Farmer Sentiment Rises During Commodity Price Rally; Concern Over Production Costs Remains

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer February results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

Download report (pdf)

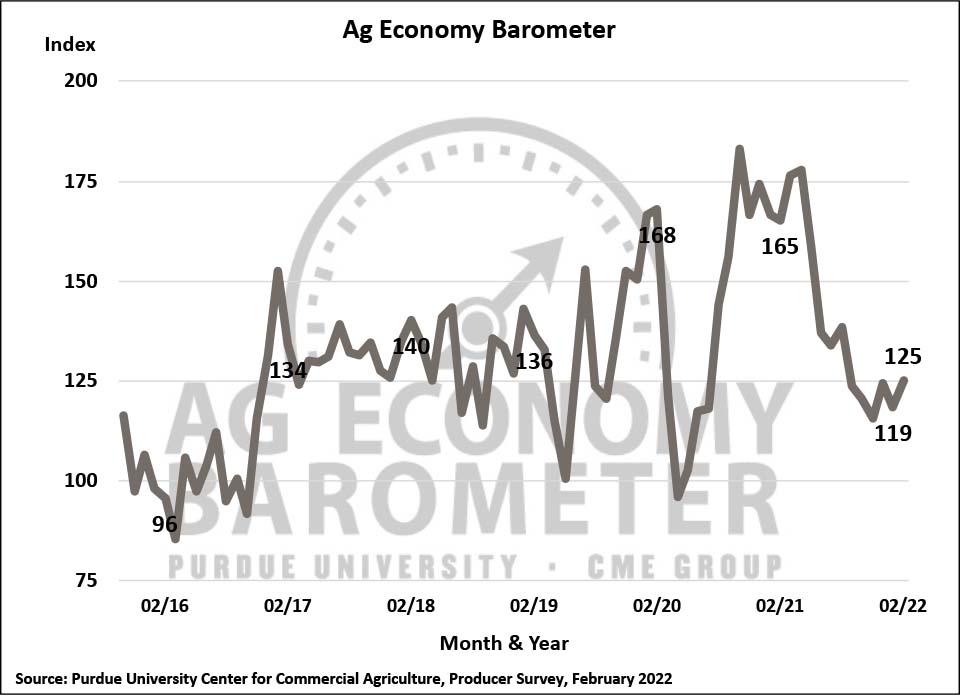

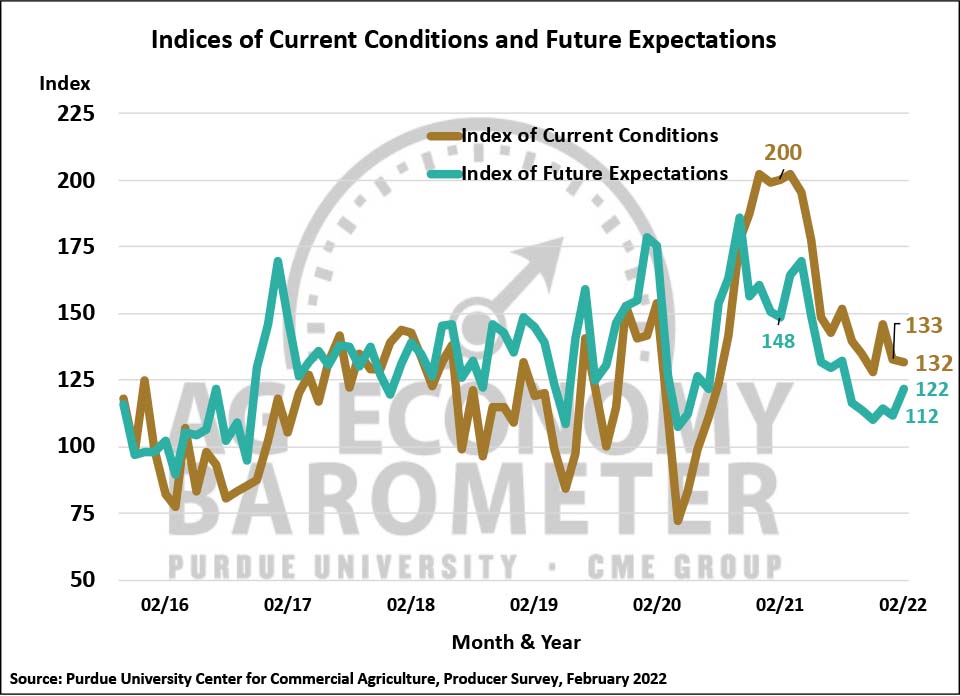

The Purdue University-CME Group Ag Economy Barometer rose 6 points in February to 125, matching the sentiment index’s reading from December. A more optimistic view of future conditions pushed the sentiment measure higher as the Index of Future Expectations rose 10 points in February to 122, the most positive reading regarding the future provided by farmers since last August. The Index of Current Conditions was virtually unchanged at 132, just one point below a month earlier. The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from February 14-18 2022, which was just prior to Russia’s invasion of Ukraine.

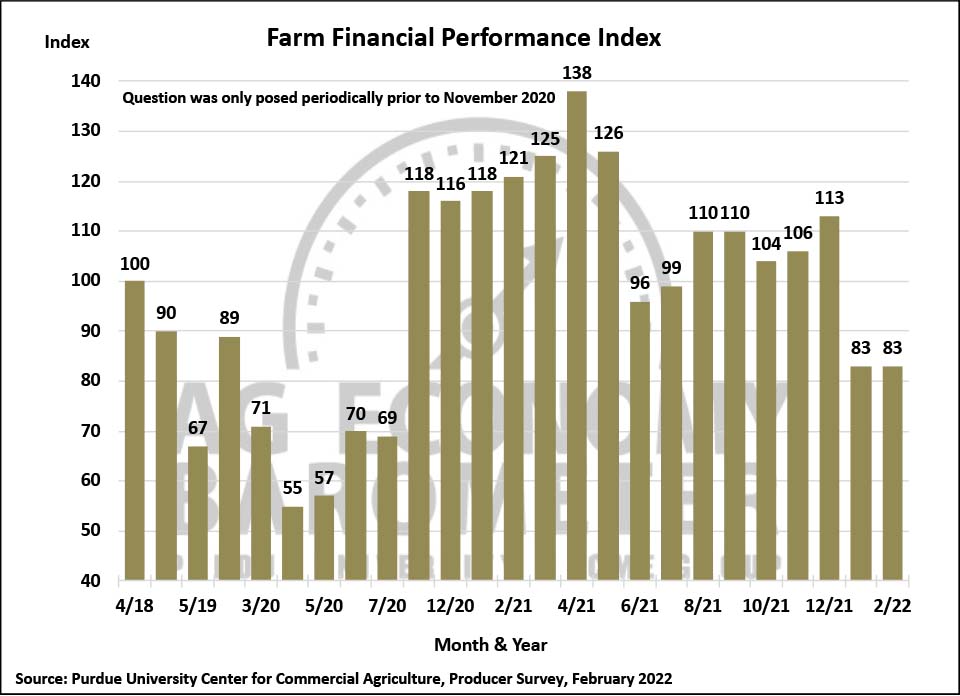

The Farm Financial Performance Index was unchanged in February, remaining at 83. The sharp drop in the index from late 2021 to 2022 indicates producers expect financial performance in 2022 to be worse than in 2021. Survey responses suggest that concerns about the spike in production costs continue to outweigh the impact of the commodity price rally that’s been underway this winter. Over the last six months, the barometer surveys have asked producers about their biggest concerns for their farming operation over the upcoming year. Higher input costs have consistently been the number one concern identified by farmers in our monthly surveys. The February survey provided respondents with a more detailed set of possible responses when answering this question than previous surveys, specifically separating government policy into two buckets, environmental policy and farm policy. Looking at results from the February survey, higher input costs (47%) continue to be the number one concern, followed by lower output prices (16%), environmental policy (13%), farm policy (9%), climate policy (8%), and COVID-19’s impact (7%).

