Farmer Sentiment Following the U.S. Election Reaches Highest Levels Since May 2021

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer November results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

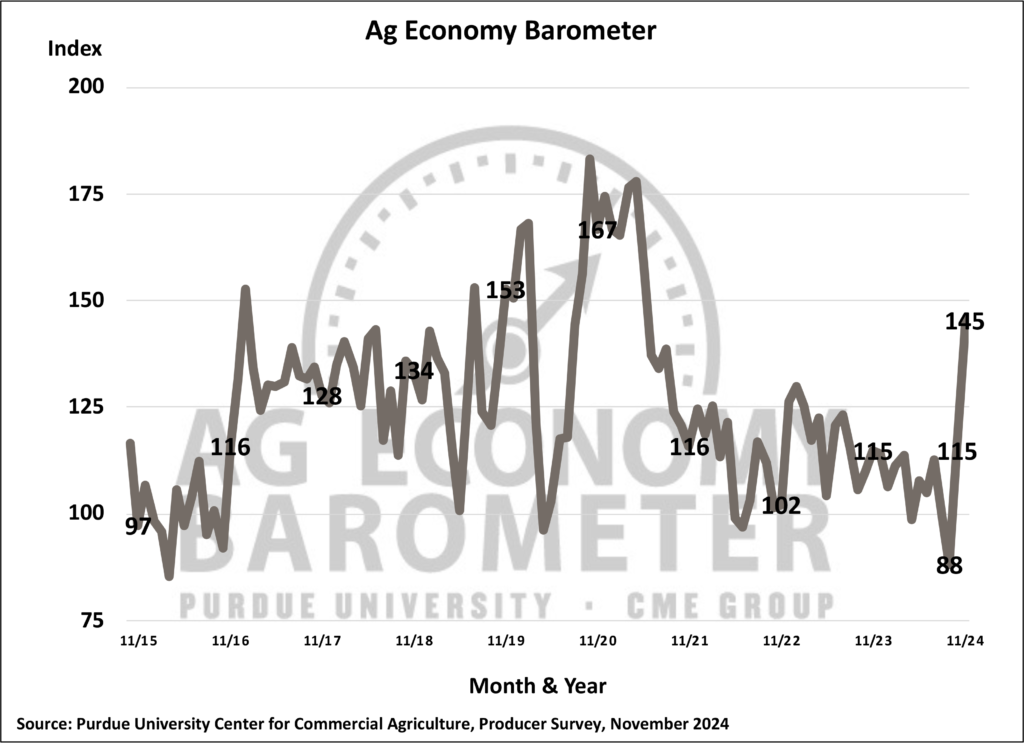

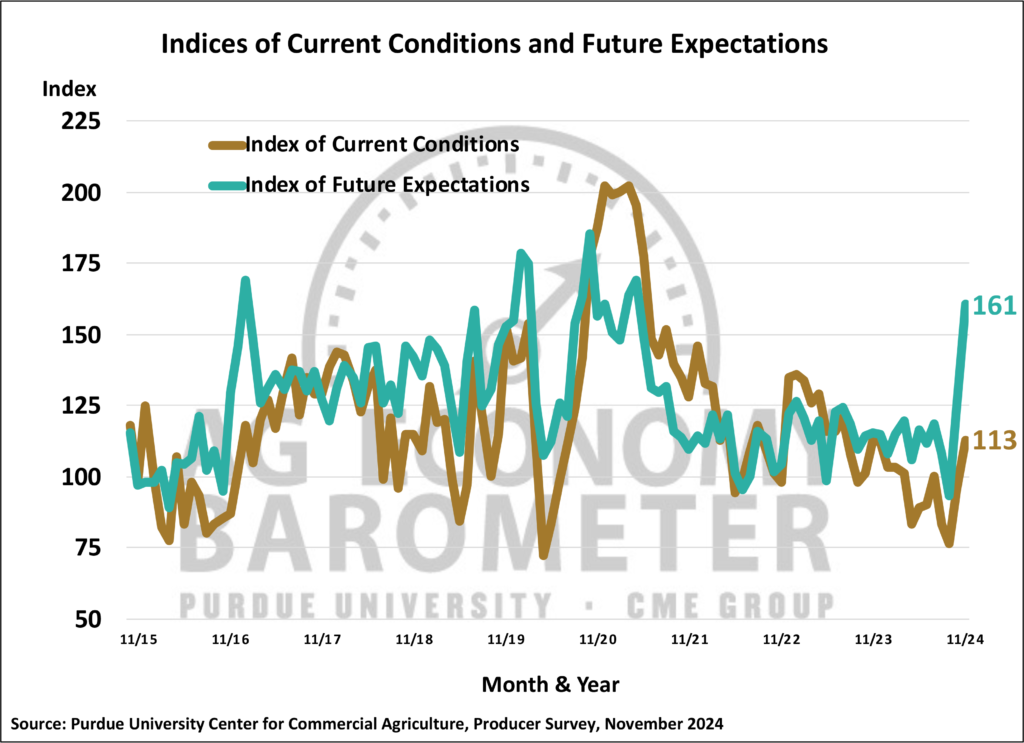

Farmer sentiment jumped again in November as the Purdue University-CME Group Ag Economy Barometer climbed 30 points to 145. Both the Current Conditions and Future Expectations indices increased in November, with the biggest improvement taking place in future expectations. The Future Expectations Index increased 37 points to 161, while the Current Conditions Index rose to 113, 18 points above October’s reading. November’s sentiment improvement pushed the barometer to its highest level since May 2021, with expectations for the future also reaching their highest level since April 2021. Some of the reasons behind the improvement in farmer sentiment include expectations for a future regulatory and tax environment for the agricultural sector that is more favorable than expected prior to the November elections. The November barometer survey took place from November 11-15, 2024.

