Farmers optimistic about the future, even as their perception of current economic conditions drops

James Mintert and Michael Langemeier, Center for Commercial Agriculture

James Mintert and gives his breakdown on the Purdue/CME Group Ag Economy Barometer December results at purdue.ag/barometervideo.

Download report (pdf)

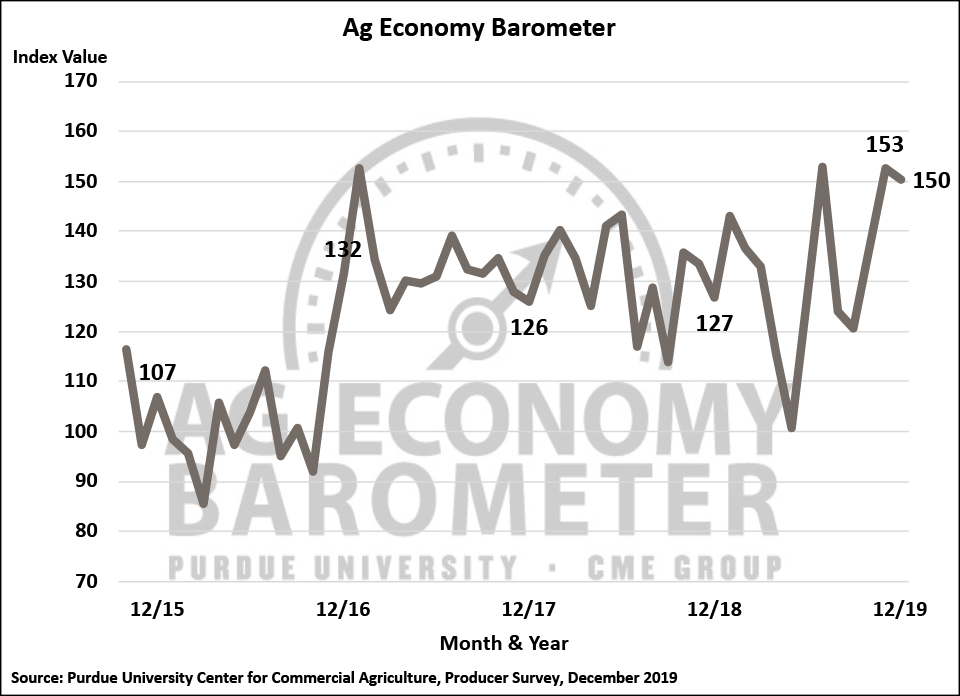

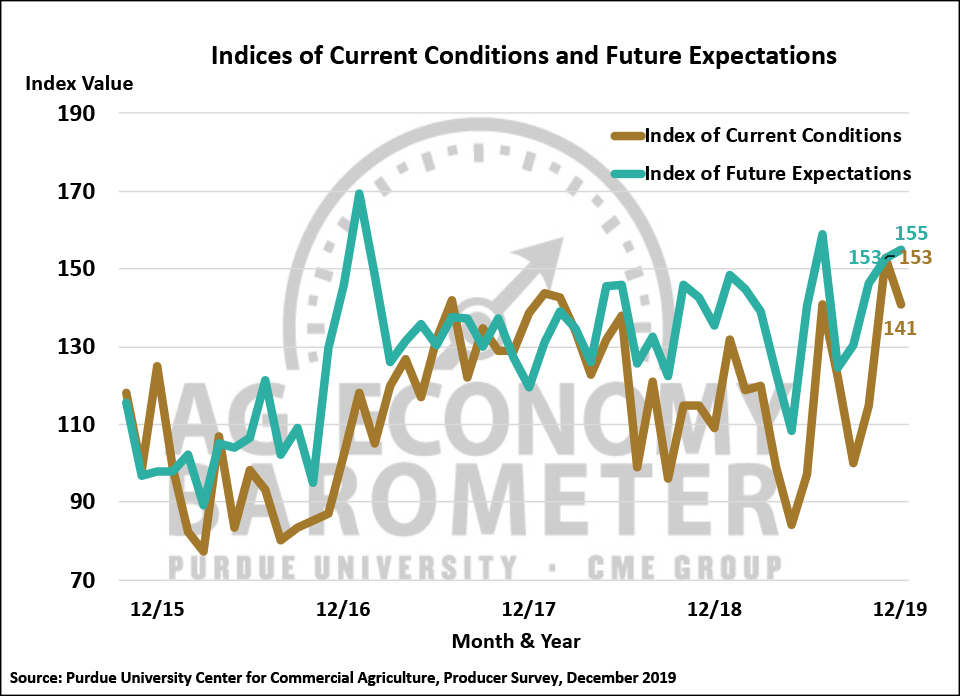

The Ag Economy Barometer drifted sideways in December, to a reading of 150 compared to 153 in November. Although the barometer changed little in December, there was a shift in producers’ perspective regarding both their farms’ and the production ag sector’s economic health. Producers expressed less confidence than a month earlier about current economic conditions as the Index of Current Conditions registered a reading of 141, a decline of 12 points compared to November’s index value of 153. In contrast, producers’ expectations for the future remained strong as the Index of Future Expectations rose slightly, to a reading of 155 compared to 153 a month earlier. This month’s Ag Economy Barometer survey was conducted from December 9-13, 2019 and is based on responses from a nationwide survey of 400 agricultural producers.

