Farmer Sentiment Drops Sharply at the Start of 2026 as Economic Concerns Increase

Michael Langemeier and Joana Colussi, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer January results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

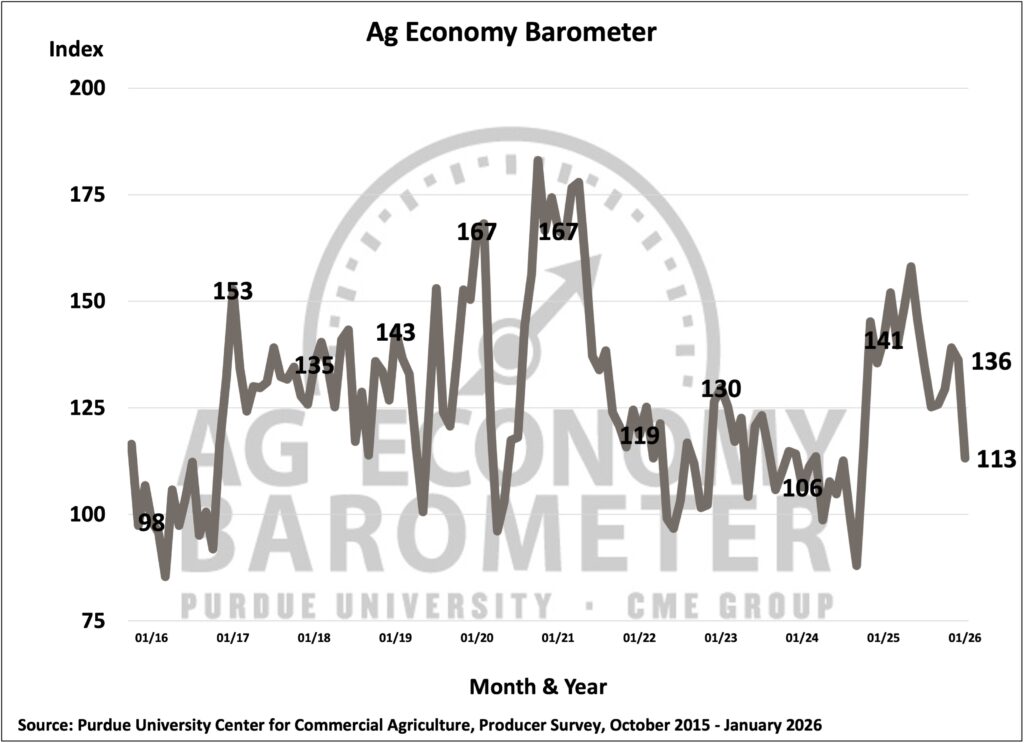

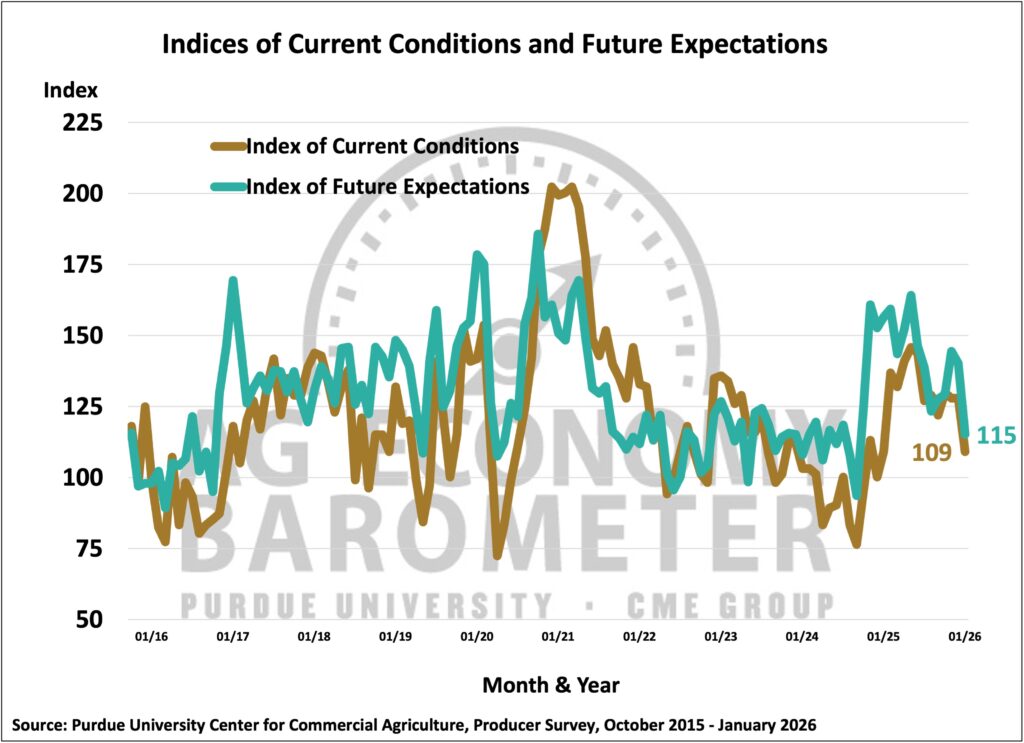

Farmer sentiment weakened sharply in January as the Purdue University-CME Group Ag Economy Barometer (AEB) Index dropped from 136 in December 2025 to 113 in January 2026 (see Figure 1). The Current Conditions Index dropped 19 points while the Future Expectations Index dropped 25 points (see Figure 2). Among the five indices that make up the AEB Index, the largest decline was in the question asking participants whether U.S. agriculture would have good times or bad times in the next five years. The index for this question fell from 122 to 88, marking its lowest point since September 2024. Respondents also expressed greater concerns about agricultural exports compared to last month. The January barometer survey took place from January 12-16, 2026. As a point of reference, the January WASDE report was released on January 12.

