Farmer Sentiment Regarding Current Conditions Slips in September

Jim Mintert gives his breakdown on the Purdue/CME Group Ag Economy Barometer August results at purdue.ag/barometervideo.

Download report (pdf)

James Mintert and Michael Langemeier

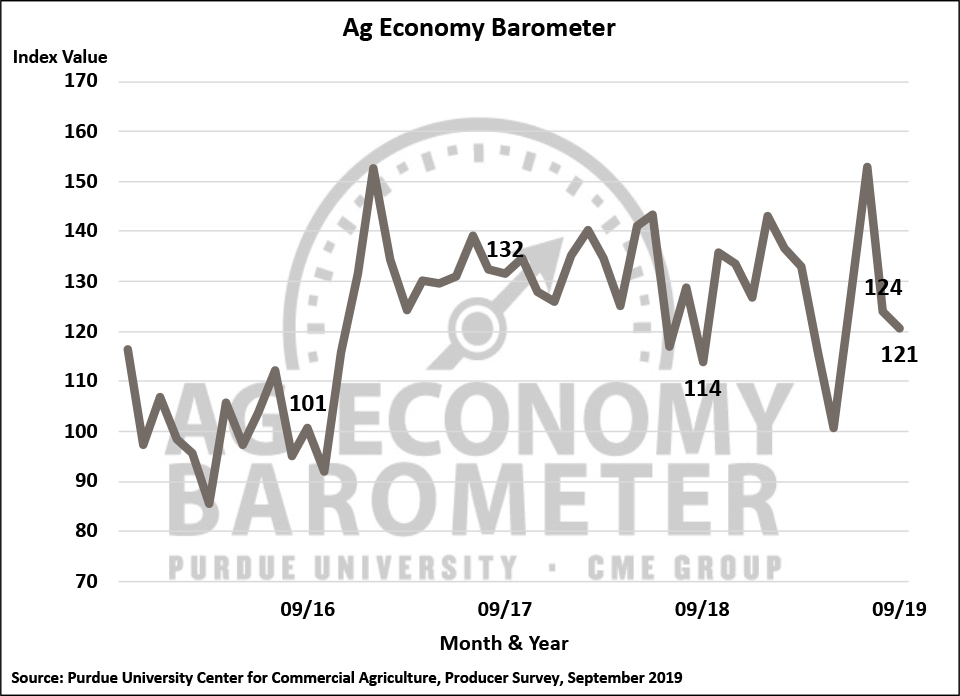

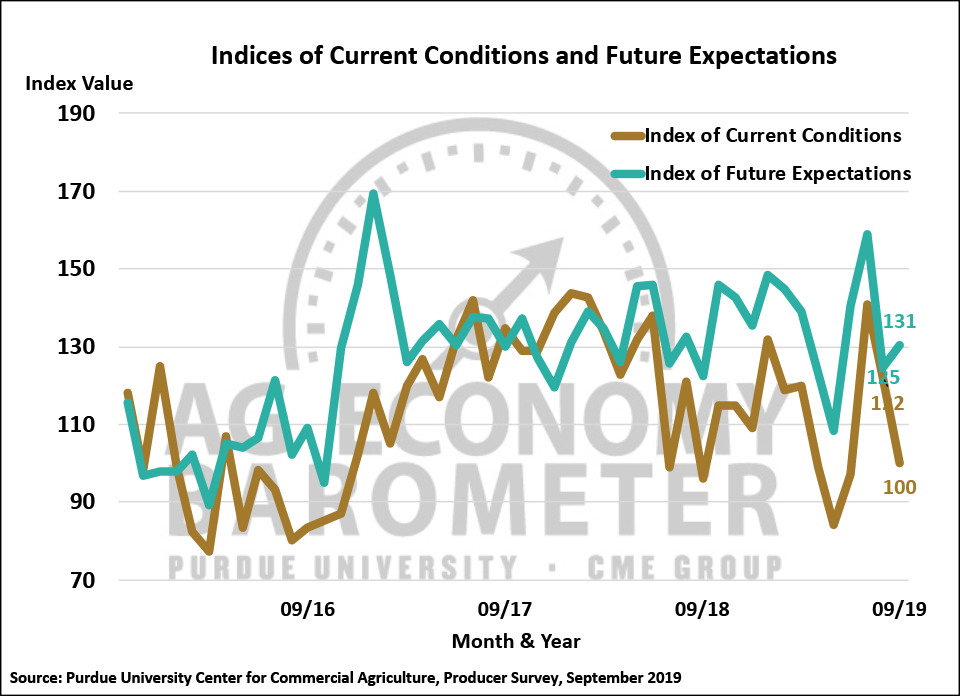

The Ag Economy Barometer dipped slightly in September to a reading of 121, down just 3 points from August, when the index stood at 124. Although the barometer’s decline was small, there was a relatively large sentiment shift among ag producers as they were noticeably more pessimistic about current conditions on their farms and in the U.S. ag economy , but somewhat more optimistic about future economic conditions, both compared to one month earlier. The Index of Current Conditions declined from a reading of 122 in August to 100 in September. This was in contrast to the Index of Future