Farmers Say Current Conditions on U.S. Farms Are Weakening

Michael Langemeier and James Mintert, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer August results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

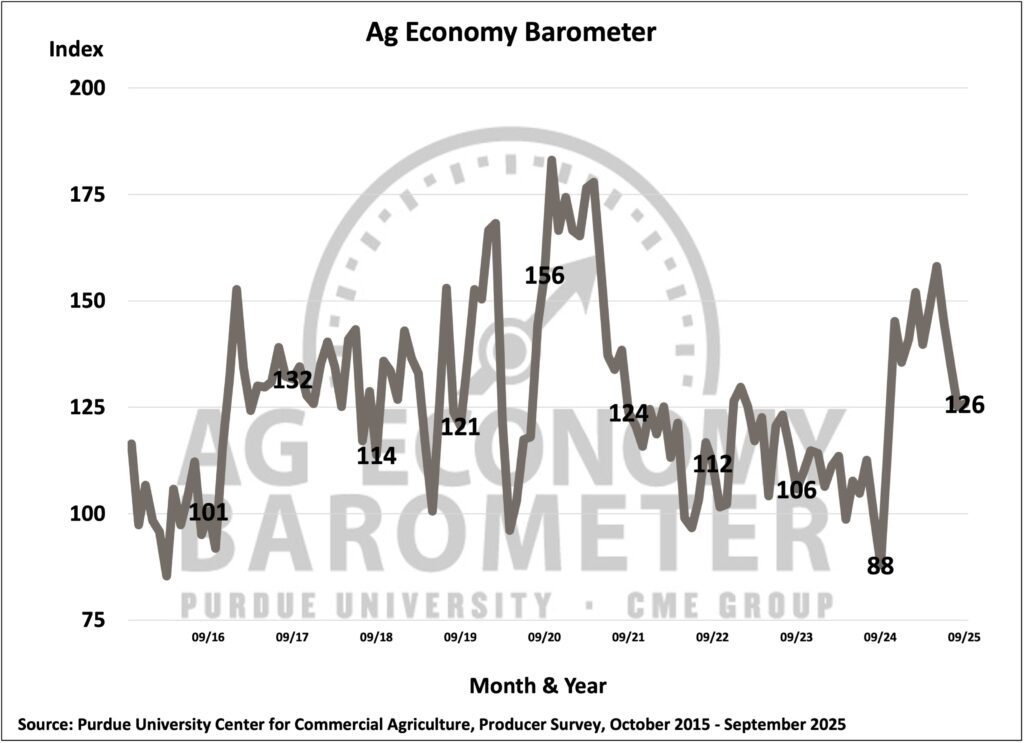

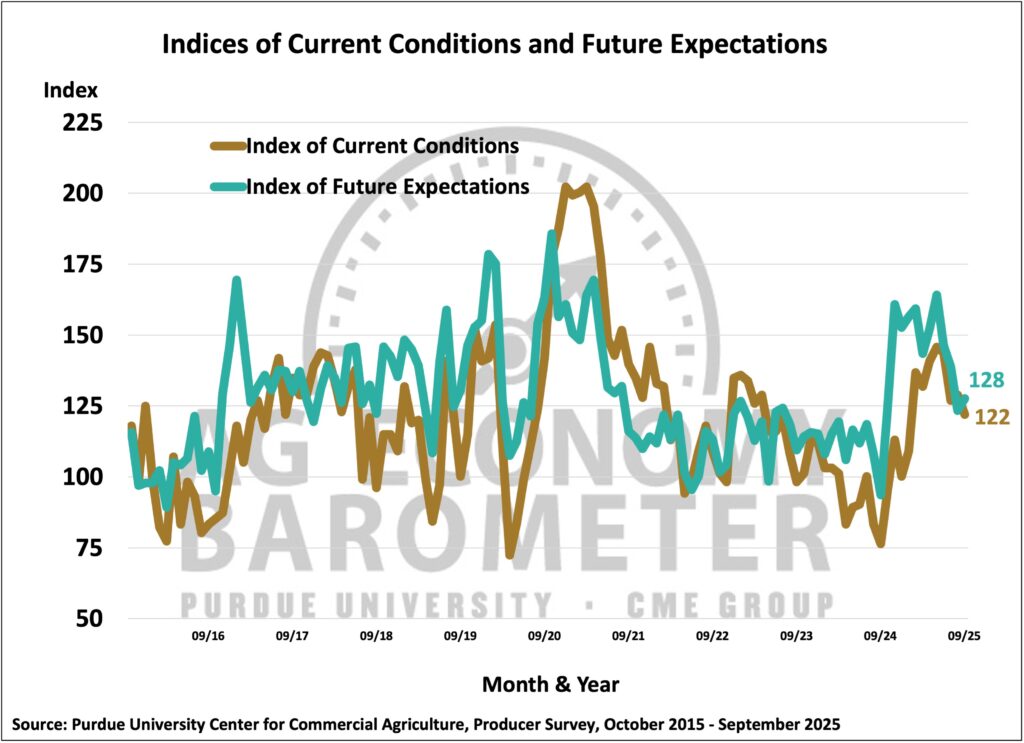

U.S. agricultural producer sentiment changed little in September as the Purdue University-CME Group Ag Economy Barometer reading of 126 was just one point higher than a month earlier. However, there was a shift in producers’ perceptions of current conditions and their expectations for the future. Producers’ perceptions of current conditions on their farms weakened as the Index of Current Conditions fell 7 points to 122. At the same time, farmers in September were a bit more optimistic about the future than in August, as the Index of Future Expectations rose 5 points to 128. This month’s survey was conducted the week following USDA’s release of the September Crop Production and World Agricultural Supply and Demand Estimates reports. The USDA reports confirmed expectations for record-high corn and soybean yields and, correspondingly, weak prices for both crops, which contributed to farmers’ weaker perceptions of current conditions. Expectations for the future were buttressed by producers’ perception that U.S. policy is “headed in the right direction” and by rising expectations that a program similar to 2019’s Market Facilitation Program (MFP) will provide payments to farmers in compensation for lower commodity prices. The September barometer survey took place from September 15-19, 2025.

