Farmer Sentiment Drifts Lower, Rising Interest Rates Contribute to Uneasiness

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer September results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

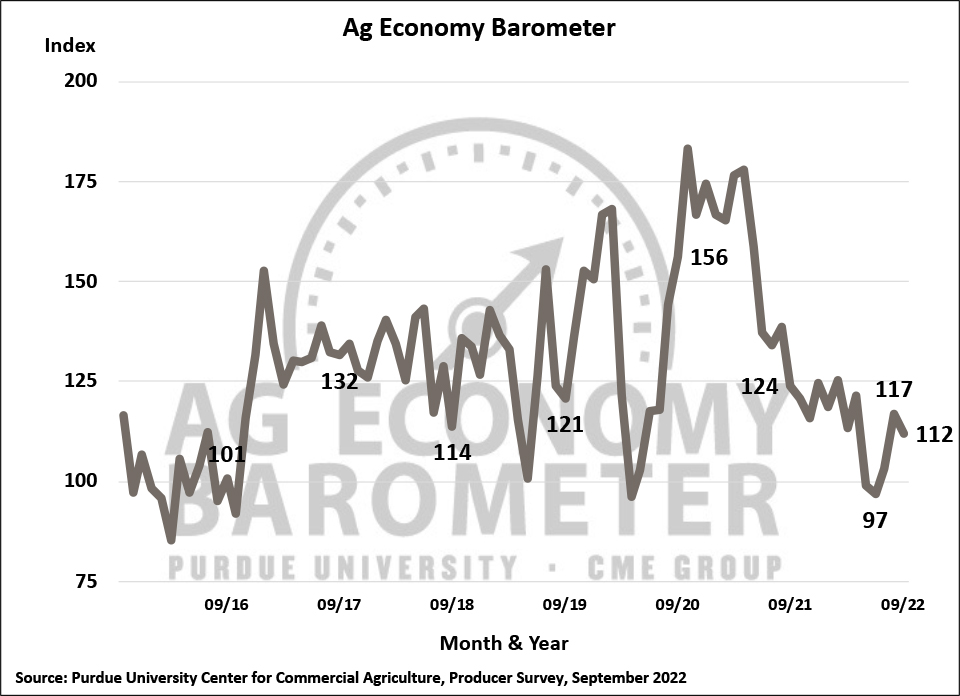

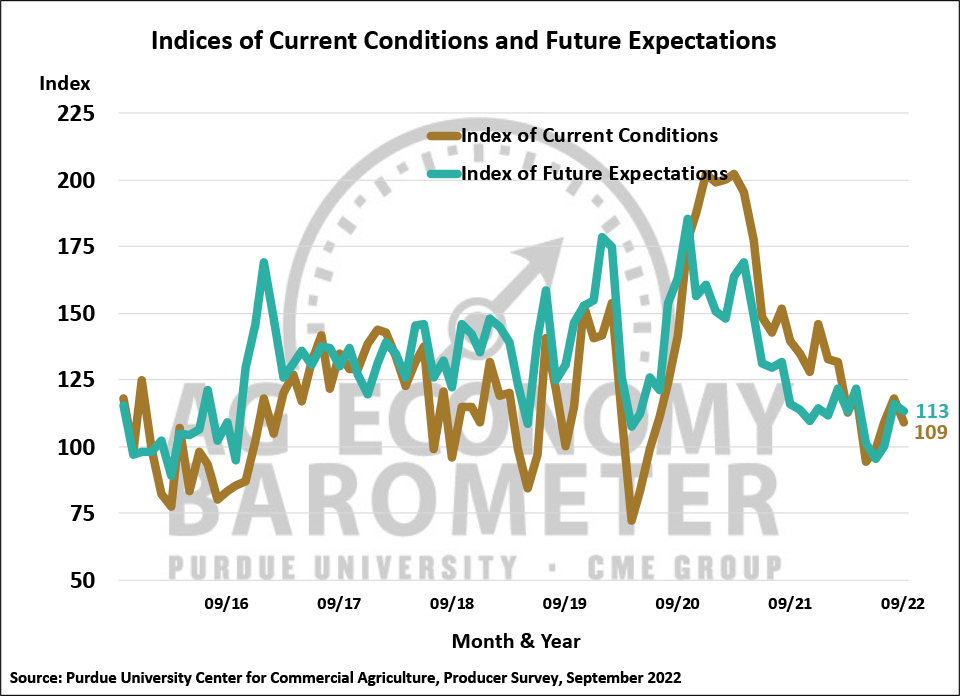

The Purdue University-CME Group Ag Economy Barometer index drifted lower to a reading of 112 in September which was 5 points lower than a month earlier. The decline in farmer sentiment was primarily the result of producers’ weaker perception of current conditions as the Current Conditions Index declined to 109, 9 points lower than in August. The Index of Future Expectations also weakened slightly, declining 3 points from a month earlier to a reading of 113. Compared to a year earlier, the barometer this month was 10% lower while producers’ assessment of current conditions was down 22%. These results stand in contrast with future expectations in September which was only 2% weaker than a year ago. The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from September 19-23, 2022, a week or more following USDA’s September Crop Production and World Agricultural Supply and Demand Estimates (WASDE).

Figure 1. Purdue/CME Group Ag Economy Barometer, October 2015-September 2022.

Figure 2. Indices of Current Conditions and Future Expectations, October 2015-September 2022.

Higher input costs are still the number one concern among survey respondents with the shift in U.S. monetary policy rising to the forefront as an issue among U.S. producers. This month 44% of respondents chose “higher input costs” as their number one concern, down from 53% last month. Second