High Input Costs and Rising Interest Rates Top Concerns As Farmer Sentiment Remains Unchanged

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer November results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

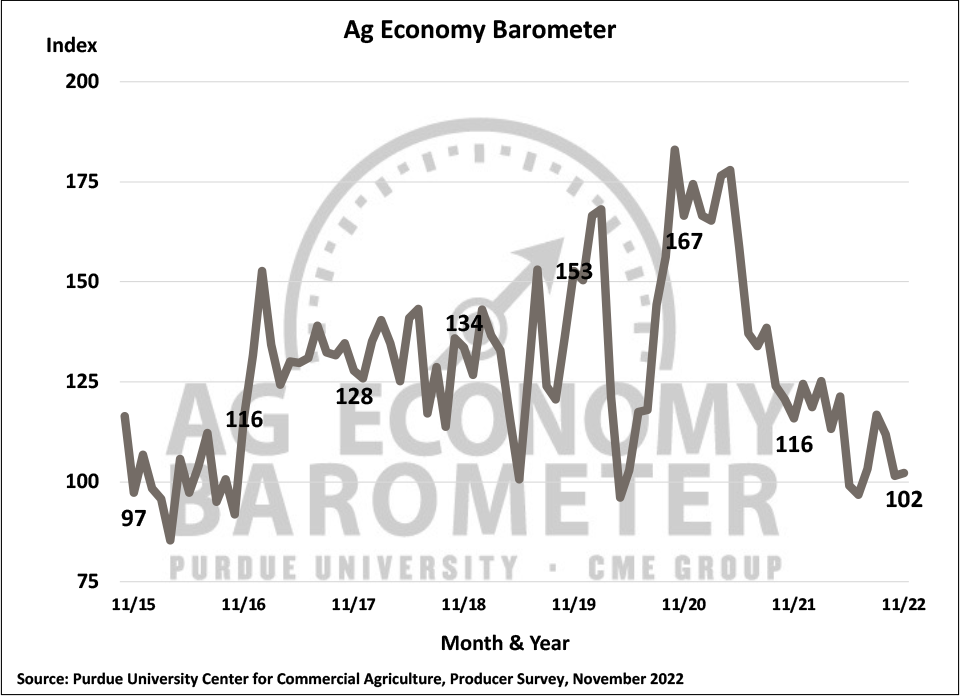

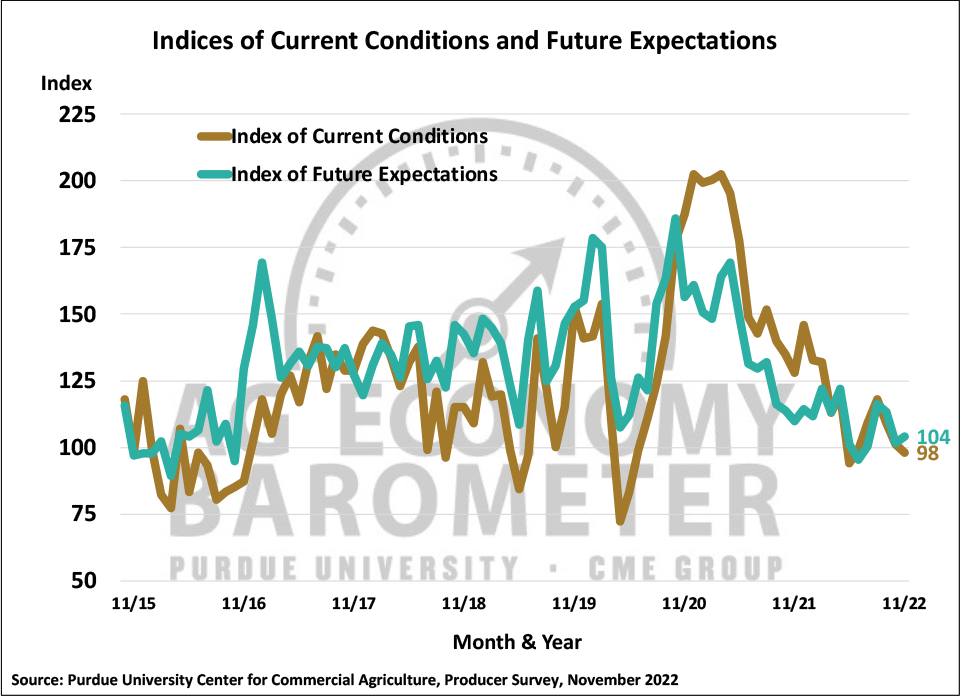

Farmer sentiment was unchanged in November as the Purdue University-CME Group Ag Economy Barometer Index came in at a reading of 102, the same as in October. There was however a slight shift in underlying sentiment as the Index of Current Conditions declined 3 points this month to a reading of 98 while the Index of Future Expectations rose 2 points to 104. This month’s survey was conducted the week following the November U.S. elections but, unlike the period immediately following the two most recent presidential elections, there did not appear to be a noticeable sentiment swing attributable to the election outcomes. The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from November 14-18, 2022.

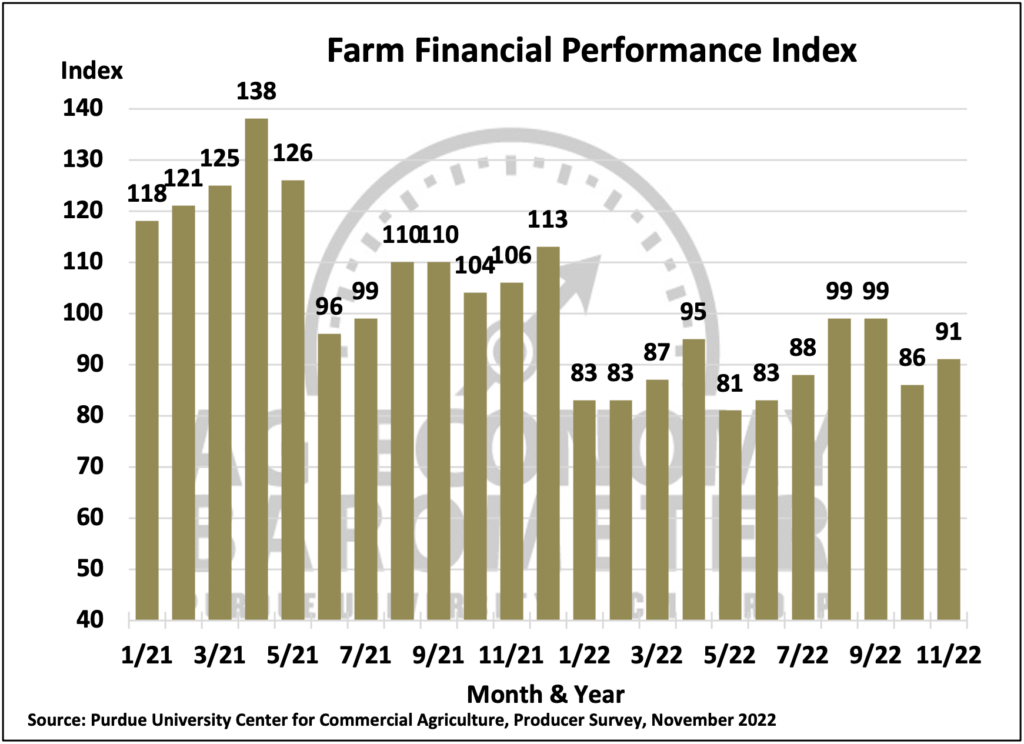

The Farm Financial Performance Index improved modestly this month to 91, up 5 points from last month, but that still left the index 14% below its year ago level of 106. The relatively weak index reading is attributable to the fact that more producers continue to say they expect their farms’ financial performance to be worse this year than last year compared to those who expect better performance. However, nearly half (45%) of producers say they expect financial performance this year to match 2021’s. Combined, this means that over two-thirds (68%) of producers say they expect financial performance in 2022 to match or exceed that of the prior year, providing a more positive perspective than that provided by the index examined in isolation. Concerns about high input costs continue to weigh on producers’ minds with 42% of respondents in this month’s survey citing that as their top concern in the year ahead. Just over one-fifth (21%) of respondents chose rising interest rates as a top concern while input availability and declining commodity prices were chosen as a top concern by 14% of respondents.

