Farmer Sentiment Weakens Amid Rising Concerns of a Cost-Price Squeeze

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer October results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

Download report (pdf)

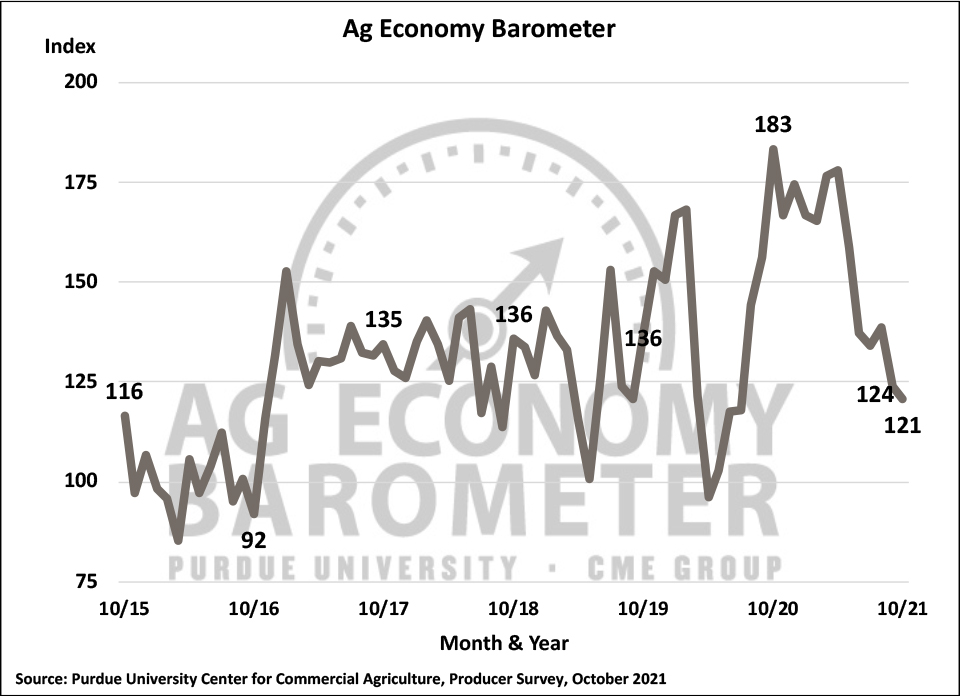

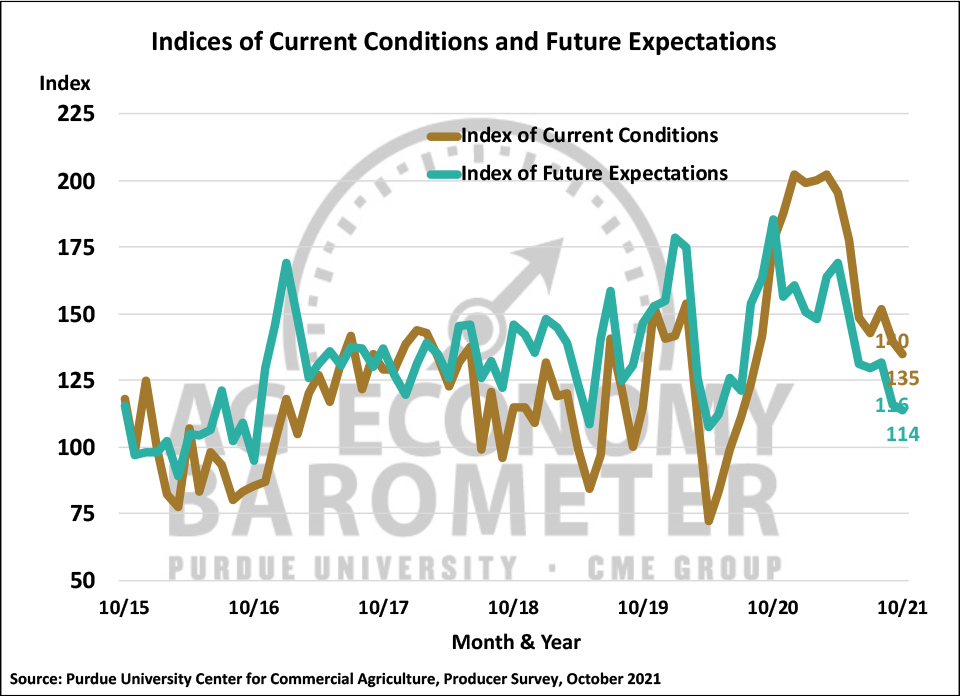

For the third month in a row, agricultural producer sentiment weakened in October as the Ag Economy Barometer declined to 121, 3 points lower than a month earlier. The modest decline in the overall sentiment index occurred as a result of producers’ weaker perceptions regarding both current and future conditions in the production agriculture sector. The Index of Current Conditions declined 5 