Farmer Sentiment Sours as Crop Prices Decline

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer May results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

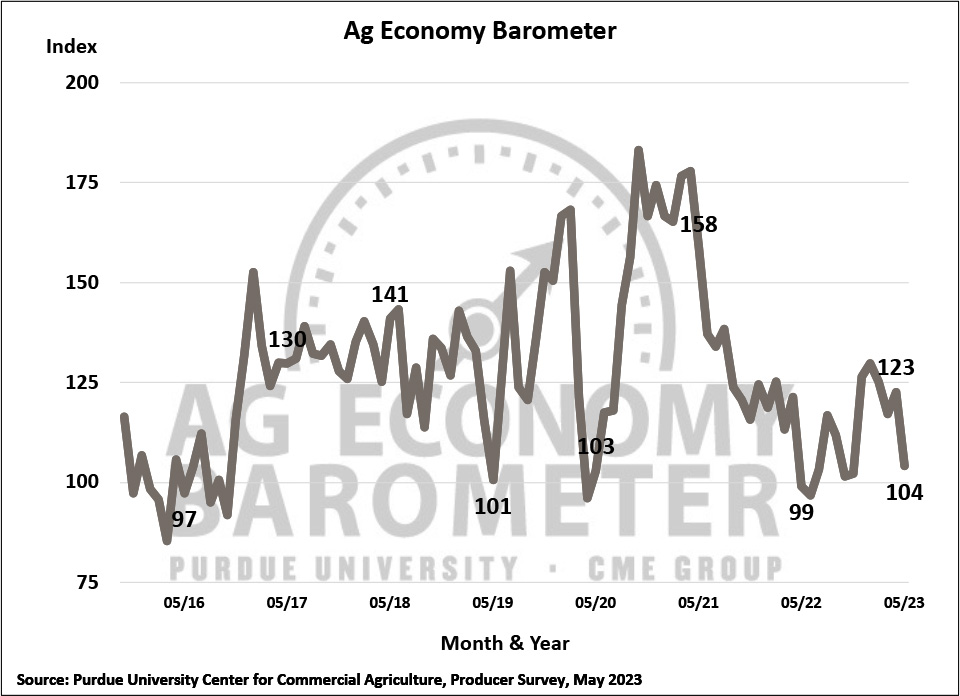

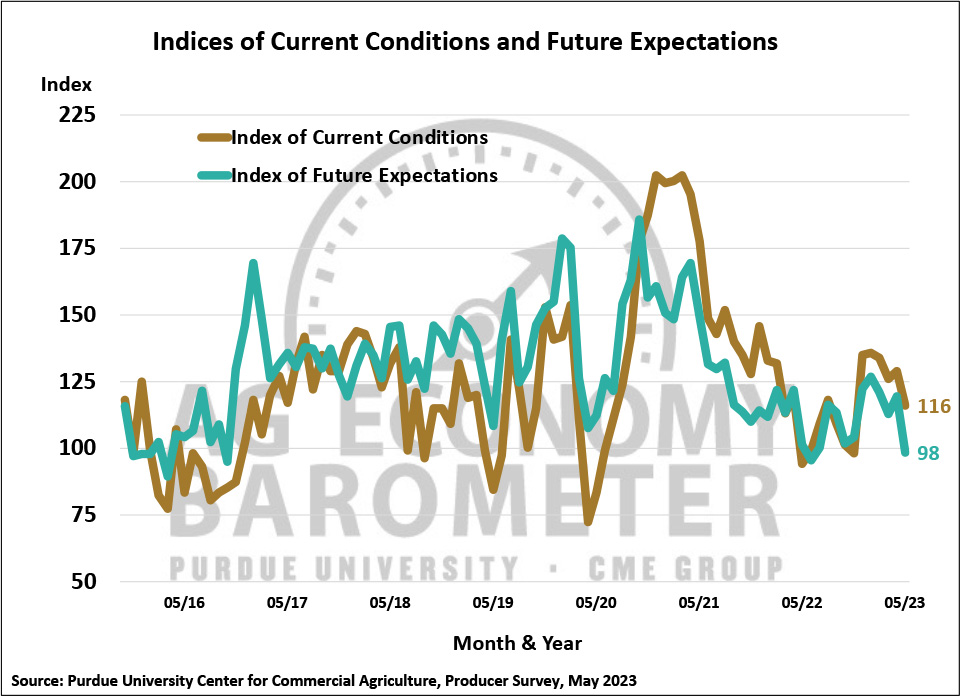

Producer sentiment fell to its weakest reading since July 2022, as the Purdue University-CME Group Ag Economy Barometer Index declined 19 points to a reading of 104 in May. This month’s weak sentiment reading was fueled by declines in both of the barometer’s sub-indices. The Index of Future Expectations declined 22 points to 98, while the Index of Current Conditions fell 13 points below a month earlier to 116. Crop price weakness helped trigger the sentiment decline. Eastern Corn Belt fall delivery bids for corn fell over $0.50/bushel (10%) and soybean bids declined over $1.00/bushel (8%) while new crop June/July delivery wheat bids declined nearly $0.50/bushel (8%) in mid-May, all compared to bids available in mid-April when the April survey was conducted. This month’s survey was conducted from May 15-19, 2023.

