Farmer Sentiment Rises on Strengthening Current Financial Position

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer December results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

Download report (pdf)

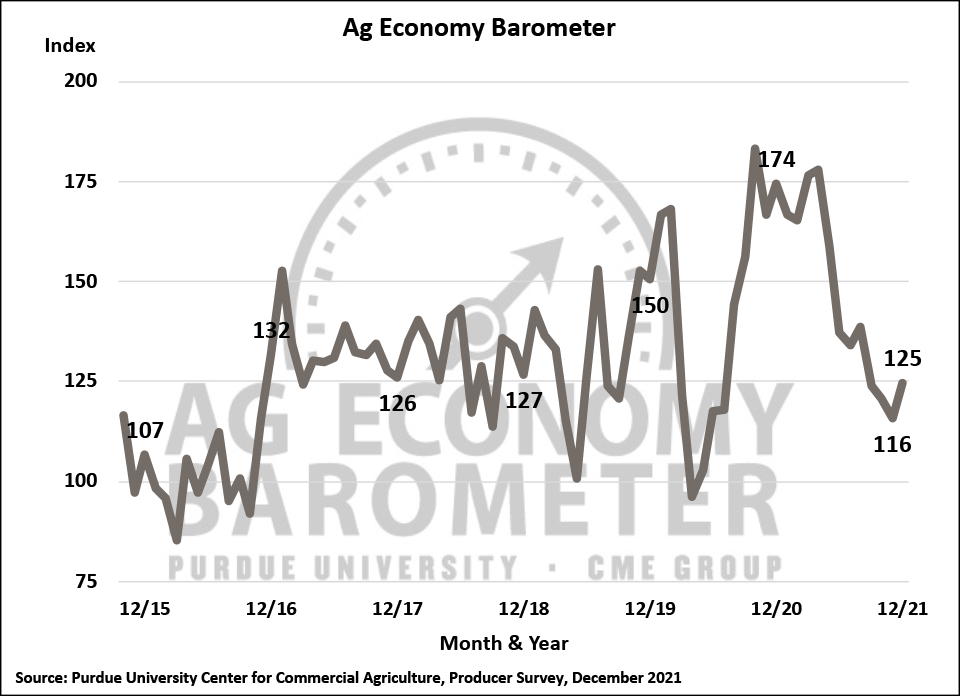

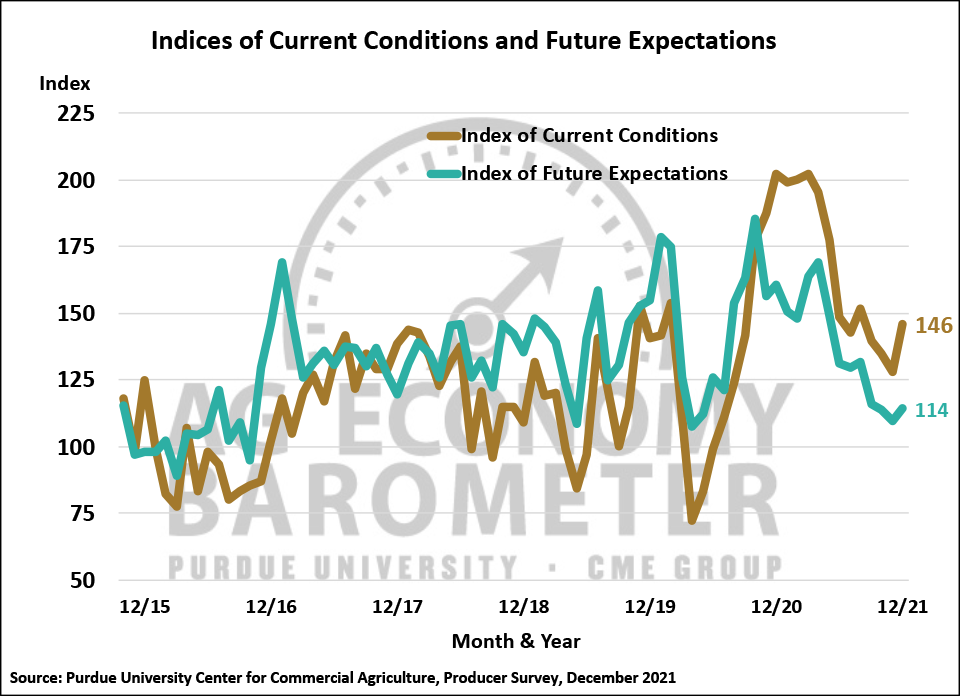

For only the second time since May, the Ag Economy Barometer rose in December. This month’s index climbed to a reading of 125, 9 points higher than in November. Both the Index of Current Conditions and the Index of Future Expectations rose in December with the rise in the barometer attributable mostly to an improved perspective on current conditions in the agricultural sector. December’s Index of Current Conditions stood at 146, 18 points higher than a month earlier, while the Index of Future Expectations rose just 4 points to 114. A more positive outlook regarding their farm’s financial situation by ag producers was a major contributor to this month’s rise in both the Index of Current Conditions and the barometer. The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from December 8-14, 2021.

