Farmer Sentiment Drifts Lower As Trade Uncertainty Hangs Over Agriculture

Michael Langemeier and James Mintert, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer December results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

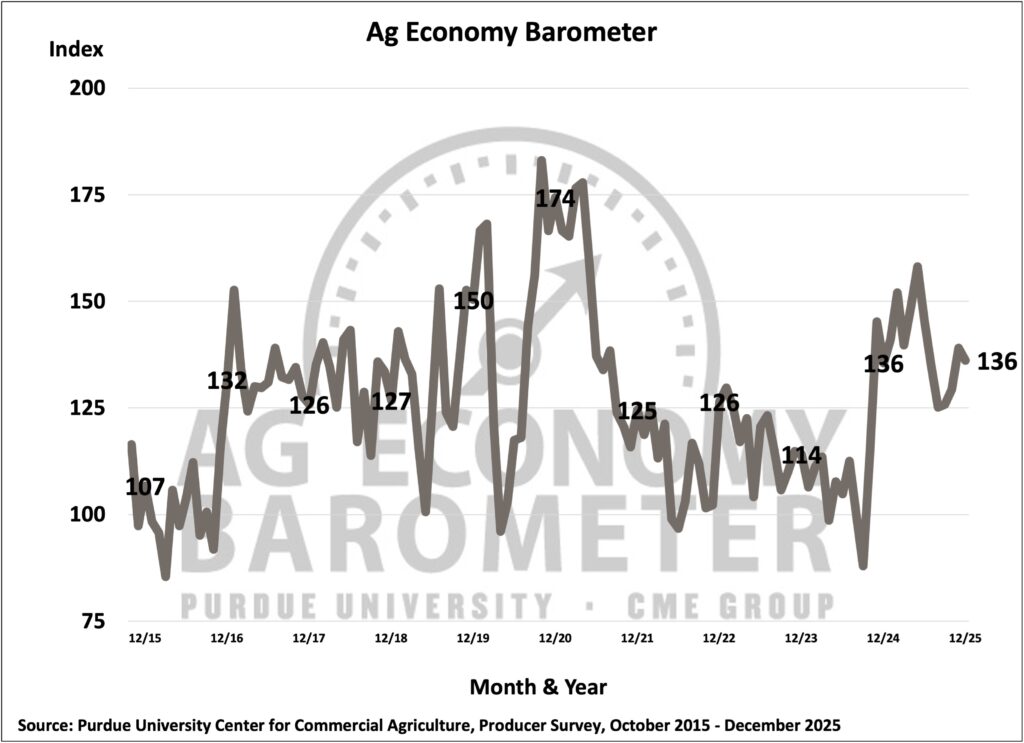

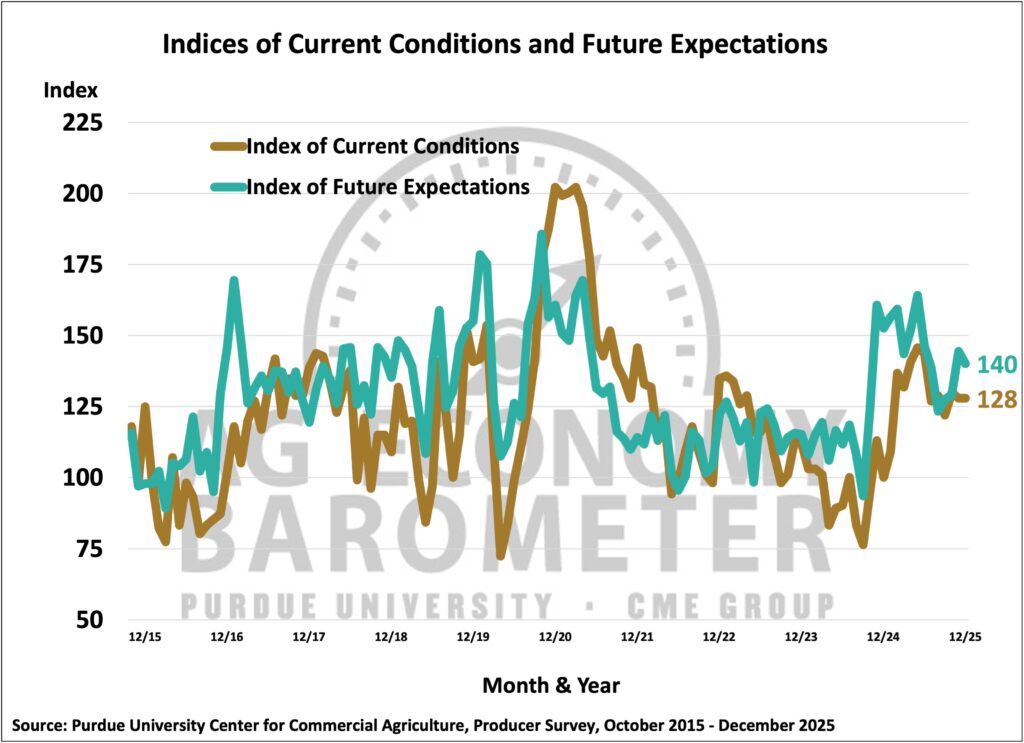

Farmer sentiment weakened slightly in December as the Purdue University-CME Group Ag Economy Barometer Index dropped just 3 points in December to a reading of 136. Weakness in the barometer was attributable to a modest decline in producers’ long-term outlook, as the Future Expectations Index fell to 140, 4 points below a month earlier. Meanwhile, the Current Conditions Index, at 128, was unchanged from November’s reading. Angst about prospects for U.S. soybean exports amid increasing competition from Brazil contributed to a slightly weaker outlook for the future among crop producers. The December barometer survey took place from December 1-5, 2025.