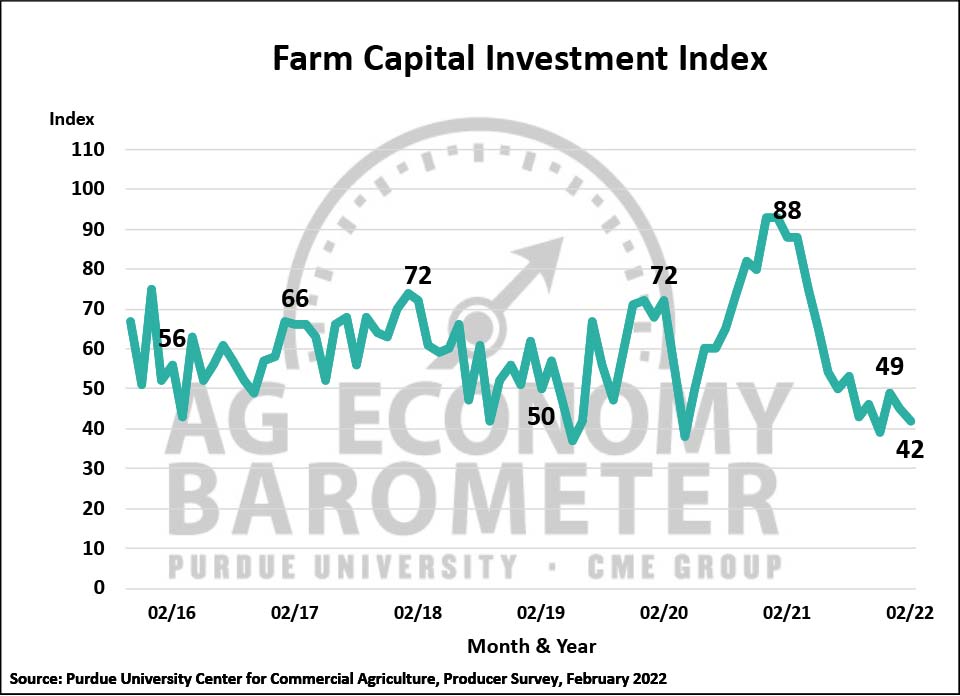

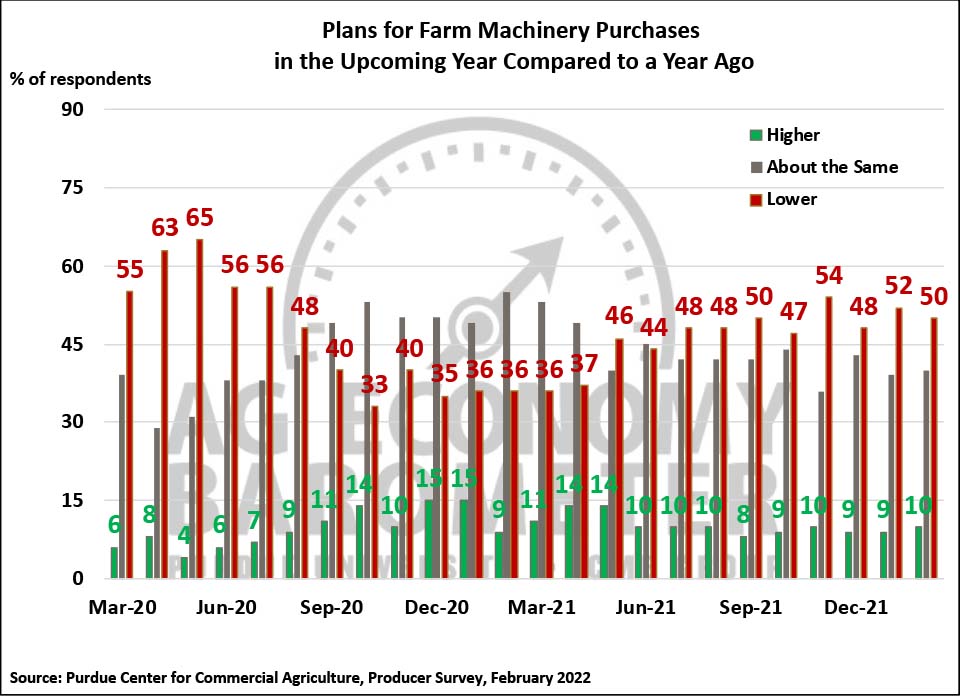

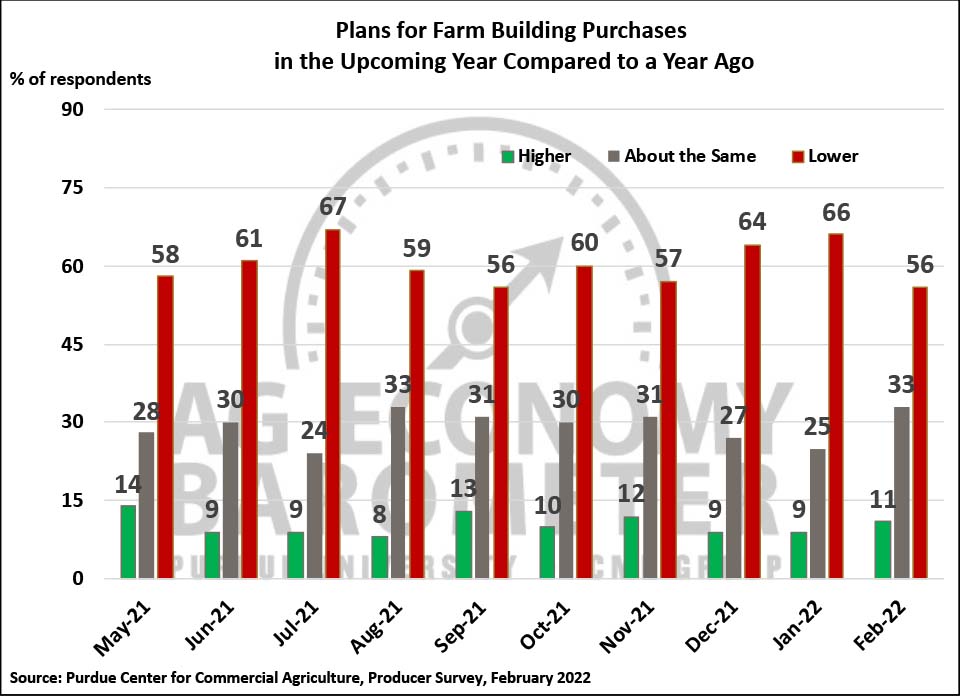

The Farm Capital Investment Index drifted lower in February to 42, a 3-point decline compared to January. Half the producers in this month’s survey said their plans for farm machinery purchases in the upcoming year are lower than a year earlier. Tight machinery inventories continue to be an issue with over 40% of producers in this month’s survey saying that low farm machinery inventories are holding back their investment plans. Plans for farm building and grain bin construction were more optimistic in February than in January, although more than half (56%) of producers this month still said their new construction plans for the upcoming year are below a year ago.

