Farmer Sentiment Improves As Interest Rate Expectations Shift

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer March results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

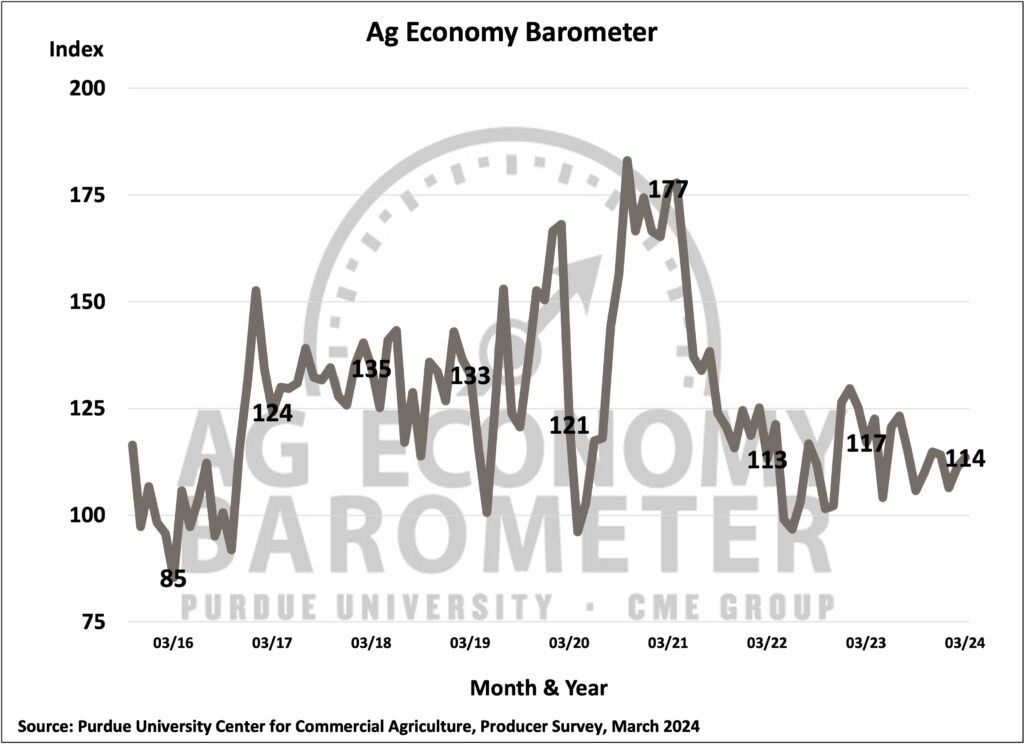

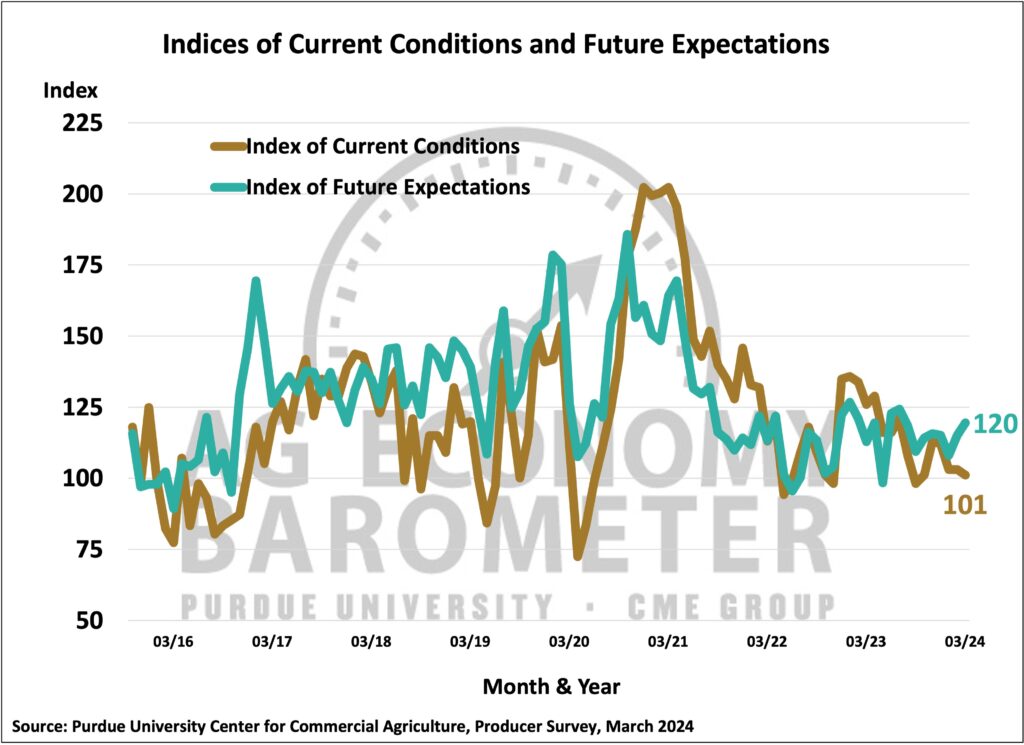

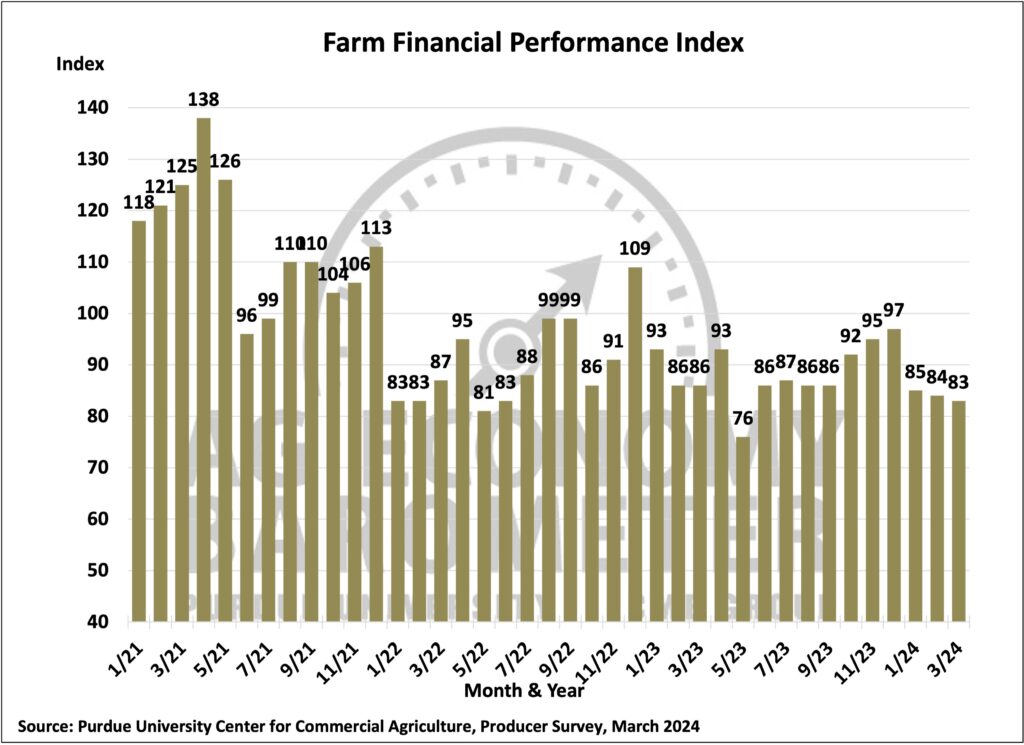

U.S. farmers’ perspective on the future improved in March helping to push the Purdue University-CME Group Ag Economy Barometer up 3 points from February to a reading of 114. The Index of Current Conditions at 101 was 2 points below a month earlier while the Index of Future Expectations reached 120, 5 points higher than in February. The split between the current and future indices was driven primarily by farmers’ perception that their financial condition has deteriorated over the last year while they expect their financial situation to improve modestly in the next 12 months. The March Ag Economy Barometer survey was conducted from March 11-15, 2024.

