Ag Barometer declines for second month amid looming trade war concerns

WEST LAFAYETTE, Ind. and CHICAGO – Trade war concerns continue to drive a sharp decline in producer sentiment toward the agricultural economy, according to the Purdue University/CME Group Ag Economy Barometer.

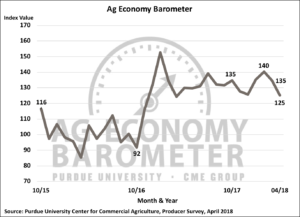

The Purdue/CME Group Ag Economy Barometer fell sharply in April, dropping from 135 to 125 amid continuing trade concerns. (Purdue/CME Group Ag Economy Barometer/James Mintert)

A publication-quality photo is available at https://news.uns.purdue.edu/images/2018/april-barometer.jpg.

The April barometer reading of 125 was 10 points lower than a month earlier and 15 points below the February reading. The barometer is based on a monthly survey of 400 agricultural producers from across the country.

The drop in producer sentiment was driven by declines in both the Index of Current Conditions, which fell 11 points to 123, and the Index of Future Expectations, which fell 9 points to 126. The Index of Current Conditions was at its lowest level since May 2017, while the Ag Economy Barometer and the Index of Future Expectations were at their lowest levels since March 2017.

Producers’ weakening perceptions of current conditions in the production agriculture sector, along with a decline in their expectations for future economic conditions, were the main drivers of the barometer’s overall decline, said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

“There seems to be a spillover effect that is driving concern among agricultural producers,” Mintert said. “Negative perceptions about exports spill over into lower expectations for commodity prices, and then that changes producers’ views about farmland prices.”

The trade dispute with China continues to be an area of concern. The biggest issue is the possible impact on U.S. soybean exports, 30 percent of which go to China. A majority of producers said they expect a sharp decline in the November soybean futures contract price, possibly to below breakeven.

The April survey also showed a decline in the number of producers expecting good times for the livestock sector, with just 45 percent saying they felt optimistic about the future compared to 59 percent a month earlier. This is the largest one-month drop since data collection began in fall 2015.

“There was already a sharp drop in hog prices that took place from mid- to late- winter, then add to that the impact of China’s 25 percent tariff on U.S. pork imports,” Mintert said. “It adds a layer of doubt regarding the profitability of pork production and appears to be affecting producers’ plans to increase hog production.”

The survey also asked producers about their perspectives on farmland values. There was a noticeable decline from mid-winter, with 46 percent feeling optimistic about higher land values in 5 years compared to 53 percent in February.

Producer sentiments toward large investments on their farms and used machinery values stayed mostly unchanged compared to a month earlier, with 28 percent of respondents saying it was a good time to make large farm investments, 1 percent lower than in March.

Read the full April Ag Economy Barometer report at http://purdue.edu/agbarometer. This month’s report includes additional information on the challenges facing livestock producers, weakening sentiment toward farmland values, and continuing trade war concerns.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) is where the world comes to manage risk. CME Group exchanges offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. Around the world, CME Group brings buyers and sellers together through its CME Globex® electronic trading platform. CME Group also operates one of the world’s leading central counterparty clearing providers through CME Clearing, which offers clearing and settlement services across asset classes for exchange-traded and over-the-counter derivatives. CME Group products and services ensure that businesses around the world can effectively manage risk and achieve growth.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT, Chicago Board of Trade, KCBT and Kansas City Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. Dow Jones, Dow Jones Industrial Average, S&P 500 and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.

Writer: Kami Goodwin, 765-494-6999, kami@purdue.edu

Sources: Jim Mintert, 765-494-4310, jmintert@purdue.edu

David Widmar, 765-494-0848, dwidmar@purdue.edu

Media Contacts:

Jennifer Stewart-Burton, Purdue University, 765-496-6032, jsstewar@purdue.edu

Chris Grams, CME Group, 312-930-3435, chris.grams@cmegroup.com

Related website:

Purdue University Center for Commercial Agriculture: http://purdue.edu/commercialag

CME Group: http://www.cmegroup.com/

Photo Caption: The Purdue/CME Group Ag Economy Barometer fell sharply in April, dropping from 135 to 125 amid continuing trade concerns. (Purdue/CME Group Ag Economy Barometer/James Mintert)

A publication-quality photo is available at https://news.uns.purdue.edu/images/2018/april-barometer.jpg.