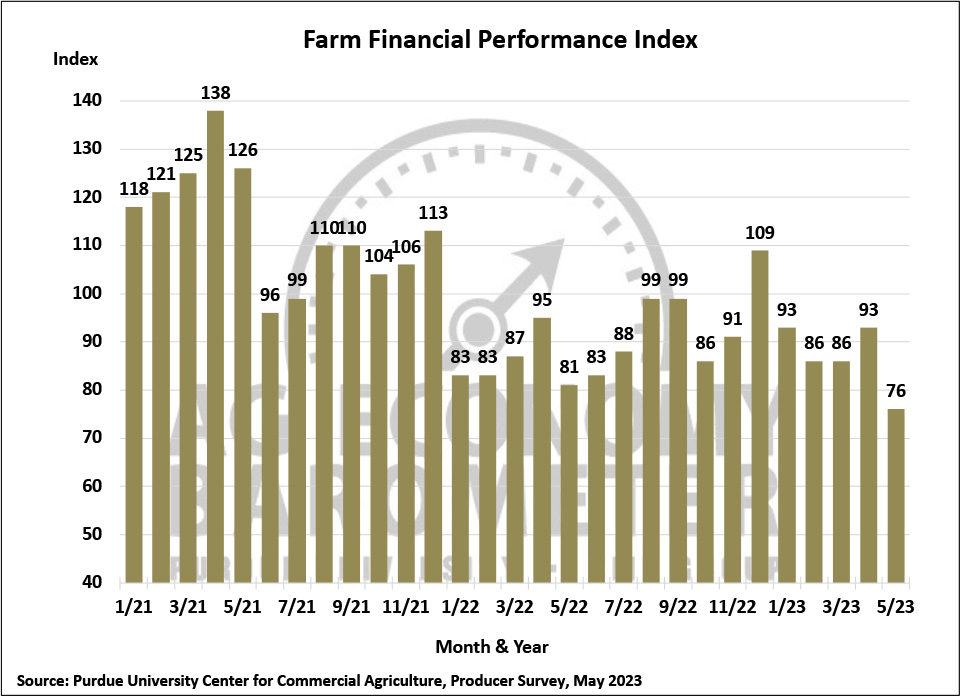

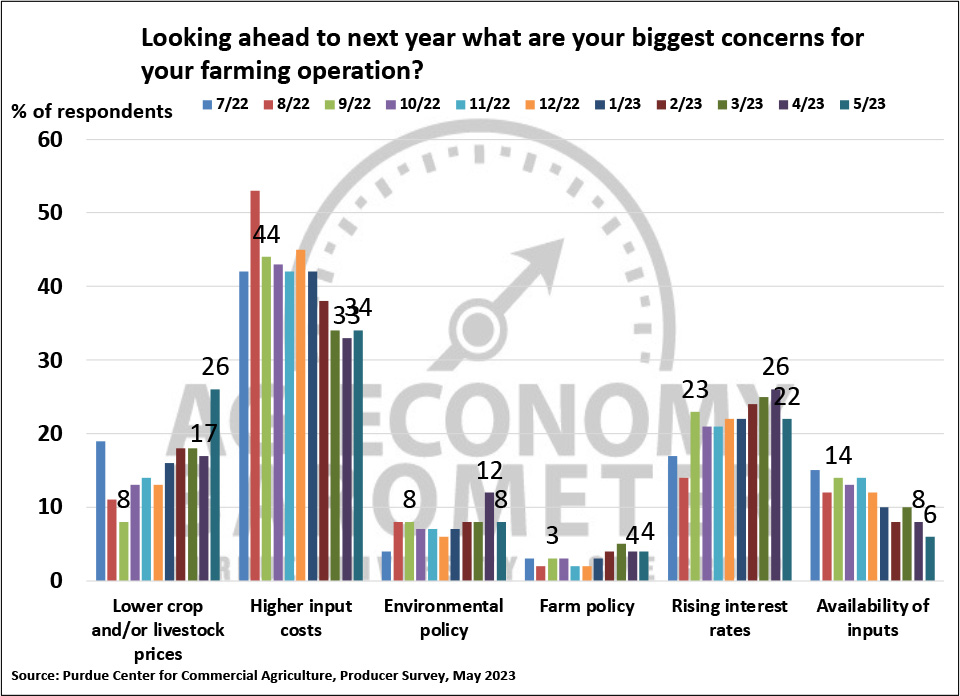

The Farm Financial Performance Index fell from 93 in April to 76 in May, a 17-point decline. Crop price weakness was likely a key factor behind the decline as 38% of this month’s respondents said they expect weaker financial performance for their farm this year compared to just 23% who felt that way in April. Although the top concern among producers in the upcoming year remains higher input costs, the risk of lower crop and/or livestock prices has become top of mind for more producers. This month 26% of respondents chose lower output prices as their top concern compared with just 8% of respondents who made that choice last September. Putting additional pressure on farmers’ profit prospects are expectations for higher interest rates in the upcoming year. Although producer’ interest rate projections have moderated somewhat in the last several months, nearly three-fifths (59%) of producers still said they expect interest rates to rise during the upcoming year and 22% of respondents chose it as a top concern for their farm in the next 12 months. Additionally, 40% of farmers in this month’s poll said they expect this spring’s U.S. bank failures to lead to some changes in farm loan terms in the upcoming year, possibly putting more financial pressure on their operations.

