Barometer: Producer sentiment falls as future optimism wanes

WEST LAFAYETTE, Ind. and CHICAGO – Producer sentiment about the agricultural economy fell in October as focus shifted to 2017 and optimism about the future declined, according to the November 1 reading of the Purdue/CME Group Ag Economy Barometer.

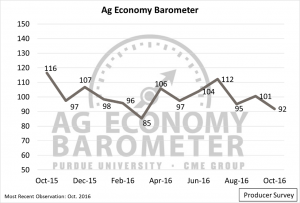

The Ag Economy Barometer fell nine points in October to 92, which is the second-lowest reading since data collection began in October 2015. (Purdue University/CME Group Ag Economy Barometer/David Widmar)

The Barometer landed at 92, down nine points from September’s 101 reading. The current reading is the second-lowest since data collection began a year ago, with only March’s 85 coming in lower. The barometer is based on a monthly survey of 400 U.S. agricultural producers.

The drop was due in large part to the Index of Future Expectations, which fell from 109 in September to 95 in October, said Jim Mintert, barometer principal investigator and director of Purdue’s Center for Commercial Agriculture.

“The decline in producer sentiment recorded during October was primarily driven by an erosion in producers’ perspective regarding the long-run health of the U.S. agricultural economy,” he said. “Producers expressed strong pessimism about the agricultural economy’s prospects in the next year.”

Seventy-nine percent of respondents said that they expect bad times financially over the next 12 months—a jump of 11 percentage points since September. This is the highest share of respondents expressing pessimism since data collection began.

A factor in producer outlook on the future is price expectations, Mintert said. This month’s survey included questions about expectations for movement in July 2017 Chicago Board of Trade (CBOT) futures prices for corn and soybeans.

Twenty-seven percent of respondents said they expect July 2017 CBOT corn futures prices below today’s levels. Twenty-five percent said they expect July 2017 CBOT soybean futures prices below where they are today.

Many producers indicated they will make crop management changes in 2017 as a result of these expectations, including 46 percent who intend to lower fertilizer rates.

Also included in the October report is the quarterly Ag Thought Leaders Survey of 100 agribusiness executives, commodity association leaders, agricultural lenders and academics engaged in the agricultural sector. Overall, the thought leaders were more optimistic about crop prices than producers.

Read the full October report, including analysis of the Ag Thought Leaders Survey, at http://purdue.edu/agbarometer. The site also has additional resources and a form to sign up for monthly barometer email updates and quarterly webinars.

The next webinar is Nov. 3 at 1:30 p.m. (EDT). Mintert and Michael Langemeier, Purdue professor of agricultural economics, will offer insights from the most recent surveys, including thought leaders, and discuss factors driving producer and thought-leader sentiment. Register at https://ag.purdue.edu/commercialag/ageconomybarometer/update/.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are now being reported on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) is where the world comes to manage risk. CME Group exchanges offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. Around the world, CME Group brings buyers and sellers together through its CME Globex® electronic trading platform and its exchanges based in Chicago, New York and London. CME Group also operates one of the world’s leading central counterparty clearing providers through CME Clearing and CME Clearing Europe, which offer clearing and settlement services across asset classes for exchange-traded and over-the-counter derivatives. CME Group’s products and services ensure that businesses around the world can effectively manage risk and achieve growth.

CME Group is a trademark of CME Group Inc. The Globe Logo, CME, Globex and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. CBOT and the Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are registered trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. All other trademarks are the property of their respective owners. Further information about CME Group (NASDAQ: CME) and its products can be found at www.cmegroup.com.

Writer: Jennifer Stewart-B

urton, 765-496-6032, jsstewar@purdue.edu

Sources: Jim Mintert, 765-494-4310, jmintert@purdue.edu

Chris Grams, 312-930-3435, chris.grams@cmegroup.com