Farmer Sentiment Plummets As Production Costs Skyrocket

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer April results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

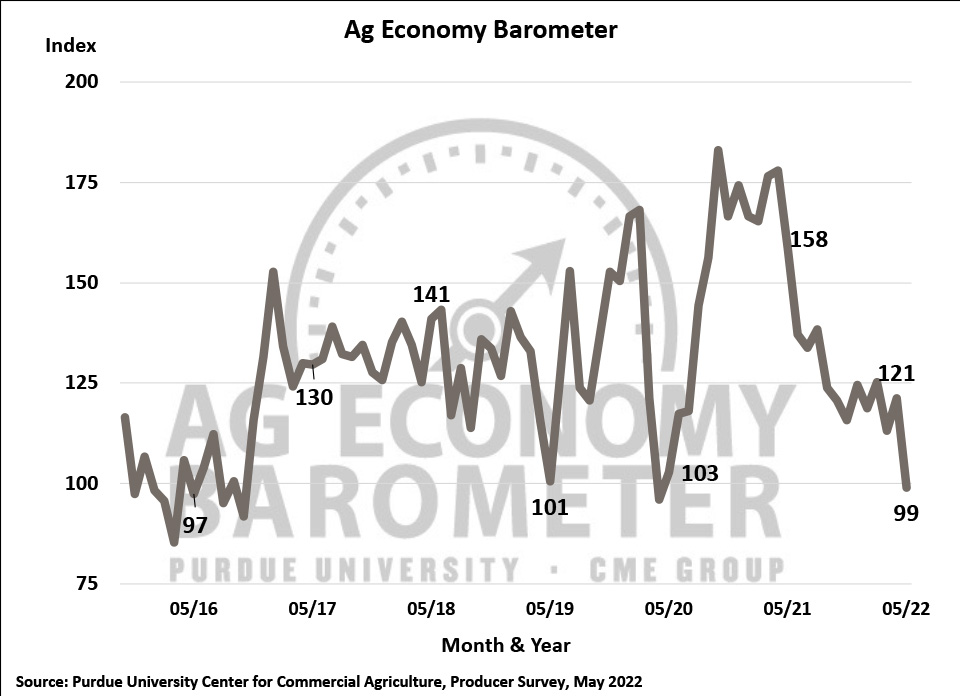

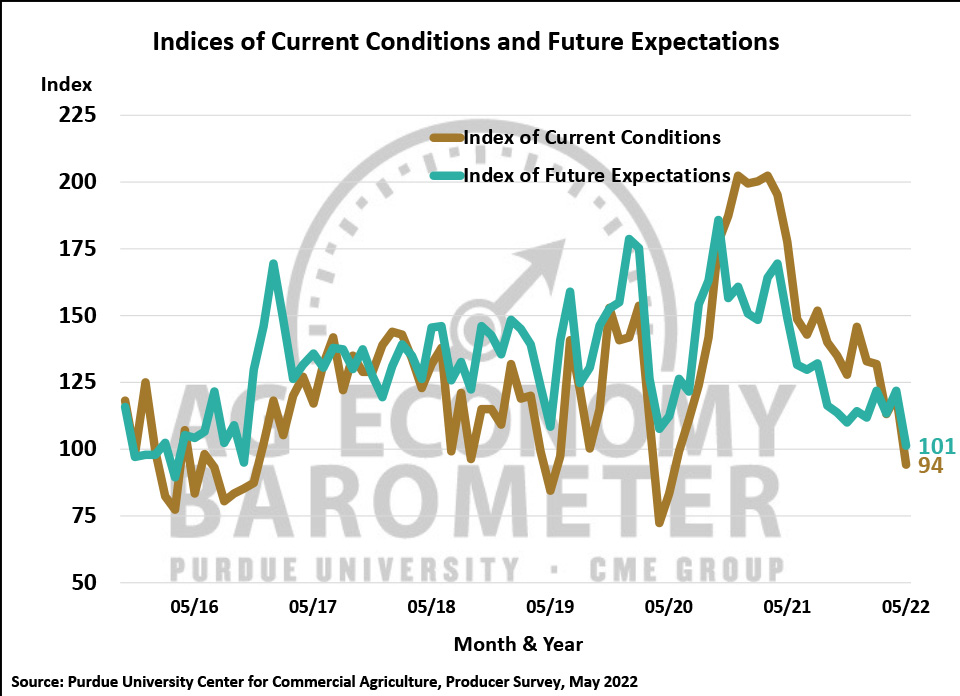

The Purdue University-CME Group Ag Economy Barometer plummeted in May to a reading of just 99, the weakest farmer sentiment reading since April 2020. The May 2022 barometer reading marked just the 9th time since data collection began in fall 2015 that the overall measure of farmer sentiment fell below 100. Agricultural producers’ perceptions regarding current conditions on their farms, as well as their future expectations, both weakened this month. The Index of Current Conditions fell 26 points to a reading of 94, while the Index of Future Expectations declined 21 points to 101 in May. Notably, this month saw a rise in the percentage of respondents who feel their farm is worse off financially now than a year earlier, an indication that escalating production costs are troubling producers. The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from May 16-20, 2022.

Figure 1. Purdue/CME Group Ag Economy Barometer, October 2015-May 2022.