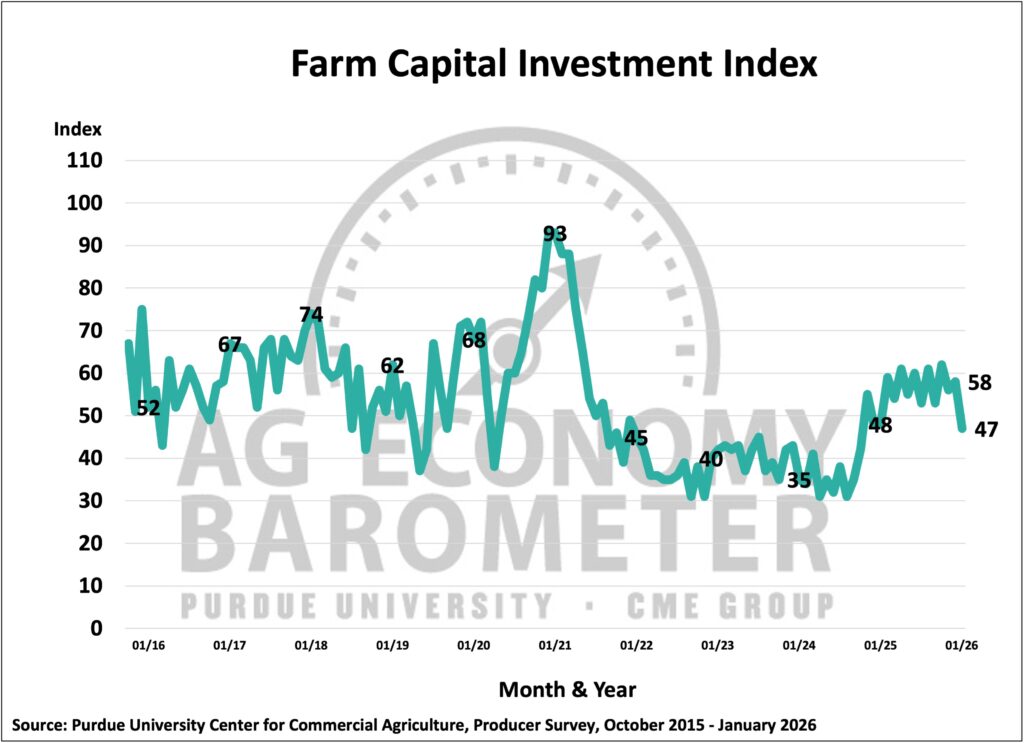

One-half of the producers surveyed reported that their farm operations were worse off than a year ago. Moreover, looking ahead 12 months, 30% expected worse financial performance, compared to 20% who expected better financial performance. At a reading of 47, the Farm Capital Investment Index decreased by 11 points from the previous month, reaching its lowest level since October 2024 (see Figure 3). Only 4% of the survey respondents indicated that they planned to increase farm machinery purchases in the upcoming year.

Since 2020, each January barometer survey has included questions about farmers’ operating loans for the upcoming year. The percentage of respondents who said they expect to have a larger operating loan this year compared to a year ago rose to 21%, up from 18% last year. In a follow-up question, producers who expect to have a larger operating loan were asked about the reasons for the increase. This year, 31% of producers who expect their loan size to increase said it was because they were carrying over unpaid operating debt from the prior year, up from 23% in 2025, 17% in 2024, and only 5% in 2023. These results are consistent with respondents’ concerns about their financial performance.