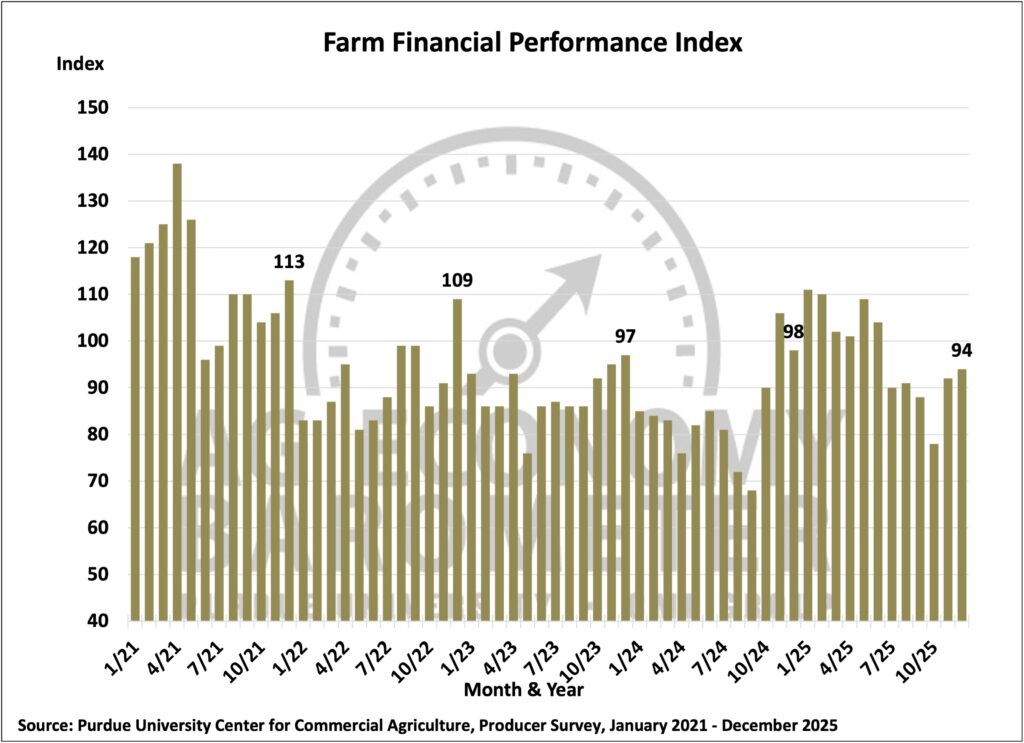

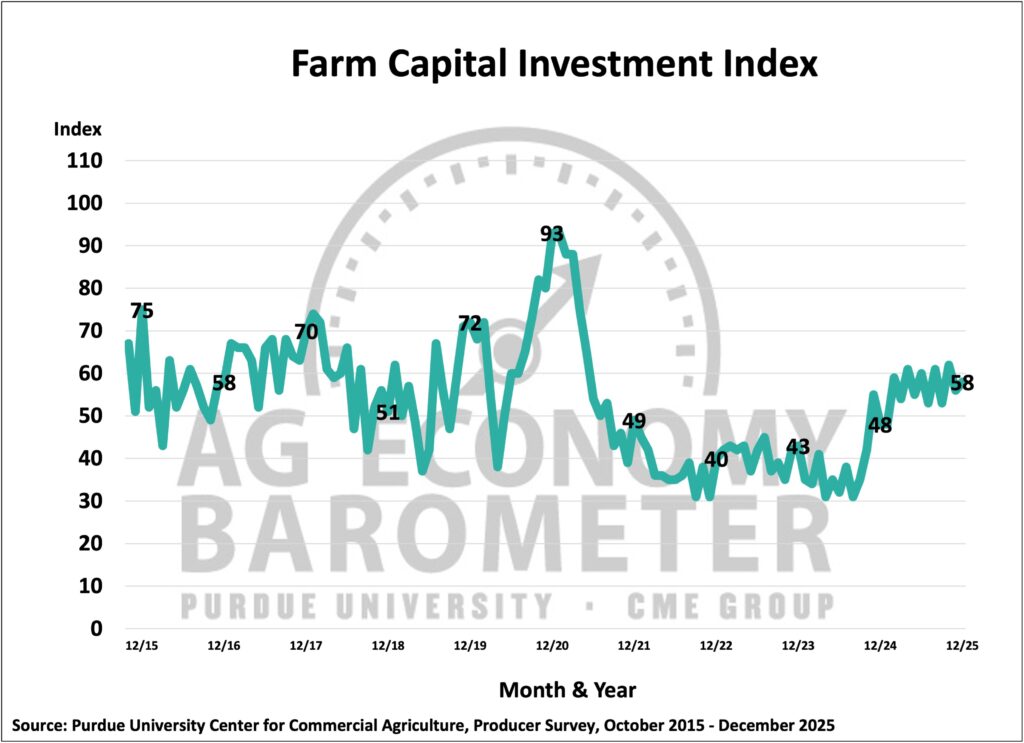

Producers’ expectations for their farms’ financial performance changed little compared to November, as the financial performance index rose just 2 points to 94. Underlying the index’s small improvement was a shift toward more producers saying they expect this year’s farm financial performance to be about the same as last year’s. At a reading of 58, the Farm Capital Investment Index also increased 2 points compared to a month earlier. Although the investment index rose slightly in December, 60% of producers still said it was a bad time to make a large investment in their farms.

