Farmer Sentiment Plummets as Coronavirus Concerns Rise

James Mintert and Michael Langemeier, Center for Commercial Agriculture

James Mintert and gives his breakdown on the Purdue/CME Group Ag Economy Barometer March results at purdue.ag/barometervideo.

Download report (pdf)

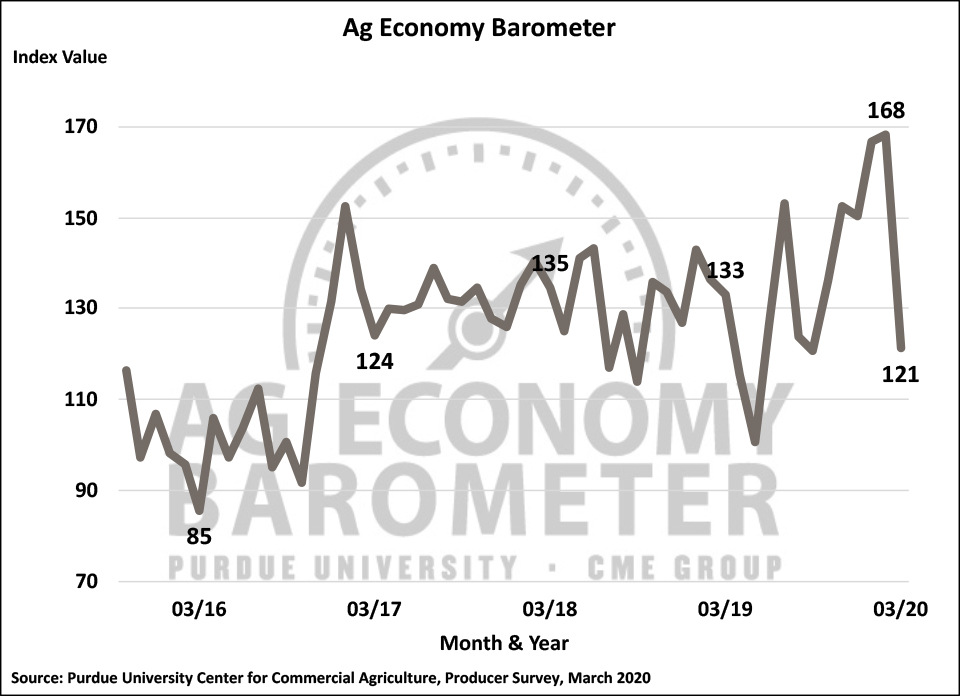

The Ag Economy Barometer plummeted in March, dipping 47 points (28%) from a month earlier to a reading of 121. The point drop was the largest one-month fall in the life of the index, which dates to October 2015. Declines in agricultural commodity prices and concerns about the coronavirus crisis impact on the U.S. economy and agricultural sector weighed heavily on farmer sentiment in March. This month’s decline in the barometer erased the sentiment improvement that took place this past fall and winter and leaves the index unchanged from its September 2019 reading. The Ag Economy Barometer is generated each month from 400 U.S. agricultural producers’ survey responses. This month’s survey was conducted from March 16-20, 2020 as the coronavirus crisis escalated in the U.S. and around the world.

