Confidence in the ag economy soars; Producers confirm large prevented plantings of corn and soybeans

Jim Mintert gives his breakdown on the Purdue/CME Group Ag Economy Barometer July results at purdue.ag/barometervideo.

Download report (pdf)

James Mintert and Michael Langemeier

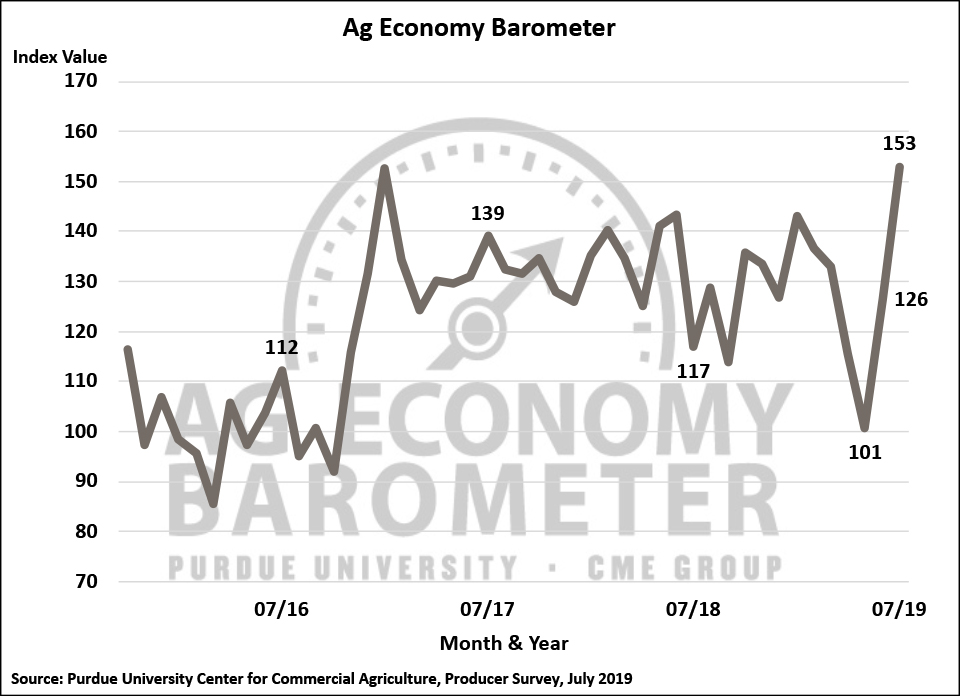

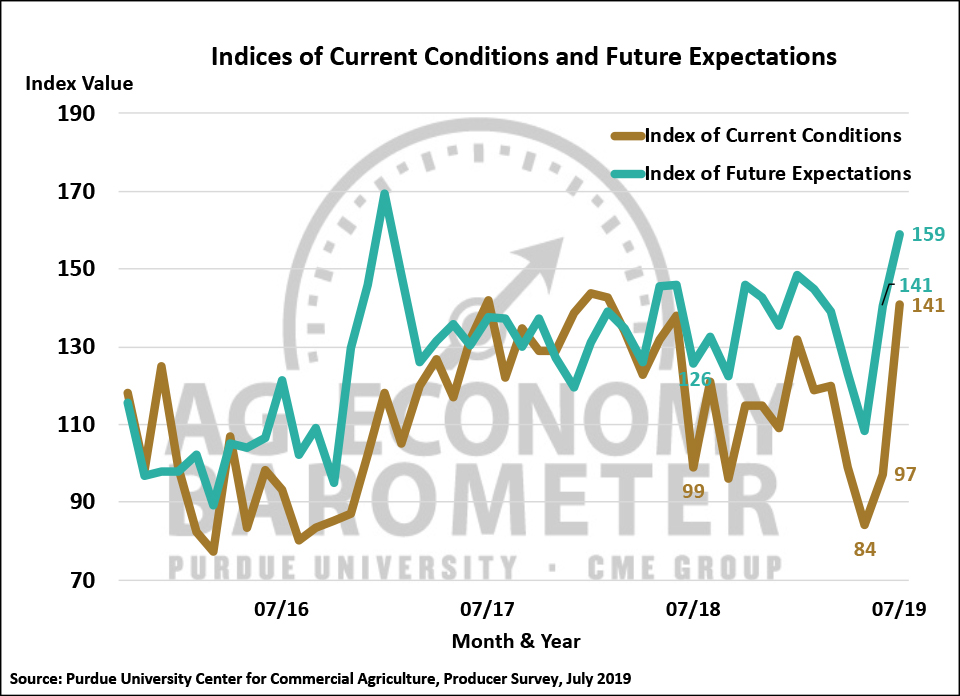

Farmer sentiment improved again in July as the Ag Economy Barometer jumped to a reading of 153, an increase of 27 points compared to June. July was the second month in a row that the barometer rose sharply, leaving the barometer 52 points higher than in May. Although both the Index of Current Conditions and the Index of Future Expectations improved during July compared to a month earlier, the big driver of the overall sentiment improvement was producers’ improved perspective on current conditions. The Current Conditions Index rose 44 points in July, the largest one-month movement since the barometer’s inception, and was actually 57 points higher than in May. For many producers the improvement in the Current Conditions Index coincided with completion of a long, drawn out spring planting season and an improvement in crop conditions. The Future Expectations Index rose to 159, 18 points higher than June. This month’s Ag Economy Barometer nationwide survey of 400 U.S. agricultural producers was conducted from July 15 through July 19, which was prior to USDA’s late July announcement of the 2019 Market Facilitation Program (MFP) per acre payment rates.