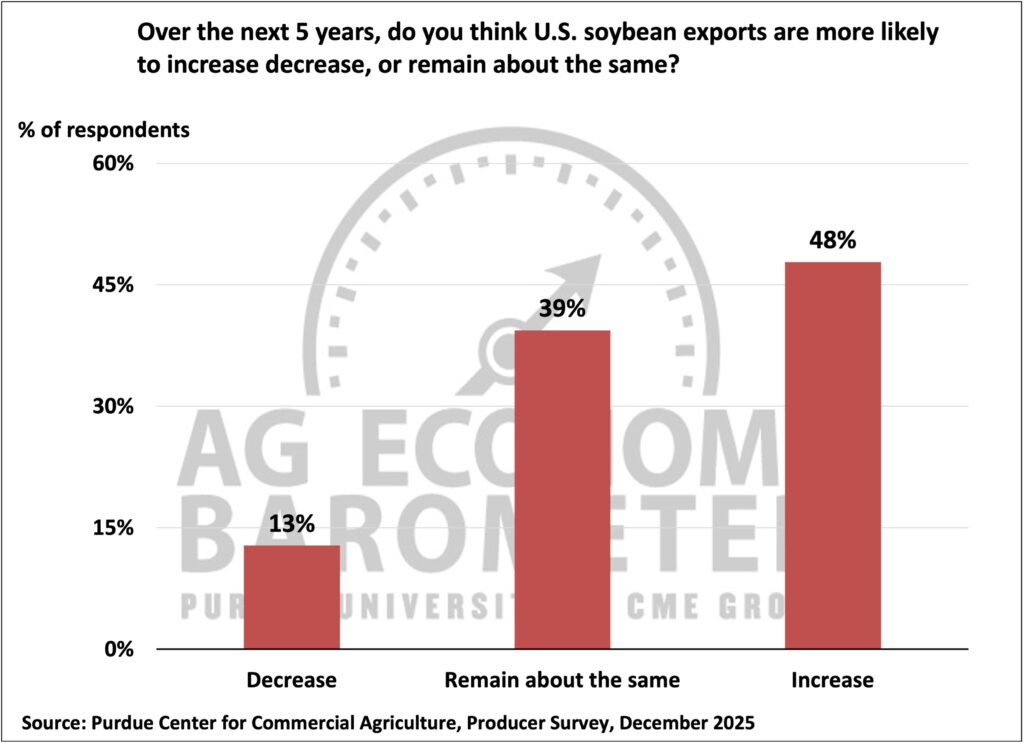

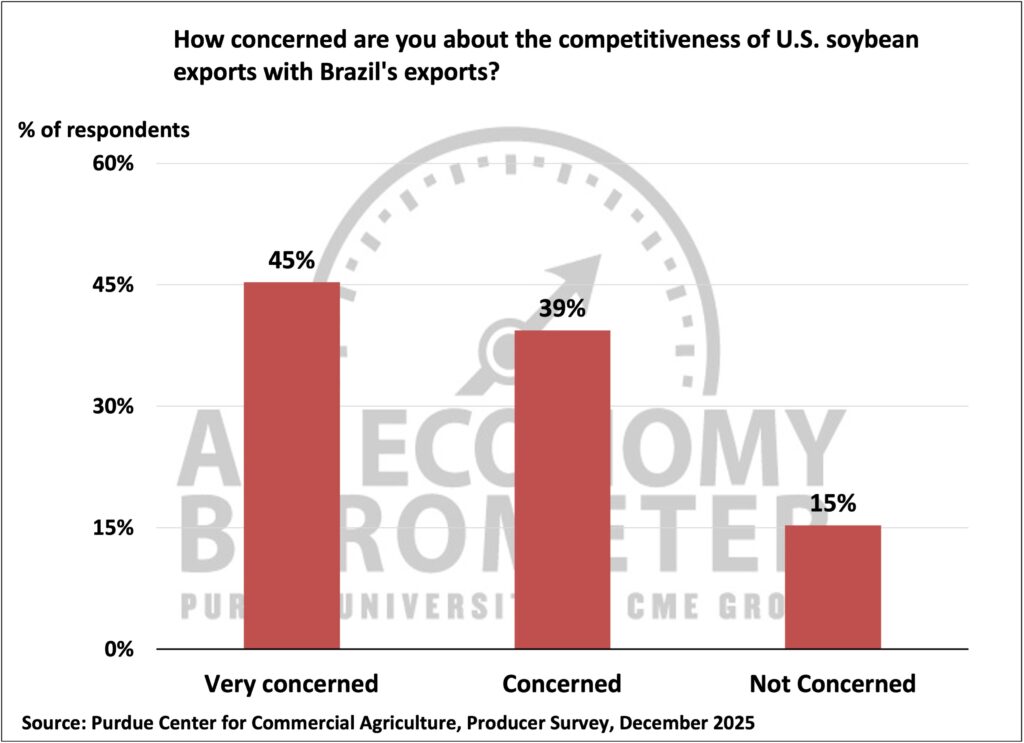

Farmers’ perspectives on U.S. agricultural exports were mixed in December. Responding to a generic question about the future of agricultural exports, producers provided one of their most optimistic outlooks of the year, with just 5% of producers looking for exports to decline over the next five years. However, when asked to focus more specifically on soybeans, a key agricultural export, their outlook was notably less sanguine. In December, 13% of corn and soybean growers said they expect soybean exports to decline over the upcoming five years, up from 8% of growers who felt that way in November. Similarly, the percentage of growers who expect soybean exports to increase in the next five years fell from 47% in November to 39% in December. Increasing competition from Brazil is weighing on producers’ minds. Eighty-four percent of corn and soybean producers said they were concerned or very concerned about the competitiveness of U.S. soybean exports versus Brazil’s, with 45% indicating they were very concerned.

