Farmer Sentiment Rebounds on More Optimistic View of Future

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer June results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

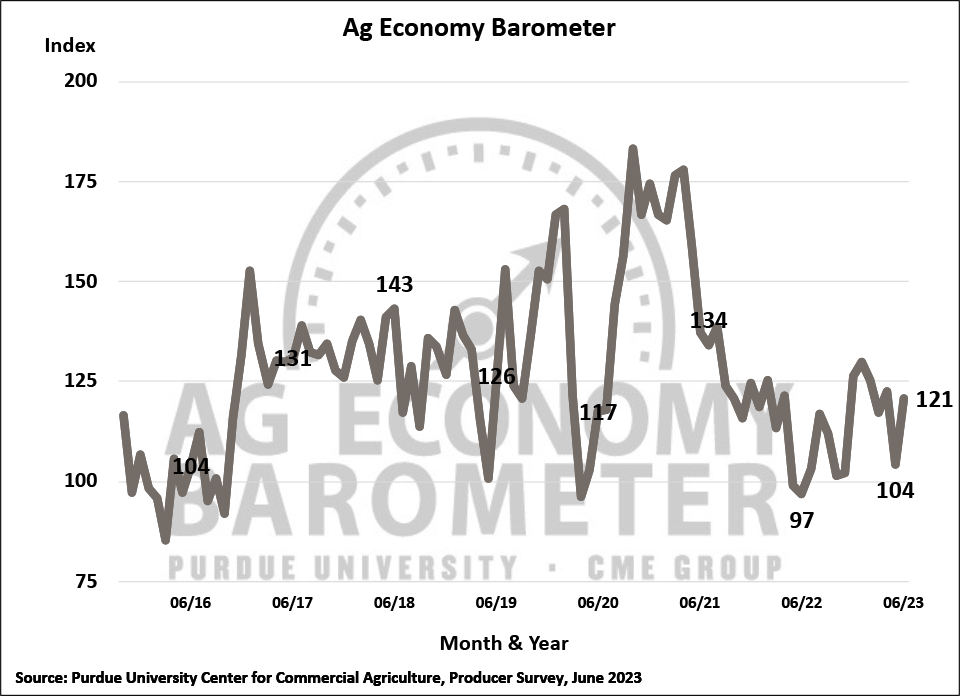

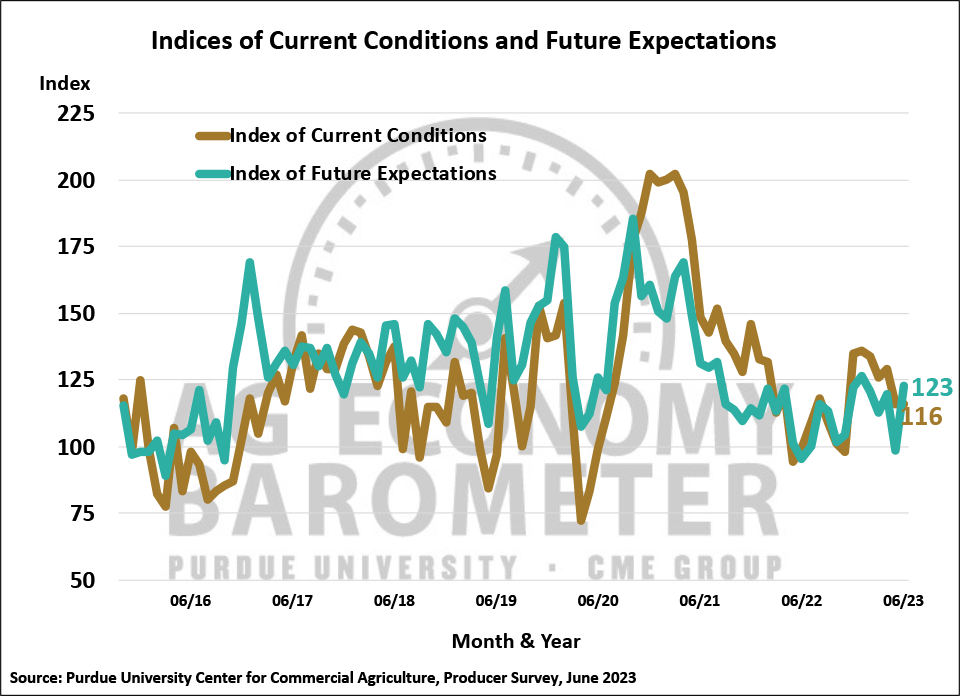

Farmer sentiment rebounded in June as the Purdue University-CME Group Ag Economy Barometer rose 17 points to a reading of 121. June’s sentiment improvement left the index near the April reading of 123 after a one-month swoon in May. The swing in sentiment was driven by producers’ more optimistic view of the future as the Index of Future Expectations rose 25 points to 123, while their perception of the current situation was unchanged. The Index of Current Conditions reading, at 116, was the same as in May. This month’s Ag Economy Barometer survey was conducted from June 12-16, 2023.