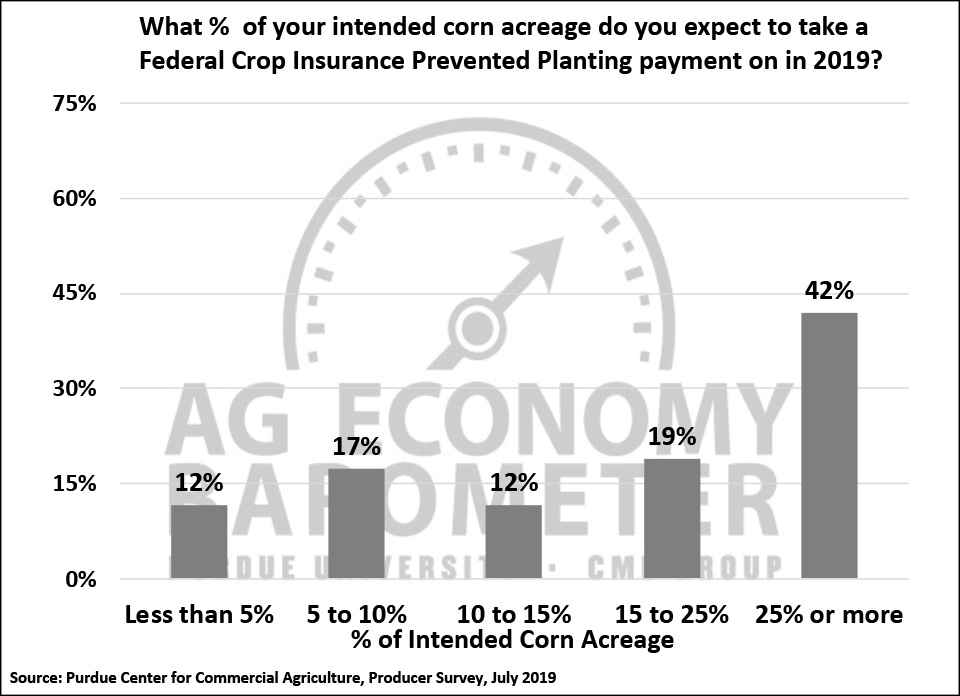

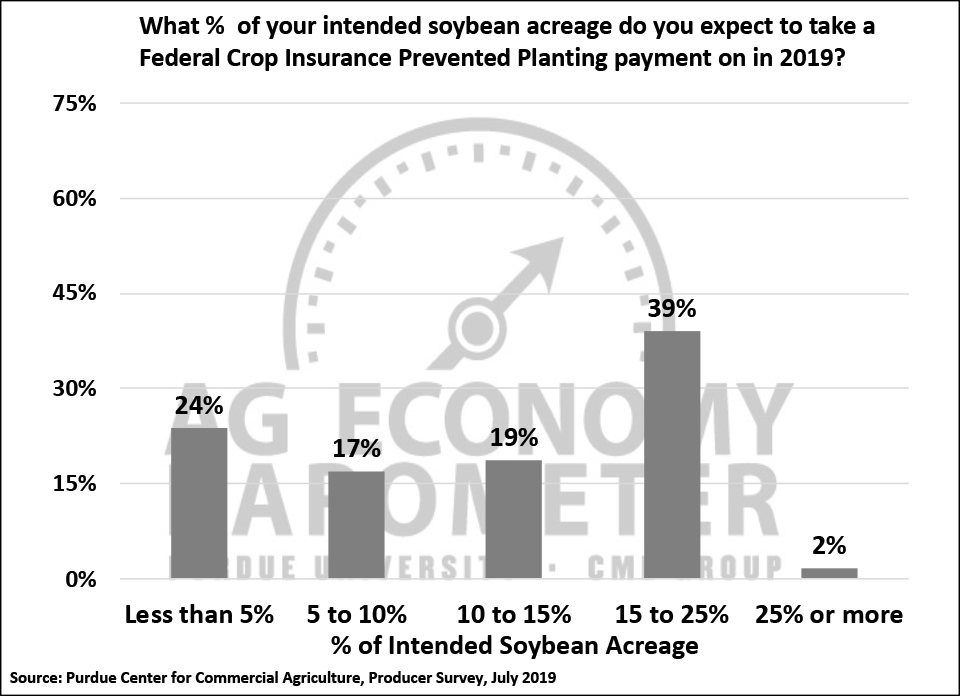

Tremendous uncertainty exists regarding how many corn and soybean acres were left unplanted this year and enrolled instead in Federal Crop Insurance’s prevented plantings program. USDA’s June Acreage report was conducted too early to adequately capture the impact of prevented plantings on 2019 corn and soybean acreage and, as result, USDA resurveyed nearly all major corn and soybean states in July to better estimate actual planted acreage. However, results from that survey won’t be published until August 12th, when the August Crop Production report is released. To help fill the information void in the meantime, this month’s barometer survey asked corn and soybean growers if they are taking a prevented planting payment on any of the corn or soybean acreage they intended to plant in 2019.

Twenty-five percent of corn/soybean growers in our survey said they are filing a prevented planting claim on some of their intended corn acreage and 24 percent said they are filing a prevented planting claim on some of their soybean acreage. We followed up by asking producers who are submitting a prevented planting claim, what percentage of their intended acreage they will claim as prevented planting? Sixty-one percent of the farmers filing a prevented corn planting claim said their prevented planting totaled 15 percent or more of their intended corn acreage and 42 percent said that they did not plant 25 percent or more of their intended acreage. The percentage of intended acreage not planted by soybean growers who are filing a prevented planting claim was not as large as for corn, but was still substantial. Thirty-nine percent of soybean growers filing a prevented planting claim said they did not plant between 15 and 25 percent of their intended soybean acreage; however, only 2 percent of producers said they were not able to plant 25 percent or more of their intended soybean acreage.

