Farmer Sentiment Recovers in May; Interest in Solar Leasing Rising

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer May results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

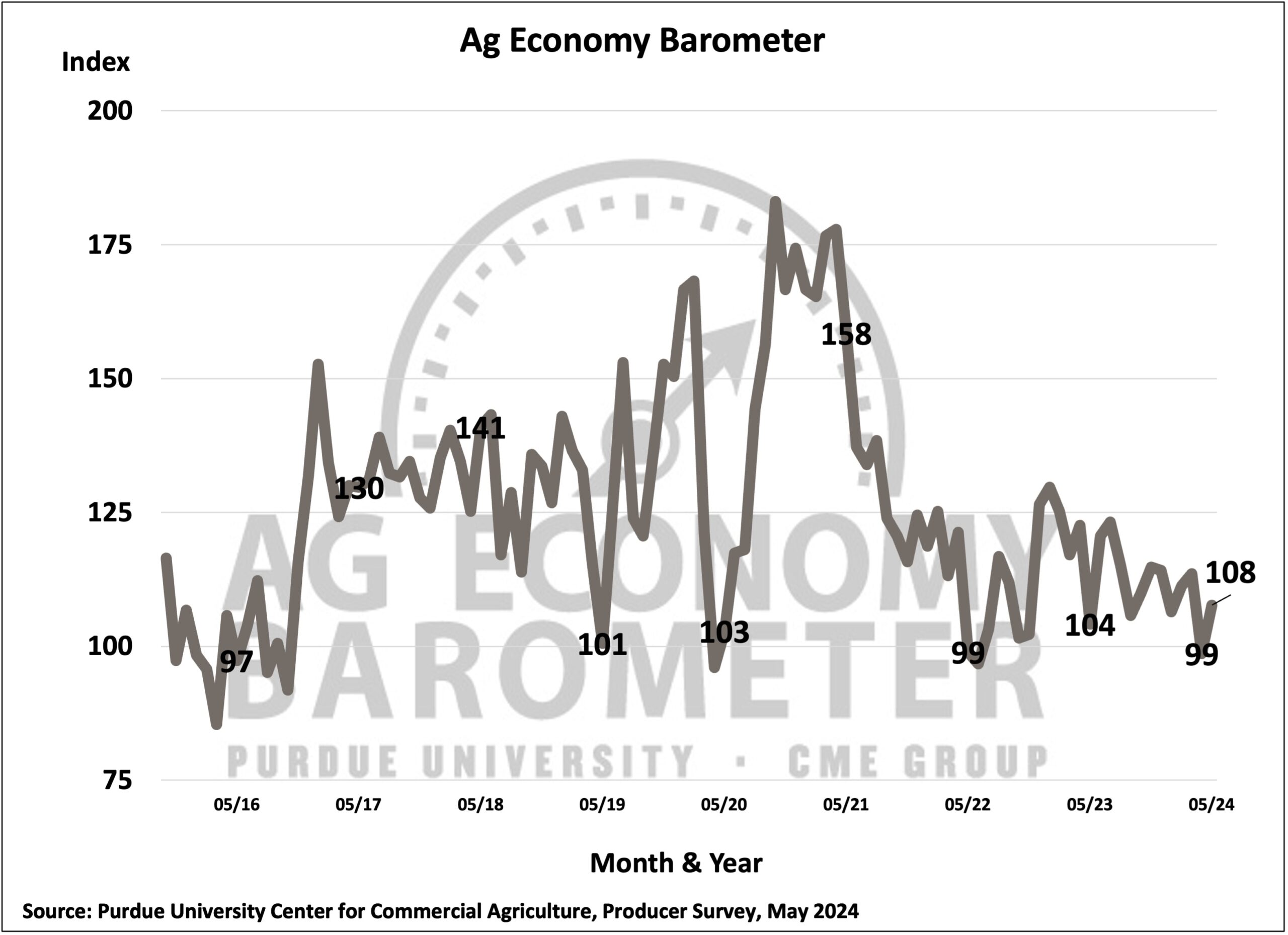

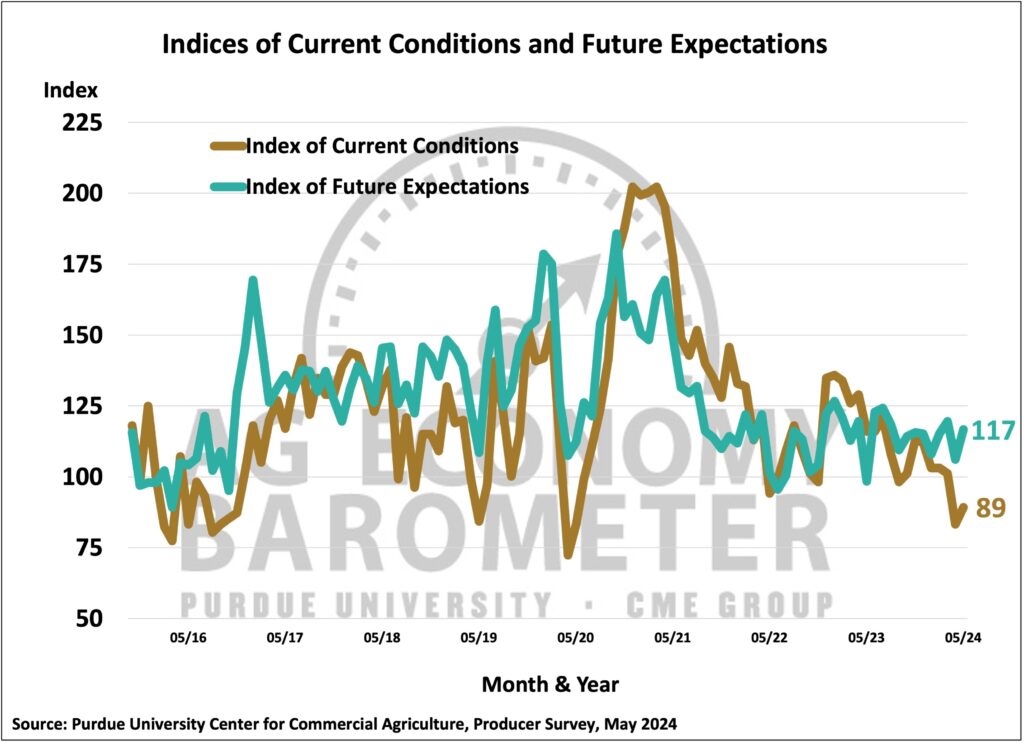

Farmer sentiment recovered somewhat in May following a sharp drop-off in April. The May reading of the Purdue University-CME Group Ag Economy Barometer came in at 108, up 9 points compared to April. Both of the barometer’s sub-indices rose as well, with the biggest improvement coming from the Index of Future Expectations, which climbed 11 points to 117, while the Current Conditions Index rose 6 points. Strengthening crop prices was a factor in this month’s sentiment improvement. For example, Eastern Corn Belt cash corn prices in mid-May were 6 to 7% higher than when the April survey was conducted, while cash soybean prices improved by 2 to 3% over the same period. The improvement in prices coincided with good corn and soybean planting progress as USDA reported the planting pace in mid-May matched the 5-year average. This month’s Ag Economy Barometer survey was conducted from May 13-17, 2024.