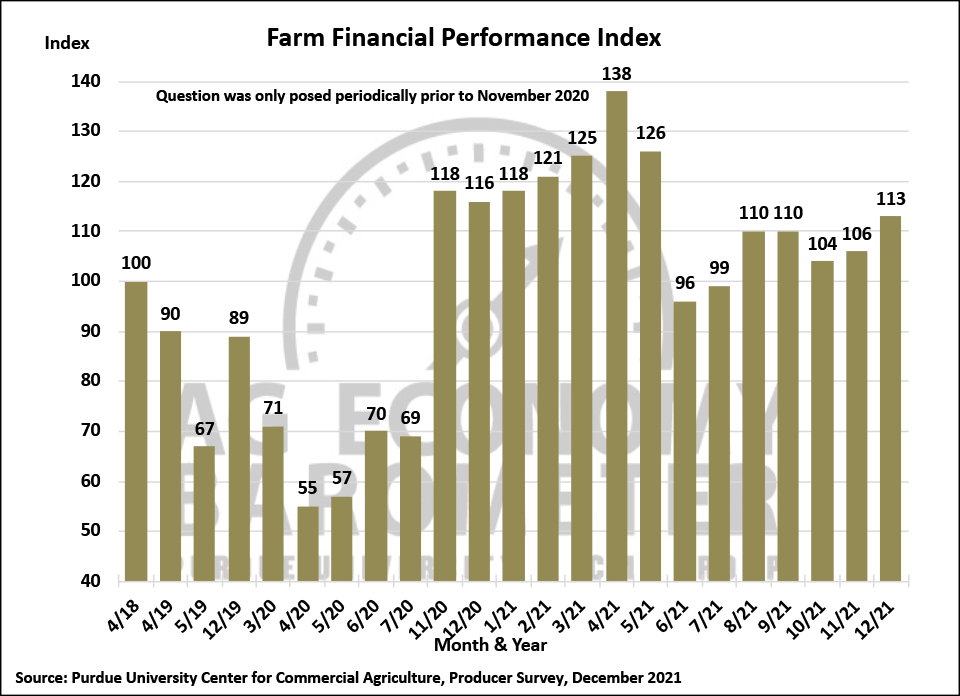

The Farm Financial Performance Index rose 7 points to 113 in December which is the index’s highest reading since May. December marked the second month in a row that farmers reported a stronger financial performance for their farms. This month’s rise leaves the financial index just 3 points below its year-ago level and caps a rise of 18 percent since the index bottomed out back in June. Crop producers taking stock of their farms’ relatively strong financial performance in 2021 as the year wound down likely explains the rise in the financial index. Unlike the barometer, this month’s Farm Financial Performance Index was markedly stronger than readings obtained just before the pandemic’s onset. For example, two years ago the financial index stood at 89, 21% lower than this month’s reading.