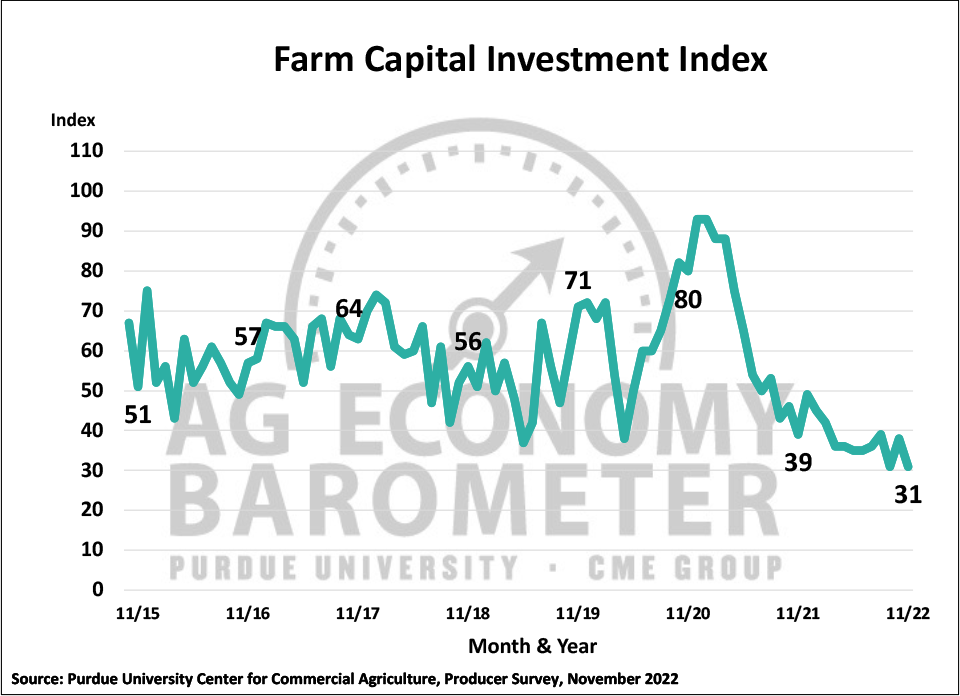

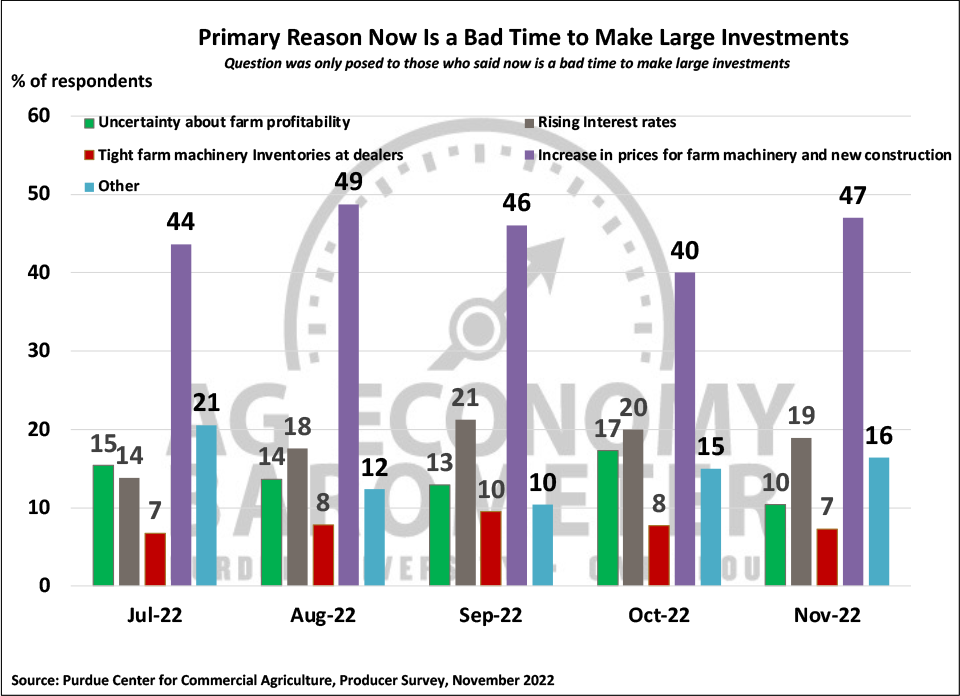

The Farm Capital Investment Index dropped back to its record low of 31 in November. This month’s decline of 7 points pushes the reading back to its September level, erasing the modest rise in the index that took place in October. It’s become increasingly clear that the index is capturing the perception among producers that this is not a good time to make large investments because prices for farm machinery and construction are high. This month just 10% of respondents said now is a “good time” to make large investments while 79% said it was a “bad time”. Among the nearly 80% of respondents who said now is a “bad time” to make large investments, almost half (47%) chose “rising prices of farm machinery and new construction” as the primary reason for their perspective.