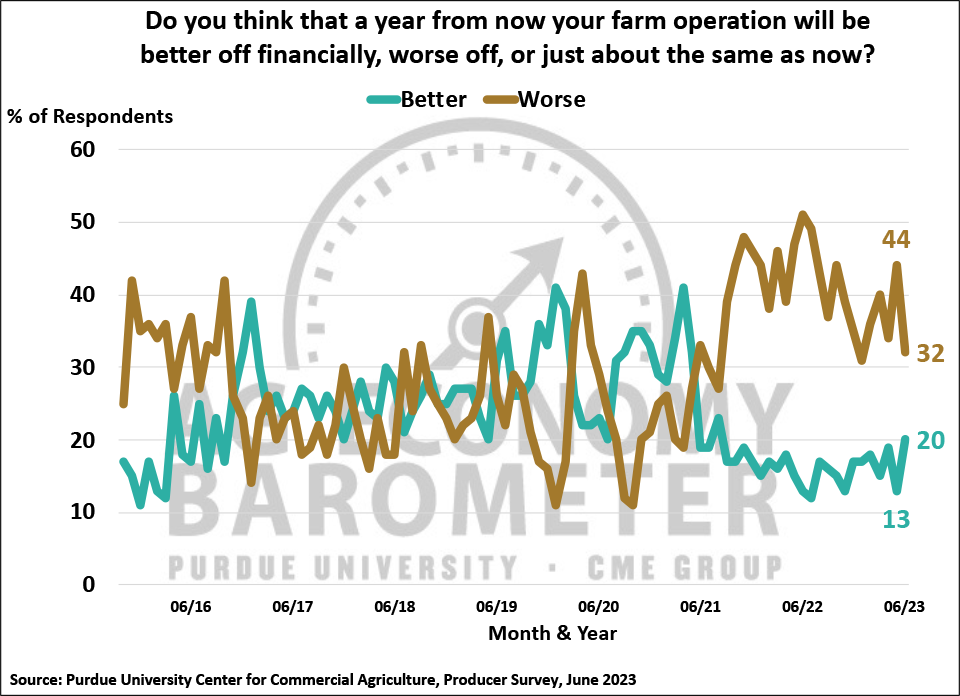

The contrast in producers’ perspectives on current conditions vs. future expectations was made clear when examining responses to individual questions in the June survey. When asked to compare their farm operation’s situation today with a year ago, 40% of respondents said their operation was “worse off” financially than a year earlier vs. 37% who felt that way in May while just 15% chose “better off” vs. 17% who made that choice in May. But when asked to look ahead one year, respondents’ attitudes changed. In June, 20% of respondents said they expected their financial condition to improve over the next year, compared to just 13% who said that in May. Meanwhile 32% expect their farm’s financial situation to decline over the upcoming year, compared to 44% who responded that way in May. Producers improved perspective on the future was not focused solely on their own farms, but extended to all of U.S. agriculture. The percentage of producers expecting good times for U.S. agriculture in the upcoming 5 years rose 8 points to 33% while the percentage expecting bad times fell 3 points to 41%.