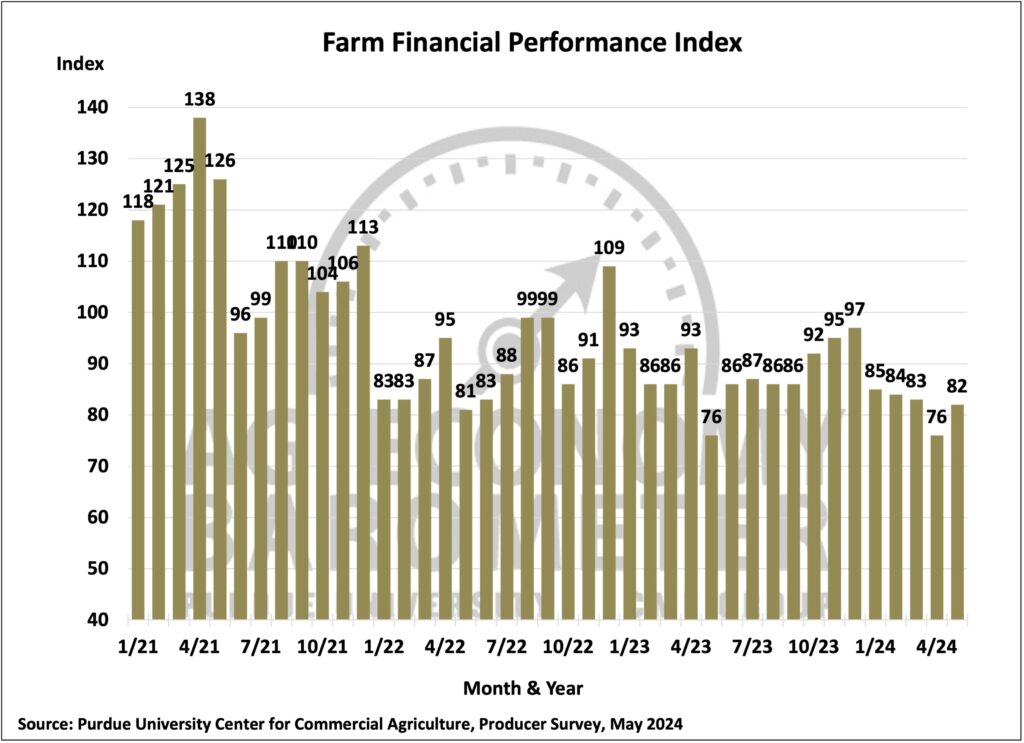

The Farm Financial Performance Index climbed to 82, up 6 points compared to April. The index is based on a question that asks producers to compare their farm’s expected financial performance to last year. Despite this month’s improvement in the index, it remained 15 points lower than at the end of last year indicating that producers still expect 2024 to be a more challenging year financially than 2023.