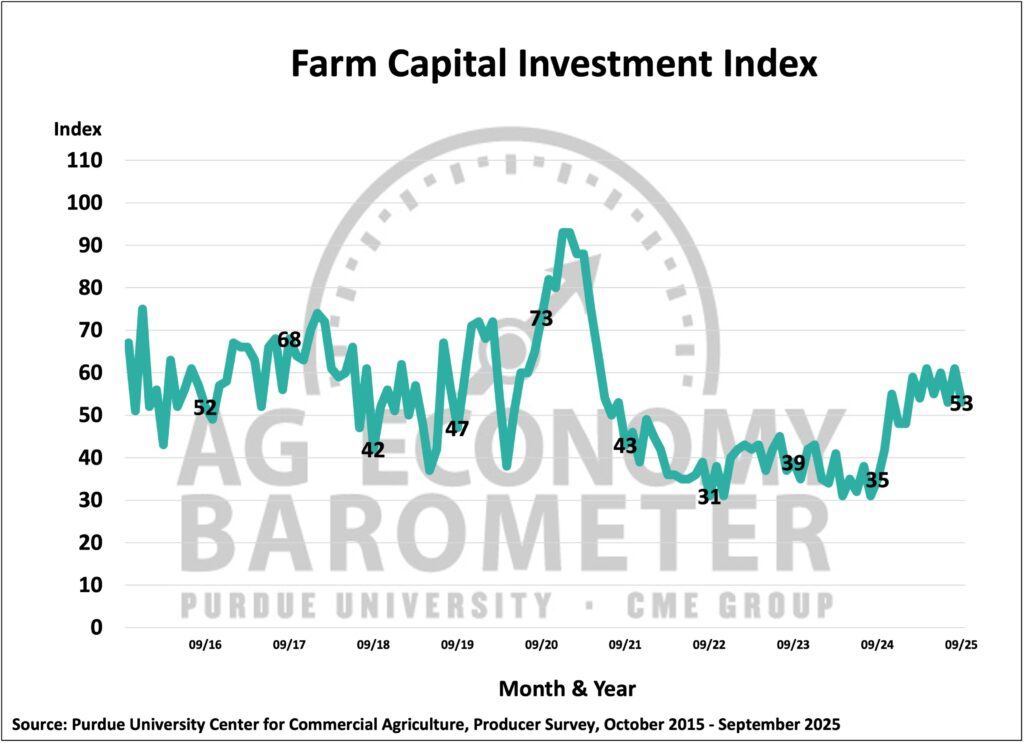

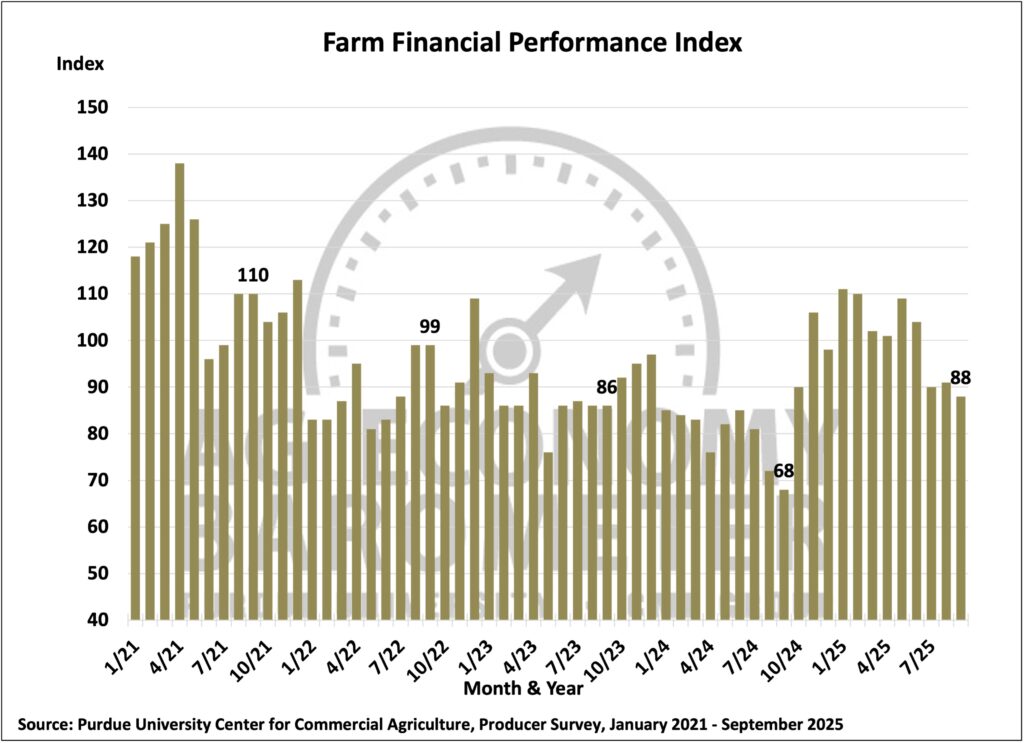

The September Farm Financial Performance Index fell to 88, 3 points lower than in August. Until July, producers expected their farms’ financial performance to be better than in 2024. September marked the third month in a row that producers said they expect weaker financial performance in 2025 than a year ago. Consistent with their weak farm income expectations, fewer farmers this month said it is a good time to make major investments in their farm operations, which helped push the Farm Capital Investment Index down 8 points to a reading of 53.

