peak. The sharp turnabout in the index this month was primarily attributable to an increase in the percentage of producers who think farmland values will decline in the next year, which rose from 13% in July to 24% in August. The long-term farmland index also weakened, falling 4 points below July’s index to a reading of 142.

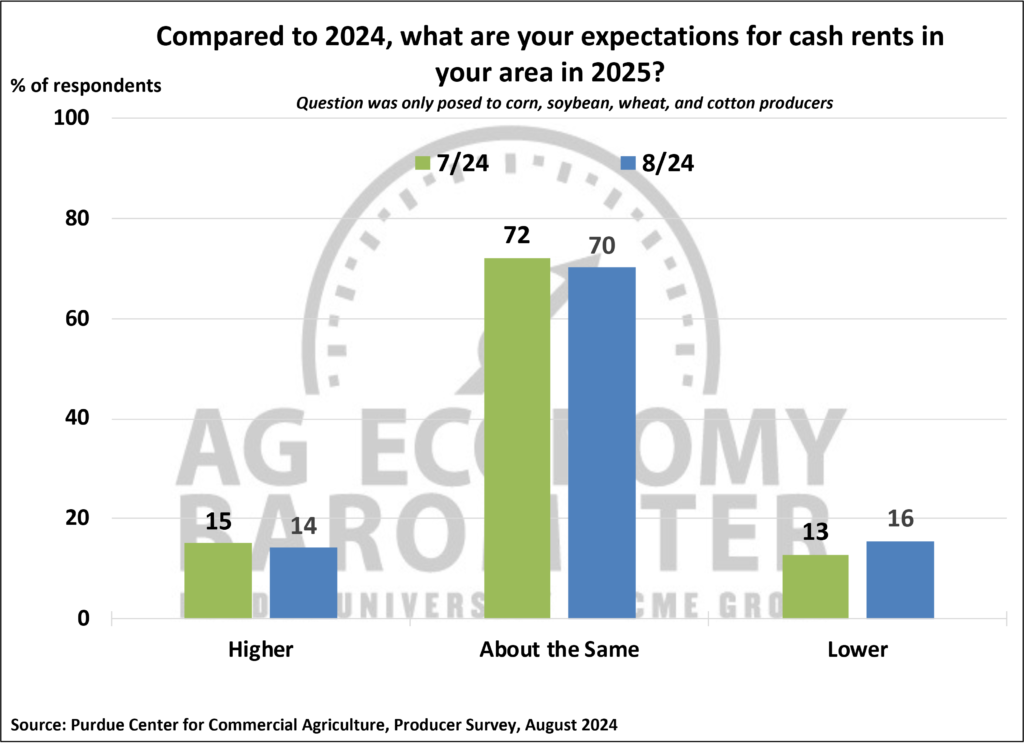

Despite concerns about the farm income outlook, most farmers in our survey still say they expect farmland cash rental rates for the 2025 crop year to remain unchanged. This month, 70% of U.S. crop farmers in our survey said they expect farmland cash rental rates to stay about the same, with just 16% of respondents reporting that they anticipate declining lease rates.

Wrapping Up

Farmer sentiment weakened sharply in August as the Ag Economy Barometer index fell 13 points compared to July. The August reading of 100 places farmer sentiment on par with sentiment in late 2015 and early 2016 when the U.S. ag economy was in the early stages of a downturn. Farmers were most pessimistic about near-term conditions, as the current index fell 17 points below a month earlier. Sentiment weakness was driven by expectations for weak farm financial performance and extended to a weak outlook for capital expenditures by farm operations. Although the short-term farmland index remained above 100, signaling that more survey respondents still expect values to rise over the next year than look for values to decline, it’s clear that farmers are less optimistic about farmland values this summer than in recent years. Notably, the short-term farmland index posted its lowest reading since spring 2020. Despite the weakness in farmer sentiment and expectations for weak farm financial performance, 70% of crop farmers in this month’s survey said they expect farmland cash rental rates to remain about the same in 2025 as in 2024.