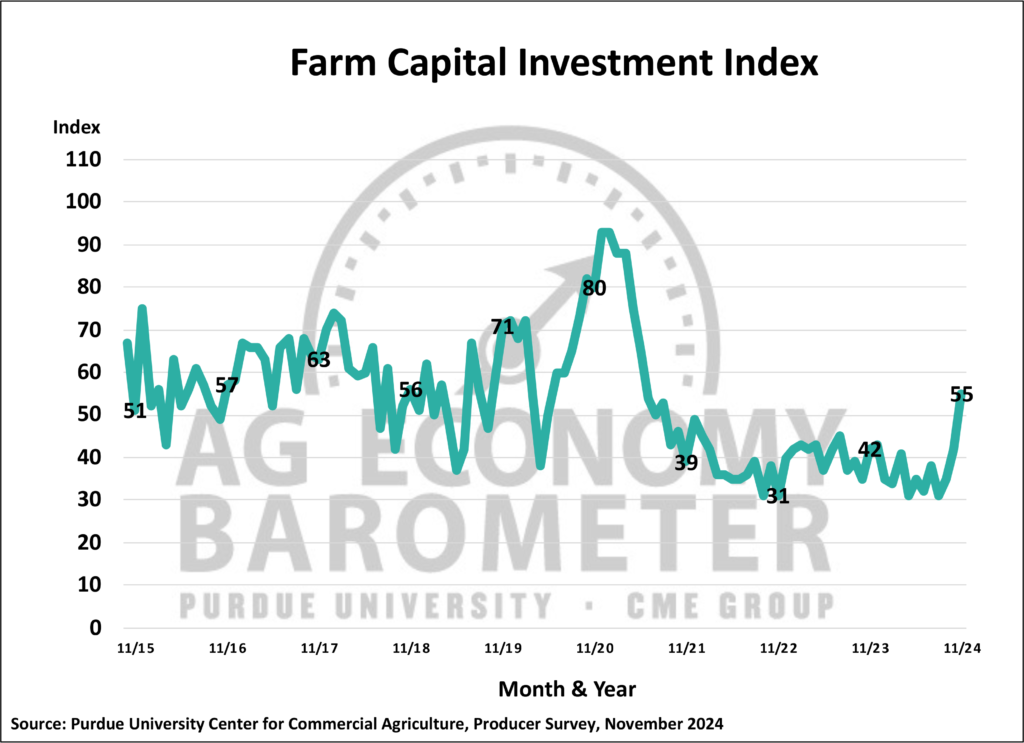

Responses to the base questions used to compute the Ag Economy Barometer index were nearly all more positive in November than in October. One-third of November’s respondents said they expect their operation to be better off financially a year from now, compared to 19% who felt that way in October. Thirty-four percent of farmers in November said they expect good times financially for the U.S. agricultural sector in the next 12 months compared to just 15% of respondents in October. When asked to look ahead five years, over half (52%) of November’s respondents said they expect U.S. agriculture to experience widespread good times compared to 34% who felt that way in October. The increase in optimism spread to farmer’s investment outlook, with 22% of November respondents reporting it is a good time to make large investments compared to 15% of farmers surveyed who felt that way in October.