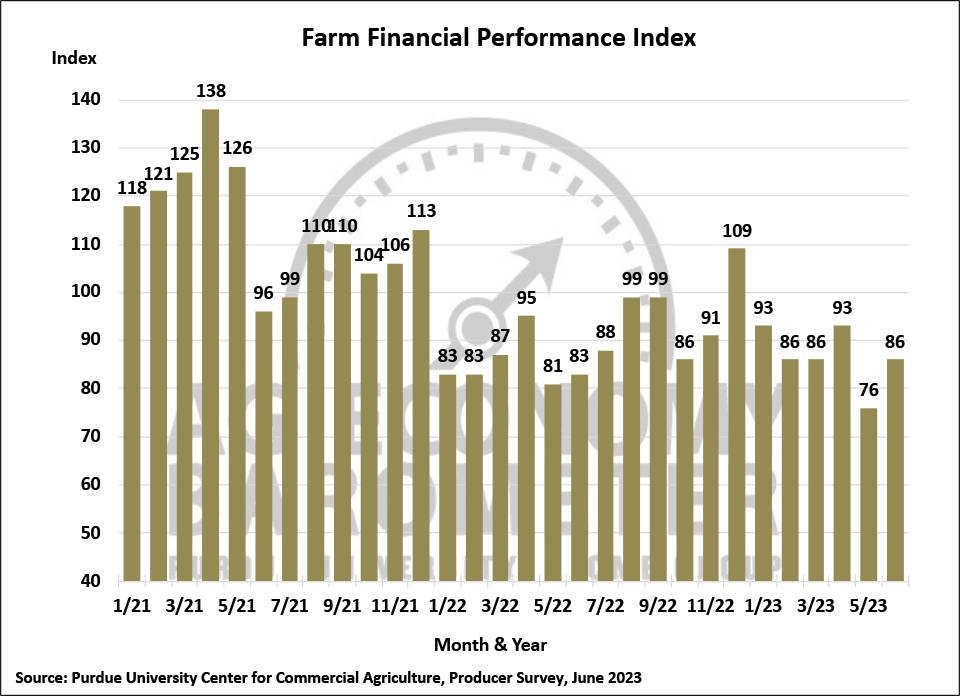

A more optimistic view of the future was also reflected in the Farm Financial Performance Index which rose 10 points in June to a reading of 86. The rally in corn and soybean prices for harvest time delivery that got underway in late May and extended into June was likely a contributing factor to the financial performance index rise. Although respondents were more optimistic about both crop and livestock returns this month, expectations for “good times” for livestock producers increased more than for crop producers. For example, 50% of respondents said they expect “good times” for livestock producers in the next 5 years, up from 37% who felt that way in May which was nearly double the increase in the percentage of respondents expecting “good times” for crop producers. Optimism about positive returns for cattle producers, especially cow-calf operations, was likely a key factor behind the positive livestock outlook.

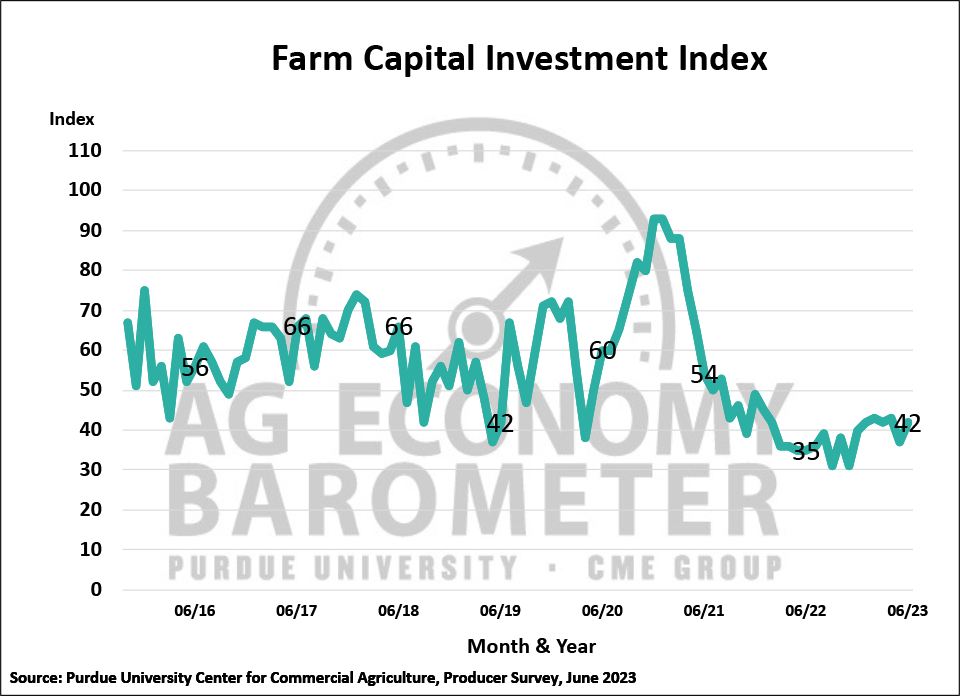

The Farm Capital Investment Index rose 5 points in June to a reading of 42 which put the index back into the range it fluctuated within from January through April. Nearly three-fourths of respondents said they view this as a bad time to make large investments in their farm operation while just 16% of producers this month said it’s a good time to make investments. The rise in interest rates shares responsibility with the rise in prices for equipment and new construction as the two key reasons cited by respondents for viewing this as a bad time for investments. This month 37% of respondents cited the increase in prices while 35% chose rising interest rates as the primary reason it’s a bad time to invest.