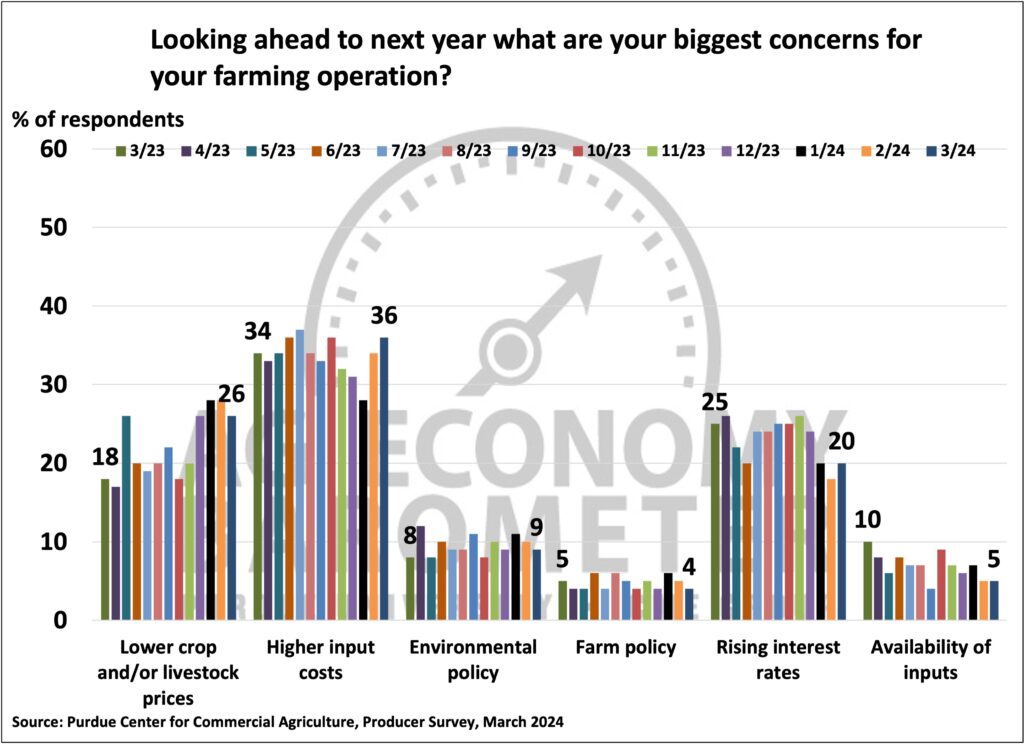

Producers’ expectations for interest rates have shifted which could help explain why producers look for financial conditions to improve. This month nearly one-half (48%) of respondents said they look for the U.S. prime interest rate to decline over the next year. That’s up from 35% of farmers who said they expect rates to decline the last time this question was posed in December 2023. And just one-third (32%) of respondents in March said they expect interest rates to increase in the next 12 months compared to 43% of respondents who were looking for rates to rise in the upcoming year when polled in December. Just 20% of respondents this month said the risk of rising interest rates was a top concern, down from 24% who chose it as a top concern in December. Producers remain focused on high input costs as their number one concern, chosen by 36% of respondents in this month’s survey.