Figure 2. Indices of Current Conditions and Future Expectations, October 2015-May 2022.

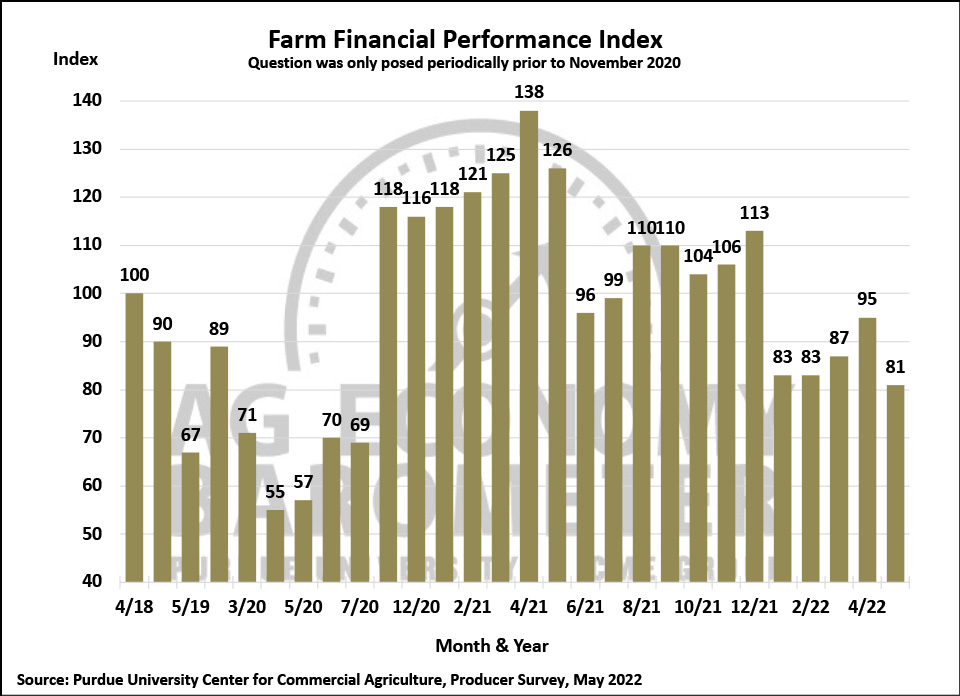

Producers exhibited a much more negative view of their farms’ financial situation this month as the Farm Financial Performance Index fell 14 points from April’s reading of 95 to 81 in May. The percentage of producers who expect their farm’s financial performance this year to worsen compared to last year rose from 29% in April to 38% in May. Responses received to the financial performance question this May were nearly the polar opposite of responses received a year earlier. In May 2022, 38% of producers said they expect worse financial performance for their farms compared to a year earlier with just 19% of respondents expecting better financial performance. This stands in contrast to a year earlier when 42 percent of survey respondents expected better financial performance while just 16% said they thought a worse financial performance was likely. Over the course of the last 13 months, the Index of Farm Financial Performance has fallen 41% below its life of survey high of 138 set in April 2021. The decline points to farmers’ lack of confidence in their farms’ financial outlook.