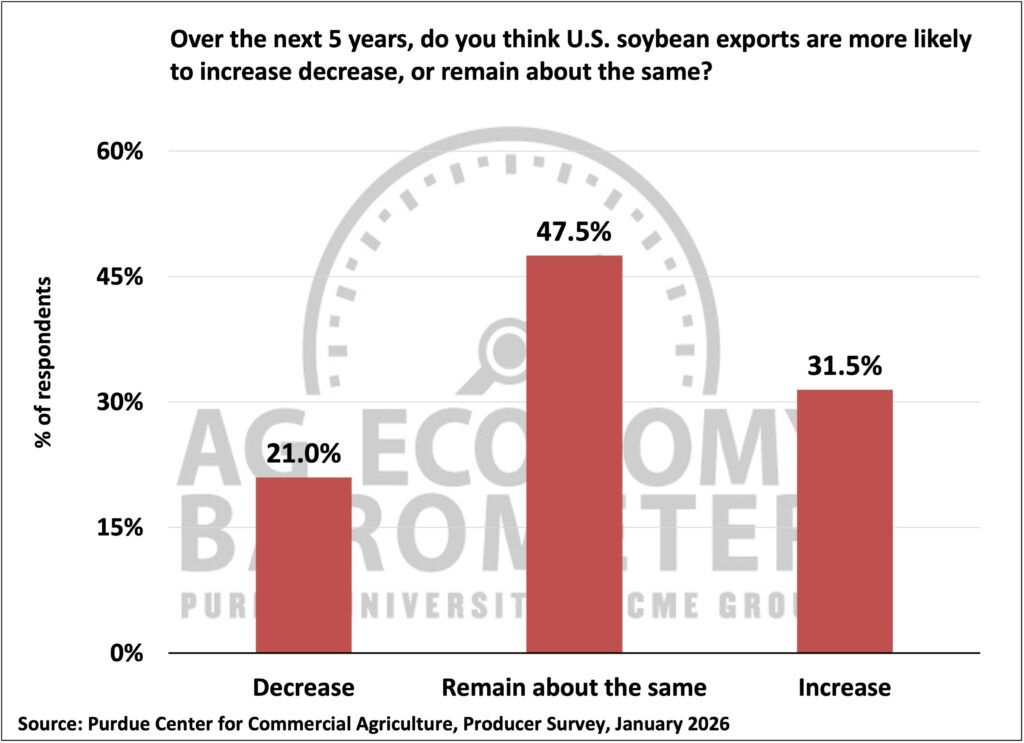

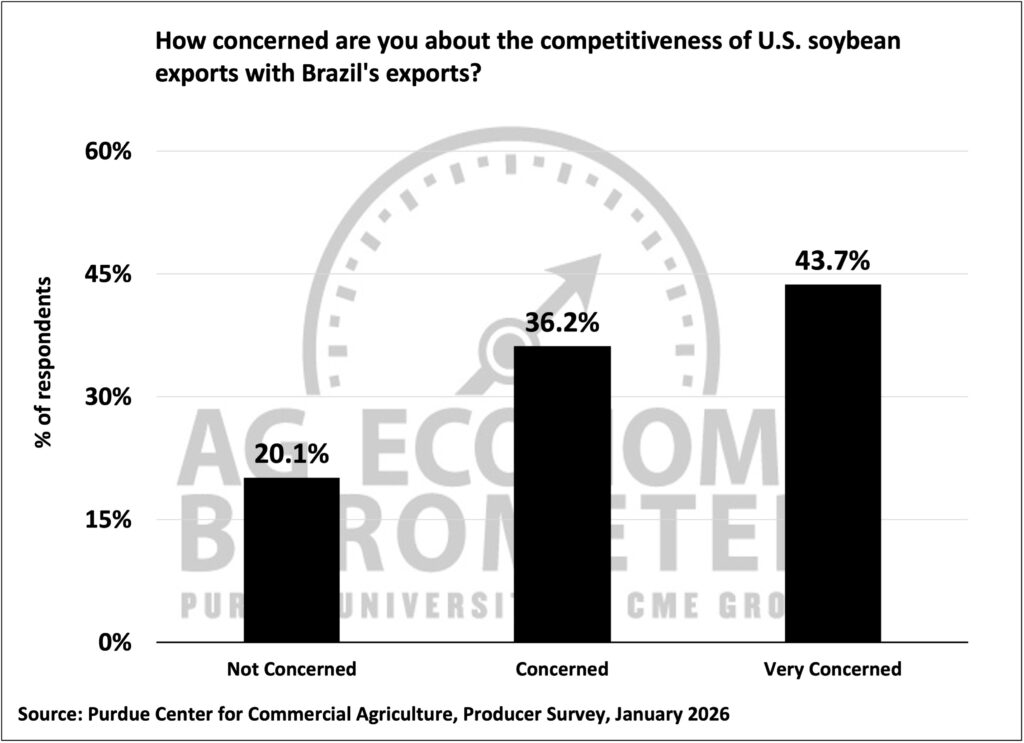

Farmers’ perspective on U.S. agricultural exports was more pessimistic in January. Responding to a broad question about the future of agricultural exports, 16% of the respondents looked for exports to decline over the next five years. In contrast, only 5% of the respondents in December expected exports to decline. When asked to focus more specifically on soybeans, a key agricultural export, 21% of corn and soybean producers in January said they expect soybean exports to decline over the upcoming five years, up from 13% of growers who felt that way in December (see Figure 4). Increasing competition from Brazil is weighing on producers’ minds. Eighty percent of corn and soybean producers said they were concerned or very concerned about the competitiveness of U.S. soybean exports versus Brazil’s, with 44% indicating they were very concerned (see Figure 5).