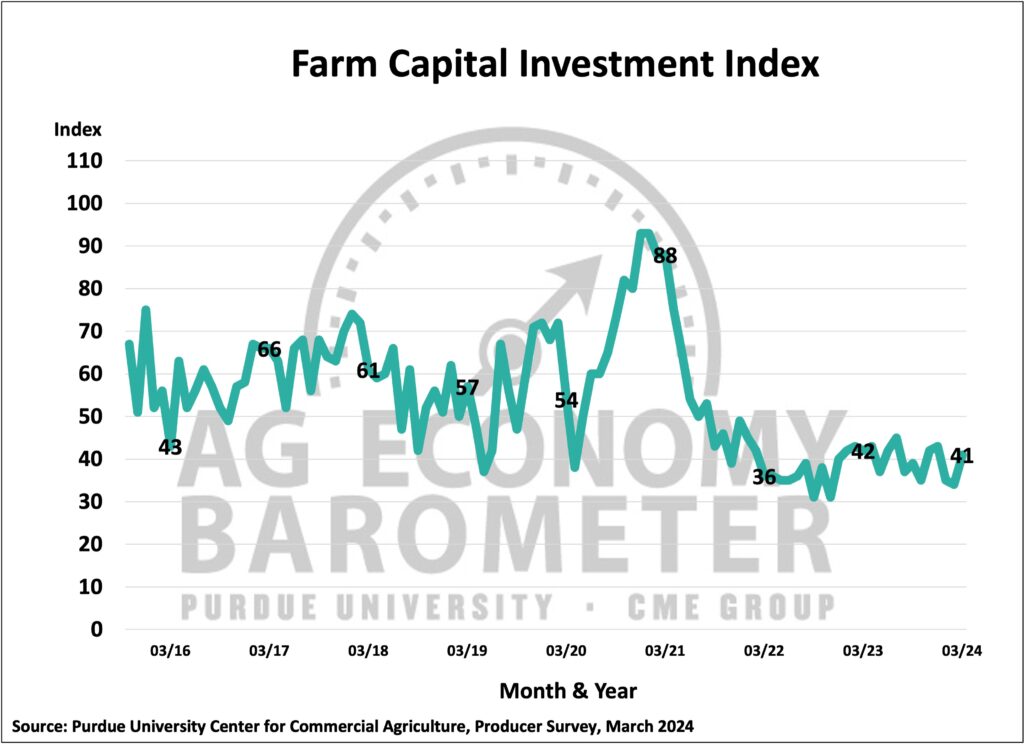

The Farm Capital Investment Index rose 7 points in March to a reading of 41 as the percentage of producers who said it’s a good time for large investment rose to 15%, up from 11% in the last 2 months. Among producers who said it’s a good time for large investments, 17% pointed to strong cash flows as a primary reason which was lower than recent months while higher dealer inventories for farm machinery was cited by 26% of respondents. Producers who feel it’s a bad time to invest continue to point to high machinery and construction costs along with high interest rates as the top two reasons for feeling it’s a bad time to invest.

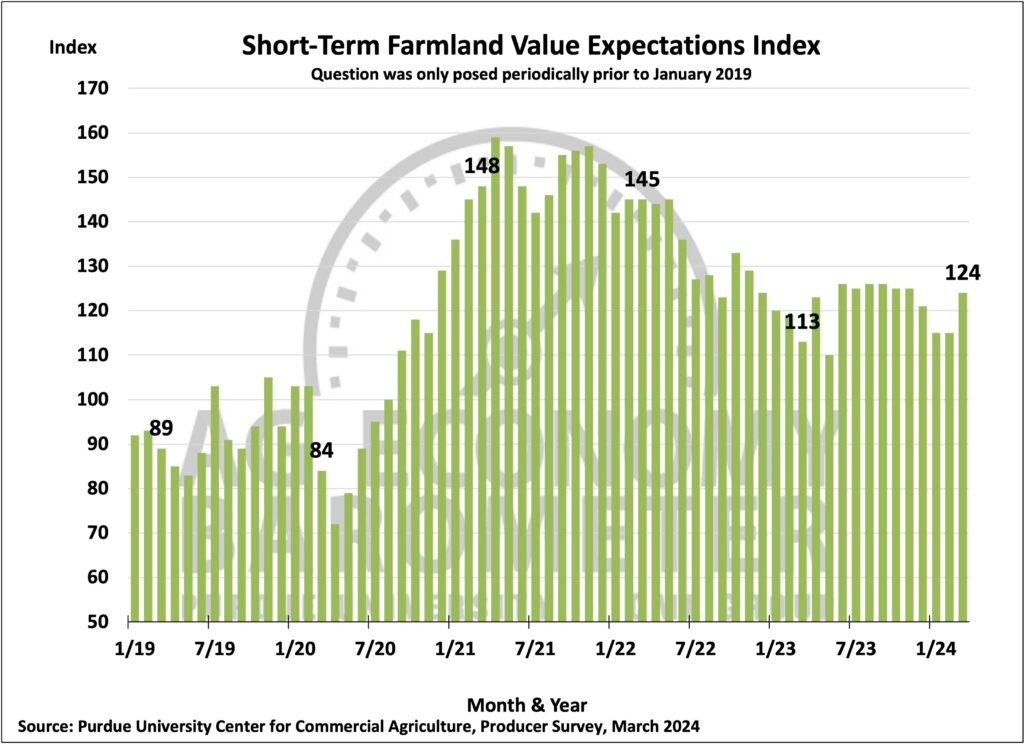

Producers’ short-run outlook on farmland values improved in March as the Short-Term Farmland Values Index rose to a reading of 124, 9 points higher than in February. This month 38% of respondents said they look for farmland values to increase in the year ahead compared to 31% of farmers who said they expected values to rise in both the January and February surveys. The shift in producers’ interest rate outlook might have been a contributing factor to the improved outlook for farmland values although that was not reflected in the follow-up question posed to respondents who said they expect values to increase. When asked why they expect farmland values to increase more producers this month pointed to inflation expectations as a supporting factor than last month (24% of respondents in March vs. 18% of respondents in February). There was also a small increase in the percentage of respondents choosing strong cash flows (8% of respondents in March vs. 6% of respondents in February) as a supportive factor. There was a modest decline in the percentage of producers who pointed to non-farm investor demand as a key factor affecting the farmland market, although with 57% of producers citing it as a key factor it was by far and away the number one reason cited for their bullish outlook on farmland values.