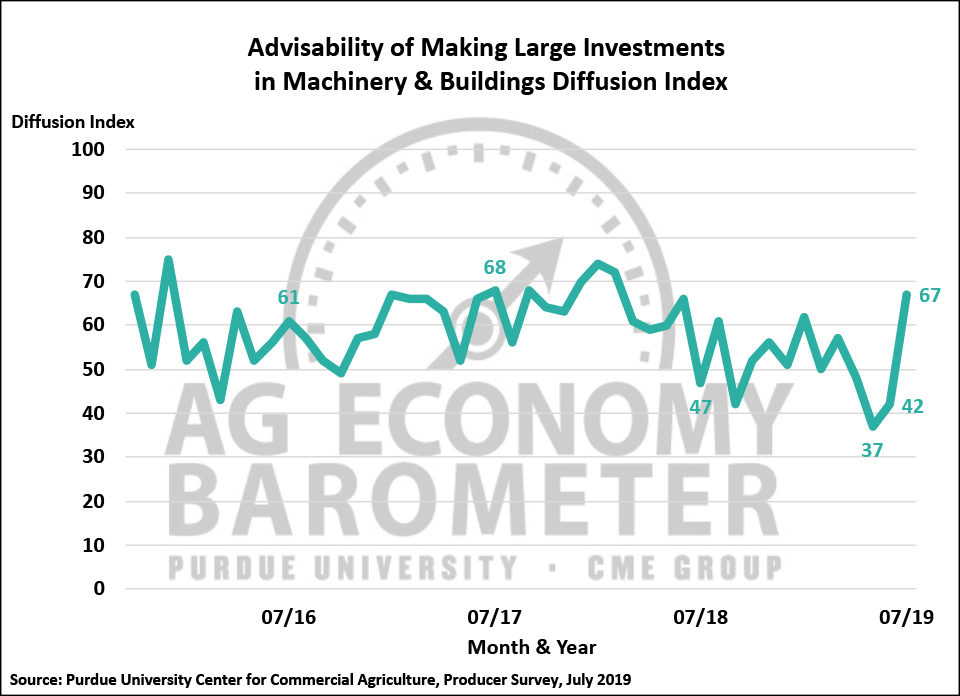

The large improvement in farmer sentiment from June to July carried over into producers’ perspective on making large investments in their farming operations. The Large Farm Investment Index jumped 25 points in July to a reading of 67 vs. 42 a month earlier. Compared to May, the index improved by 30 points, which was the largest 2-month improvement in the index since data collection began in fall 2015. The increase in the investment index pushed it above where it was at the start of this year and was actually the highest reading for the index since February 2018.

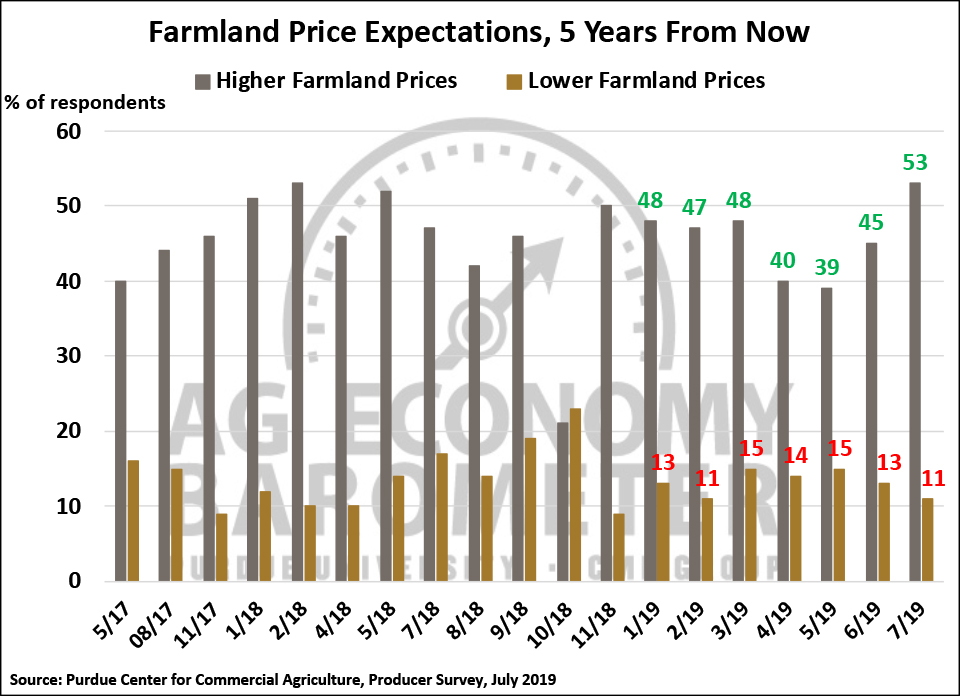

The sentiment shift was also reflected in producers’ expectations regarding farmland values, which improved markedly in July compared to a month earlier. The percentage of producers expecting land values to increase in the upcoming 12 months jumped from just 10 percent in June to 21 percent in July, which was the highest percentage since February 2018. Producers’ longer-range view of farmland values also improved as 53 percent of producers said they expect values to rise over the next 5 years compared to 45 percent who felt that way in June and 39 percent back in May.

Prospects for improving trade relations with China continue to ebb and flow. To gauge whether or not producers expect to see the trade dispute resolved quickly, we’ve been asking producers if they expect the dispute to be settled by July 1 (on the March-May surveys) or by September 1 (on both the June and July surveys). Compared to the June survey, producers were less optimistic that the trade dispute will be resolved quickly. In July, 78 percent of producers said they thought it unlikely the trade dispute would be resolved by September 1, compared to 68 percent who felt that way in June. Just 15 percent thought it likely the trade dispute would be resolved by September 1 in July compared to 32 percent of respondents who felt that way in June.