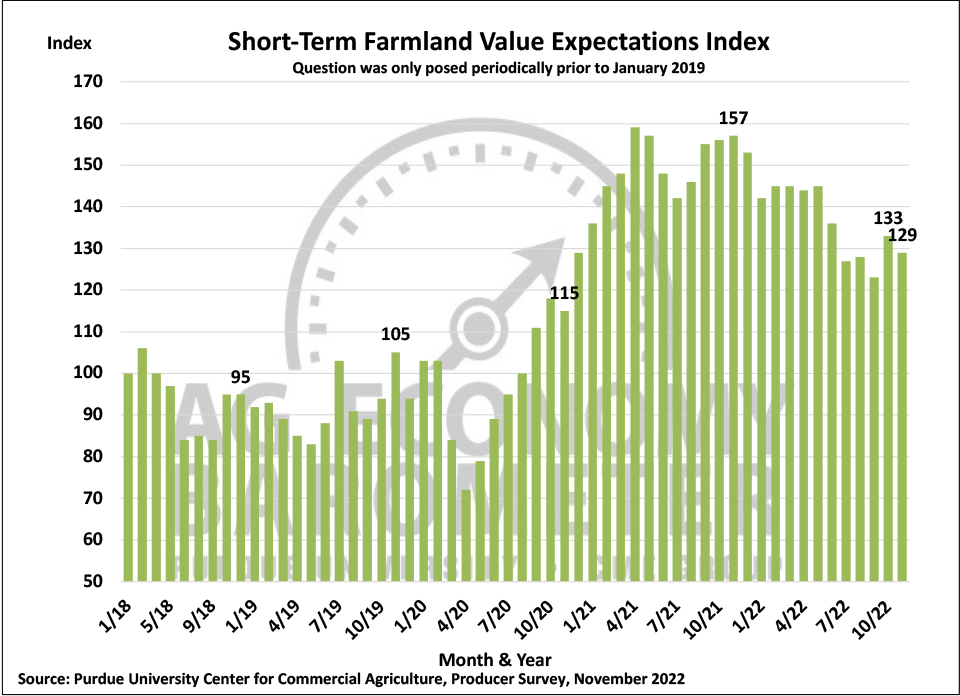

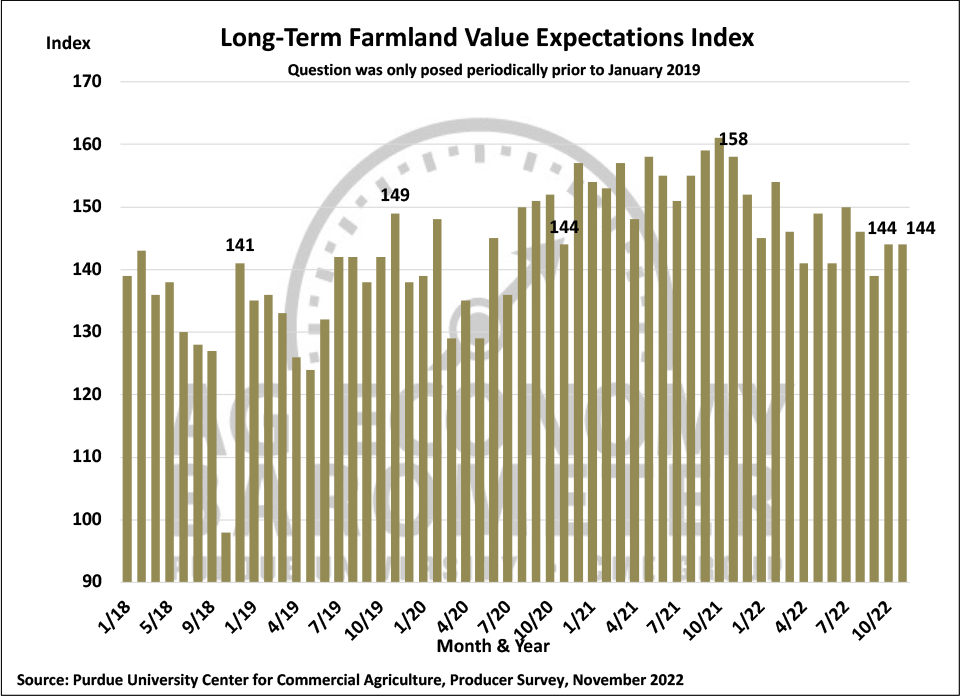

The Long-Term Farmland Value Index held steady this month with a reading of 144 while the short-term index declined slightly to a reading of 129, 4 points lower than last month. Although farmland auction results in the Corn Belt continue to set new record highs, both farmland value indices are well off the highs established in fall 2021. Survey results indicate farmers are less bullish about future farmland values than a year ago. Looking behind the indices to the raw responses to the survey questions reveals a noticeable uptick in the percentage of respondents who think farmland values could weaken. When asked to look ahead one year, 12% of respondents this month said they expect values to decline compared to just 4% who felt that way a year ago. Among producers who expect farmland values to rise over the next 5 years, over half (52%) chose non-farm investor demand as the primary reason for their optimism.