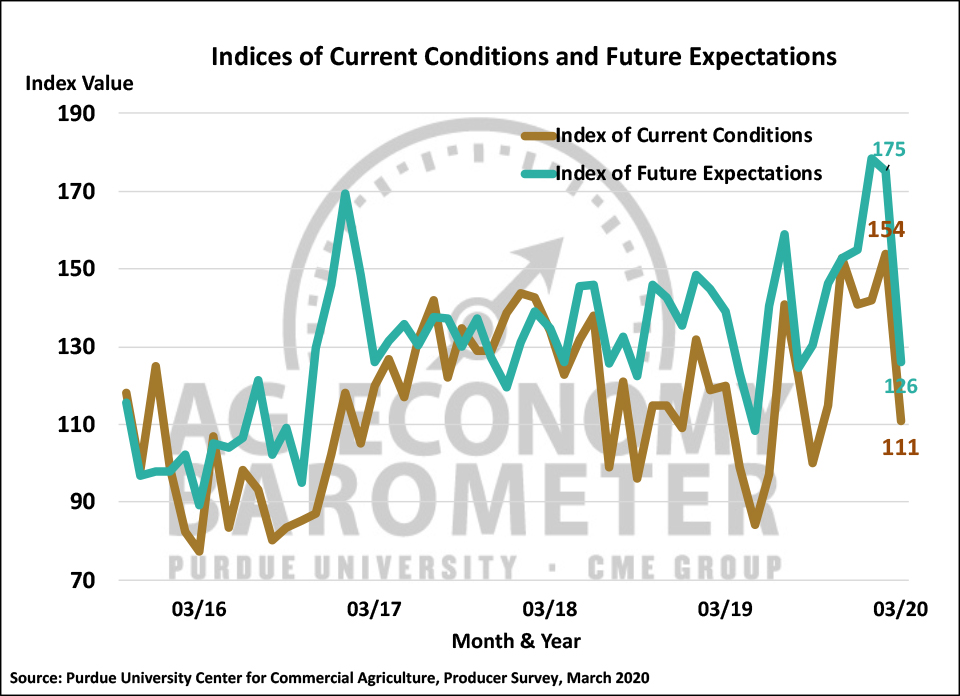

The Index of Current Conditions and the Index of Future Expectations plunged during March as both indices experienced their largest one-month declines since data collection began in 2015. The Index of Current Conditions declined 43 points and the Index of Future Expectations dropped 49 points, both compared to one-month earlier. Producers’ sentiment regarding current conditions, with a reading of 111, was the lowest observed since last September when the Index of Current Conditions stood at a reading of 100. The Index of Future Expectations reading of 126 was the lowest value for that index since August 2019.