points to 135 in October while the Index of Future Expectations fell to 114 from 116 a month earlier. Recent weakness in farmer sentiment appears to be driven by a wide variety of issues, with concerns about input price rises topping the list. The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from October 18 to 22, 2021.

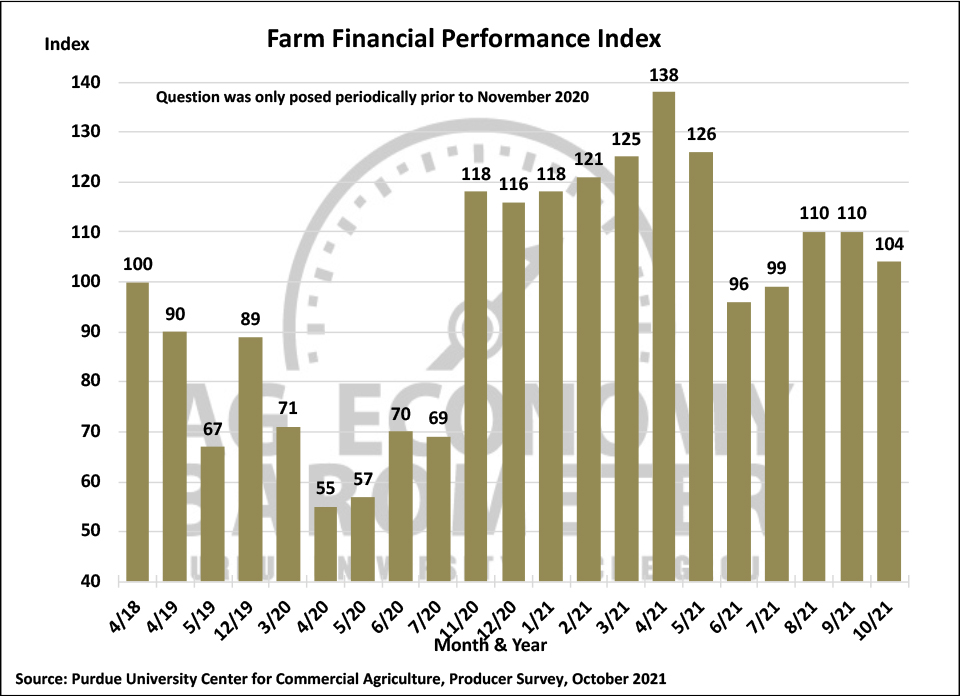

The Farm Financial Performance Index declined 6 points to 104 in October. Rapid run-ups in input prices, especially fertilizer for crop production, are giving rise to concerns about producers’ operating margins weakening. Livestock producers are also concerned about a cost-price squeeze, especially in the pork and dairy sectors.