on the list of producers’ concerns for the upcoming year was “rising interest rates”, chosen by 23% of respondents, up from 14% in August. Third on the list of concerns was “availability of inputs” chosen by 14% of producers in the survey. The percentage of producers with concerns about input availability has been relatively stable over the last 3 months, ranging from a low of 12% to a high of 15% suggesting this issue is not going away. Interestingly, the percentage of producers choosing “lower crop and/or livestock prices” as one of their biggest concerns declined over the summer. In July 19% of respondents chose it as one of their biggest concerns while just 8% of producers chose it in this month’s survey.

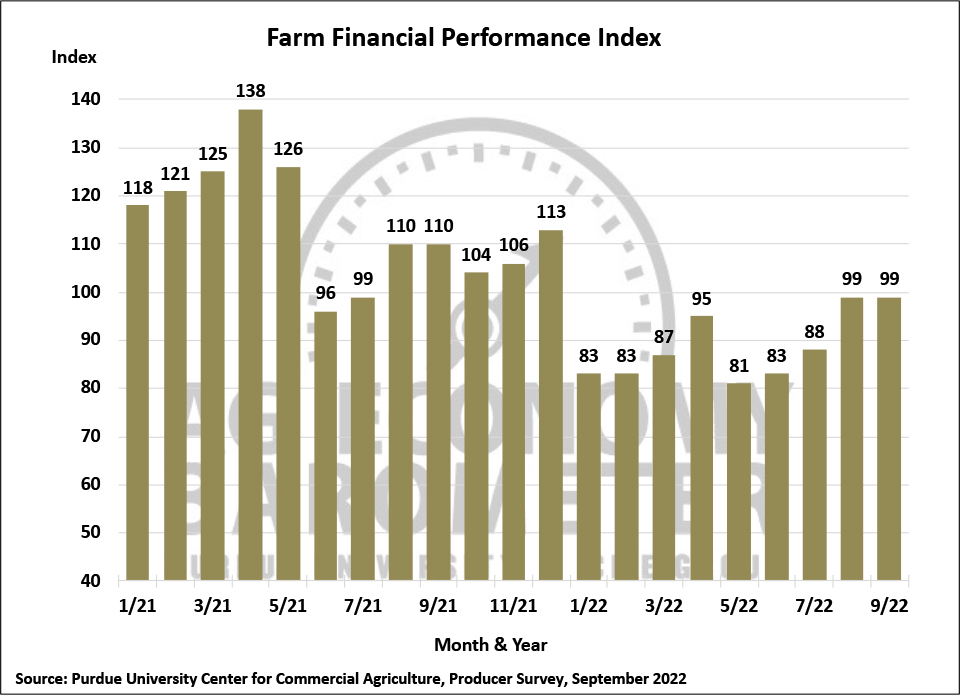

This month’s Farm Financial Performance Index was unchanged from a month earlier at 99 but was still 10% lower than a year earlier. Compared to earlier this year, producers clearly feel better about their farm’s financial performance. Back in May, 38% of respondents said they expected their farm’s financial performance in 2022 to be worse than in 2021. This month that percentage declined to 29% while the percentage expecting better performance rose from 19% in May to 28% this month. Uncertainty surrounding input costs and availability was partly responsible for the negative perspective held last spring by many producers. As the year unfolded, however, producers’ worst fears regarding input cost rises and poor input availability did not materialize providing much more certainty to their farm’s financial outlook and contributing to their improved perspective on farm financial performance.