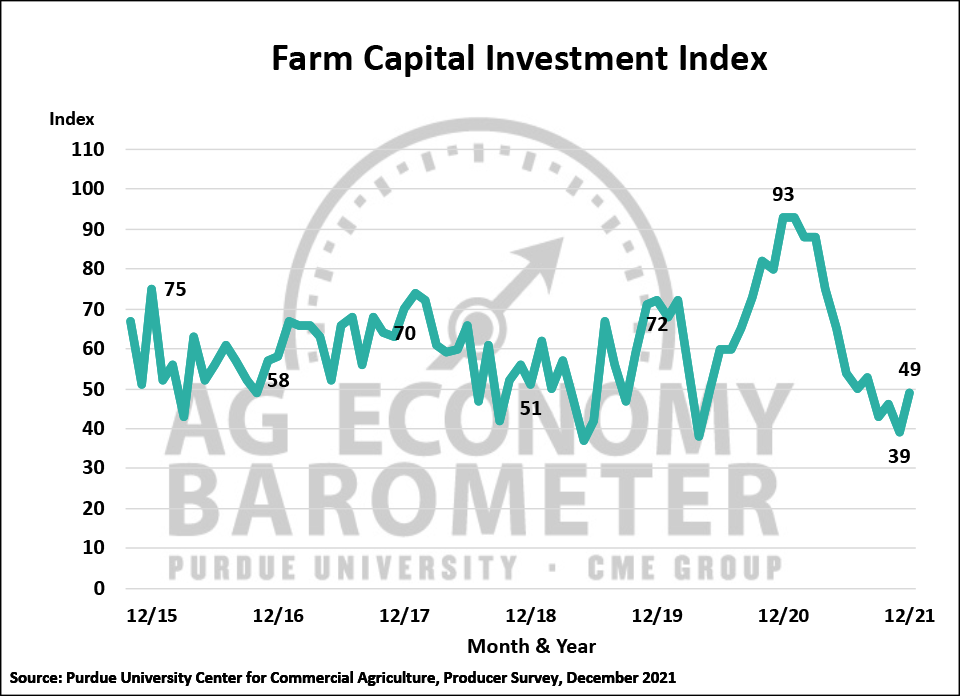

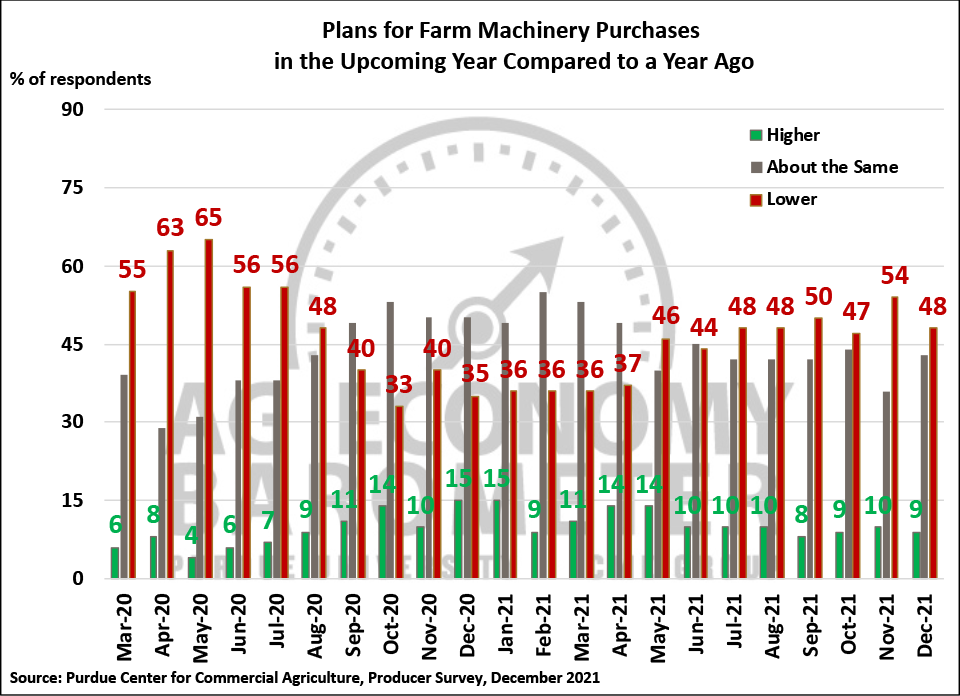

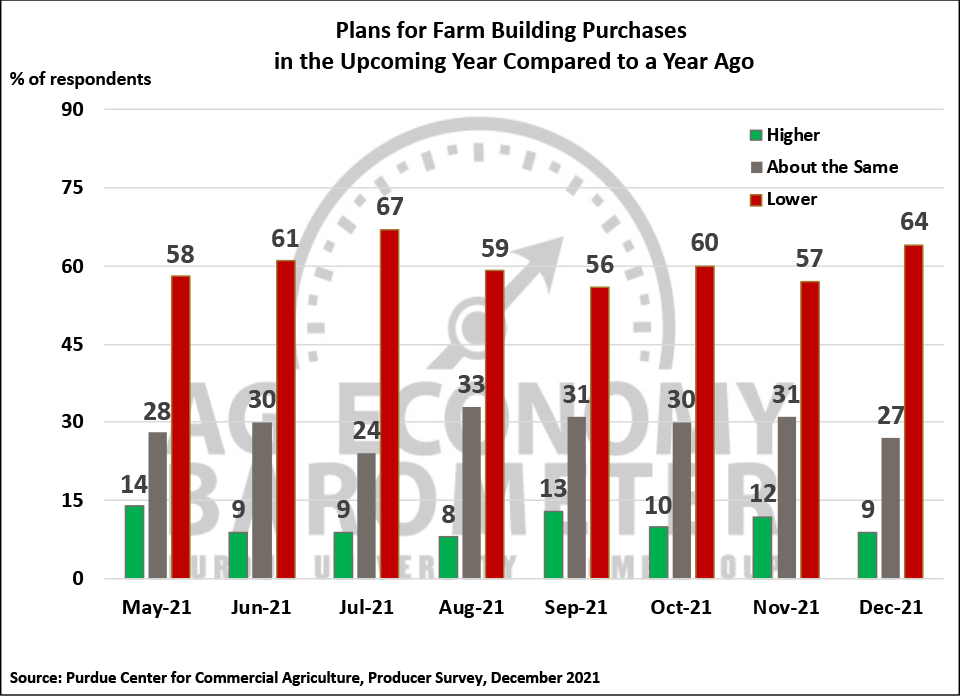

For just the third time this year, the Farm Capital Investment Index rose in December. The index climbed 10 points to a reading of 49, the most positive value for the investment index since August, but still 47% lower than in December 2020. The investment index’s improvement was primarily the result of fewer producers saying now is a bad time to make large investments in buildings and machinery. When asked more specifically about their farm machinery and construction plans, fewer producers this month said they plan to reduce their machinery purchases in the upcoming year, responding instead that they plan to hold their investments steady with the prior year. However, compared to responses recorded in November, a larger number of producers this month said they plan to reduce their investments in farm buildings and grain bins vs. a year earlier. Supply chain issues continue to hamper producers’ capital investment plans. This month 45% of survey participants said that low farm machinery inventory levels impacted their farm machinery purchase plans.