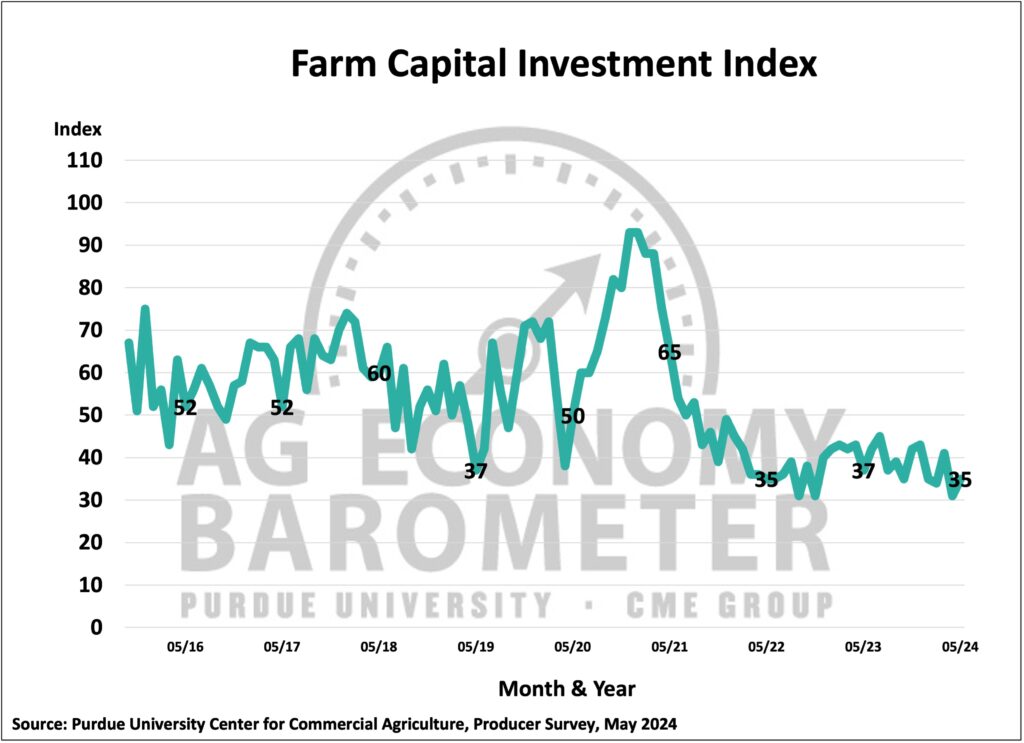

Producers’ outlook on capital investments improved in May, but producers maintained a cautious attitude towards investments as the Farm Capital Investment Index came in at a reading of 35. Although the 4-point rise pulled the index off its all-time low reading of 31, this month’s survey still indicated that 77% of respondents feel it’s a bad time to make large investments, while just 12% of respondents said it was a good time to invest. Interest rates and relatively high prices for farm machinery and new construction were the two primary reasons cited for this being a bad time to make large investments. Among those producers who think it’s a good time to invest, nearly half (45%) said they felt that way because of high inventories at machinery dealers.

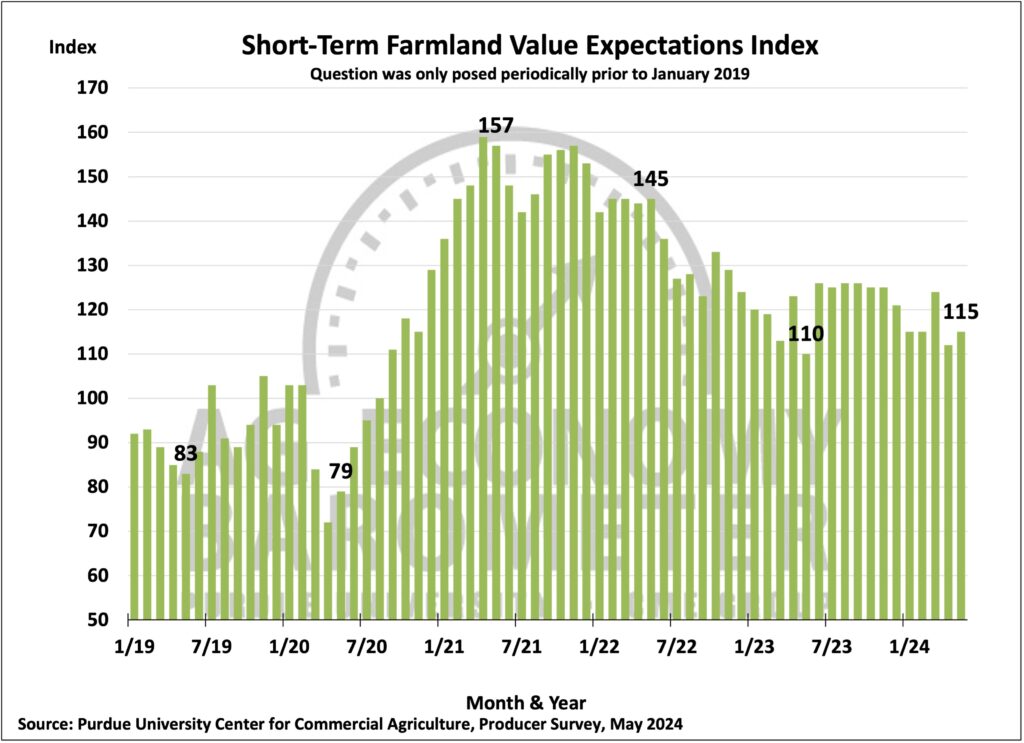

Producers’ perspective on farmland values changed little in May compared to a month earlier as the Short-Term Farmland Value Expectations Index rose just 3 points. Reviewing producers’ short-term farmland value outlook over the last several months and comparing it to results from last fall reveals a weaker outlook among producers in 2024 than in fall 2023. During the first five months of 2024, the index averaged 116 compared to an average of 124 during October-December 2023, a decline of 6%. Producers who expect values to rise over the next year consistently point to non-farm investor demand and inflation as the top two reasons for their optimistic outlook on farmland. In both the April and May surveys, the question’s response categories were expanded to include energy production from wind and solar installations. Interestingly, in May, 12% of the bullish respondents pointed to energy production as a key reason for their outlook, up from 8% in the April survey.