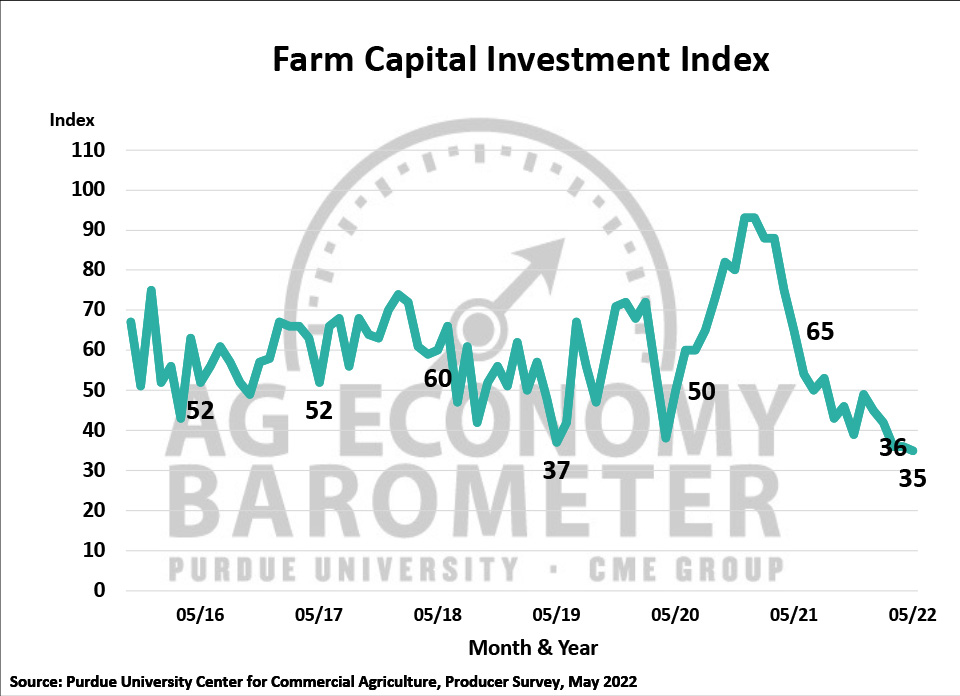

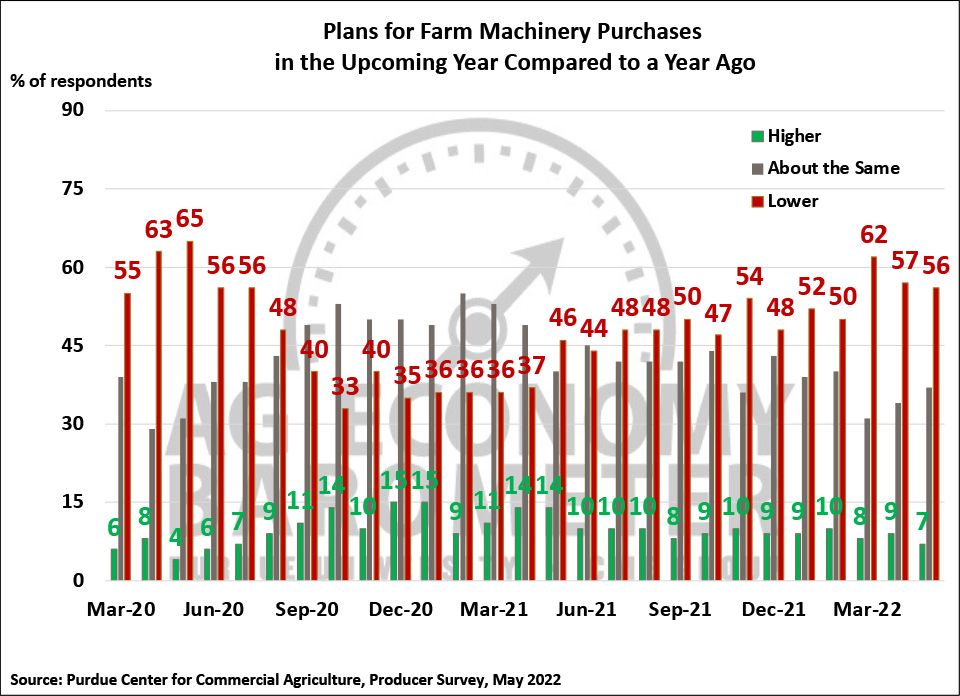

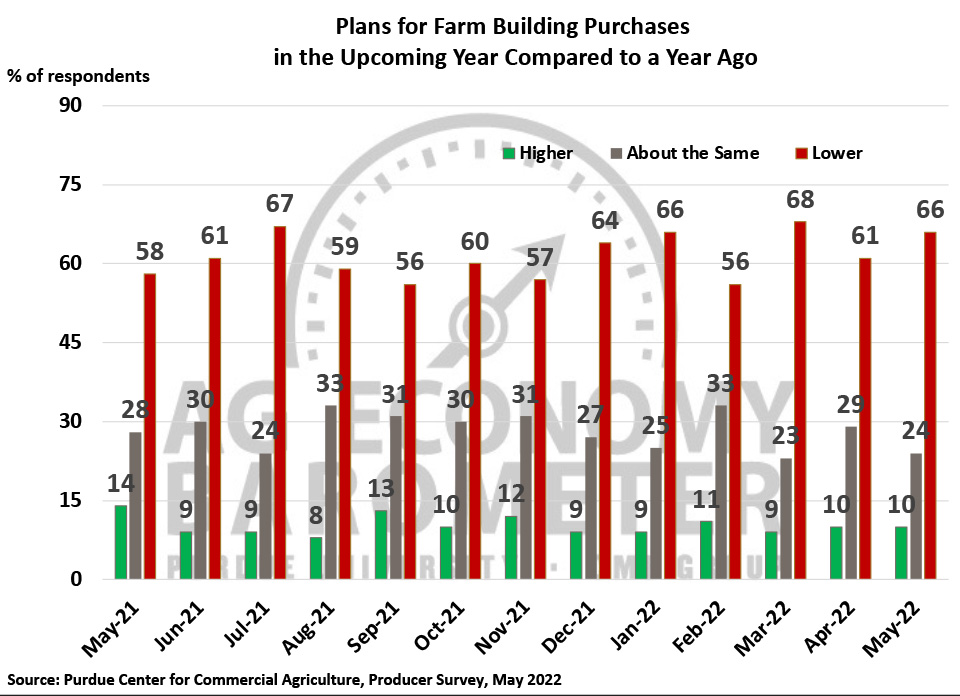

The Farm Capital Investment Index drifted lower in May to 35, a new low for the index. The May reading was down just one point from a month earlier but was 30 points below its May 2021 reading. In this month’s survey, only 13% of respondents said this is a good time to make large investments in their operation while 78% said they viewed it as a bad time to invest in things like machinery and buildings. Half of the producers in this month’s survey said their machinery purchase plans were impacted by low farm machinery inventory levels, up from 41% in the April survey, suggesting that supply chain issues are at least partly responsible for the ongoing weakness in the capital investment index.

When asked what their biggest concerns are for their farming operation, once again producers, overwhelmingly (44%), chose higher input costs as the biggest issue facing their farming operation in the upcoming year. Nearly 6 out of 10 (57%) producers said they expect prices paid for farm inputs in 2022 to rise 30% or more compared to prices paid in 2021. The percentage of producers expecting costs to increase this dramatically has risen sharply since the end of 2021, shifting from 38% of producers in December who expected costs to rise by 30% or more to this month’s 57% of all respondents. For the second month in a row, the May survey asked producers about their expectations for input costs in 2023 compared to 2022. This month nearly 39% of producers said they expect costs next year to rise 10% or more compared to this year’s already inflated costs. Compared to the April survey, fewer producers this month said they expect to see input prices decline next year. In April, 18% of respondents were anticipating lower input prices in 2023, but in May just 12% of producers said they expect input prices to fall back in 2023.

Noticeably fewer producers this month reported having difficulty purchasing crop inputs for the 2022 crop season than in prior surveys. In the May survey, one out of five (19%) producers said they had difficulty purchasing inputs for the 2022 crop season, down from an average of 32% who reported difficulties in the December through April surveys. Among those producers who still reported difficulties, problems were apparent in all major input categories including herbicides, farm machinery parts, fertilizer and insecticides.

