Farmer Sentiment Rises as Producers Report Improved Financial Conditions On Their Farms

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer October results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

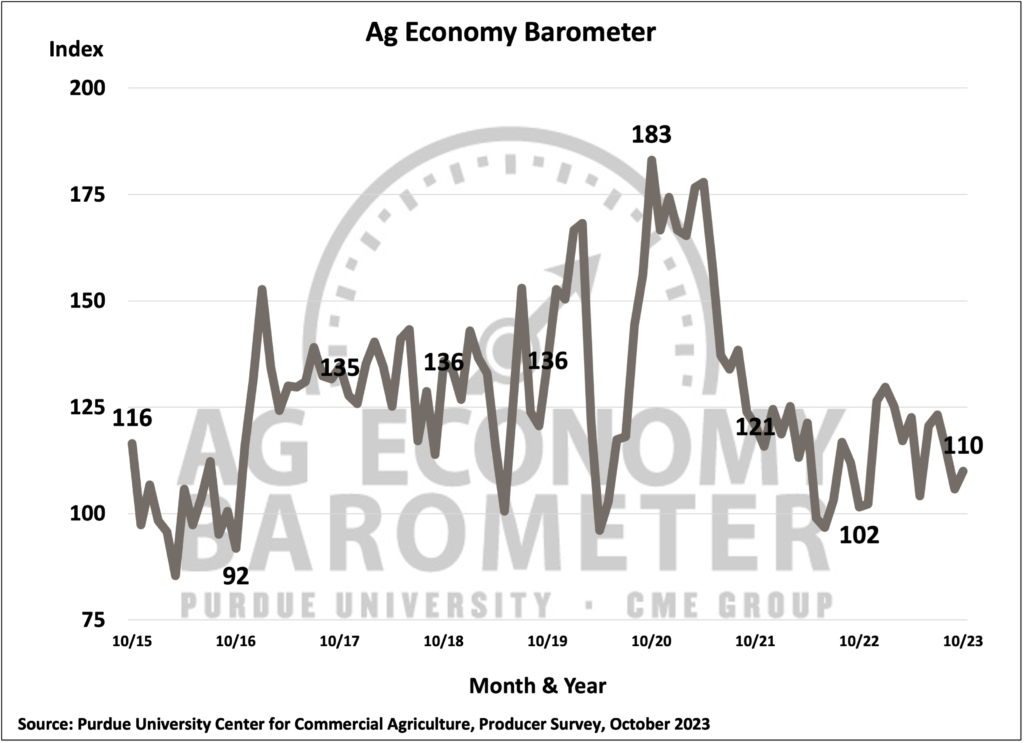

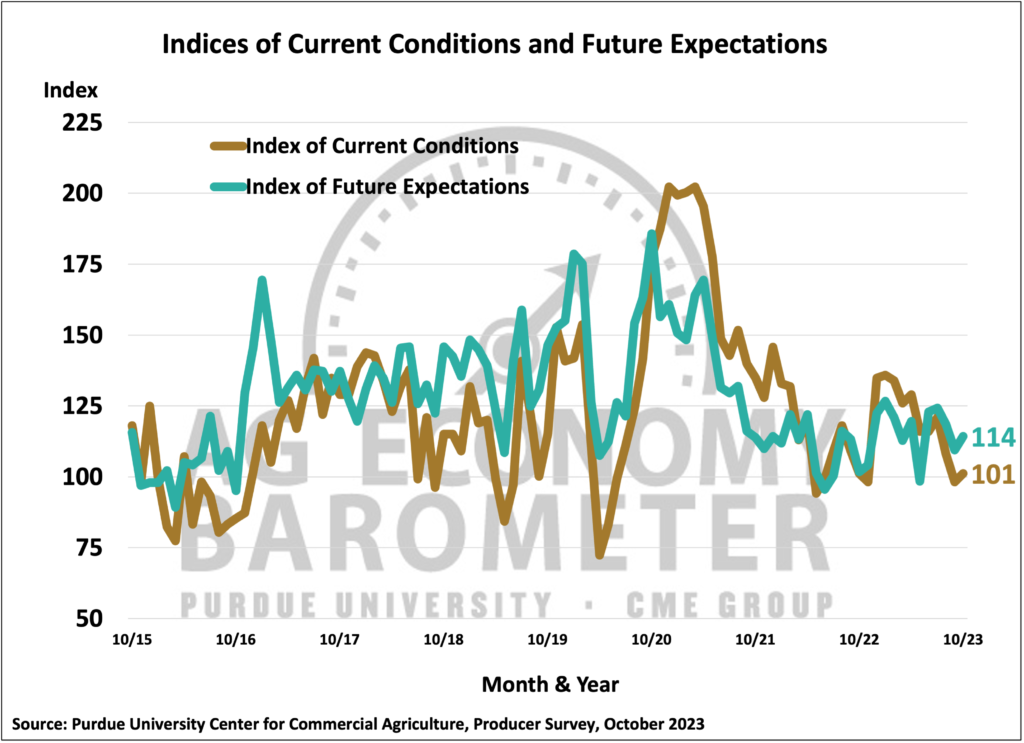

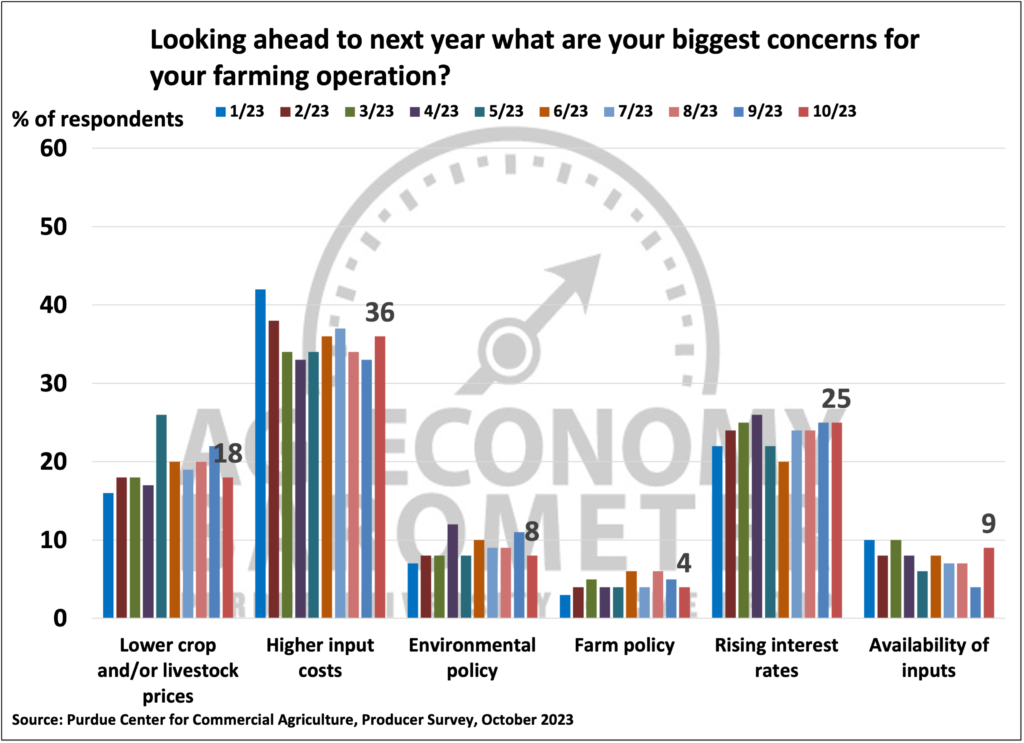

The Purdue University-CME Group Ag Economy Barometer rose 4 points in October to a reading of 110. The modest improvement in farmer sentiment resulted from farmers’ improved perspective on current conditions on their farms as well as their expectations for the future. The Index of Current Conditions rose 3 points to 101 while the Index of Future Expectations rose 5 points to 114. Farmers in this month’s survey were a bit less concerned about the risk of lower prices for crops and livestock and felt somewhat better about their farms’ financial situation than a month earlier. This month’s Ag Economy Barometer survey was conducted from October 16-20, 2023.