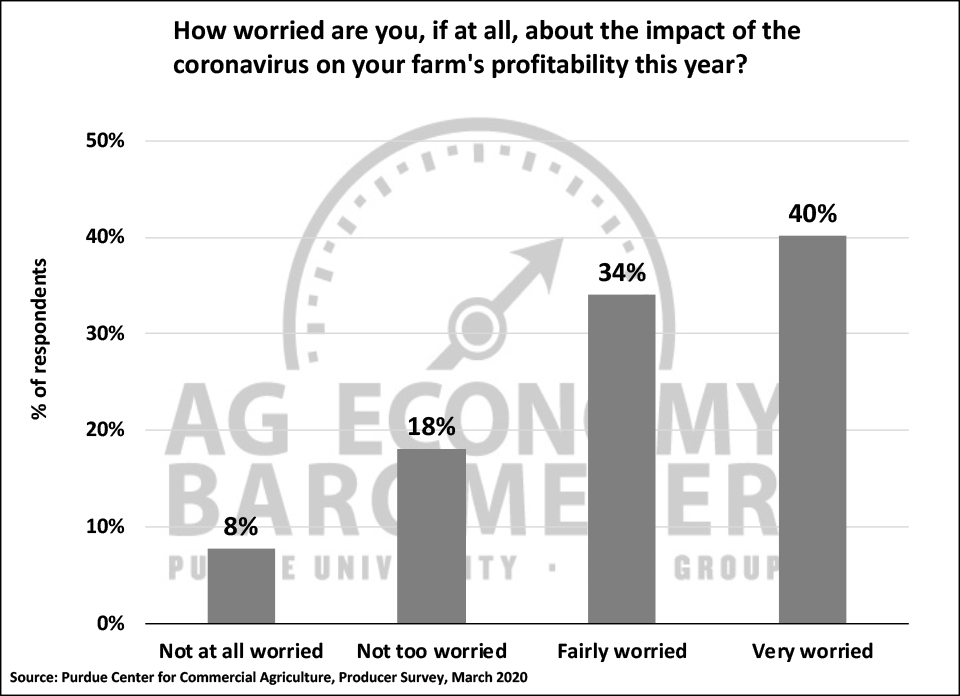

Producers’ weakened sentiment was expressed in various ways in this month’s survey. First and foremost, U.S. farmers said they were concerned about how the coronavirus will impact their farms in 2020. Seventy-four percent of respondents to the March survey said they were either “fairly worried” (34 percent) or “very worried” (40 percent) about the impact of the virus on their farm’s profitability this year. Coinciding with their concern about the coronavirus impact, an increasing number of farmers said they expect their farm’s financial performance this year to be worse than last year. For example, in March, 40 percent of respondents said they expect their farm’s financial performance in the upcoming year to be worse than a year earlier, compared to just 30 percent of respondents who felt that way in December. Expectations for a weaker business climate in the U.S. agricultural sector were also evident. The percentage of producers expecting good times in the agricultural economy in the next 12 months fell from 50 percent in February to 19 percent in March.