Expectations, which actually rose 6 points compared to August, with a September reading of 131. The Ag Economy Barometer is based upon results from a nationwide telephone survey of 400 U.S. crop and livestock producers. This month’s survey was conducted from September 9-13, 2019.

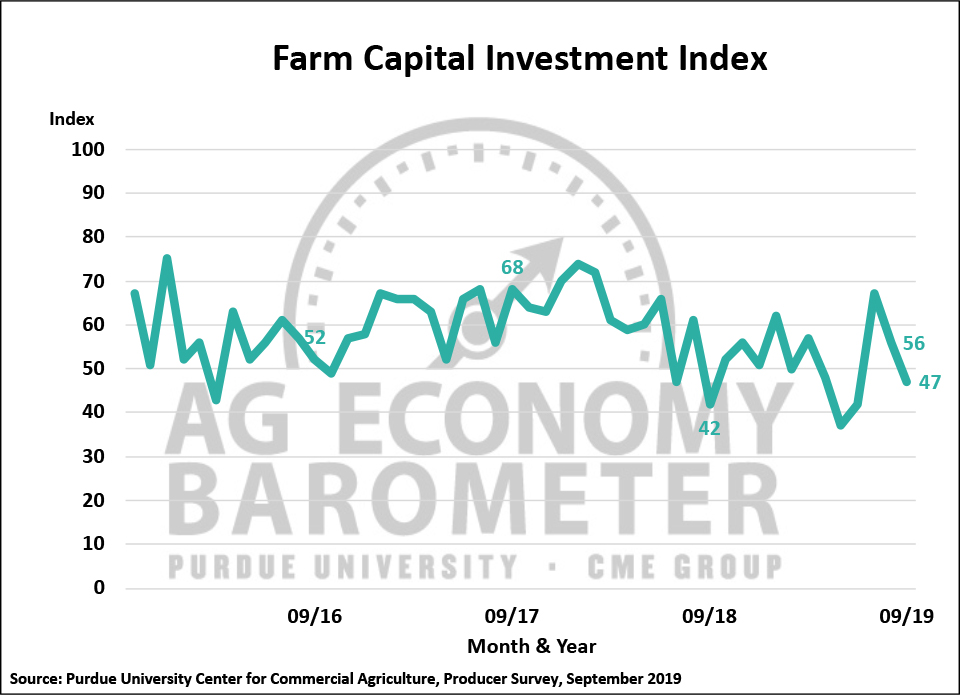

Concerns about current economic conditions on their farms spilled over into producers’ perspective on making large investments in their farming operations. The Farm Capital Investment Index, which is based upon a question posed to farmers each month regarding the advisability of making large investments in their farming operations in items such as machinery or buildings, declined for the second month in a row to 47. This was down 9 points compared to August and 20 points below the Farm Capital Investment Index’s highest reading of this calendar year, observed in July when crop prices were near their 2019 peak.