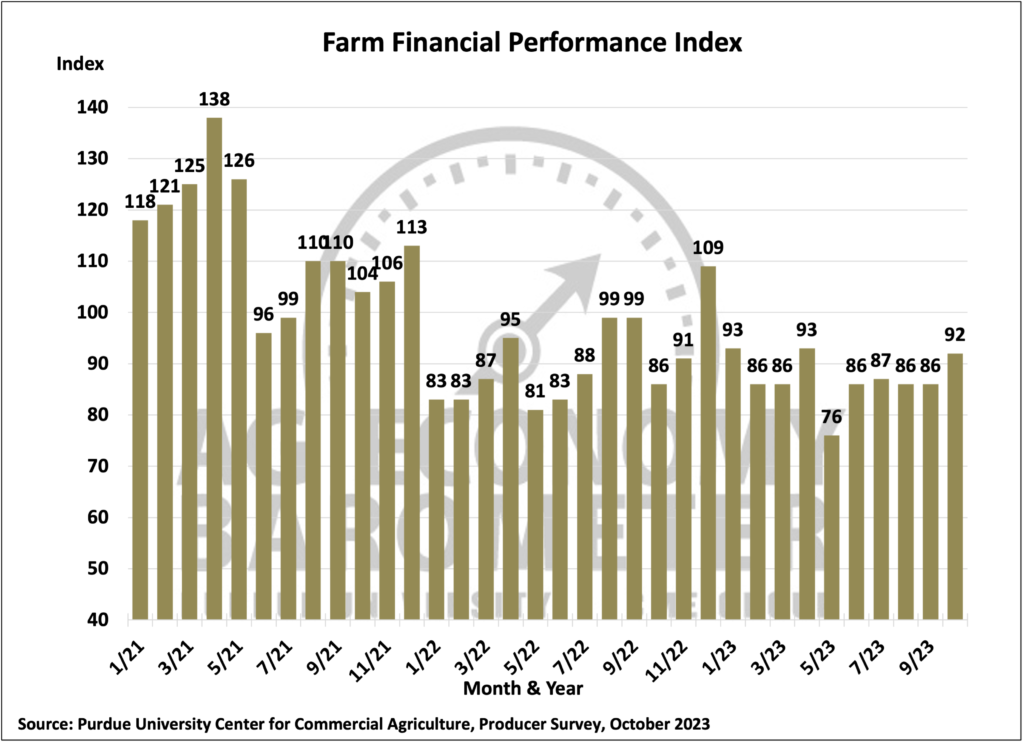

Farmers’ more sanguine view of their farms’ financial situation was reflected in the Farm Financial Performance Index which rose 6 points in October compared to September. This month’s index value of 92 was the highest farm financial performance reading since April and pushed the index 7% above a year ago. The index’s rise stood in contrast to USDA’s’ forecast for 2023 net farm income to fall below 2022’s income level. Reports of higher than expected corn and soybean yields in some Corn Belt locations, along with a modest rally in corn prices, likely contributed to this month’s rise in the financial conditions index.