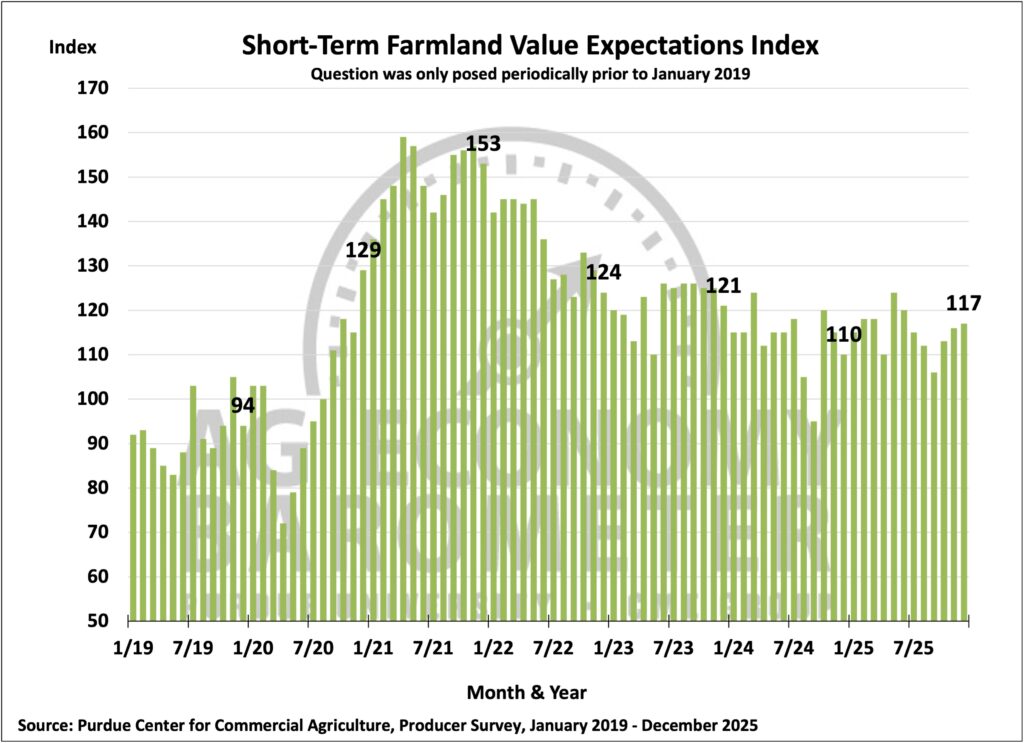

Farmers remained optimistic about farmland values in December. The Short-Term Farmland Value Expectations Index and the long-term index were virtually unchanged, as both indices rose just one point compared to November. The small increase left the short-term index at 117, which was 11 points above its most recent low in September and 7 points higher than a year earlier. The long-term index reading of 166, a new record high, was 20 points above its most recent low in September and 11 points higher than a year ago.