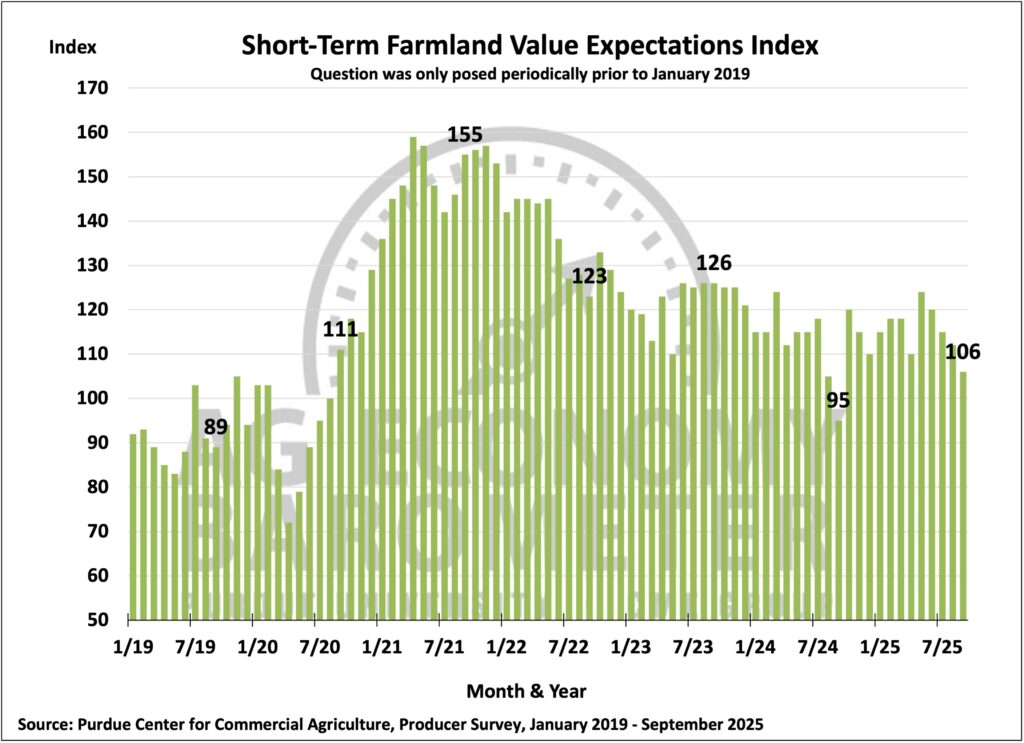

Producers’ short-term outlook for farmland values weakened in September for the fourth consecutive month. The Short-Term Farmland Values Expectations Index fell 6 points to 106, which was 18 points lower than 2025’s peak reading of 124 recorded in May. Looking at producers’ responses to the question about farmland values, this month’s change in the index was primarily attributable to fewer producers saying they expect values to rise and a larger proportion of farmers expecting farmland values to remain about the same. Fifty-eight percent of this month’s survey respondents said they expect farmland values to remain about the same over the course of the next year, up from 54% a month earlier.