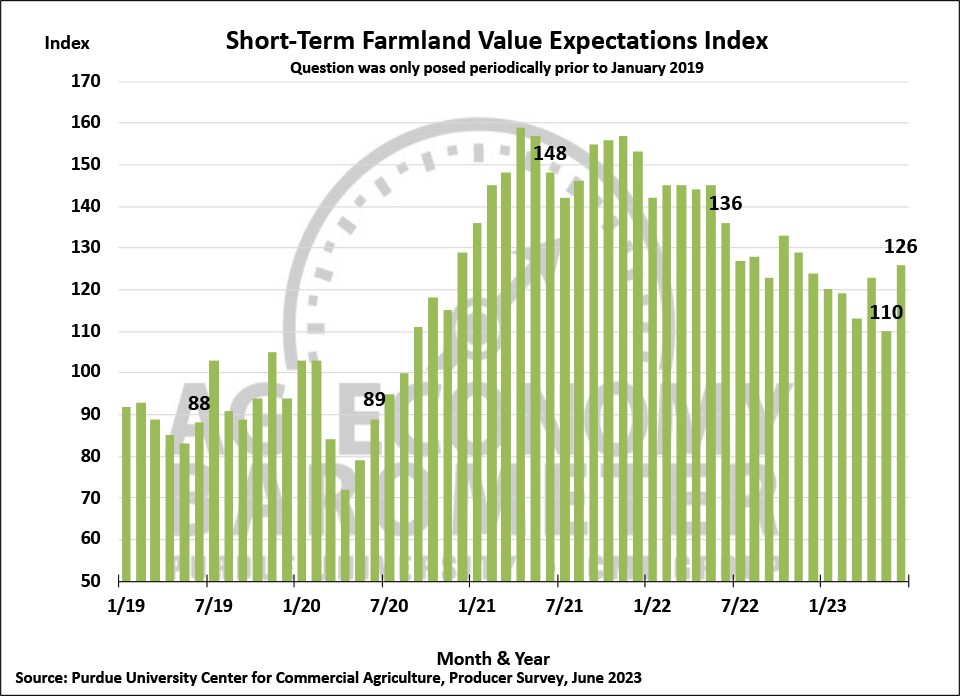

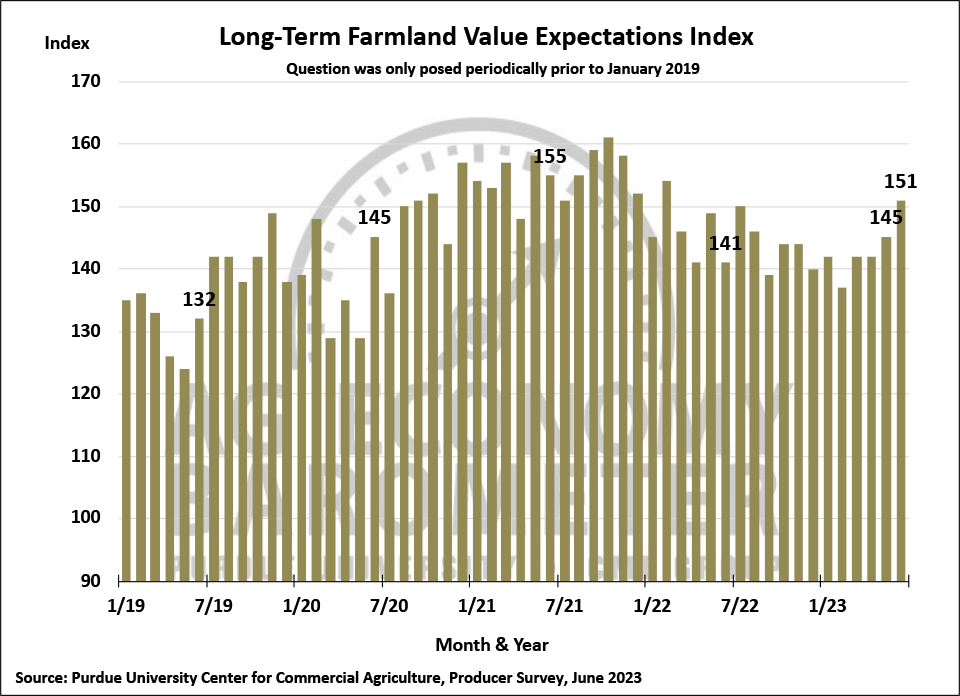

Producers became more optimistic about farmland values in June as both the short and long-run farmland value indices rose. The short-term index, which asks producers about their outlook over the next 12 months, jumped 16 points to a reading of 126, its highest reading since last November. Meanwhile, the long-term index, which asks producers to look ahead 5 years, rose a more modest 6 points to a reading of 151, pushing that index up to its highest level since February 2022. The more positive outlook for farmland values was consistent with the improved longer-term outlook for U.S. agriculture that was evident in this month’s survey. Additionally, 43% of producers in this month’s survey think interest rates have peaked and nearly a quarter of survey respondents expect to see lower interest rates within the next year.