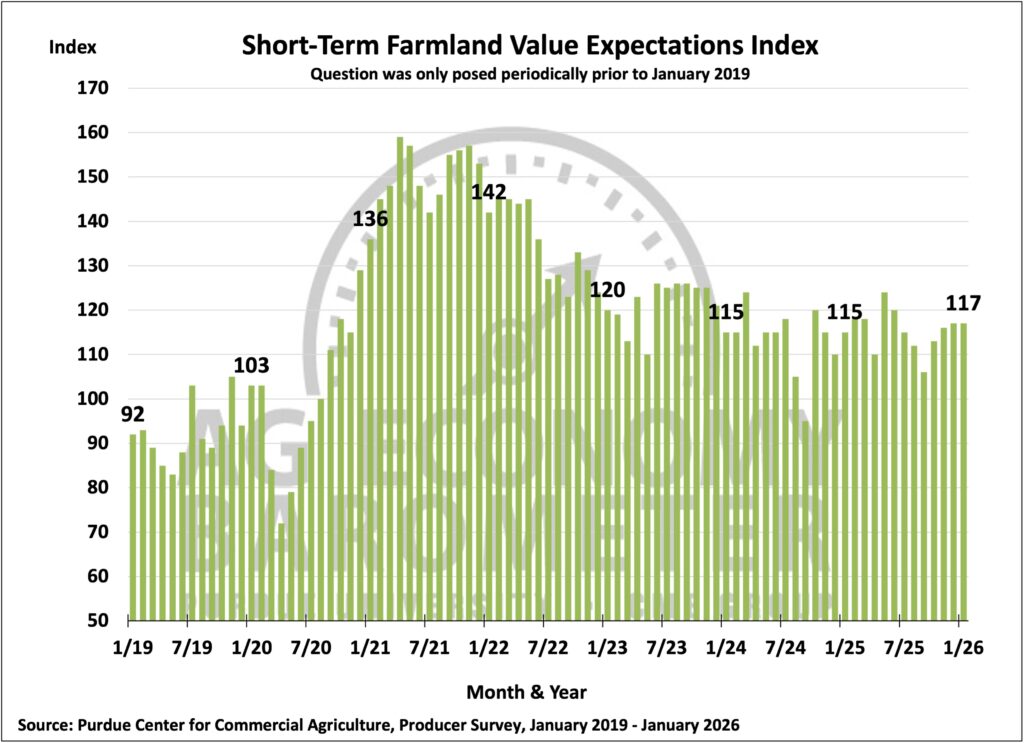

Respondents remained optimistic about short-term farmland values in January, but optimism regarding long-run land values waned. The Short-Term Farmland Value Expectations Index remained unchanged at 117 (see Figure 6). After reaching a new record high of 166 in December, the long-term index declined to 152 in January. Alternative investments, net farm income, and interest rates were cited as the three factors having the most influence on farmland values.

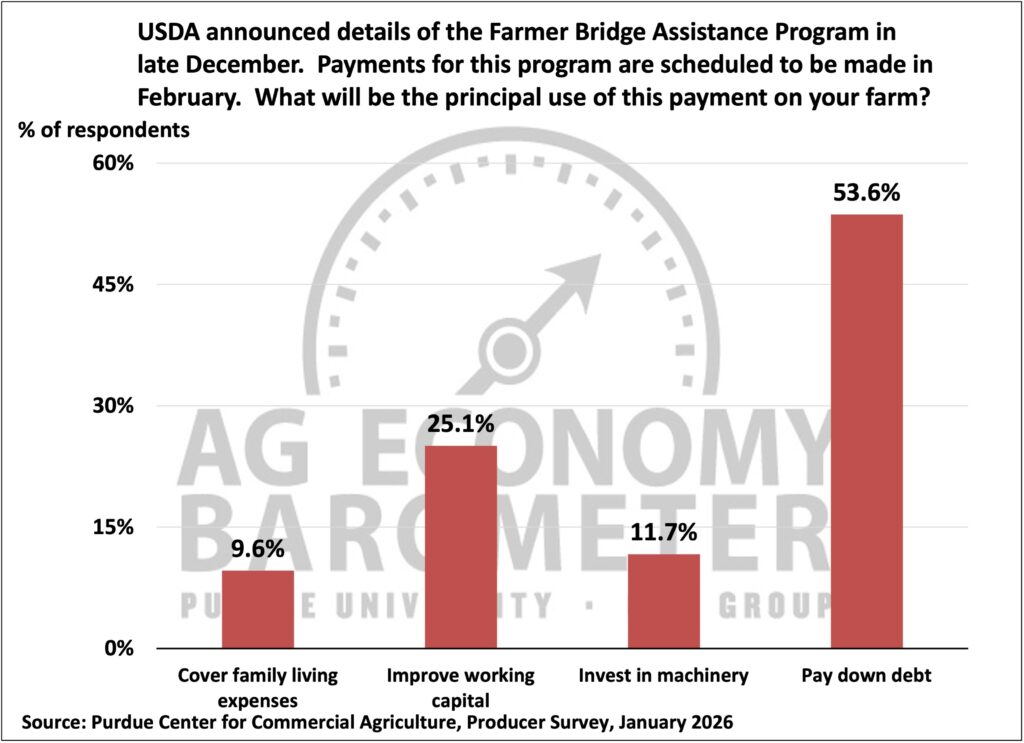

This month’s survey included a question related to the Farmer Bridge Assistance Program announced in late December. Corn and soybean producers were asked about the use of these payments. Over 50% of the respondents indicated that these payments would be used to pay down debt. Another 25% of respondents said that they would use these payments to improve working capital. The remainder noted that these payments would be used for family living (10% of respondents) or to invest in farm machinery (12% of respondents) (see Figure 7).