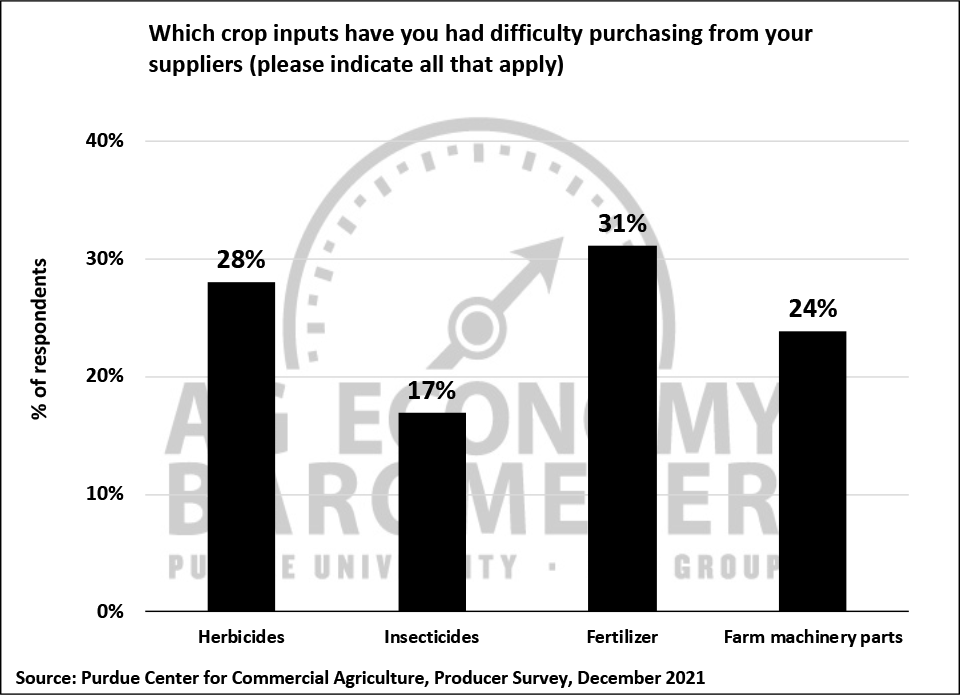

Farmers are very concerned about rising production costs and the availability of production inputs. When asked what their biggest concerns are for their farming operation in the upcoming year, higher input cost was overwhelmingly the top choice, with 47% of respondents choosing it from a list that included lower crop and/or livestock prices, environmental policy, farm policy, climate policy and COVID’s impact. In this month’s survey over half (57%) of producers said they expect farm input prices in the upcoming year to rise by more than 20% compared to a year earlier and nearly four out of ten respondents said they expect input prices to rise by more than 30%. This month’s survey also asked crop producers if they have had any difficulty purchasing crop inputs from their suppliers for the 2022 crop season. Nearly four out of ten (39%) of respondents said they’ve experienced some difficulties. In a follow-up question, producers experiencing difficulties making purchases were asked which crop inputs they’ve had trouble purchasing. Responses were quite varied indicating there are problems across the supply chain with farmers reporting difficulties in purchasing fertilizer (31%), herbicides (28%), farm machinery parts (24%) and insecticides (17%). Despite their concerns about both the rising cost and availability of inputs, just over half of corn/soybean growers said they expect farmland cash rental rates to rise in 2022 compared to 2021.