Figure 3. Farm Financial Performance Index, April 2018-May 2022.

Figure 4. Farm Capital Investment Index, October 2015-May 2022.

Figure 5. Plans for Farm Machinery Purchases in the Upcoming Year Compared to a Year Ago, March 2020-May 2022.

Figure 6. Plans for Constructing New Farm Buildings and Grain Bins, May 2021-May 2022.

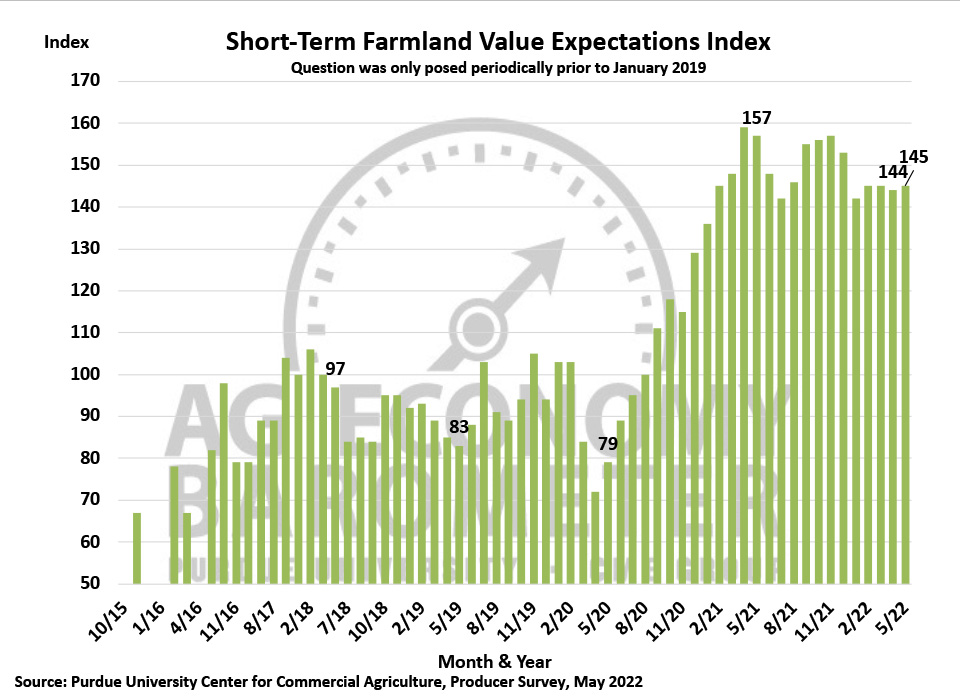

Figure 7. Short-Term Farmland Value Expectations Index, November 2015-May 2022.