Figure 3. Farm Financial Performance Index, April 2018-September 2022.

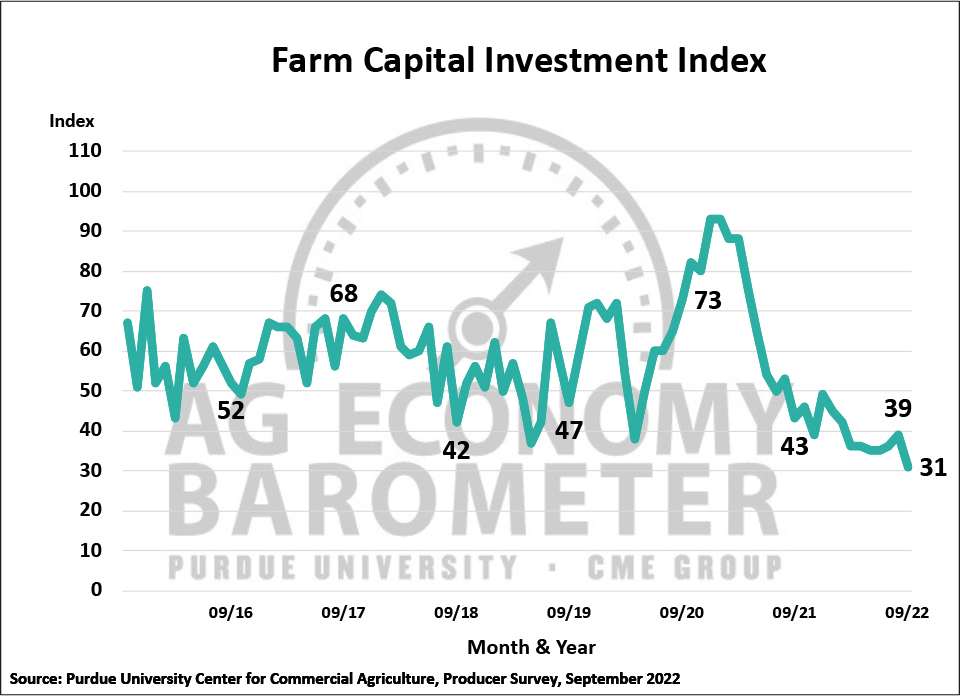

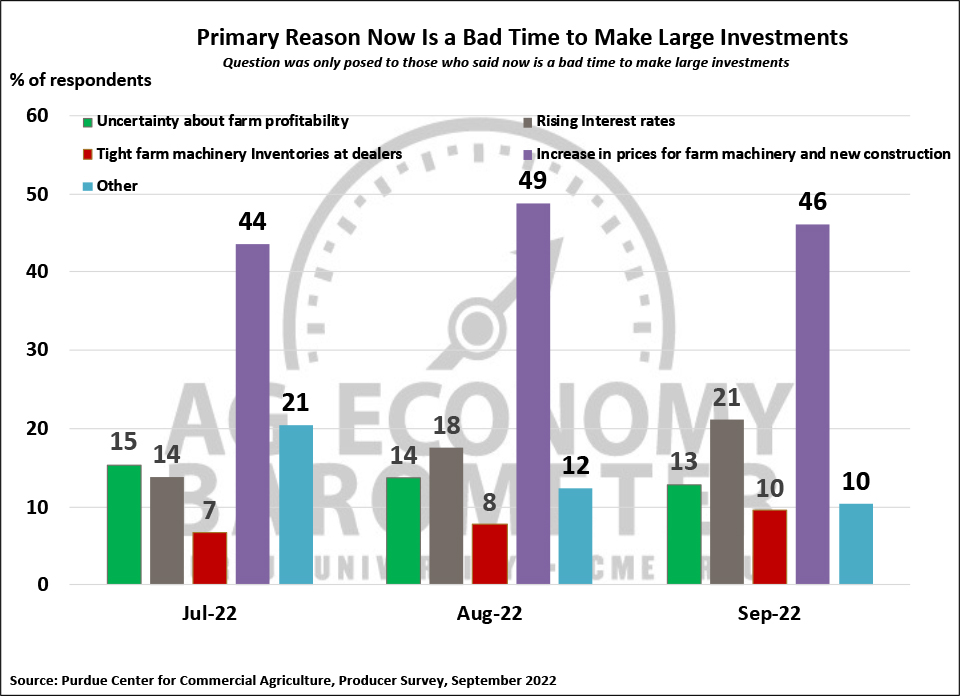

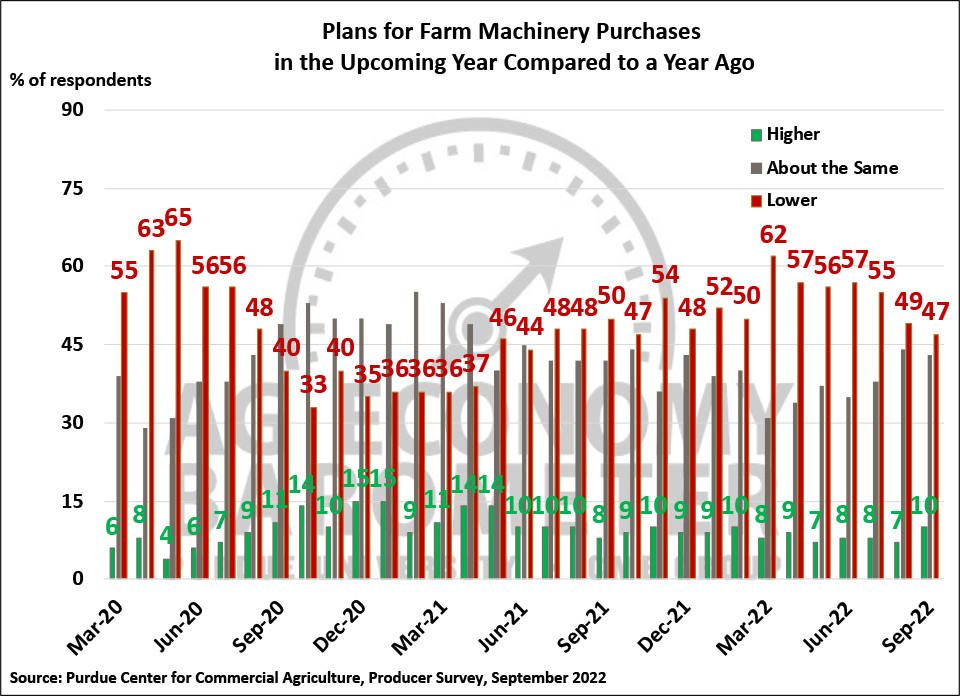

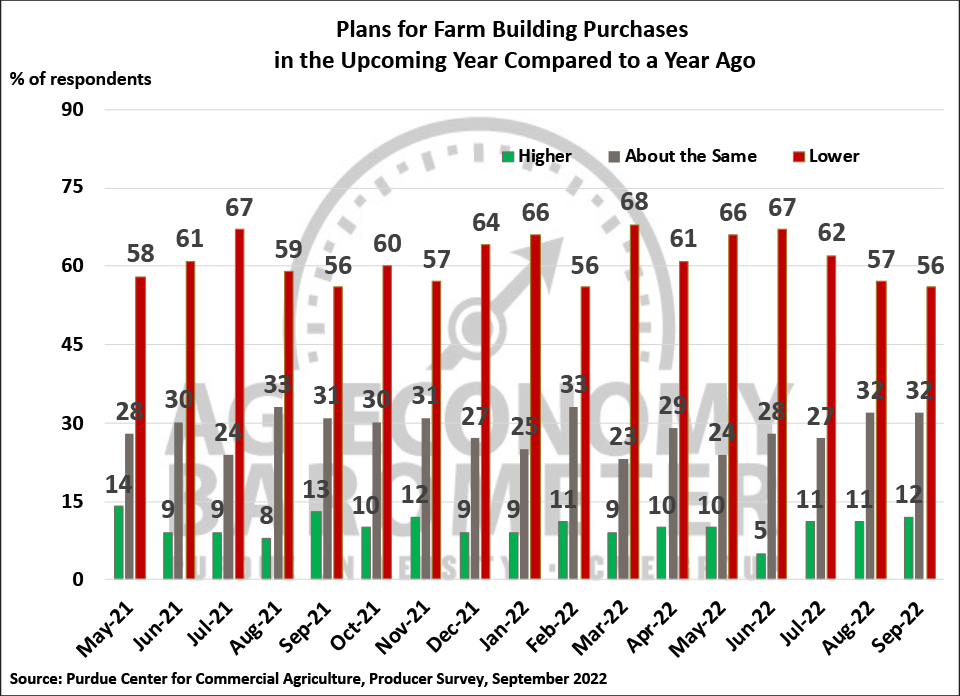

The Farm Capital Investment Index declined to a record low of 31 in September as producers continue to indicate that they do not view this as a “good time” to make large investments in their farming operations. Despite that negative perspective, the percentage of producers who plan to reduce their farm machinery purchases declined again this month, down 2 points compared to responses in August. Since peaking in March at 62 percent, the share of producers who plan to reduce their machinery purchases compared to a year earlier has been declining, dipping to 47% this month. Producers’ plans for farm building purchases tell a similar story, declining from a high of 68% who planned to reduce their building and grain bin purchases back in March to 56% who felt that way in the September survey. Once again, a follow-up question was posed to farmers who reported this being a “bad time” to make large investments to learn why they felt that way. For the third month in a row, producers overwhelmingly said it was primarily because of the increase in prices for farm machinery and new construction. However, interest rates are starting to become a factor influencing producers’ decision making. Throughout the summer the percentage of farmers who chose “rising interest rates” as a primary reason for thinking it’s a bad time to make large investments rose from 14% in August to 21% in September.