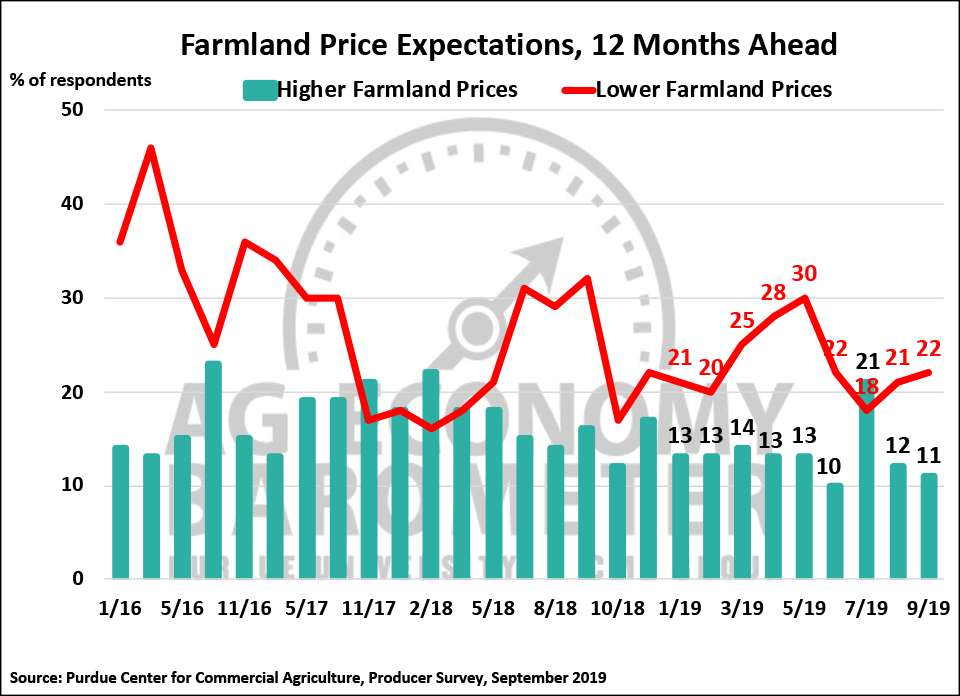

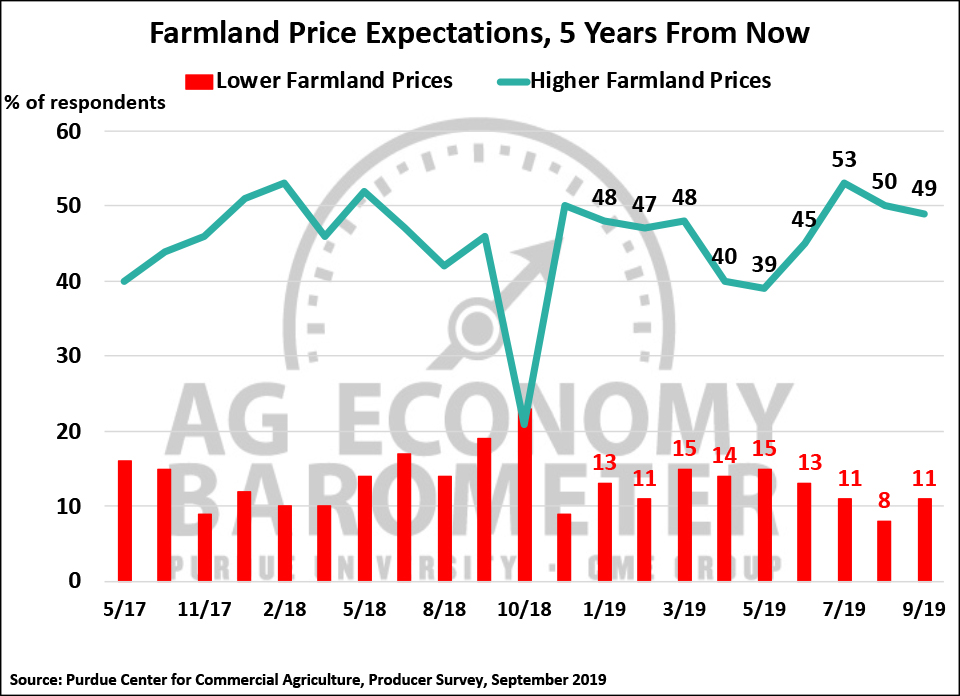

Producers’ expectations for farmland values drifted lower in September compared to August as the 12-month and 5-year indices of farmland values both weakened. When asked to look ahead both 12 months and 5 years, the percentage of farmers expecting lower farmland values increased modestly and the percentage of farmers expecting higher values decreased, which pushed both indices down slightly.