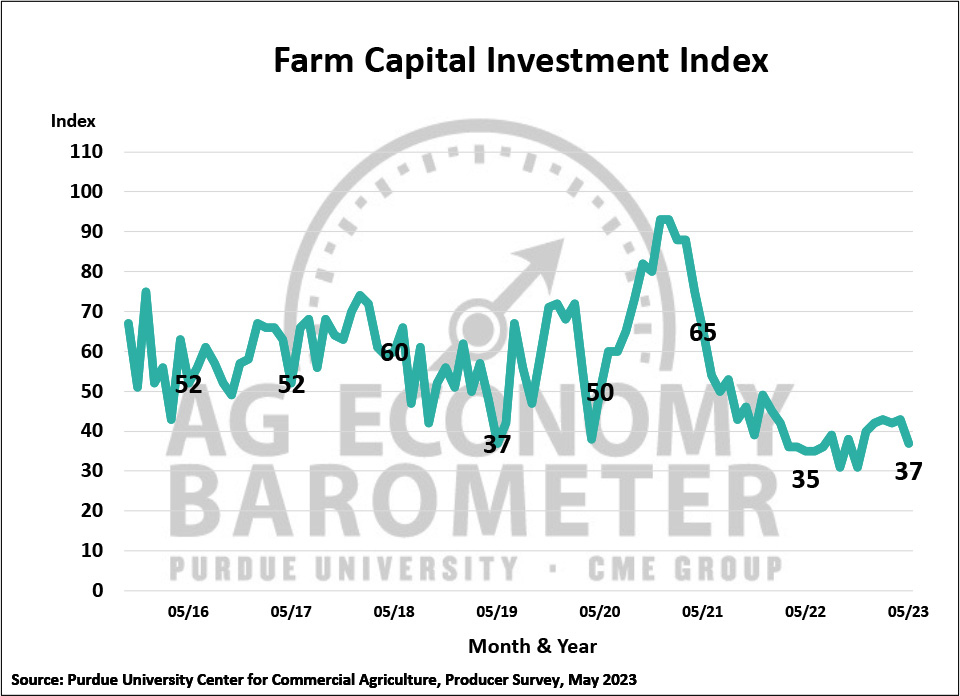

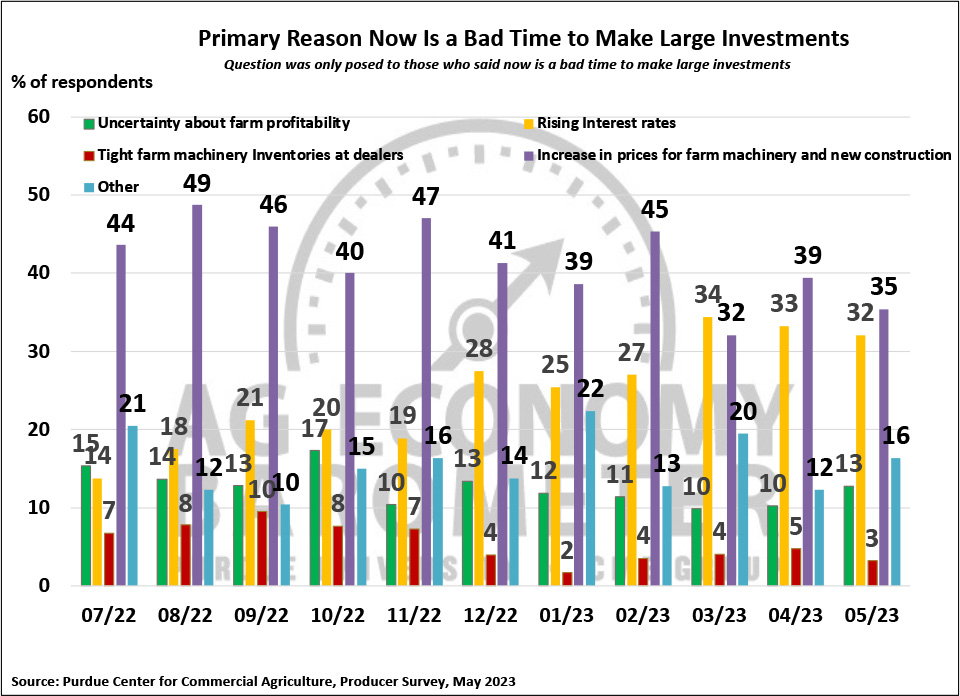

Unsurprisingly, given the weakness in the other sentiment indices, the Farm Capital Investment Index also declined in May. The investment index fell 6 points compared to a month earlier, pushing it down to 37, its lowest reading since last November. Among the three-fourths (76%) of producers who said it’s a bad time for large investments, two-thirds (67%) said the key reasons are price increases for machinery and new construction and rising interest rates.