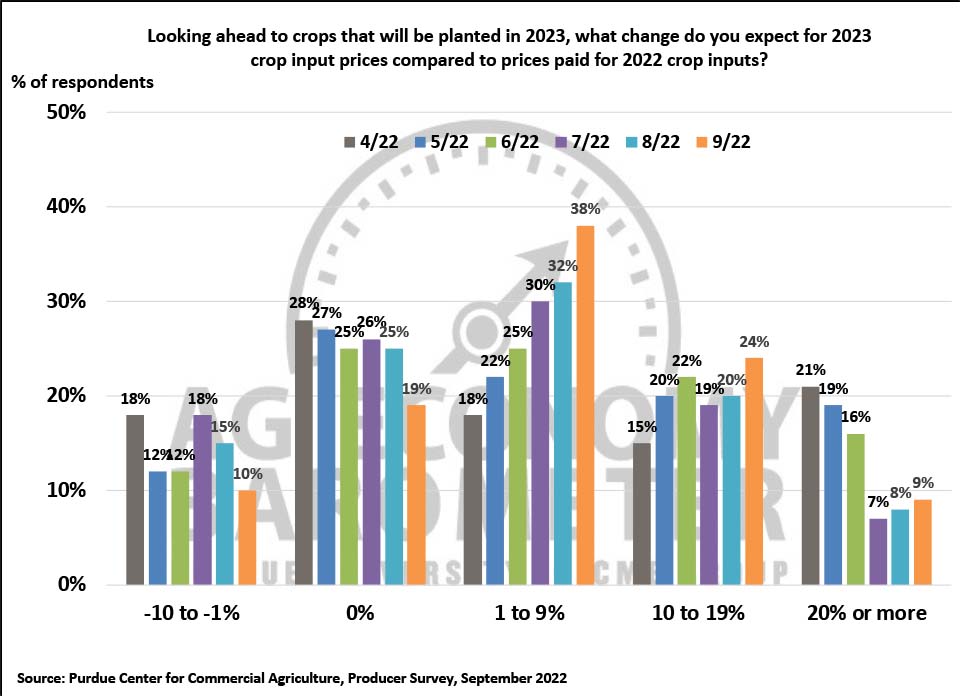

Fewer producers this month said they expect either no change in crop input prices or expect input prices to decline in 2023 compared to 2022 than in recent surveys, while more producers expect an input price rise that matches up more closely with the rate of inflation. In April, 18% of respondents expected input prices in 2023 to decline, whereas this month just one out of ten producers said they look for prices to fall up to 10% below 2022’s level. Over the same time frame, the percentage expecting no change in prices for 2023 declined from 28% to 19%. The largest share (38%) of producers this month expect input prices to rise from 1 up to 9%, compared to 18% who felt that way in April. And nearly a fourth of producers this month said they expect input prices to rise from 10 up to 19%, compared to just 15% of producers who expected input prices to rise that much back in April. Interestingly, in April one out of five producers looked for 2023 input prices to rise by 20% or more whereas in September, just 9% of survey respondents said they expect an input price rise of that magnitude.

Producers’ perspective on farmland values continues to soften. This month the Short-Term Farmland Value Expectations Index fell 5 points to 123 while the long-term index fell 7 points to 139. A year ago, the short-term index, which provides producers’ perspective one year into the future, stood at 155. This month’s reading leaves the index 21% lower than a year earlier while the long-term index has fallen 12% over the same time frame. In a follow-up question posed to respondents who expect farmland values to rise over the next 5 years, over 60% of respondents said that the main reason they expect values to rise is non-farm investor demand, up from 45 to 51% who thought that was the main driver back in January and February. At the same time, fewer respondents on this month’s survey said they expect low interest rates to support farmland values than in the past. In January and February, 6 to 9% of respondents who said they expect values to rise cited “low interest rates” as the main reason. In the September survey, just 1% of respondents pointed to low interest rates as the principal reason they expect farmland values to rise.