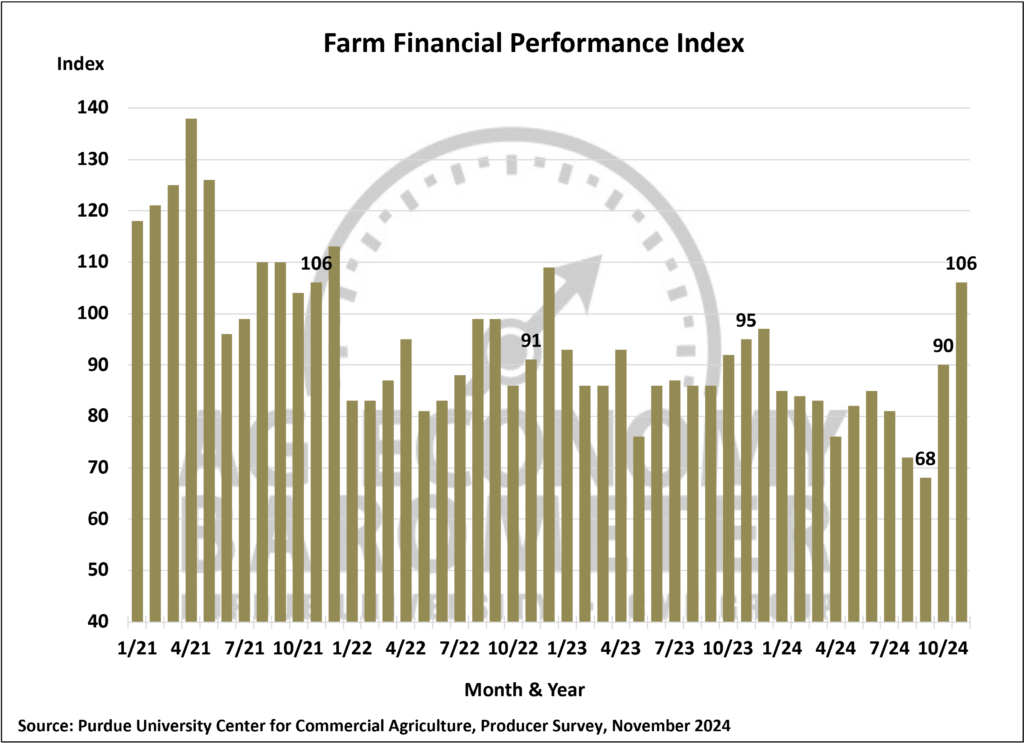

The sentiment improvement extended to farmers’ perspectives on capital investments, with the Farm Capital Investment Index rising 13 points to 55, which is the index’s highest reading since May 2021. The shift in investment sentiment was motivated in part by expectations for better financial performance in 2025 compared to 2024. Each month, the barometer survey asks respondents about their expectations for their farm’s financial performance in the upcoming year. For the second month in a row, the percentage of producers who expect better times in the upcoming year rose. In November, 25% of respondents said they expect better times next year compared to 16% who felt that way in October. The shift in perspective boosted the Farm Financial Performance Index to a reading of 106, 16 points higher than October and 38 points above September’s index.