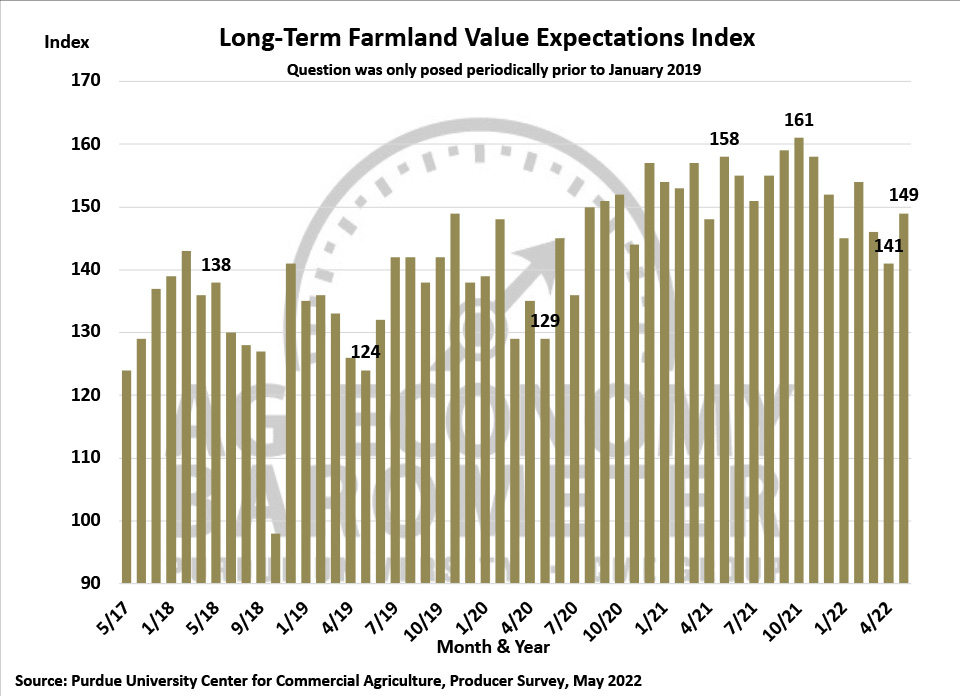

Despite the weak sentiment expressed by farmers regarding their farms’ financial performance, producers remain relatively optimistic about farmland values. The Long-Term Farmland Value Expectations Index, based upon producers’ farmland outlook over the upcoming 5 years, rose 8 points in May to a reading of 149. This month’s reading takes the long-term index back to its pre-pandemic (February 2020) level. The Short-Term Farmland Value Expectations Index, based upon producers’ 12-month outlook, at a reading of 145 was virtually unchanged from a month earlier. The short-term index has been range–bound throughout 2022, fluctuating between 142 and 145. Both the short and long-term farmland indices in May were 7 to 8% below the peak levels attained last fall.

The contrast between farmers’ relatively optimistic view of farmland values and their expectations for weak farm financial performance continues to be a bit of a puzzle. For the last several months, our monthly survey has included a follow-up question posed to respondents who expect farmland values to rise over the next 5 years, asking them about the main reason they expect values to rise. Respondents have consistently chosen non-farm investor demand as the top reason followed closely by inflation. Interestingly, few respondents chose strong farm cash flows or low interest rates as the main reason they expect farmland values to rise.

Figure 8. Long-Term Farmland Value Expectations Index, May 2017-May 2022.

The war in Ukraine has disrupted food production and distribution leading to serious concerns about the availability of food supplies, especially in importing countries. Wheat supplies and prices are of special concern because many low-income countries are reliant upon wheat imports from the Black Sea region. Multiple policy proposals have been discussed in the U.S. as a means of encouraging more wheat production. This month’s survey included several questions focused on crop producers’ wheat production plans and how they might respond to policy proposals.

Approximately 39% of the respondents to this month’s survey said they have used a wheat/double-crop soybean crop rotation at some time in the past. Twenty-eight percent of the producers who have experience with a wheat/double-crop soybean rotation said they plan to increase the percentage of their farms’ cropland devoted to this rotation by planting more wheat in fall 2022. The shift towards increasing wheat acreage is likely the result of the expected profitability improvement of the wheat/double-crop soybean rotation.

One of the policy proposals discussed by the Biden administration is a $10/acre double-crop soybean crop insurance subsidy to make this crop rotation more attractive to producers. This month’s survey asked respondents if the subsidy would encourage them to plant more wheat in fall 2022 than would otherwise be the case. Among producers who have employed a wheat/double-crop soybean rotation in the past, just over one in five (22%) said it would encourage them to plant more wheat. Among producers who have not followed a wheat/double-crop soybean rotation in the past, just one out of ten producers said the insurance subsidy would encourage them to plant more wheat this fall.

Wrapping Up

Farmer sentiment plummeted in May as the Ag Economy Barometer dipped to its lowest level since the early days of the pandemic in spring 2020. Despite strong commodity prices, producers are very concerned about their farms’ financial performance in 2022. Weakness in producers’ sentiment appears to be driven by the rapid rise in production costs and uncertainty about where input prices are headed. Fewer producers this month said they experienced difficulty in purchasing crop inputs than reported having difficulty throughout the winter and early spring,suggesting that input availability did not impact planting progress this spring. Despite concerns about farm financial performance, producers remain relatively optimistic about farmland values, largely because of expectations for strong non-farm investor demand and inflation. Finally, this month’s survey suggests that producers with wheat/double-crop soybean experience plan to increase their wheat acreage in fall 2022.