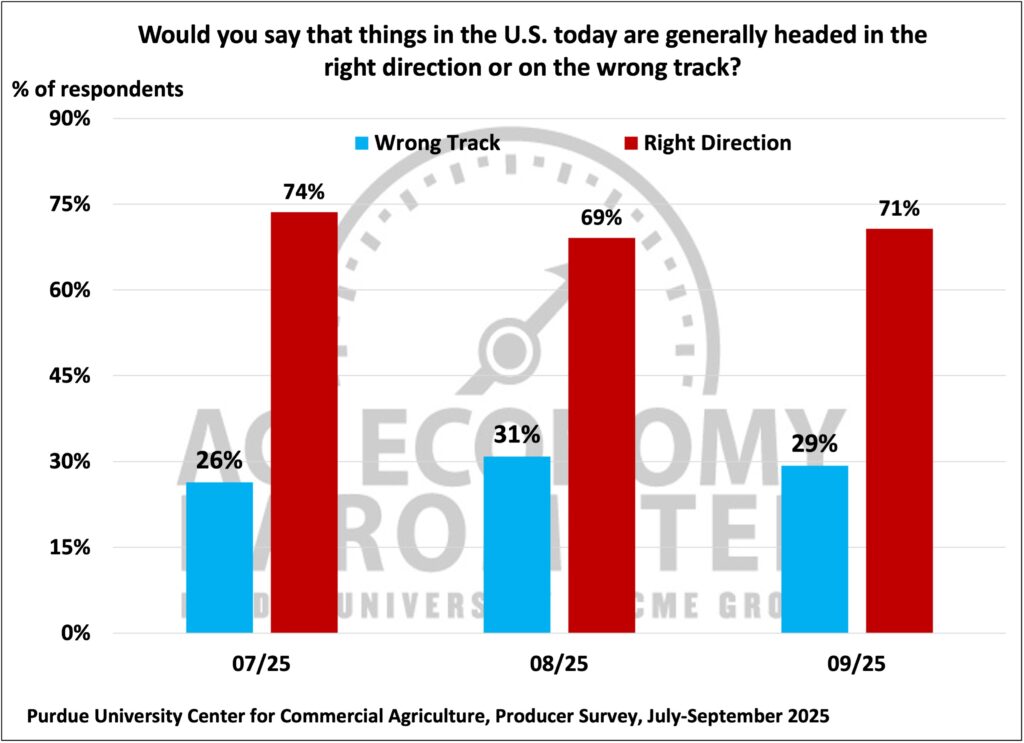

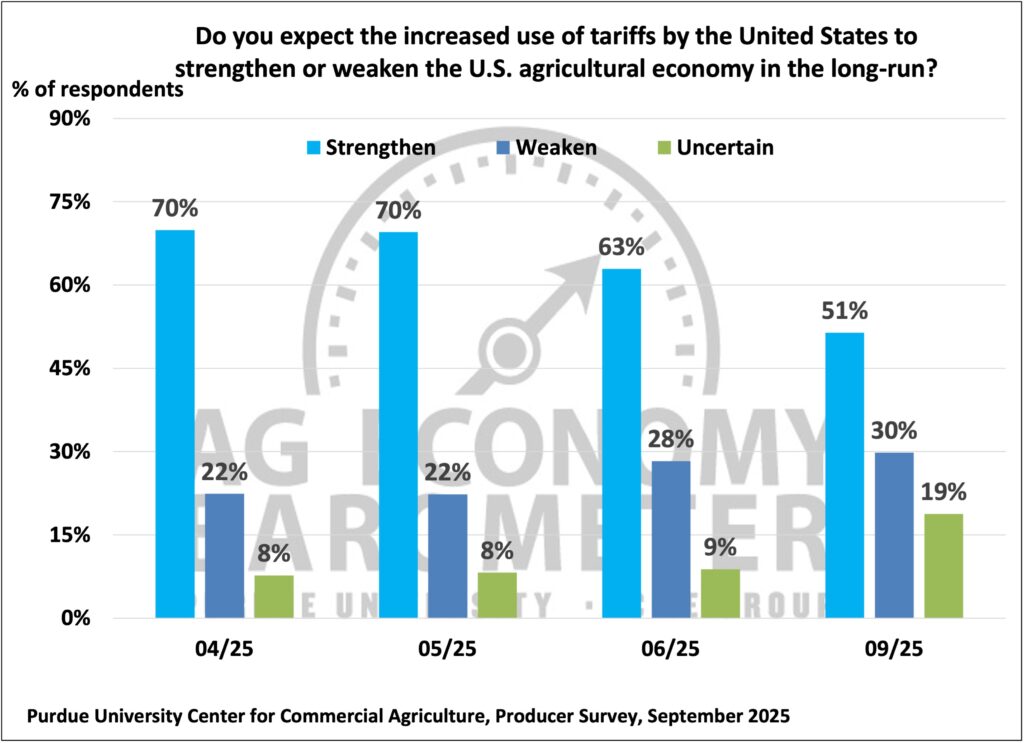

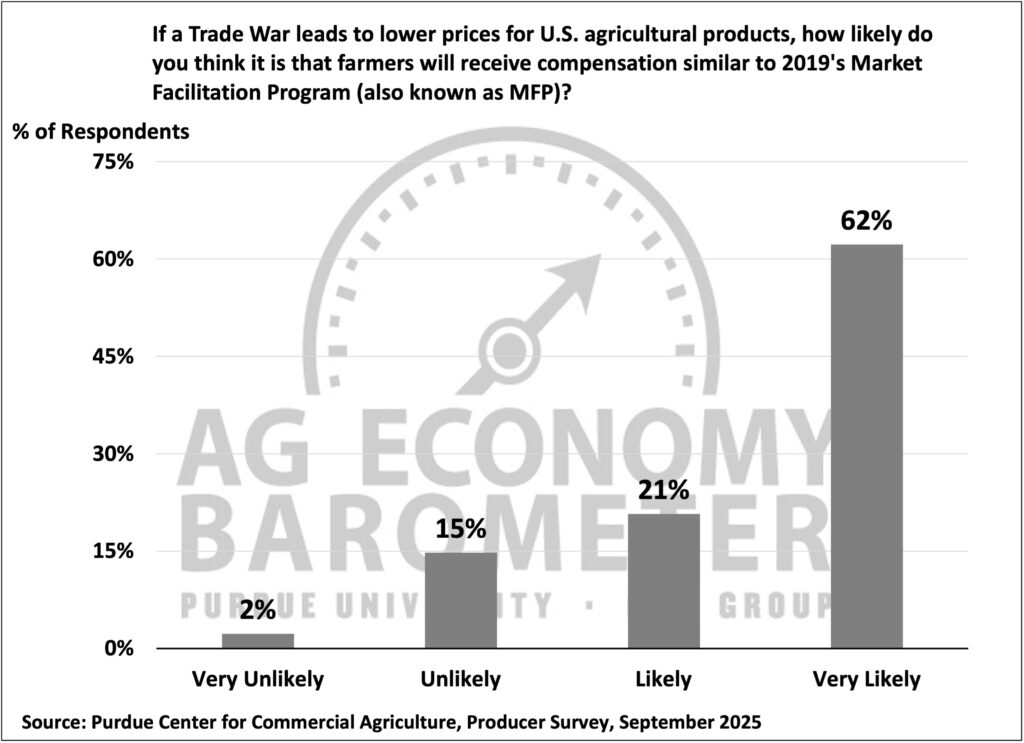

One factor that appears to be influencing farmer sentiment is farmers’ perspectives on the multitude of policy changes implemented in the U.S. in 2025. For example, a substantial majority (71%) of U.S. farmers in this month’s survey reported that things in the U.S. today are “headed in the right direction.” This month’s results were similar to those obtained in the July and August barometer surveys, when 74% and 69% of respondents, respectively, chose “right direction.” However, when asked specifically about whether they expect the increased use of tariffs to strengthen or weaken the U.S. agricultural economy, just over half (51%) said they expected tariffs to strengthen the agricultural economy in the long run. That’s down from 63% of June’s survey respondents and 70% of respondents in both the April and May surveys who said they expect the use of tariffs to have a long-run positive impact. Moreover, in September, 30% of respondents said they think the U.S. tariff policy will weaken the agricultural economy, up from 22% who felt that way in April and May. More than twice as many respondents in September (19%) said they were uncertain about the impact of tariffs on the agricultural economy, compared to April and May, when just 8% of respondents said they were uncertain about the impact. Concerns about the impact of tariffs on the U.S. agricultural economy are being offset by expectations among farmers that a program similar to the 2019 MFP will help compensate farmers for lower commodity prices. Eighty-three percent of respondents said they think that an MFP-style program is either likely (21%) or very likely (62%) if a trade war leads to lower prices for U.S. agricultural products.