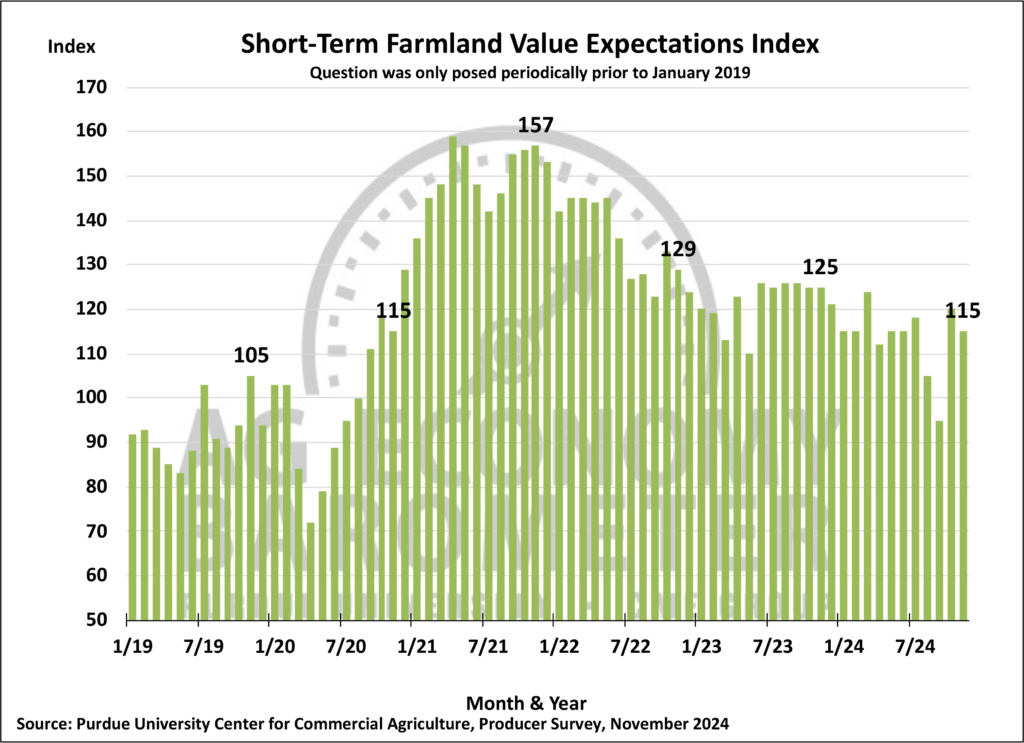

On the heels of sharp improvements in both the short-term and long-term farmland indices in October, both farmland value indices drifted lower in November. Compared to a month earlier, the Short-Term Farmland Value Expectations Index fell 5 points, and the Long-Term Farmland Value Expectations Index fell 3 points in November. The small declines left the short- and long-term indices at readings of 115 and 156, respectively.