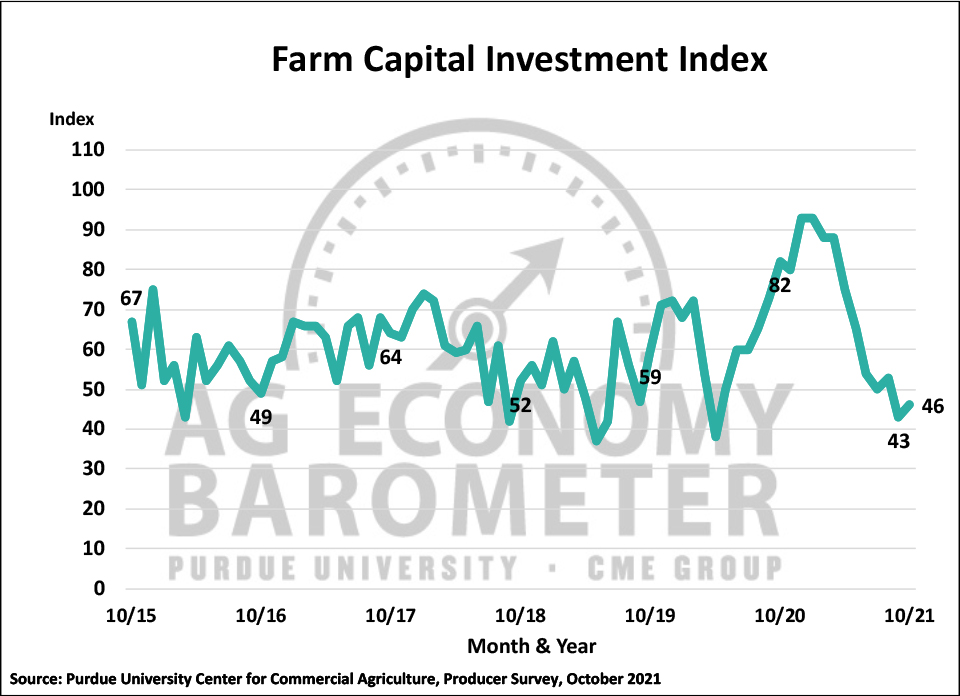

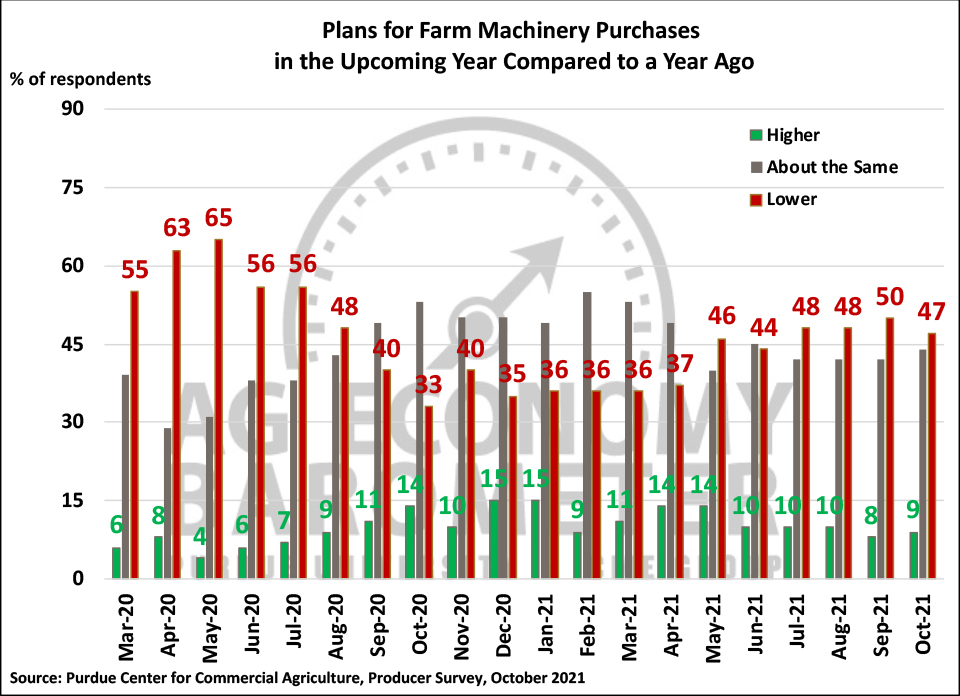

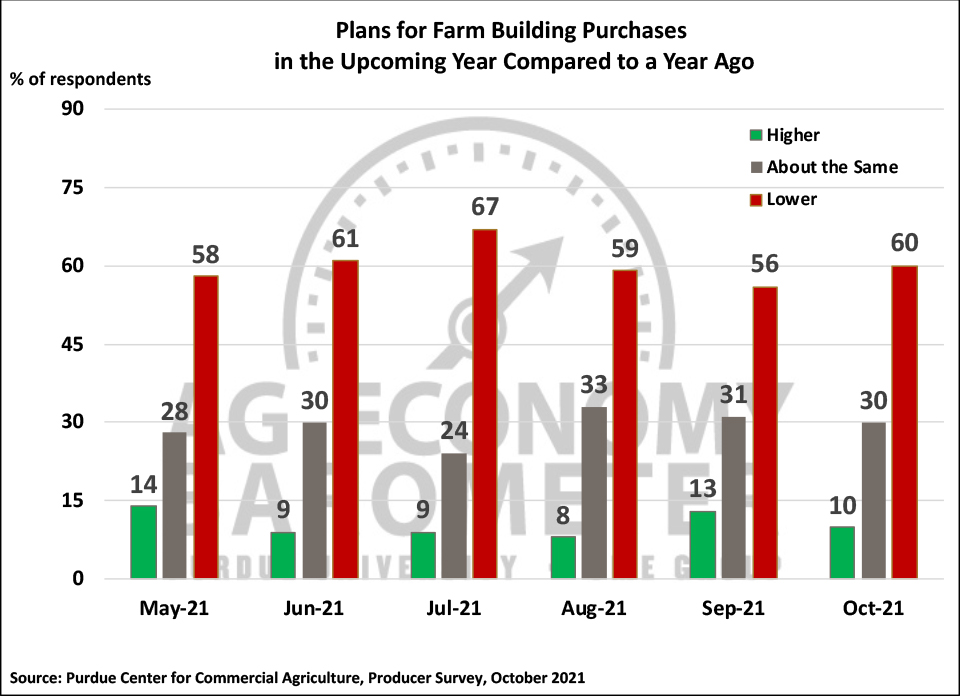

There was a modest improvement in the Farm Capital Investment Index in October, rising 3 points to a reading of 46 compared to 43 in September. The investment index’s small improvement this month still leaves it 50% lower than the very optimistic level that existed at the start of 2021. Notably, tight machinery inventories continue to hold back producers’ machinery investment plans as nearly four out of ten respondents said their machinery purchase plans were impacted by low farm machinery inventory levels. The small upward shift this month was primarily attributable to fewer producers saying they planned to reduce their machinery purchases compared to a year earlier. Weaker construction plans among producers this month weighed on the investment index as the percentage of producers planning to increase building and grain bin construction on their farms fell to 10% in October vs. 13% a month earlier.