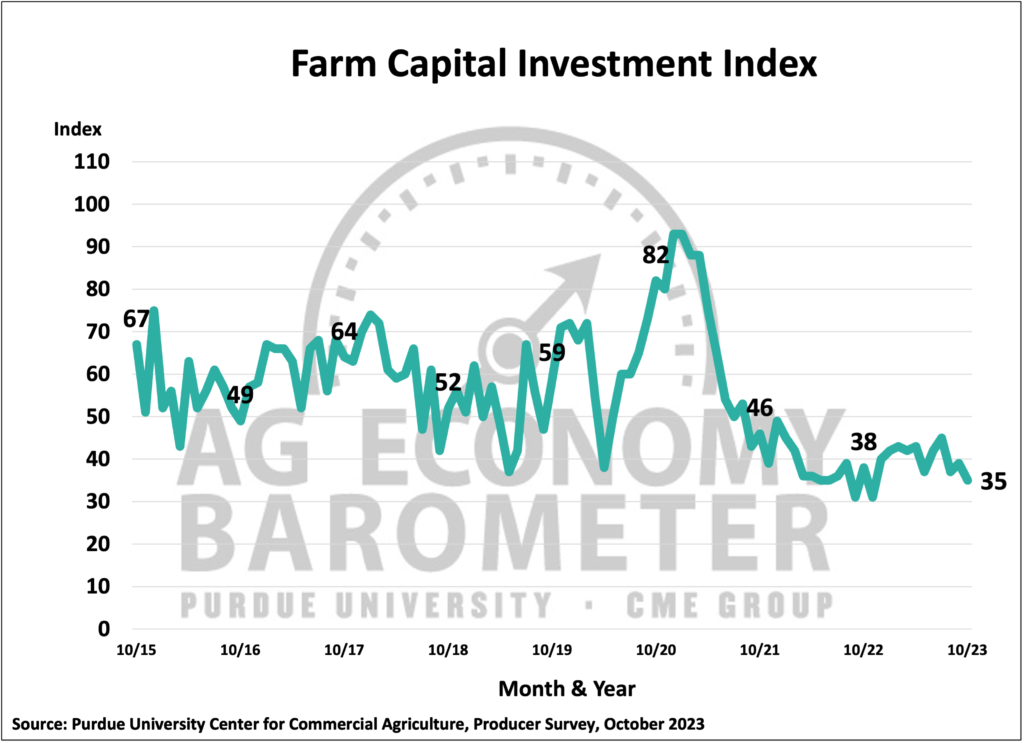

Despite the perception that financial conditions were stronger than a month earlier, the Farm Capital Investment Index fell 4 points in October to a reading of 35. This was the lowest reading of the year for the investment index. In October, nearly 8 out of 10 (78%) respondents said it was a bad time to make large investments in their farm operation, while just 13% of farmers responding to the October survey said it was a good time to make large investments. Among those who said it’s a bad time to invest the most commonly cited reason was rising interest rates, chosen by 41% of respondents. October was the fourth month in a row that a follow-up question was posed to respondents who said it’s a good time to invest. In July and August “strong cash flows” was the most commonly chosen reason for saying it’s a good time to make investments. However, that slipped to 32% in September and fell again in October to just 24% of respondents who felt strong cash flows was a good reason to invest. Interestingly, in October more producers with a favorable view of investing in their farms pointed to expansion opportunities as a key reason than in prior months, rising to 20% of respondents, up from an average of just over 6% in the July through September surveys.