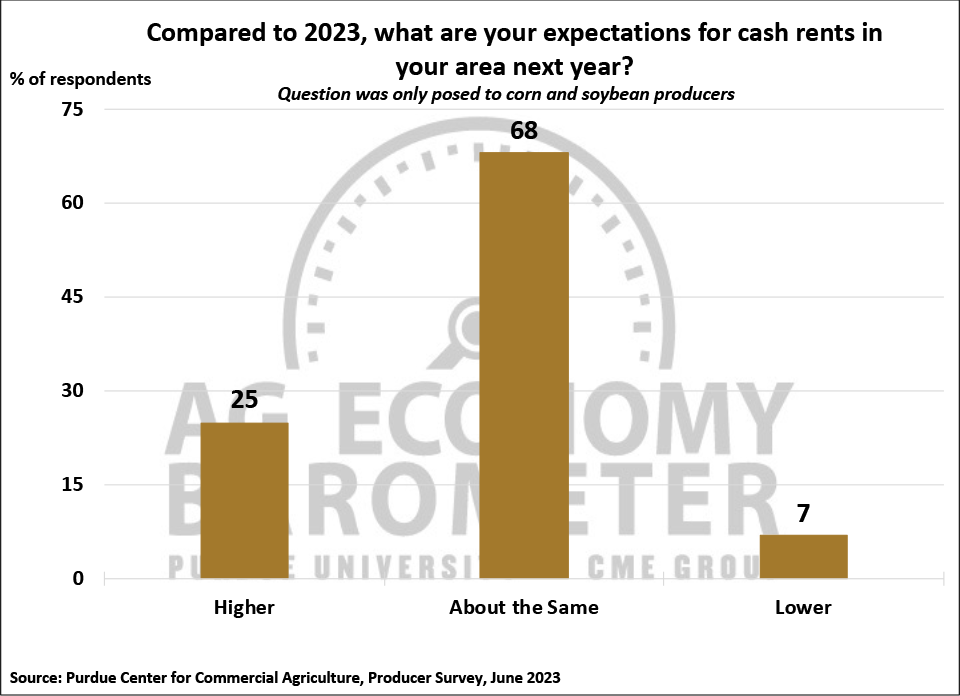

This month’s survey also included a question targeted toward corn and soybean producers regarding their expectations for farmland cash rental rates in 2024. Twenty-five percent of the corn/soybean producers in this month’s survey said they expect 2024 cash rental rates in their area to rise above 2023’s rates. In a follow-up question only posed to respondents who said they expect rental rates to rise, nearly one-third (32%) said they expect rental rates in 2024 to increase up to 5%, while nearly half (49%) look for rates to rise from 5 up to 10%, both compared to 2023.

Several questions were posed in the June survey to learn more about what producers are thinking concerning the passage of a new farm bill. Corn and soybean producers continue to view the Crop Insurance title as the most important component of the farm bill followed closely by the Commodity title. In both May and June, the survey included questions asking corn/soybean producers if they expect Congress to raise the PLC reference prices for corn and soybeans. This month half of those respondents said they look for Congress to raise both the corn and soybean reference prices. Finally, in response to ongoing concerns about the recent Supreme Court ruling upholding California’s Proposition 12 mandating housing standards for hogs processed into pork that will be sold in California, respondents were asked about the likelihood Congress would overturn Proposition 12 as part of a new farm bill. Producers were split in their response to this question. Just over one-third (36%) of respondents said it’s either somewhat or very unlikely that Congress will try and overturn Proposition 12 in a new farm bill, while one-fourth (25%) of farmers in the June survey said it’s at least somewhat likely Congress will take on Proposition 12 in new farm bill legislation.

Wrapping Up

Agricultural producer sentiment rebounded in June with the Ag Economy Barometer index climbing 17 points to a reading of 121. The sentiment improvement was all attributable to farmers’ more optimistic view of the future as the Index of Future Expectations reached 123, 25 points higher than in May. The future expectations improvement stood in contrast to producers’ appraisal of current conditions which was unchanged from May. The more optimistic view of the future held by respondents was reflected across the board as the Farm Financial Conditions, Short and Long-Term Farmland Value Expectations, and Farm Capital Investment indices all improved in June compared to May. Looking ahead, one-fourth of corn/soybean producers said they expect farmland cash rental rates to rise in 2024.