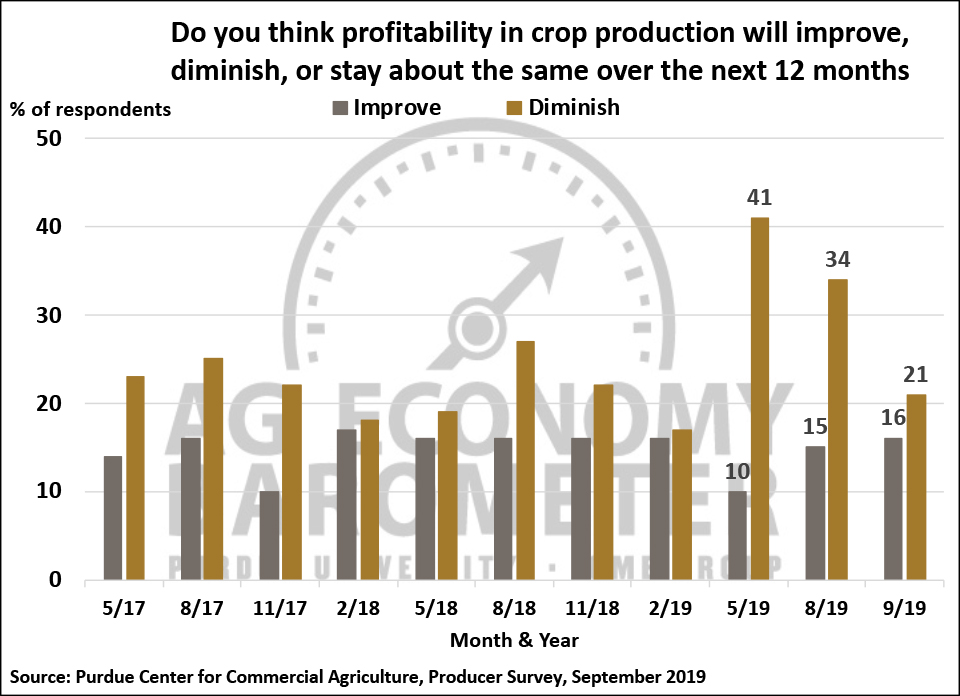

As crop growing conditions improved this season, producer’s short-run perspective on profitability of crop production changed significantly. Periodically we ask farmers if they expect profitability in crop production to improve, diminish or stay the same over the next 12 months. When we posed this question in May, at a time when concerns about delayed planting were rising and crop prices were low, farmers had an extremely negative outlook with 41 percent of respondents telling us they expected profitability to decline over the next year. When we next posed this question in August, producers’ perspective was starting to shift, although just over one-third (34 percent) of respondents still said they expected profitability to decline. In September, producer’s response shifted again, with just one out of five producers (21 percent) telling us they expected profitability to decline over the next year. When considered jointly with this month’s decline in the Index of Current Conditions, this could be a signal that growers expect better times in 2020 compared to 2019, possibly because they are looking forward to a return to more normal growing conditions and crop production in 2020.