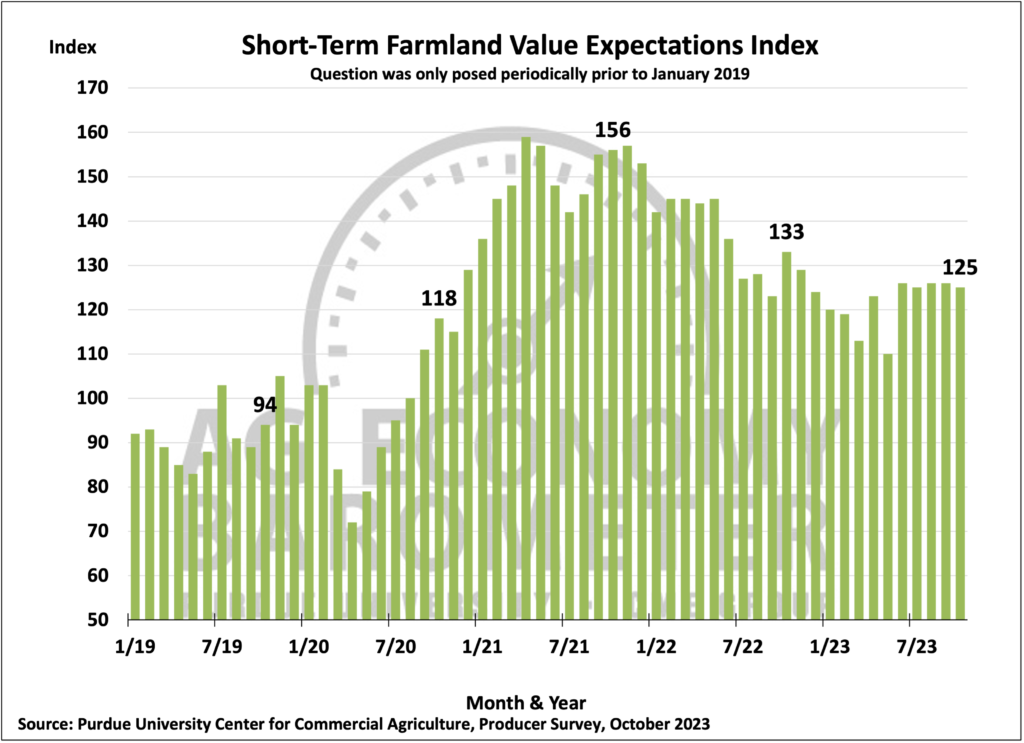

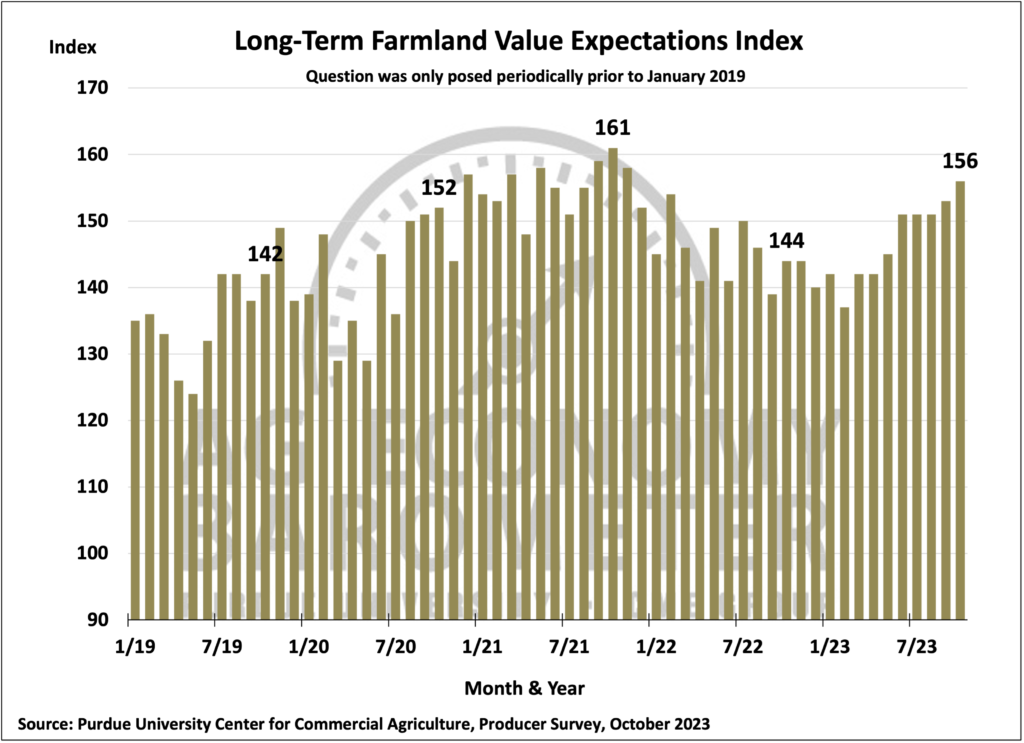

Just over one-third (35%) of producers in this month’s survey said they expect farmland values to rise in their area in the upcoming year while nearly two-thirds (65%) of survey respondents expect farmland values to rise over the next 5 years. As a result, the Short-Term Farmland Value Index changed little, dropping just one point compared to a month earlier, while the Long-Term Farmland Value Expectations Index rose three points. Key reasons cited by producers for optimism about farmland values over the next five years continue to be 1) non-farm investor demand, followed by 2) inflation.