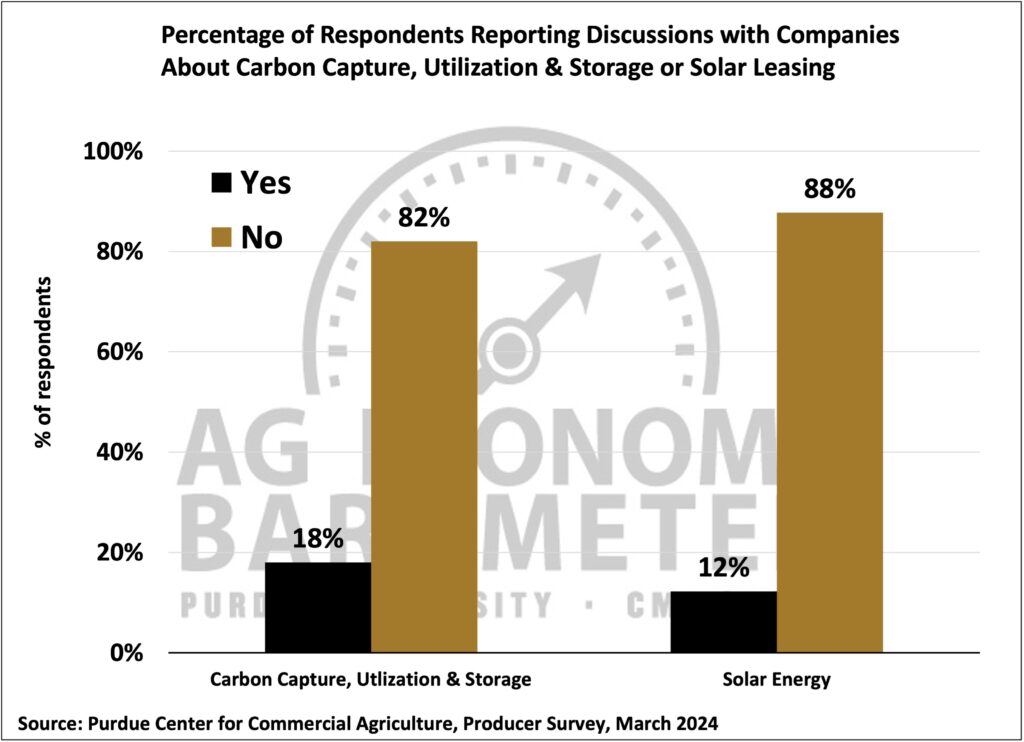

Interest on the part of companies desiring to use farmland for either sequestering carbon or solar energy production appears to be rising. This month’s survey asked respondents if either they or one of their landowners have been approached about possible Carbon Capture Utilization and Storage (also referred to as CCUS) on farmland and nearly one out of five (18%) of respondents responded yes. In a follow-up to a question posed in the February survey, 12% of this month’s respondents said that, in the last six months, they have engaged in discussions with companies interested in leasing farmland for a solar energy project. That percentage compares to 10% of respondents in February who reported solar energy project discussions taking place recently. When asked about the long-term farmland lease rates offered by solar energy companies, 54% of respondents this month said they were offered a lease rate of $1,000 or more per acre and just over one-fourth of respondents (27%) said they were offered a lease rate of $1,250 or more per acre.

The March barometer survey included several questions focused on farmers’ policy expectations following the fall 2024 elections. Eighty percent of this month’s respondents said they are concerned that, following the fall 2024 elections, there will be government policy changes affecting their farms in the years ahead. Forty-three percent of respondents said they think regulations impacting agriculture will be more restrictive following the elections while just 18% said they expect a less restrictive operating environment. Four out of ten producers (39%) said they think taxes impacting agriculture will rise following the fall 2024 election while half of respondents said they expect no change in agriculture’s tax environment.

Wrapping Up

Farmer sentiment improved modestly in March with the rise primarily attributable to producers expecting financial conditions on their farms to improve in the year ahead. The improvement in farmers’ financial outlook was buttressed by an improved interest outlook with nearly half of this month’s respondents saying they expect interest rates to decline over the next 12 months. Consistent with expectations for an improvement in financial conditions on their farms, more producers said this is a good time to make large investments helping to push the Farm Capital Investment Index up 7 points compared to a month earlier. Farmers’ short-run outlook for farmland values also improved this month as the short-run farmland index climbed 9 points above its February reading. Interest in using farmland for solar energy production and sequestering carbon appears to be on the rise with 12% of respondents discussing solar energy leases and 18% saying they or their landowners were approached about possible Carbon Capture Utilization and Storage on farmland.