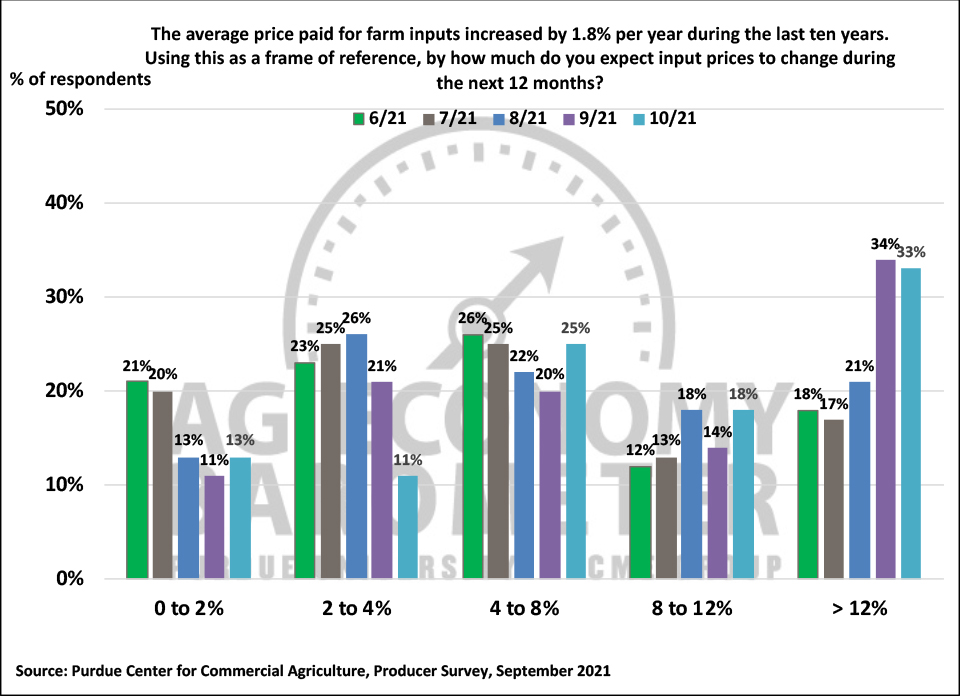

Rising input costs are on most producers minds. This month over half (51%) of producers in our survey said they expect input prices to rise 8% or more in the upcoming year and one-third of producers said they expect those prices to rise by 12% or more. The dramatic rise in fertilizer prices that’s taken place in recent months is a key factor in concerns about rising input costs. For example, USDA data from Illinois indicates that nitrogen (NH3) prices in October 2021 were up 130% compared to a year earlier and up over 40% compared to last spring while potash and phosphate prices experienced similar price increases. But concerns about rising input costs also extend to other inputs such as seed, pesticides, and machinery repairs and ownership costs. Rapidly rising input costs are leading farmers to become concerned about a cost-price squeeze on their operating margins.

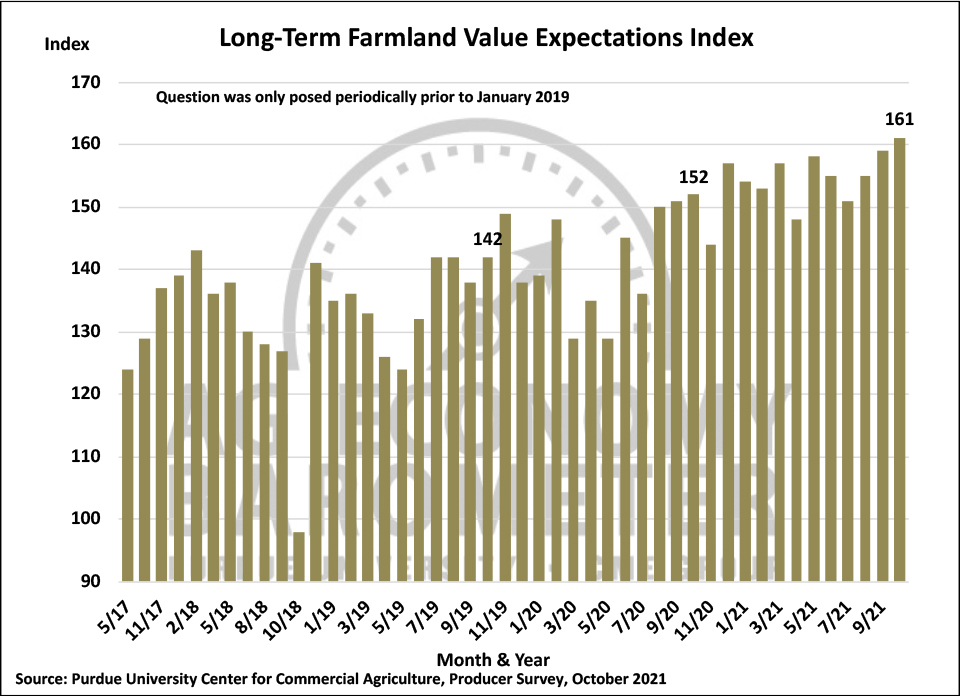

Despite the concerns expressed about rising costs and their impact on operating margins, producers remain bullish on farmland values. The Long-Term Farmland Value Expectations Index set a new record high this month with a reading of 161, 2 points higher than a month earlier while the short-term index rose 1 point to 156. The one-point rise in the Short-Term Farmland Value Expectations Index left it just 3 points below its record high, which was set last spring. The optimism expressed by farmers regarding farmland values is consistent with reports of recent farmland sales, especially in the Corn Belt, with recent farmland auction prices at or near record highs. However, concerns about rising input costs are starting to have a dampening effect on expectations for farmland cash rental rates. In August and September, nearly half (49%) of the corn-soybean producers in our survey said they expected farmland cash rental rates in 2022 to rise above 2021’s rental rates. In October, the percentage of producers expecting higher farmland rental rates dipped to 43% while the percentage expecting rates to remain unchanged rose to 55% compared to 50% in September.