A slim majority (52 percent) of farmers on the December barometer survey indicated that their farm’s financial performance in 2019 matched their initial budget projections. On the same survey 3 out of 10 producers said their farm’s financial performance was worse than expected at the outset of the year, which was partially offset by nearly 2 out of 10 (19 percent) respondents indicating performance was better than expected. The varied responses to this question are indicative of the variability in economic conditions among U.S. farm operations as 2019 came to a close.

To better assess the level of financial stress among U.S. farms, we asked producers in November and again in December whether they expected their farm’s operating loan in 2020 to be larger than, about the same, or smaller than in 2019. We followed up with respondents who indicated they expect to have a larger operating loan to learn why the size of their loan is likely to increase. About 1 out of 5 farms in our surveys (19 to 21 percent), expect to have a larger operating loan in 2020 than in 2019. Approximately 3 out of 10 of those farm operations (29 to 30 percent) indicated the reason for the larger operating loan is that they expect to carryover unpaid operating debt from 2019 into 2020. Carrying over unpaid operating debt from one year to the next is a sign of financial stress. Responses to these two questions suggest that about 6 percent of farms surveyed in late 2019 were experiencing significant financial stress.

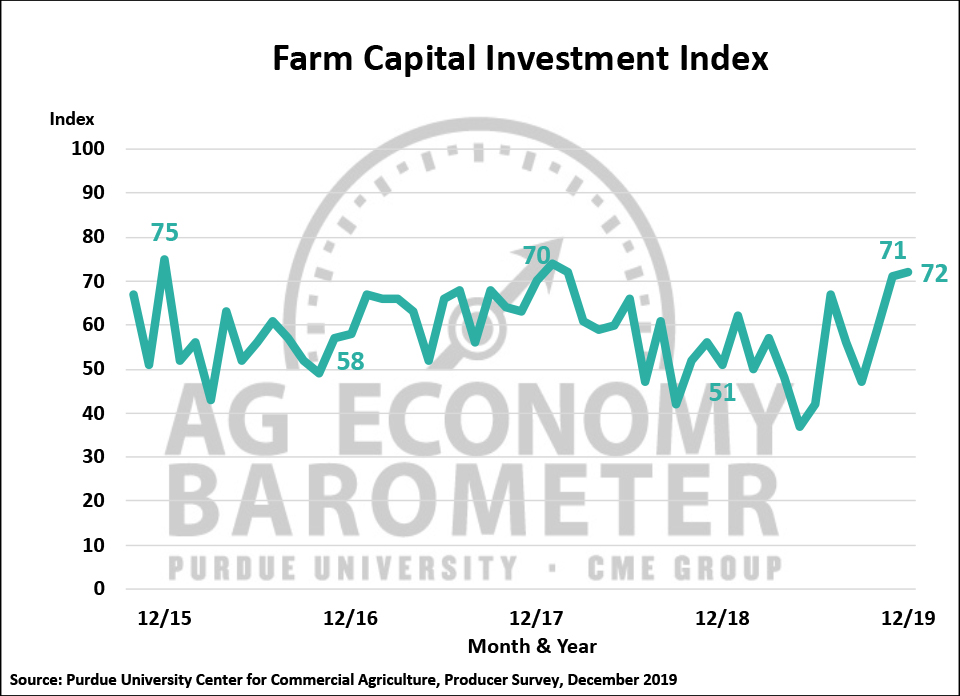

The Farm Capital Investment Index changed little in December compared to November with an index reading of 72, up 1 point from a month earlier. December’s index value of 72 left the investment index at its highest value for 2019. The investment index was quite volatile during 2019, ranging from a low of 37 in May before recovering to December’s peak value. December’s reading suggested that, despite the decline in the Index of Current Conditions, producer optimism was strong enough that farmers were more willing to consider making large capital expenditures on farm machinery and buildings than a year ago when the Farm Capital Investment Index stood at just 51.