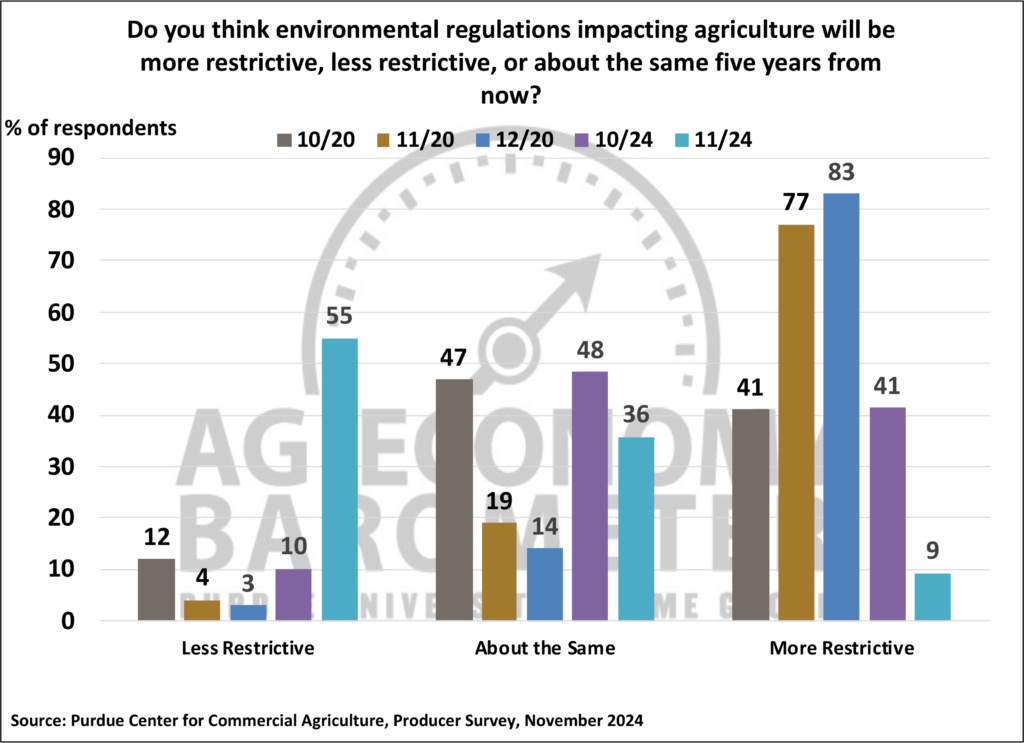

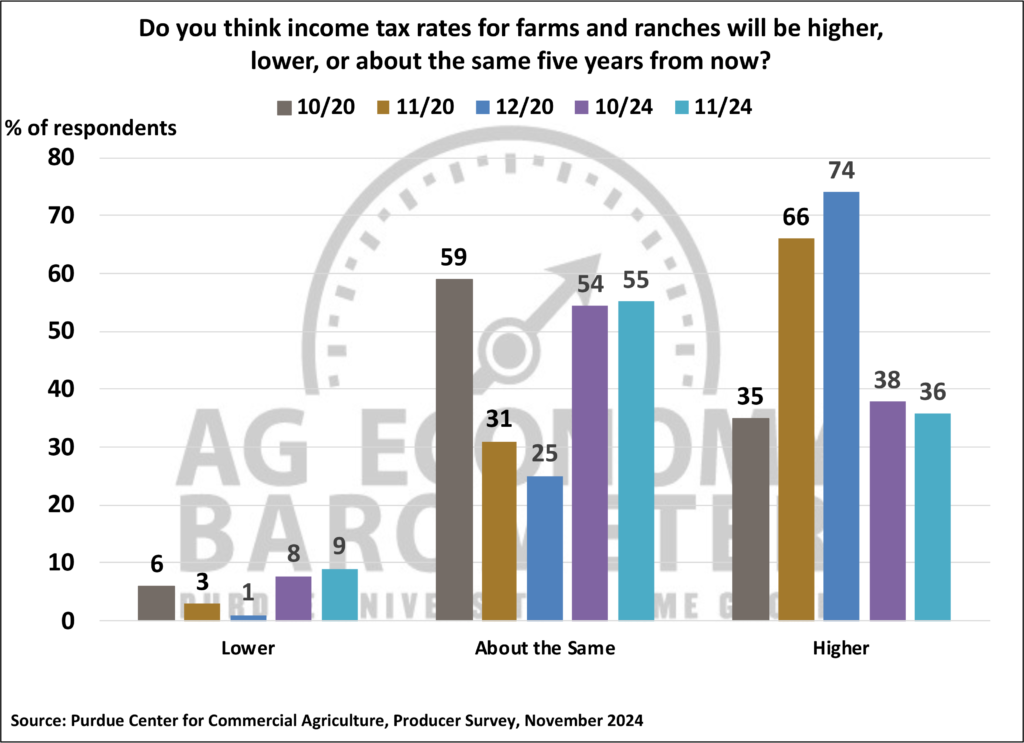

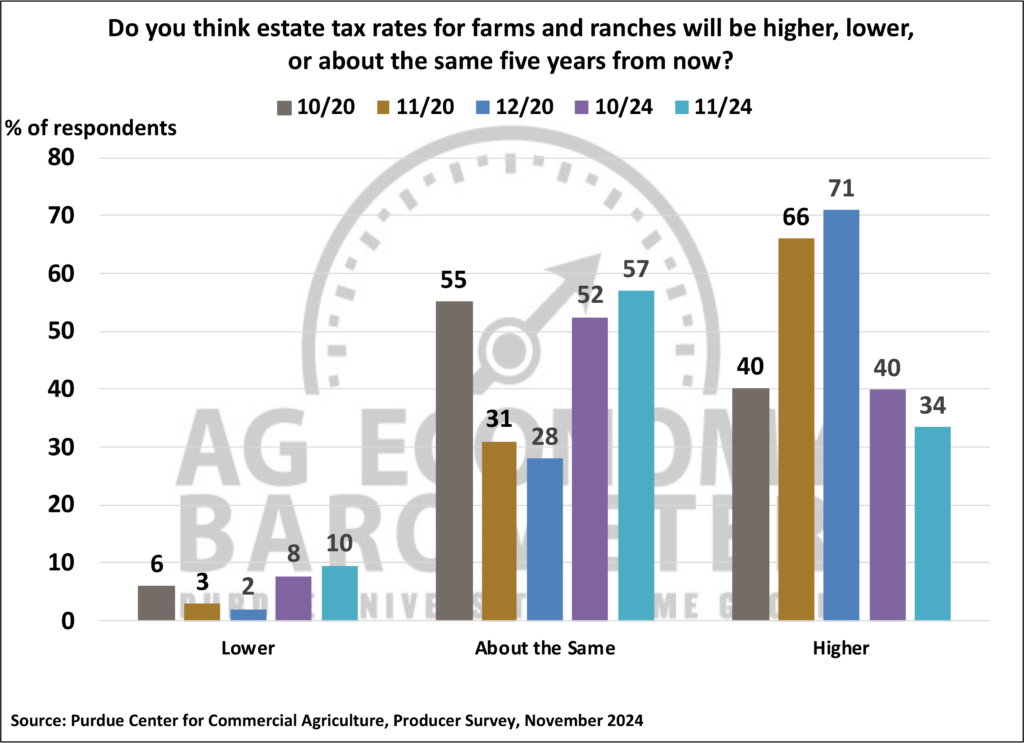

To better understand how farmers’ sentiment is related to potential policy shifts associated with a change in presidential administrations, barometer surveys included several policy-related questions before and after the presidential elections of 2020 and 2024. Following the 2024 election, there was a big swing in farmers’ perspectives on environmental regulations impacting agriculture. In October, 41% of respondents said they expected the regulatory environment to become more restrictive in the next five years, with just 10% of respondents expecting a less restrictive regulatory environment. This stood in contrast with results from the November survey, in which just 9% of farmers in the survey said they expect more restrictive regulations, while 55% of farmers said they expected environmental regulations to become less restrictive. When asked about taxes, there was a modest shift in expectations from October to November 2024, with a much larger shift in expectations when compared to results surrounding the 2020 election. Over half of respondents (55%) in November said they look for income tax rates to stay about the same in the upcoming year. This compares to just 25% of respondents who looked for income tax rates to remain unchanged following the 2020 election. Over half (57%) of the respondents in the November survey also said they think estate tax rates will remain unchanged in the next 5 years, whereas in November 2020, just 28% of respondents said they expected estate tax rates to remain unchanged.