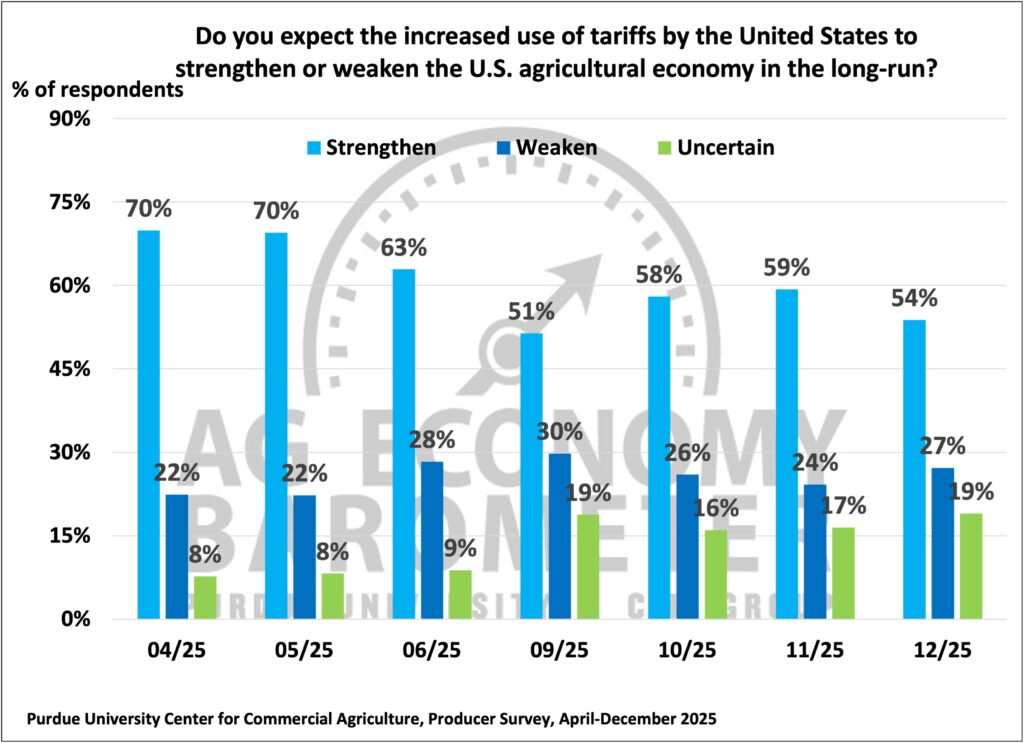

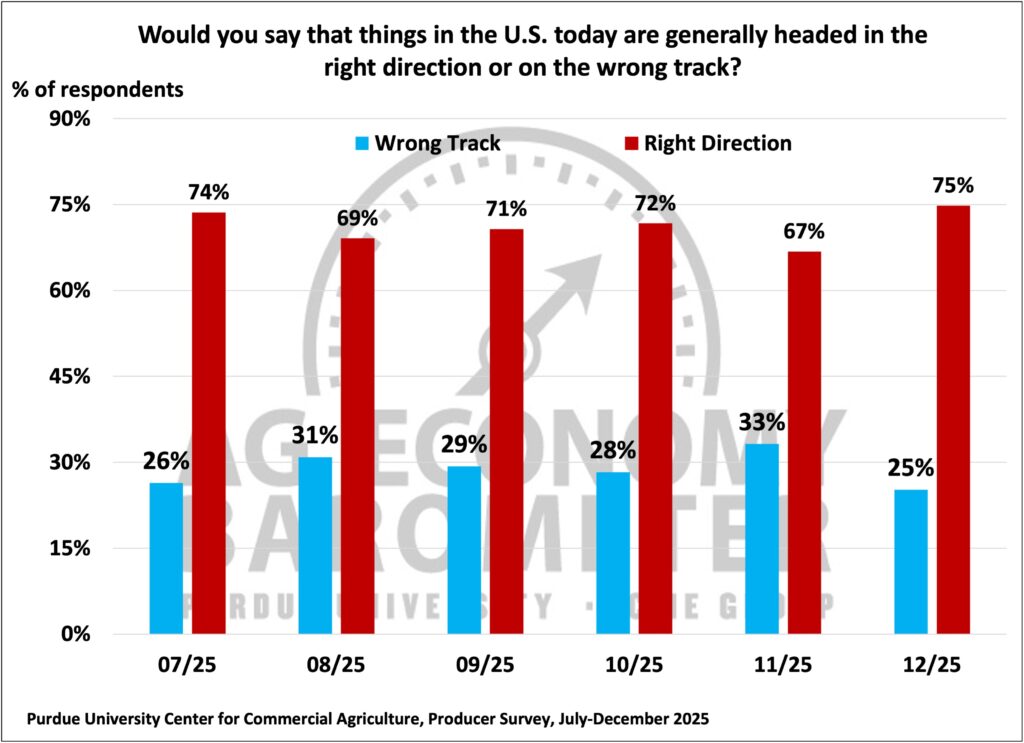

Confidence in the use of tariffs to strengthen the U.S. agricultural economy is showing signs of waning. In December, 54% of respondents said they expect the use of tariffs to strengthen the agricultural economy, down from 58% and 59% in October and November, respectively. Farmers who are uncertain about tariffs’ long-run impact rose to 19% of respondents in December, up from 17% a month earlier. The percentage of producers who say they are uncertain about how tariff policy will affect the agricultural economy in the long run has more than doubled since this question was first posed in the spring. However, when asked if the U.S. is headed in the “right direction” or on the “wrong track,” three-fourths (75%) of respondents chose “right direction” in December, which was the highest percentage recorded since this question was first included in barometer surveys starting in July.

Wrapping Up

Farmer sentiment drifted lower in December as producers became slightly less optimistic about the future than in November. The small decline in overall farmer sentiment occurred despite the fact that producers held a more optimistic view of their farms’ financial performance and were slightly more optimistic about farmland values than a month earlier. Uncertainty about the future of agricultural trade continues to influence farmer sentiment. Nearly one in five (19%) respondents said they are uncertain about how U.S. tariff policy will affect the agricultural economy in the long run. In addition to rising concerns about tariff policy impacts on agriculture, almost 9 out of 10 (86%) corn and soybean growers said they were concerned about increasing competition from Brazil affecting U.S. soybean exports, which might also underlie weakness in expectations for the future.