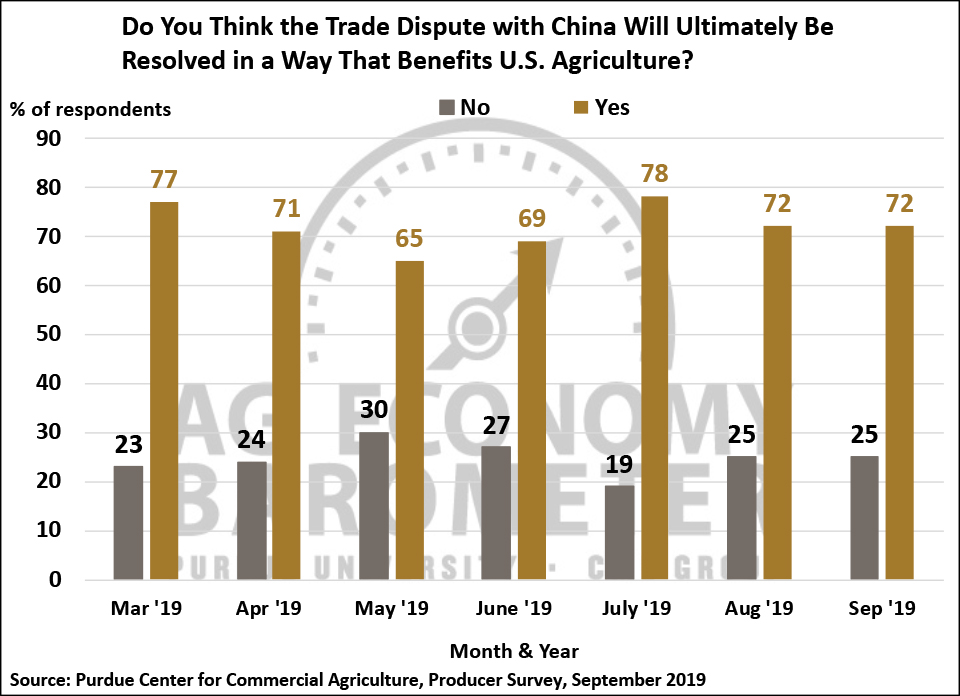

We continue to monitor producers’ perspective on the trade dispute and tariff battle with China. Interestingly, the percentage of producers that expect the dispute to be settled soon increased over the summer, rising from just 22 percent in July to 41 percent in September. At the same time, the percentage of farmers that expect a favorable outcome to the trade dispute remained above 70 percent throughout the summer, after dipping down to 65 percent in May.

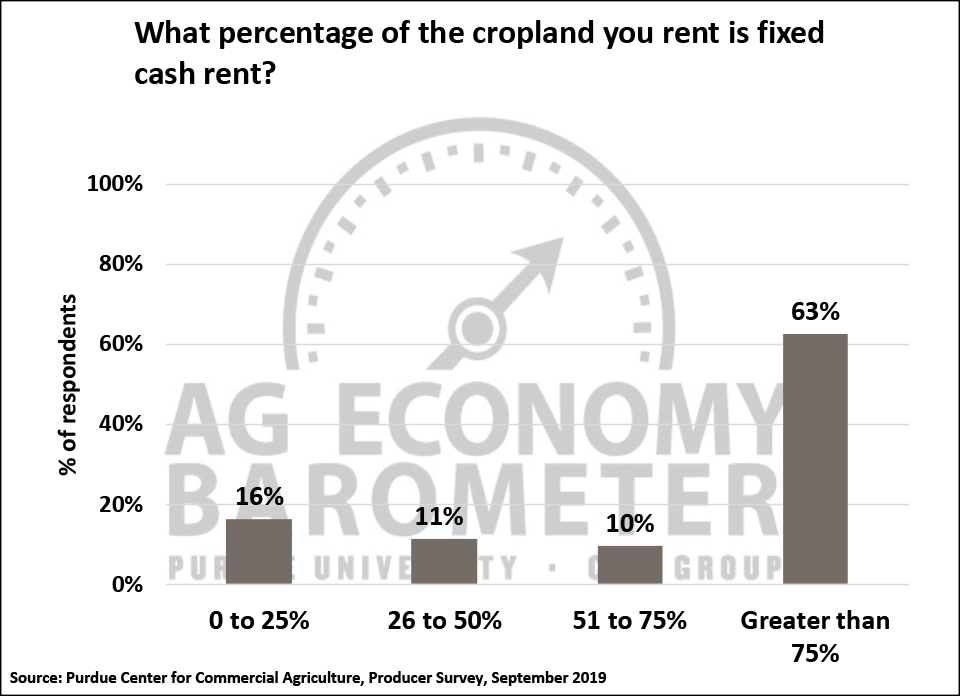

During late summer and fall, many farmers that rent cropland discuss rental arrangements with landowners so we posed several questions to learn more about their rental arrangements. Two-thirds of the farmers in our survey indicated they rent cropland as part of their farming operation. The most common rental arrangement was cash rent (73 percent of respondents), followed by share rent (18 percent of respondents) and flexible cash rent (9 percent of respondents). Sixty-three percent of the farmers that cash rent cropland said that more than 75 percent of their rented cropland is cash rented confirming the importance of cash rental rates on farm profitability.

Wrapping Up

The Ag Economy Barometer drifted lower in September as producers became more pessimistic about current economic conditions on their farms. Concerns about current economic conditions led producers to be less inclined to think now is a good time to make large investments in their farming operations as the Farm Capital Investment Index declined 9 points to a reading of 47, which was 20 points lower than in July. Producers were slightly more pessimistic about farmland values over both the upcoming 12 months and the next 5 years than they were in August. But fewer farmers told us they expected crop profitability to decline in the upcoming year than when we posed the same question last spring and earlier this summer. Taken in context with the decline in the Index of Current Conditions, it could be that more farmers expect growing conditions to improve in 2020 compared to 2019, which would lead to stronger financial performance next year for many farming operations. Finally, more farmers are optimistic the trade dispute with China will be resolved soon than when surveyed earlier this summer, while the percentage of farmers who expect the dispute to be resolved in a way that is favorable to U.S agriculture remained above 70 percent for the third month in a row.