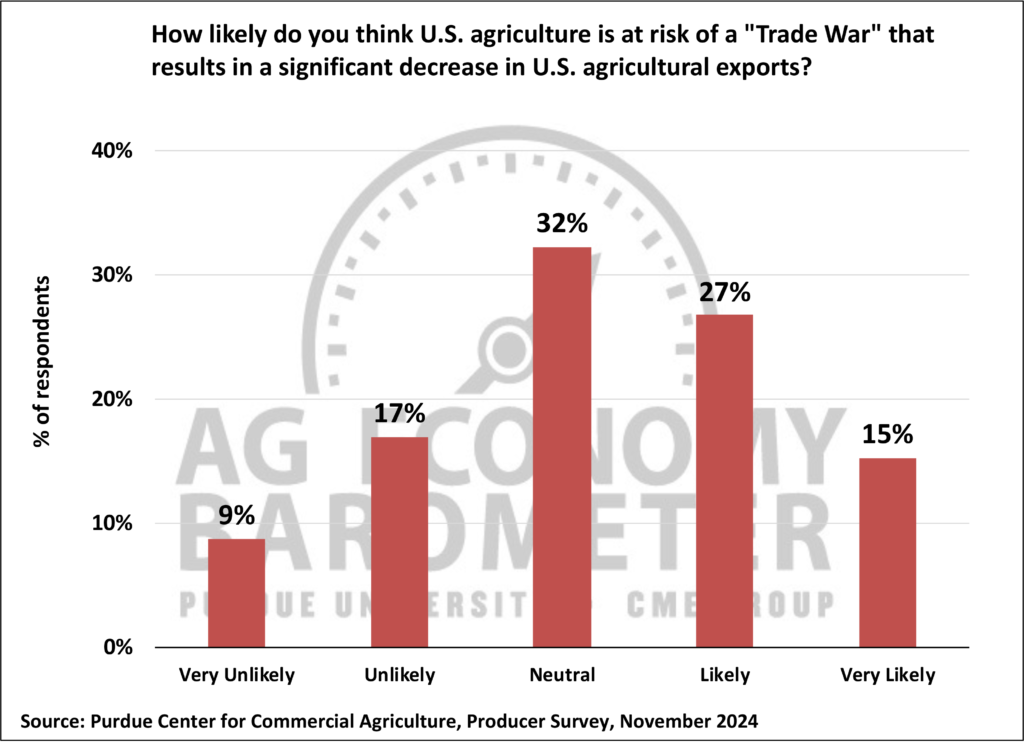

International trade is important to U.S. agriculture, and farmers in the November survey expressed some concerns about the future of agricultural trade under a new administration. Forty-two percent of respondents to the November survey said they think it is either “likely” or “very likely” that U.S. agriculture is at risk of a “Trade War” that results in a significant decrease in U.S. agricultural exports.

Wrapping Up

For the second month in a row, U.S. farmers’ sentiment improved markedly in a survey taken just one week following the November 2024 elections. Once again, the sentiment improvement was largely attributable to producers expressing more optimism about the future as the Future Expectations Index rose to its highest level since April 2021. Producers’ sentiment improvement carried over into a more optimistic view about making large capital investments in their farming operation. At the same time, however, producer sentiment regarding farmland value changes in their home area over both the next year and the next 5 years changed little compared to a month earlier. In November, a majority of producers said they expect a less restrictive environmental regulatory environment for agriculture in the upcoming 5 years, which was a big shift compared to October. With respect to income tax and estate tax rates, the shift was small from October to November 2024. However, when compared to results from November 2020, there was a shift, with far more producers expecting a more favorable tax regime following the 2024 election than the 2020 election. Perhaps the biggest concern expressed by farmers as the transition to a new administration gets underway is the future of agricultural trade, with over two-fifths of survey respondents saying they think a “trade war” is either likely or very likely.