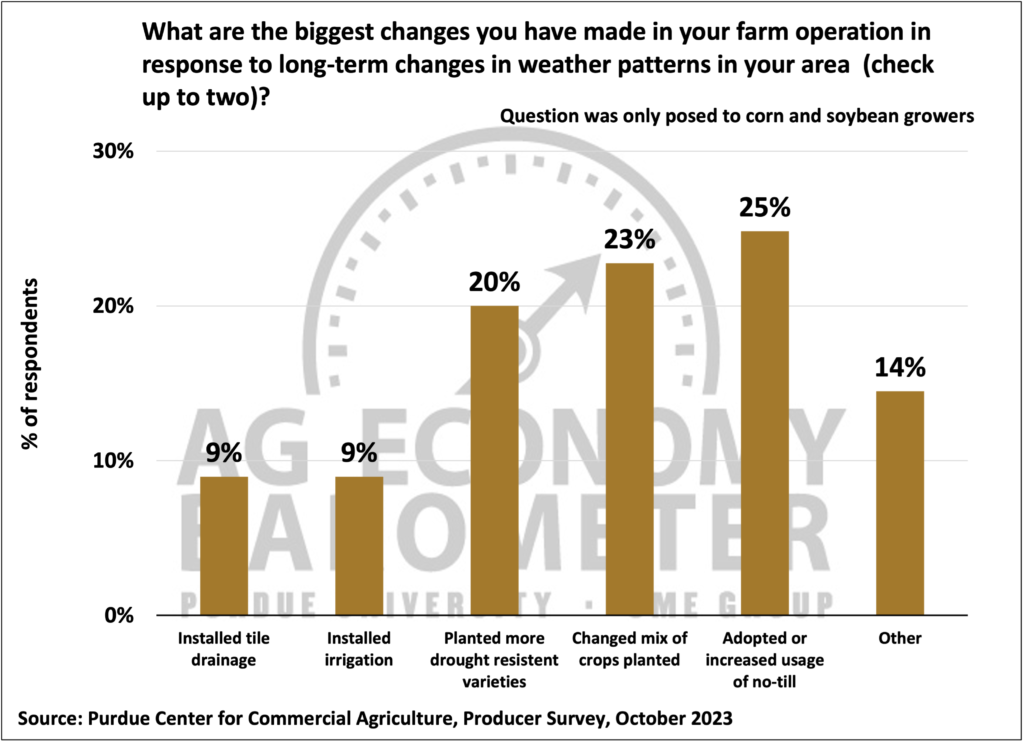

Dry weather this past spring and summer stimulated discussions among producers about shifts in long-term weather patterns. This month’s survey asked corn and soybean producers if they have explicitly made any changes in their farming operation in response to changes in long-term weather patterns in their area. Nearly one out of four corn/soybean farmers (24%) in the October survey indicated they implemented changes in their farm operations to better deal with shifting weather patterns. A follow-up question posed only to farmers who said they’ve made changes, asked them to identify the biggest operational changes they’ve made to date. Responses indicated farmers are choosing from among a broad mix of technologies to adapt to changing weather patterns. The top choice, made by 25% of respondents was “increased use of no-till” followed by “changed mix of crops planted”, chosen by 23% of farmers in this month’s survey. One out of five farmers (20% of respondents) who made changes said they “planted more drought resistant varieties”. Finally, a smaller subset of farmers indicated they’ve made capital investments to better prepare for shifting weather patterns. Nine percent of farmers said they “installed tile drainage” with another 9% of respondents indicating that they “installed irrigation”.

Wrapping Up

There was a modest improvement in farmer sentiment in October as farmers reported a small improvement in current conditions on their farms along with better expectations for the future. In particular, producers reported better financial conditions on their farms in October than in September, although that did not translate into a more favorable investment outlook among survey respondents. Farmers continue to be cautiously optimistic about farmland values, particularly when asked to look ahead five years. Nearly one in four corn and soybean farmers responding to this month’s survey reported making changes in their farm operation in response to long-term weather pattern changes in their area. Changes implemented by farmers were wide ranging and some farms reported making multiple changes to their farm operations in response to shifting weather patterns.