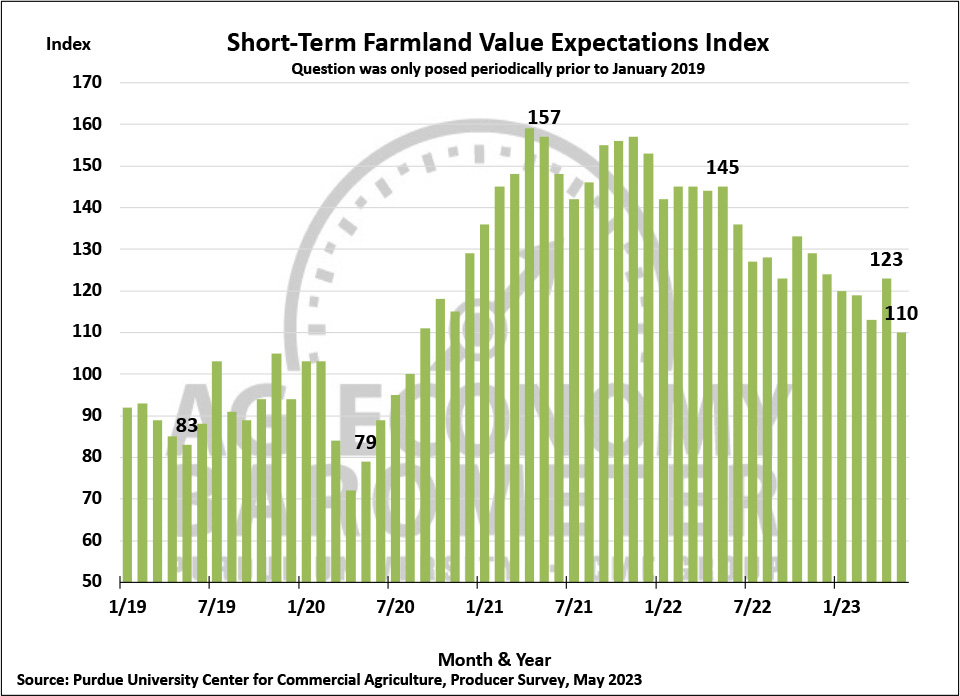

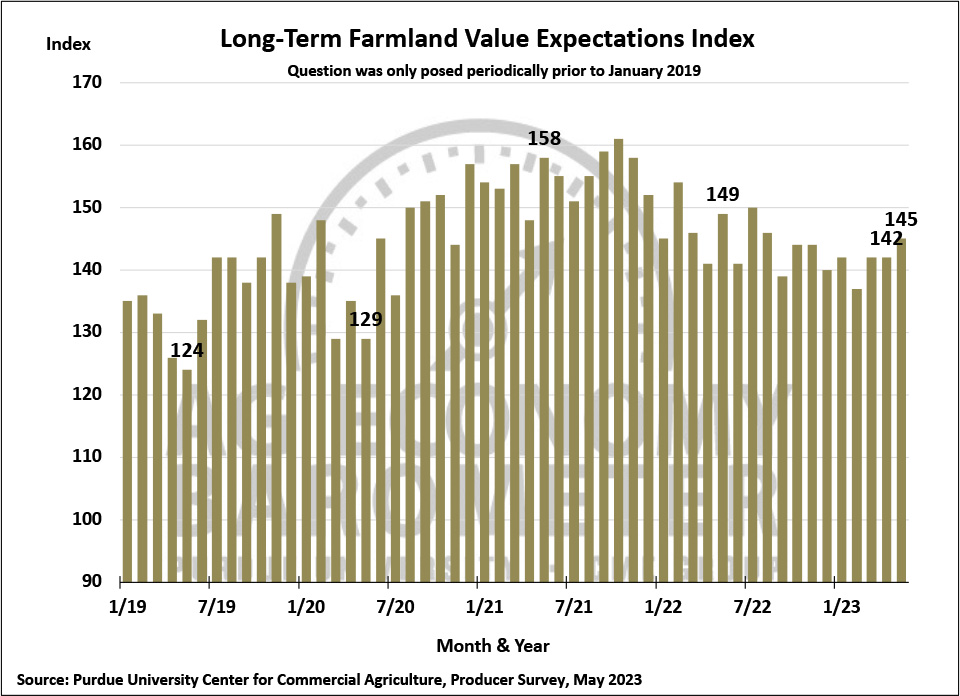

In a turnaround from last month, the Short-Term Farmland Value Expectations Index fell 13 points in May. The May index value of 110 was the weakest short-term index reading since August 2020. In this month’s survey, just 29% of respondents said they expect farmland values to head higher over the next 12 months compared to 54% who felt that way a year earlier. In contrast to their weaker short-term outlook, producers remain more optimistic about the longer-term outlook for farmland values as the Long-Term Farmland Value Expectations Index rose 3 points in May compared to April. However, this month’s modest rise in the long-term index to 145 still leaves it below a year earlier when the index stood at 149. Among those producers who expect farmland values to rise over the upcoming 5 years, the two most commonly cited reasons for their optimism continue to be expectations for strong non-farm investor demand and inflation, chosen by 66% and 21% of respondents, respectively.

When asked what will be important to them in a new Farm Bill, nearly half (48%) of producers in the May survey said the Crop Insurance Title will be the most important aspect of a new Farm Bill to their farms. Coming in second place as the most important Farm Bill Title was the Commodity Title, chosen by one-fourth (25%) of respondents. In a follow-up question, corn and soybean growers were asked what change, if any, they expect to see to the Price Loss Coverage (PLC) reference prices in a new Farm Bill. Close to half (45%) of corn and soybean growers said they expect Congress to establish higher reference prices for both crops in a new Farm Bill. On the other hand, very few producers think there is a likelihood of Congress reducing reference prices in a new Farm Bill with just 10% and 13% of respondents expecting lower reference prices for soybeans and corn, respectively.

Wrapping Up

Farmer sentiment dropped sharply in May as the Ag Economy Barometer Index declined 19 points, the Index of Current Conditions dipped 13 points and the Index of Future Expectations fell 22 points below a month earlier. Weaker crop prices compared to a month earlier combined with ongoing concerns about rising interest rates, high input prices, and even the possibility that recent U.S. bank failures could lead to changes in farm loan terms in the upcoming year all contributed to weak producer sentiment. Producers’ perspective on farmland values in the year ahead weakened as the Short-Term Farmland Value Expectations Index fell 13 points to its lowest reading in three years. Nearly half of producers feel that the most important aspect of new Farm Bill legislation will be the Crop Insurance Title, while a fourth of producers say the Commodity Title will be the most important part of a new Farm Bill. Almost half of corn and soybean producers expect Congress to raise PLC reference prices for both crops when a new Farm Bill becomes law.