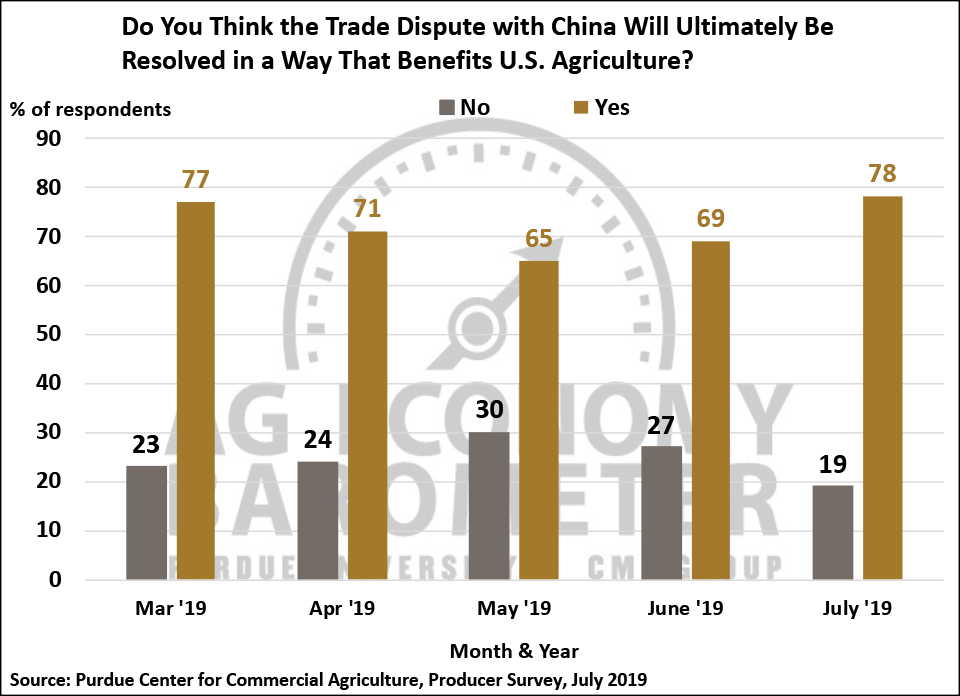

We’ve also been asking producers if the they think the trade dispute with China will ultimately be resolved in a way that benefits U.S. agriculture. We’ve posed this question each month since March 2019 and the results have been interesting. In March over three-fourths (77 percent) of producers said they expected a favorable outcome to the trade dispute for U.S. agriculture in the long-run. Support for that view seemed to wane in the spring, however, dipping to about two-thirds (65 percent) in May. But farmers became a bit more optimistic about the trade dispute’s outcome in June, and in July, 78 percent of respondents said they expected a favorable outcome to the trade dispute for U.S. agriculture, indicating support was virtually unchanged compared to March.

Each summer we ask farmers about prospects for farming operations in their area to increase in size over the upcoming 12 months and the next 5 years. Farmers improved sentiment this July seemed to spill over into improved expectations for future growth opportunities. For example, in July 2018, just 12 percent of respondents told us that they expected growth opportunities in the next year to increase, but in July 2019, this increased to 23 percent of farmers in our survey. Similarly, when asked to look ahead 5 years, nearly half of the respondents (49 percent) this year said they expected greater growth opportunities compared to just 34 percent who felt that way in July 2018.

Wrapping Up

Ag producer sentiment in July improved dramatically as the Ag Economy Barometer increased 27 points compared to June and was up 52 points compared to May. The sentiment shift since May 2019 was the largest two-month swing in the barometer since data collection began in fall 2015. This month’s large rise in the barometer was motivated mostly by a better perspective on current conditions as the Current Conditions Index rose 44 points compared to June. The shift in sentiment carried over into producers having a more optimistic perspective on farmland values and whether or not now is a good time to make large investments in their farming operations. Unusually wet weather conditions this spring prevented many Corn Belt farmers from planting all of their intended corn and soybean acreage. Approximately one-fourth of corn and soybean growers in our survey said they were filing a prevented planting claim on at least some of their intended corn and soybean acreage. Survey responses indicated that prevented planting acreage will be quite large, especially for corn. Sixty-one percent of the farmers in our survey who filed a prevented corn planting claim said their prevented planting totaled 15 percent or more of their intended corn acreage and 42 percent said that they did not plant 25 percent or more of their intended acreage. On the soybean side, 39 percent of soybean growers filing a prevented planting claim said they did not plant between 15 and 25 percent of their intended soybean acreage.