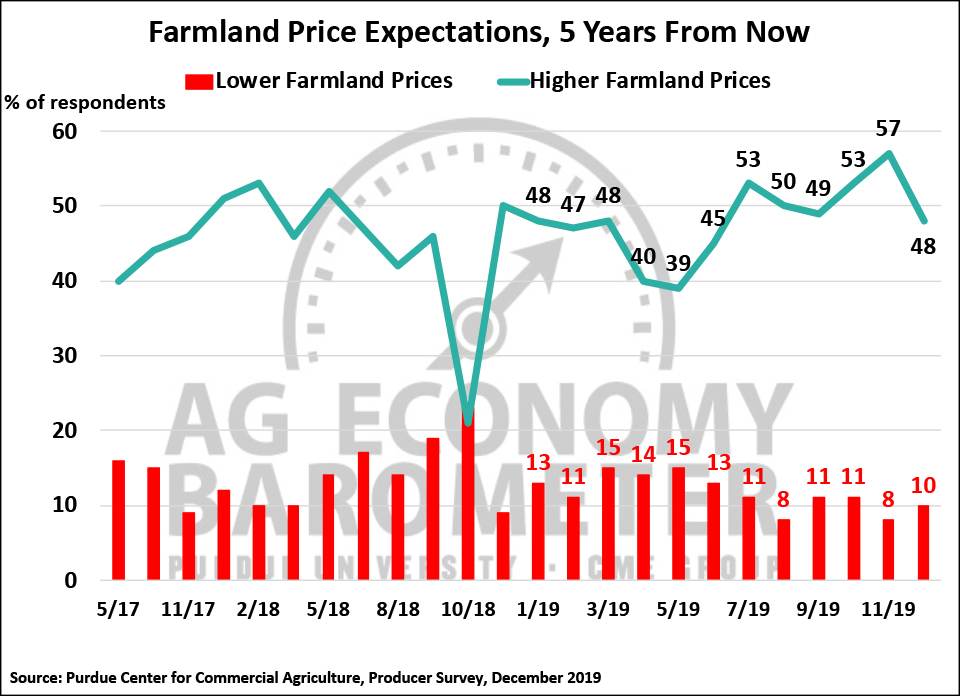

Farmers surveyed in December were somewhat less optimistic about the future direction of farmland values than indicated on November’s survey. The percentage of respondents who expect higher farmland values, both in the upcoming year and the next 5-years, declined in December compared to a month earlier. Similarly, more respondents in December said they expect future farmland values to decline, both in the year ahead and 5-years ahead, than on the November survey. Reviewing responses to the two farmland value questions over the course of 2019 indicates that sentiment regarding the direction farmland values will take rebounded sharply from the very negative sentiment expressed in May, leaving expectations in December nearly unchanged from the beginning of 2019.