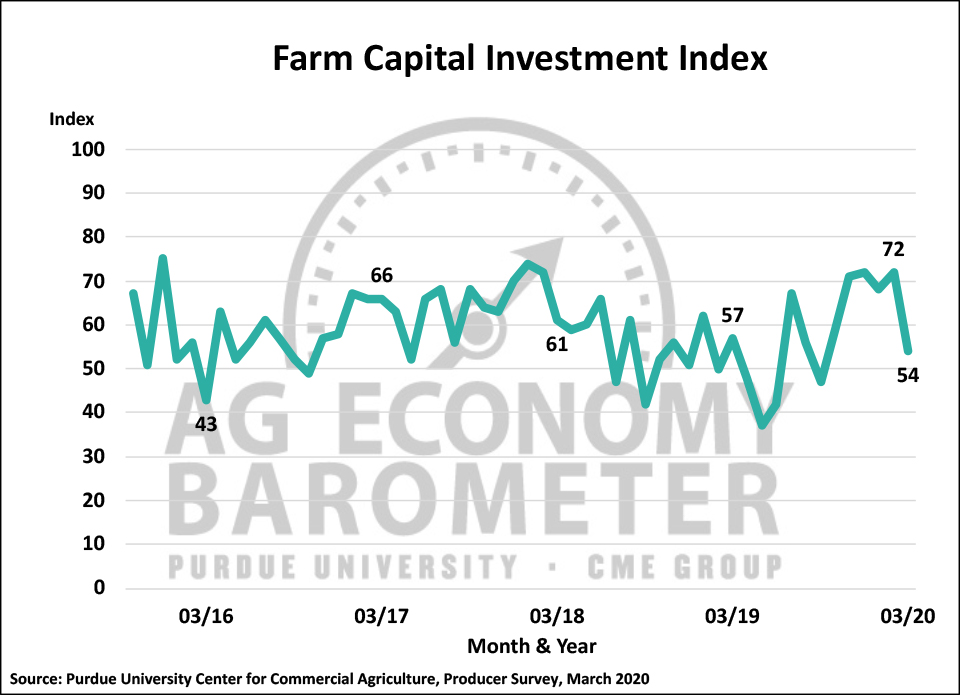

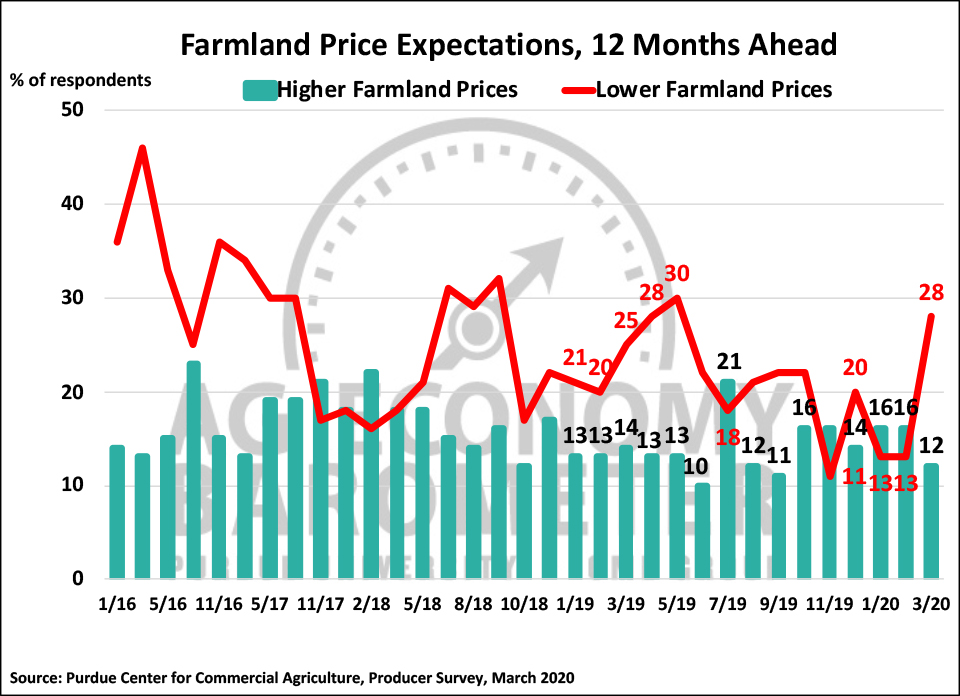

Farmers’ concerns about a deteriorating agricultural business climate were also evident in their responses regarding possible capital investments in machinery, buildings and farmland. The Farm Capital Investment Index, which is focused on investments in machinery and buildings, fell 18 points to an index value of 54, its lowest reading since June 2019 when the Midwest was buffeted by too much rainfall and widespread crop planting delays. When asked for their views on farmland values, the percentage of farmers expecting farmland values to decline in the year ahead jumped from 13 percent in February to 28 percent in March. Looking ahead 5 years, the percentage of farmers expecting farmland values to rise over that longer time frame declined from 59 percent in February to 41 percent in March, which was the weakest perspective provided by farmers on farmland values since last May.

Farmers also became less optimistic in March about the outcome of the trade dispute with China. The percentage of farmers expecting the soybean trade dispute with China to be resolved soon, which peaked in January at 69 percent, fell to 47 percent. This was the second month in a row that expectations for a quick resolution to the trade dispute declined. At the same time, the percentage of producers who expect the trade dispute to be resolved in a way that’s ultimately beneficial to U.S. agriculture declined to 68 percent from an average of just over 80 percent who felt that way in January and February. In another sign that farmers were less confident that the trade dispute with China will be resolved soon, more farmers in the March survey said they expect to receive an MFP payment on their 2020 crop production than did a month earlier. In March, 62 percent of survey respondents said they anticipate USDA providing MFP payments to U.S. farmers for the 2020 crop year. That was a significant increase compared to a month earlier when just 45 percent of farmers said they expected to receive an MFP payment this year.

Wrapping Up

Farmer sentiment plummeted during March as the coronavirus crisis spread around the globe. The Ag Economy Barometer declined 47 points from February to March, which was the largest one-month decline in the life of the index. The Index of Current Conditions and the Index of Future Expectations also declined sharply during March as farmers expressed concerns about both their current and future situations. Nearly three-fourths of farmers participating in the March Ag Economy Barometer survey said they were either “fairly worried” or “very worried” about the coronavirus’ impact on the farms’ profitability this year. The percentage of farmers expecting good times in agriculture in the upcoming 12 months fell from 50 percent in February to just 19 percent in March and the percentage of farmers expecting their farms’ profitability to decline this year compared to last year increased to 40 percent in March from 30 percent back in December. The weakened outlook made farmers less optimistic about investing in their farming operations as the Farm Capital Investment Index fell 18 points to a reading of 54, its lowest reading since last May. Farmers’ perspective on farmland values also deteriorated as the percentage expecting farmland values to decline over the next 12 months jumped from 13 percent in February to 28 percent in March.