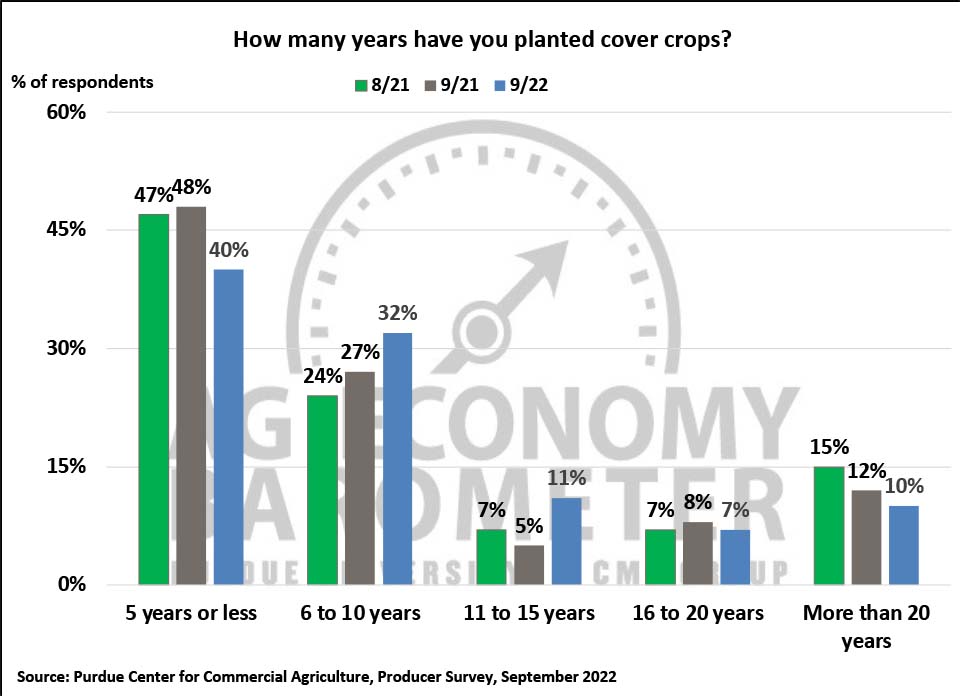

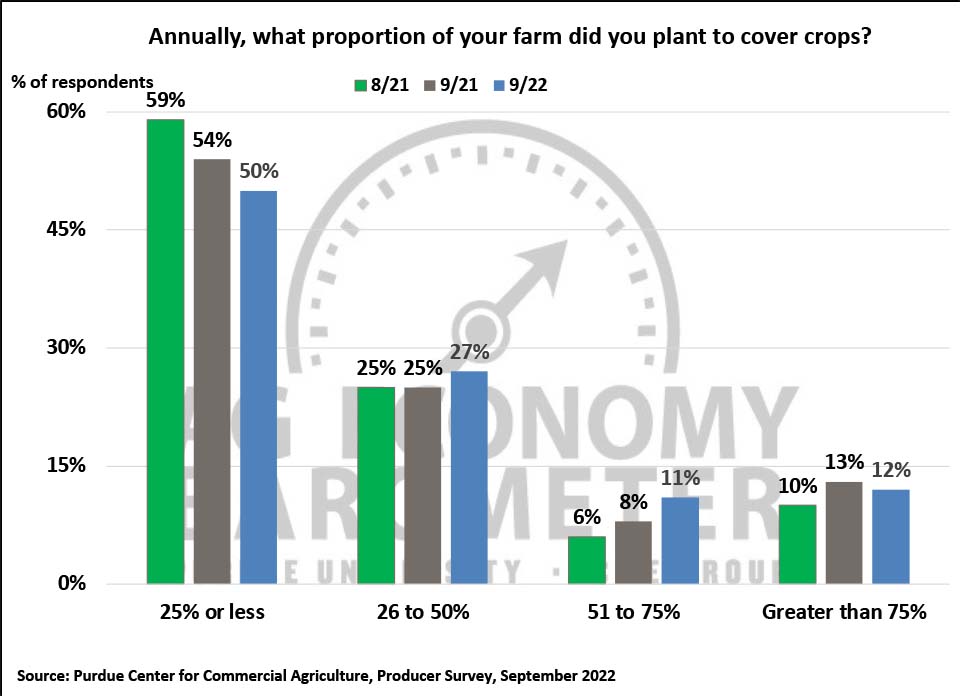

This month’s survey included a series of questions about cover crop usage as a follow-up to the same questions posed in 2021. Nearly six out of 10 (57%) of respondents said they currently plant cover crops on a portion of their farmland while approximately one out of four producers said they have never planted a cover crop. Most producers who report planting cover crops say they only do so on a portion of their farmland. Half of the farmers in this month’s survey who plant cover crops said they do so on 25% or less of their cropland. Nearly a fourth of respondents said they plant cover crops on over 50% of their farms’ acreage. A large share (40%) of producers who reported planting cover crops this month said they have been planting cover crops for 5 years or less. On the other end of the spectrum, 28% of respondents said they have been planting cover crops for more than 10 years. Reasons cited by producers for planting cover crops are varied, but “improve soil health” at 37% of respondents and “improve erosion control” at 33% of respondents were the top two reasons cited by cover crop users. Just 5% of cover crop users indicated “carbon sequestration” was a motivation for planting cover crops.

Figure 4. Farm Capital Investment Index, October 2015-September 2022.

Figure 5. Why is Now a Bad Time to Make Large Investments?, September 2022.

Figure 6. Plans for Farm Machinery Purchases in the Upcoming Year Compared to a Year Ago, March 2020-September 2022.