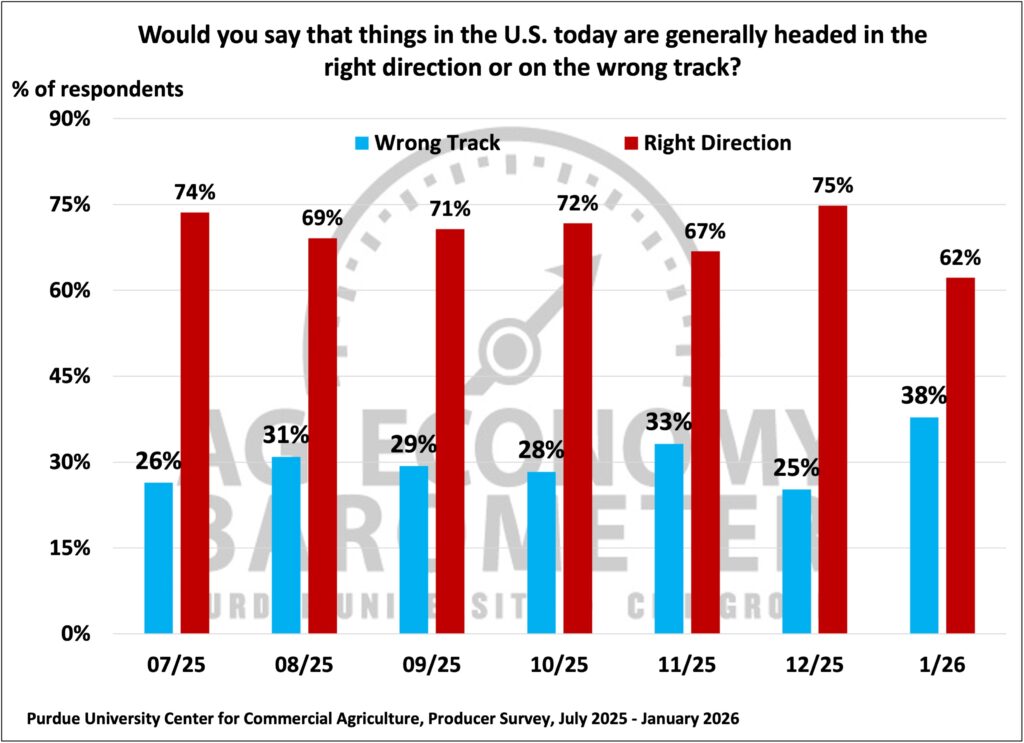

As in the last few months, producers were asked if the U.S. is headed in the “right direction” or on the “wrong track”. The percentage of producers who indicated the U.S. is headed in the “right direction” dropped from 75% in December 2025 to 62% in January 2026 (see Figure 8).

Wrapping Up

Farmer sentiment declined sharply in January amid growing concerns about the agricultural economy. The percentage of producers who expected there to be bad financial times in the next twelve months increased from 47% in December 2025 to 59% in January 2026, while the percentage of producers who thought U.S. agriculture would have widespread bad times during the next five years increased from 24% to 46%.

Respondents were also more concerned about exports in January, with 16% expecting exports to decrease in the next five years. When asked about operating loans in the upcoming year, 21% indicated that they expected their operating loan to increase. Although an increase in input costs was the primary reason for this increase, 31% indicated that the increase was due to unpaid operating debt from prior years. Finally, despite the announcement of the Farmer Bridge Assistance Program payments in late December, the percentage of producers who thought the U.S. was heading in the right direction dropped from 75% in December 2025 to 62% in January 2026.

Taken together, these results suggest that producer sentiment shifted notably at the turn of the year, with farmers beginning 2026 in a more pessimistic frame of mind.