Partly in response to tax credits included in the Inflation Reduction Act, interest among ethanol plants to pursue Carbon Capture and Storage (CCS) projects has been increasing. To learn more about CCS, this month’s survey asked respondents if they or one of their landowners had been approached about a possible Carbon Capture and Storage project from an ethanol plant. Seven percent of respondents said they had been in contact about a CCS project. Payment rates reported per acre varied widely, ranging from less than $26 per acre to, in some cases, more than $50 per acre. Future surveys will focus on obtaining more information about CCS projects.

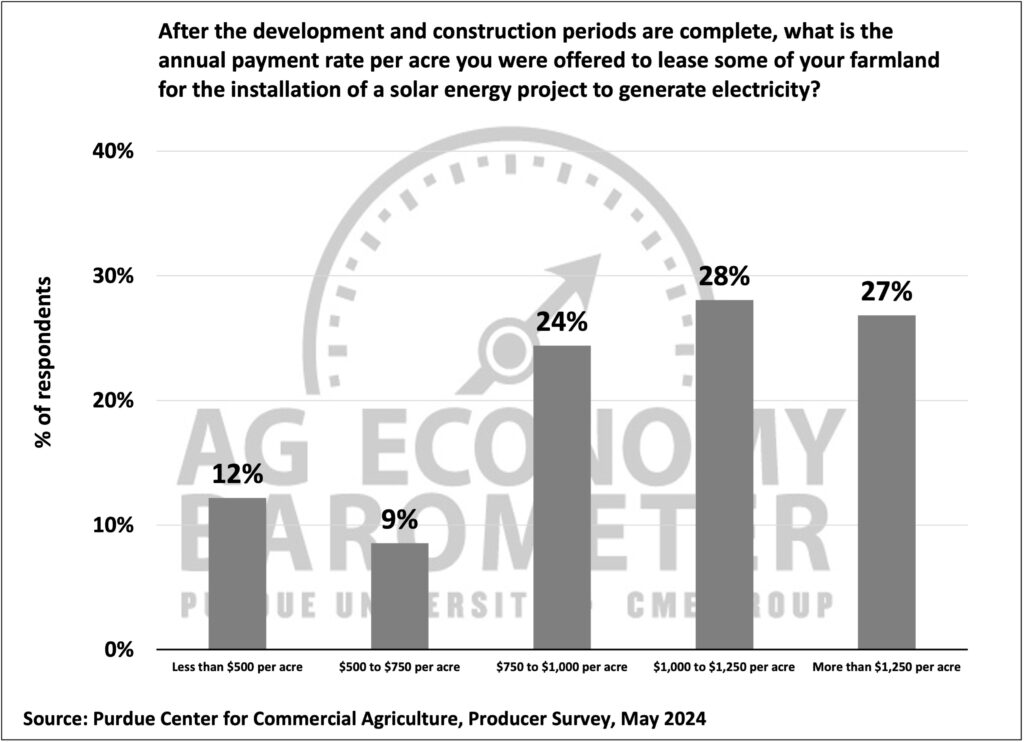

Interest in leasing farmland for solar energy production continues to rise. In both the April and May surveys approximately 20% of survey respondents, up from just 12% in March, said they have discussed leasing farmland for solar energy production in the last six months. Like April’s survey results, over half (55%) of respondents said they were offered a long-term lease rate of $1,000 per acre or more, and 27% said they were offered more than $1,250 per acre. Combining results from both the April and May barometer surveys, approximately 30% of respondents who have discussed leasing with a company have signed a solar energy lease on farmland they control.

Wrapping Up

Farmer sentiment improved in May following a sharp decline in April. Increases in crop prices provided producers with a somewhat more optimistic financial outlook, which helped boost producer sentiment. Although sentiment and financial performance expectations improved in May compared to April, they both remain weak from a longer-term perspective. There was a small uptick in the Short-Term Farmland Value Expectation Index in May, but sentiment about farmland values in 2024 remains weaker than last fall. Interest in leasing farmland for solar energy production continues to rise as 1 out of 5 survey respondents reported discussing a solar energy lease with a company in just the last six months.