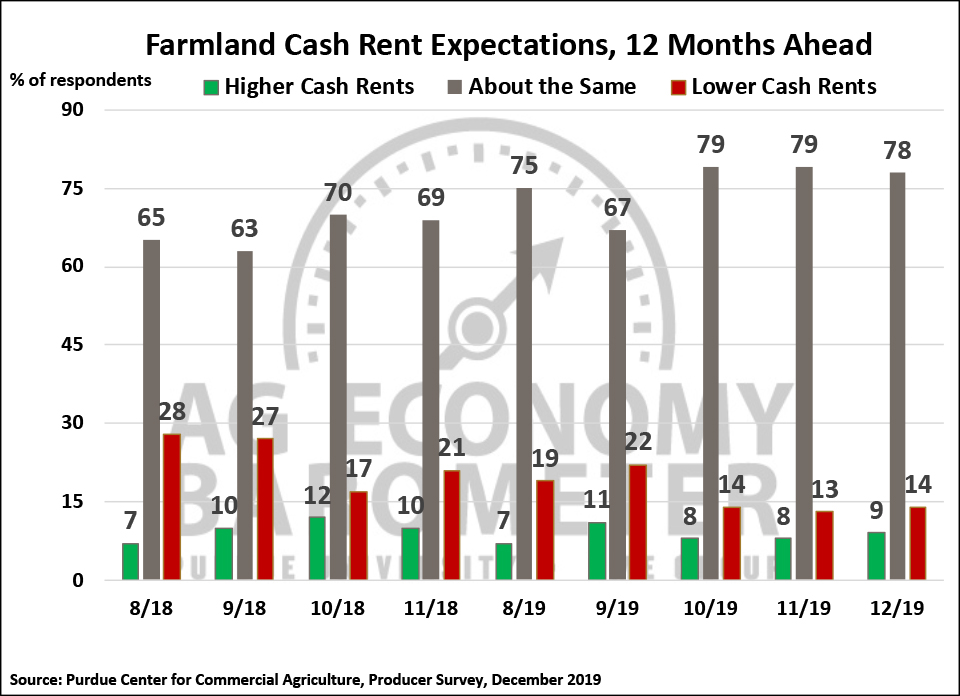

Nearly 8 out of 10 producers in our surveys expect cash rental rates in the upcoming year to be unchanged from 2019. When asked about their cash rental rate expectations on three consecutive surveys (October through December 2019), 78 to 79 percent of respondents said they expected no change in rental rates in the year ahead. On the same set of surveys, just 8 to 9 percent said they expected rental rates to rise and 13 to 14 percent said they expected rates to decline. This contrasts with fall 2018 when 69 to 70 percent of respondents expected no change in rates, 10 to 12 percent expected higher rental rates, and 17 to 21 percent of respondents expected rental rates to decline. Overall, farmers appear to be more confident that farmland cash rental rates will be stable than they were last year.

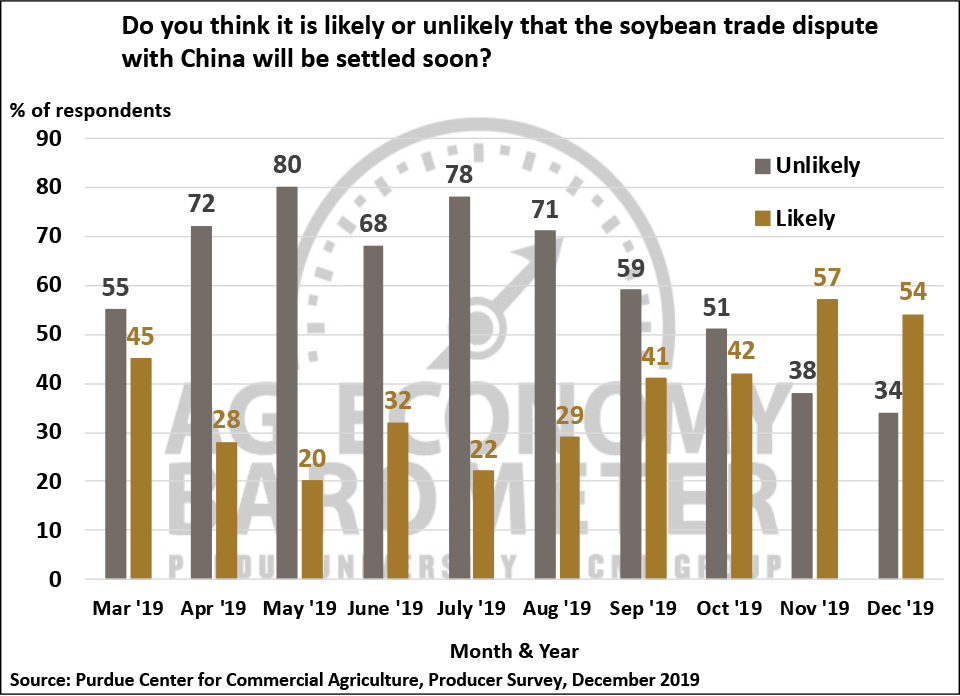

Producers remained confident in December that the trade dispute with China will be settled soon. Although the percentage of producers indicating that they expect a quick resolution slipped slightly to 54 percent in December from 57 percent in November, the percentage of producers who believe it’s unlikely the dispute will be settled soon also fell from 38 percent to 34 percent, leaving overall sentiment regarding the dispute’s resolution virtually unchanged. The percentage of producers who feel the dispute is likely to be resolved in a way that is ultimately beneficial to U.S. agriculture dipped in December to 72 percent from 80 percent in November. The percentage of producers expecting a favorable resolution has averaged 73 percent since we first posed this question in March 2019. Except for a brief decline last May and June, the percentage of producers expecting a beneficial resolution to the trade dispute has consistently remained above 70 percent.

Wrapping Up

Farmer sentiment drifted sideways in December as the Ag Economy Barometer registered a reading of 150 compared to 153 in November. Agricultural producers in December were less optimistic about current economic conditions on their farms than a month earlier but remained optimistic about future economic conditions. The Farm Capital Investment Index rose 1 point in December compared to November, leaving it at its highest level of the year and well above a year earlier. Farmers continued to be much more optimistic about future farmland values than they were last spring, although they were somewhat less optimistic in December than they were in November. Compared to a year ago, producers appear to be more confident that farmland cash rental rates will remain unchanged in 2020. Some farms are experiencing financial stress. Approximately 6 percent of the farms included in the December survey indicated that they will have a larger operating loan in 2020 because they expect to carryover unpaid operating debt from 2019 into 2020. Finally, over half of the producers in our survey expect the trade dispute with China to be resolved soon. The percentage of farmers who expect the trade dispute to be resolved in a way that’s favorable to U.S. agriculture dipped in December from November but remained above 70 percent as it has for all but two months since we first posed this question to producers in March 2019.