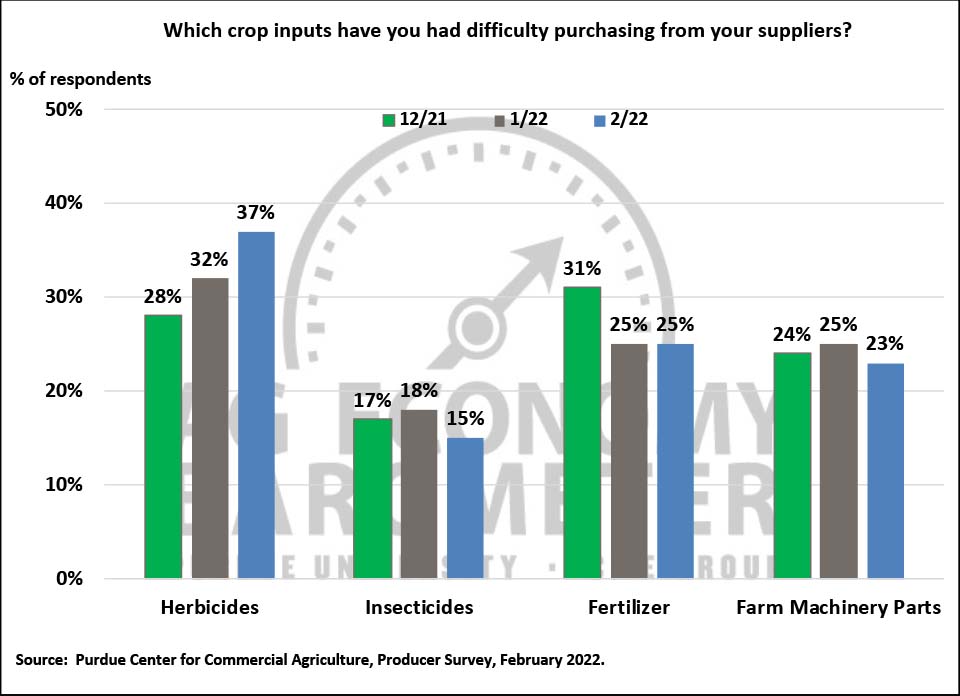

Other supply chain issues continue to plague agricultural producers. Similar to last month, 30% of crop producers in this month’s survey say they’ve had some difficulty purchasing 2022 crop inputs from their suppliers. In a follow-up question posed to corn and soybean producers who said they experienced difficulty procuring inputs, farmers indicated the herbicide supply chain is most problematic, followed by fertilizer and farm machinery parts. To learn more about how crop producers are responding to surging fertilizer prices, corn producers were again asked if they plan to change their nitrogen fertilizer application rate in 2022 compared to the rate used in 2021. One-third of corn producers in this month’s survey said they plan to use a lower nitrogen application rate this year than they did in 2021, compared to 37% of corn producers who said they planned to reduce their nitrogen application rate last month.

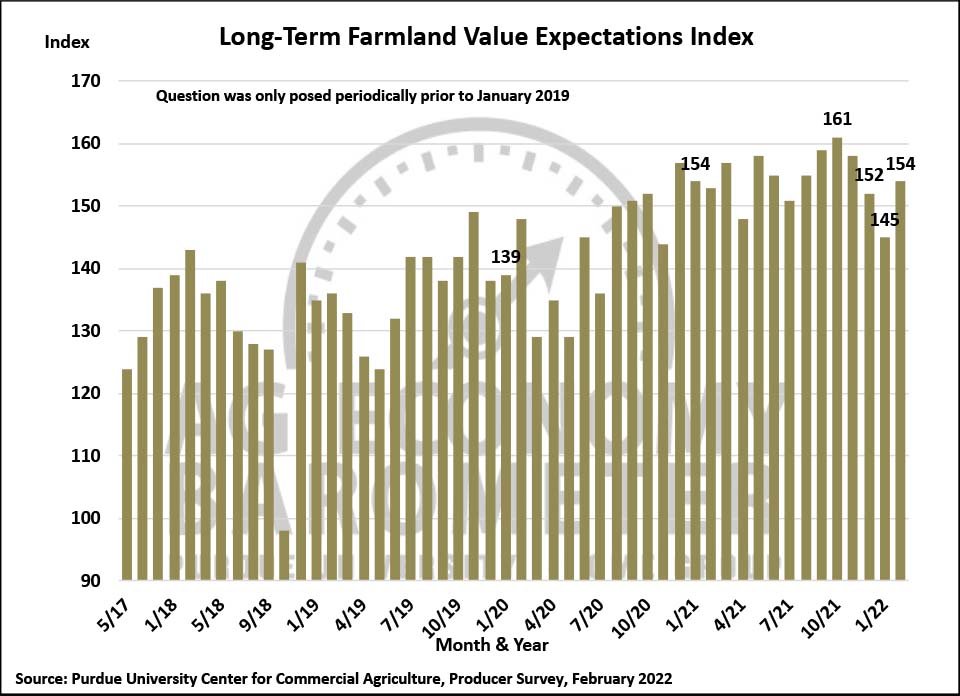

When asked for their views on farmland values, producers were a bit more optimistic in February than in January. Both the short and long-term farmland value indices rose in February. The biggest increase was in the long-term index which is based on farmers’ expectations for farmland values 5-years ahead. The long-term index rose 9 points to a reading of 154 while the short-term index, based on the 12-month outlook for farmland values, rose 3 points to a reading of 145. Both indices were at higher levels last fall suggesting producers are not quite as bullish as they were in late 2021. However, both indices remain at levels that suggest farmers do not expect any weakness in farmland values over either the short or long-run time horizons.