Figure 7. Plans for Constructing New Farm Buildings and Grain Bins, May 2021-August 2022. Plans for Constructing New Farm Buildings and Grain Bins, May 2021-September 2022.

Figure 8. How many years have you planted cover crops? September 2022.

Figure 9. Annually what proportion of your farm did you plant to cover crops? September 2022.

Figure 10. Looking ahead to crops that will be planted in 2023, what change do you expect for 2023 crop input prices compared to prices paid for 2022 crop inputs? September 2022.

Wrapping Up

Farmer sentiment drifted lower in September as the Ag Economy Barometer declined 5 points to 112. Weaker sentiment regarding current conditions was the primary driver of this month’s decline in the barometer. Input cost rises are a key factor behind the relative weakness in farmer sentiment. Producers are also becoming increasingly worried about the impact of rising interest rates on their farm operations with more of them citing it as a reason why they think now is not a good time to make large investments. Farmers’ perspective on farmland values showed further signs of softening this month as both the short and long-term farmland value indices declined. Farmers’ usage of cover crops appears to be increasing with 57% of respondents reporting that they use cover crops on at least some of their farmland. Most cover crop users employ cover crops on just a portion of their acreage, with improving soil health and improving erosion control cited as the two most common motivations for planting cover crops, while very few cover crop users said they plant cover crops primarily to sequester carbon.