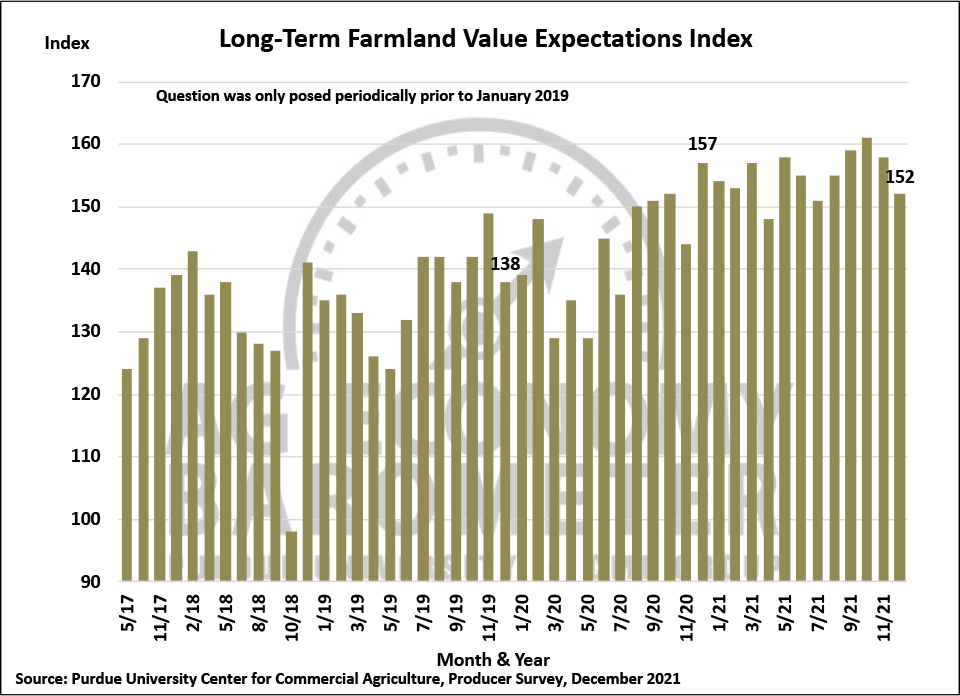

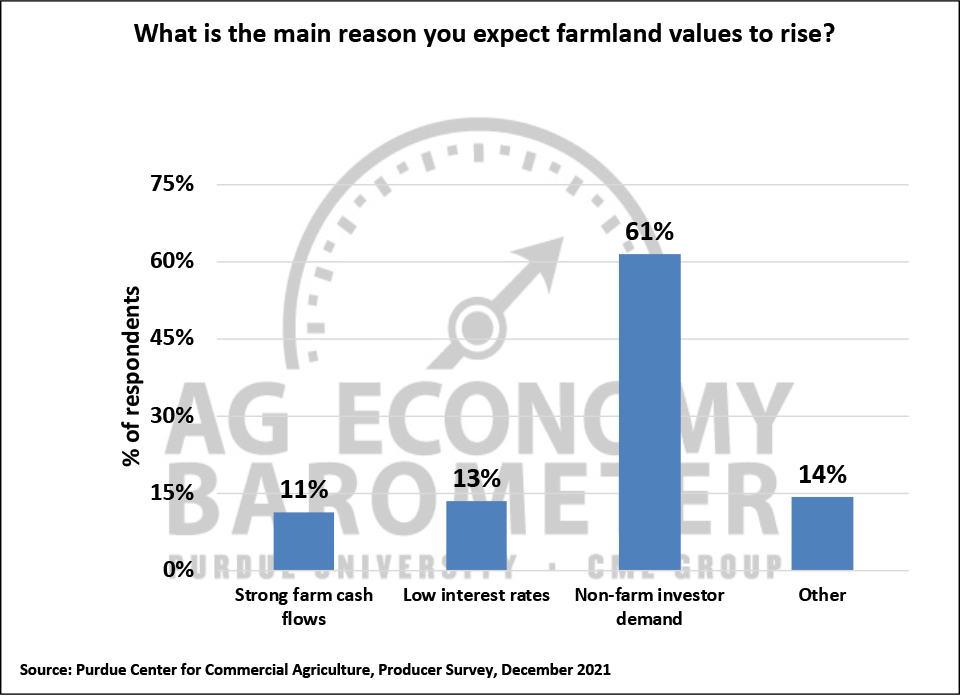

Both the short-term and long-term farmland value indices declined slightly in December. The Short-Term Farmland Value Expectation Index declined 4 points to 153, while the long-term index declined 6 points to 152. Although both indices declined in December, they remain near their all-time highs. Farmland values, especially in the Corn Belt, have risen sharply over the last year. Iowa State University’s farmland value survey recently reported that the average farmland value in Iowa increased 29% from November 2020 to November 2021. The fact that values have climbed dramatically in recent months could be leading some producers to question whether or not values will continue rising. This month’s survey included a follow-up question to producers who indicated they expect farmland values to rise over the next five years, asking them for the main reason they expect farmland values to rise. By far the top response from producers in the survey was non-farm investor demand (61%) followed by low interest rates (13%) and strong farm cash flows (11%) with 14% of respondents indicating another factor not listed on the survey was their primary reason for expecting values to rise.

Wrapping Up

The Ag Economy Barometer rose 9 points in December, marking just the second rise in the overall sentiment index since May. Both the Index of Current Conditions and the Index of Future Expectations rose in December with a stronger current conditions index primarily responsible for the barometer’s rise. Producers’ improved perspective on their farms’ financial position appeared to be the primary driver of the sentiment improvement as the Farm Financial Performance Index climbed 7 points this month. Unlike other measures of farmer sentiment, the financial performance index in December 2021 was higher than it was before the pandemic’s onset. Agricultural producers are concerned about rising input costs with nearly half (47%) of producers choosing it as a top concern for 2022 and nearly four out of ten respondents said they expect farm input prices to rise by more than 30% in 2022 compared to 2021. Supply chain issues continue to haunt the nation’s agricultural sector. Forty-five percent of respondents said that tight farm machinery inventories impacted their machinery purchase plans and 39% of producers in this month’s survey said they’ve experienced difficulty in purchasing crop inputs for the 2022 crop season.