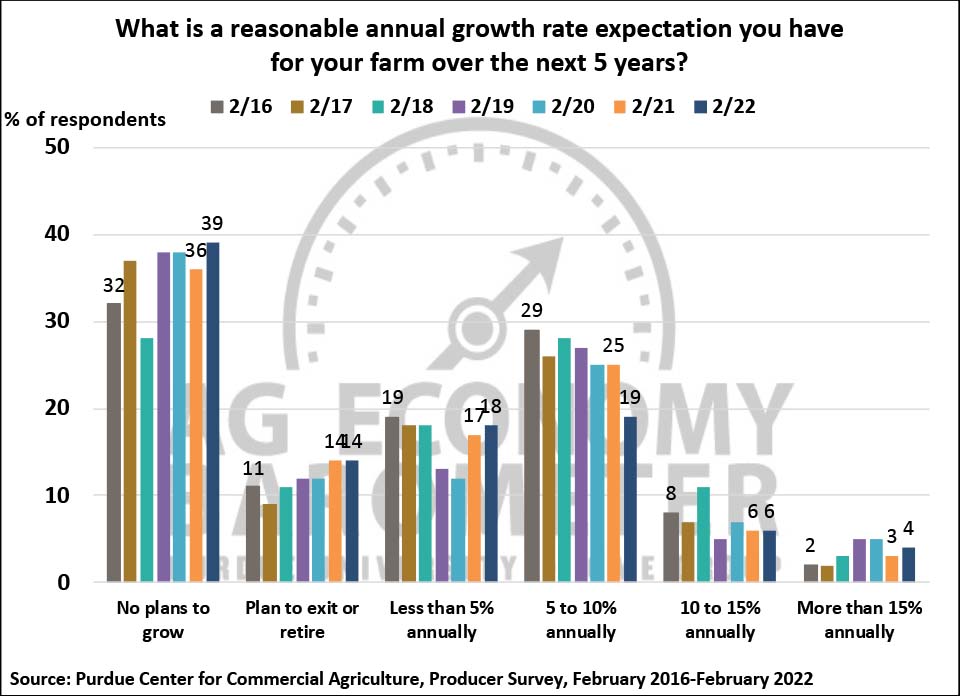

Each winter the barometer survey includes a question asking producers to project their farm’s annual growth rate over the next five years. Reviewing the seven years of responses to this question a couple of trends emerge. First, the percentage of producers who say they either have no plans to grow or plan to exit/retire in the next five years has been increasing. In February 2016, when this question was first posed, 33% of survey respondents said they either planned to exit farming or had no plans to increase their operation’s size. In February 2022, over half (53%) of respondents said they fit into one of these two categories. Second, the percentage of producers who think their operation’s annual growth rate will range from 5 to 10% has been drifting lower over time. In 2016, nearly three out of ten producers said their operation was in this category while in 2022, only 19% of respondents anticipate an annual growth rate of 5 to 10%. Finally, the share of producers indicating their farm is in the slow growth category, less than 5% annual growth, does not appear to have changed appreciably since 2016, ranging from 19% in 2016 to 17 and 18% in the last two years, respectively.

The need for better broadband coverage in rural areas has been highlighted in several legislative proposals at both the state and national level. The February barometer survey included a question asking respondents to characterize the quality of their farm’s internet access. Just three out of ten respondents said they had “High Quality” internet access followed by 41% who chose “Moderate Quality”. Twelve percent of respondents said they did not have internet access at all with another 16% choosing “Poor Quality,” suggesting that nearly three out of ten farms in the February survey are unable to take advantage of many applications and services which require reasonable quality internet access.

Wrapping Up

Farmer sentiment improved modestly in February as the Ag Economy Barometer rose 6 points from January to February. The shift in sentiment was primarily attributable to producers expressing a bit more optimism about the future than in January. Producers remain concerned about the spike in production costs leading them to expect weaker farm financial performance in 2022 than in 2021. Supply chain issues continue to hold back farmers’ plans for investments in farm machinery as well as buildings and grain bins. Thirty percent of corn/soybean producers said they’ve had some difficulty purchasing inputs for the 2022 crop with herbicides being the most commonly cited procurement problem followed by fertilizer and farm machinery parts. In response to high fertilizer prices, one-third of corn producers in this month survey said they plan to reduce their nitrogen application rate compared to the rate they used in 2021. Finally, the percentage of producers who say they either have no plans to increase the size of their farming operation or plan to exit or retire from farming in the upcoming five years appears to be increasing over time, rising from one-third of respondents in 2016 to just over half of the respondents to this month’s survey.