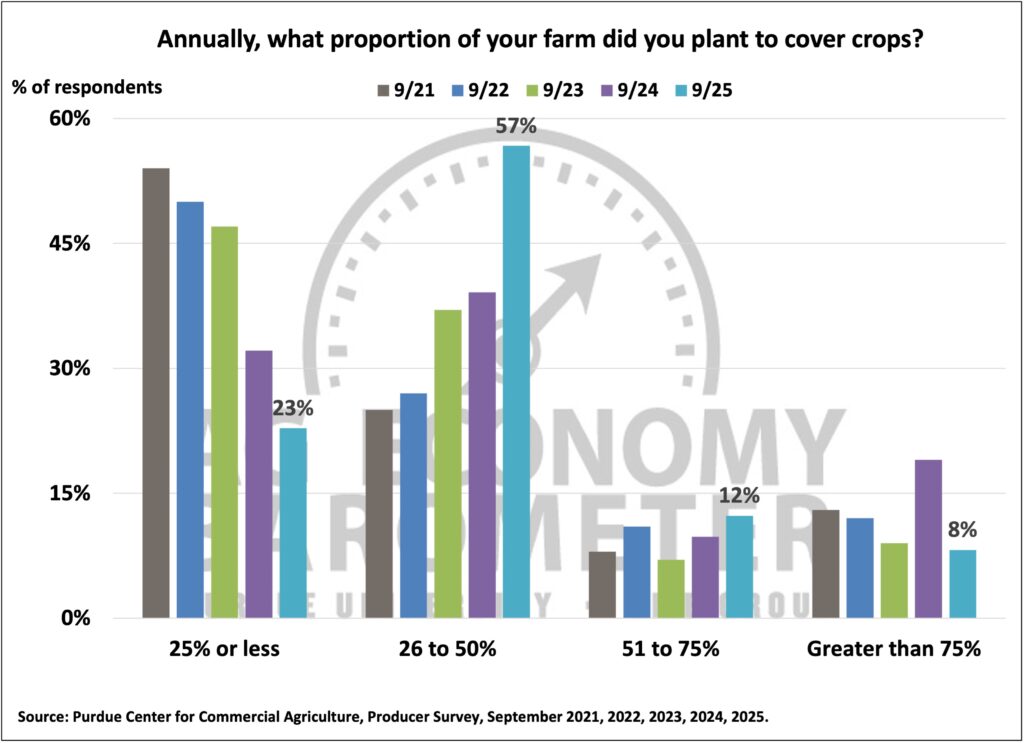

Each September since 2021, the Ag Economy Barometer survey has included several questions focused on cover crop usage by corn and soybean farmers. Over half (53%) of the farmers surveyed this month said they currently use cover crops on at least some of their acreage. That percentage has fluctuated between a low of 52% and a high of 57% over the last five years. Among producers who use cover crops, 40% of respondents said they’d been using them for five or fewer years, while 9% of respondents reported using cover crops for more than 20 years. Reviewing trends in responses over the five years of data collected, producers who use cover crops appear to be using them on a higher percentage of their total crop acreage. This year, over half (57%) of respondents who reported using cover crops said they planted cover crops on 26 to 50% of their acreage. That compares with just 25% of respondents in the 2021 survey who said they planted cover crops on more than one-fourth of their acreage.

Wrapping Up

Current conditions are weakening on U.S. farms, with weakness focused on crop farms. Farmers expect weaker financial performance in 2025 than in 2024, and fewer farmers this month said they expect farmland values to rise in the year ahead than in previous surveys this year. Weakness in the farm financial outlook spilled over into a weaker capital investment outlook by producers in September. Although producers in September were less confident that the use of tariffs by the U.S. will prove beneficial to the agricultural economy in the long run than they were earlier this year, a large majority of producers still say that things in the U.S. are “headed in the right direction.” Finally, over 80 percent of producers think it’s likely or very likely that, in the event that a trade war negatively impacts commodity prices, a program similar to 2019’s MFP will help compensate for agricultural product price weakness.