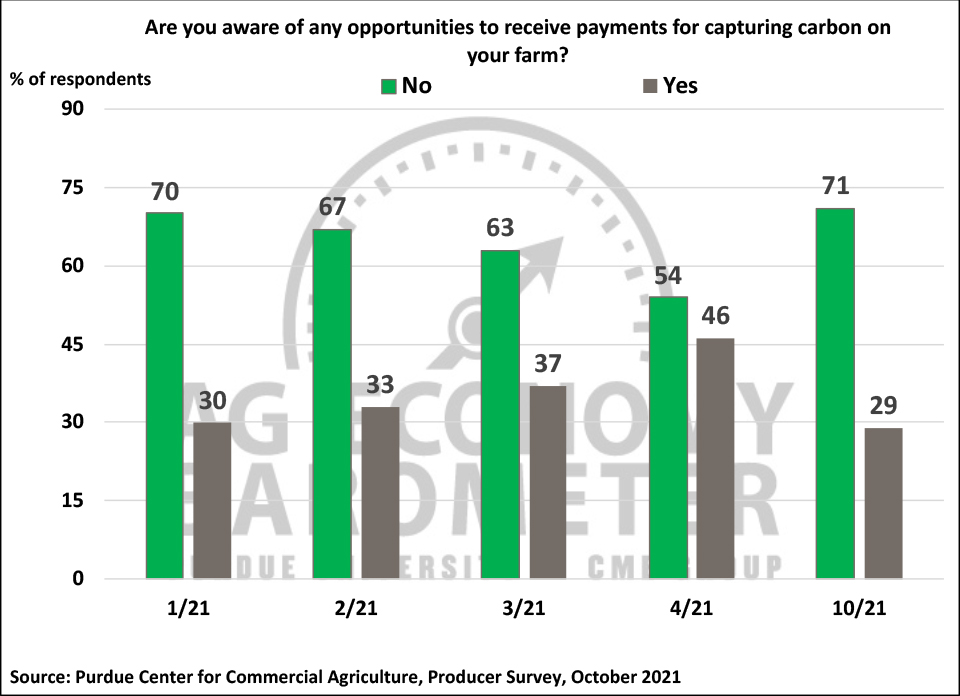

The possibility of leasing farmland for carbon sequestration continues to generate a lot of interest. In a follow-up to survey questions posed last winter and spring, we asked this month’s survey respondents a series of questions about leasing farmland to capture carbon. In this month’s survey, 29% of respondents said they were aware of opportunities to receive payments to capture carbon on their farms. When compared to survey results from last winter and spring, it appears that despite a rise in interest and publicity, awareness of carbon capture opportunities by producers on their farms has not increased. Among producers who are aware of opportunities to receive carbon capture payments on their farms, just over 2% said they had discussed carbon capture payments with any companies. Last winter and spring, an average of about 5% of survey respondents who were aware of payment opportunities said they had engaged in discussions with companies. Among the very small number of producers who had discussed payments with companies, the most common payment offered was less than $10 per metric ton of carbon followed by payment rates of $10 to less than $20 per metric ton.

Wrapping Up

Famer sentiment remained weak in October as the Ag Economy Barometer drifted lower to a reading of 121, leaving the index down nearly one-third since its springtime peak. Rising input costs, along with commodity prices that are lower than earlier this year, are major reasons behind the decline in farmer sentiment. The Farm Capital Investment Index remains weak, in large part because of supply chain problems as four out of ten respondents said tight machinery inventories were holding back their purchasing plans. Despite the weak overall sentiment expressed by producers, they remain optimistic about farmland values, both in the upcoming year and over the next five years. Approximately three out of ten producers in our survey said they are aware of potential opportunities to receive payments on their farms for capturing carbon, suggesting that little if any change in opportunities has taken place since early 2021. Among the small number of producers who have discussed a carbon capture contract with a company, the most common payment rate offered was less than $10 per metric ton of carbon followed by rates of $10 to less than $20 per metric ton.