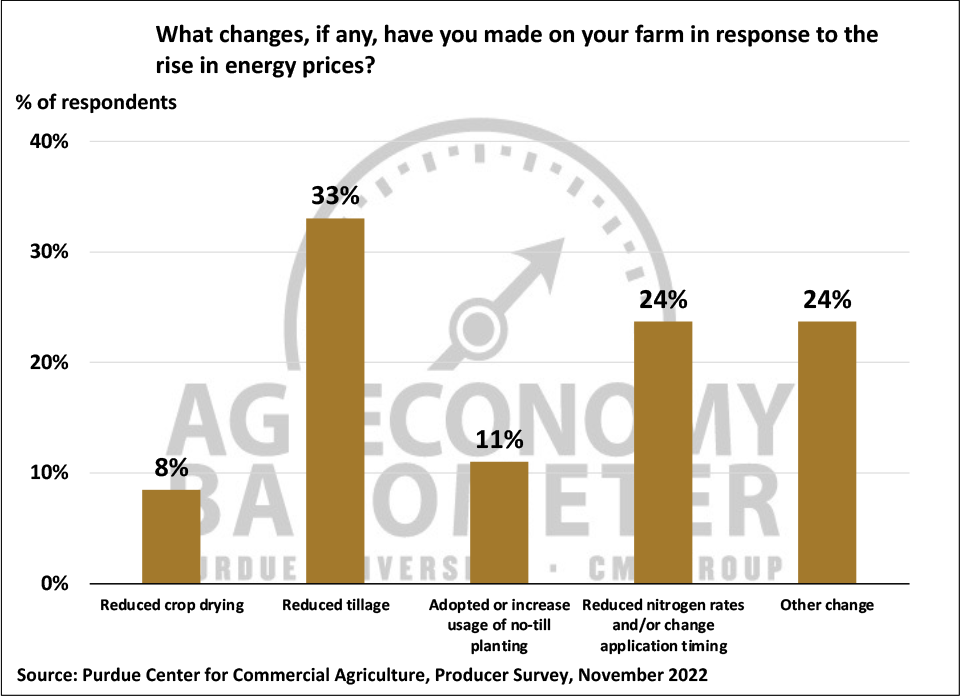

Given the sharp rise in energy prices that’s taken place this year, this month’s survey asked producers how they’ve responded to the increase in their costs. Just over a fourth (27%) of this month’s respondents indicated they’ve made changes in their operation because of rising energy prices. When queried further regarding the changes they’ve implemented, responses were quite varied. The top response chosen by one-third of those making changes was reduced tillage followed by reduced nitrogen rates and/or changed application timing which was chosen by 24% of respondents. Increased use of no-till was chosen by 11% of respondents while 8% said they reduced crop drying. Respondents who chose the “other” category when responding were asked to specify what change they made. Farmers listed a variety of specific changes with two of the more common ones being the use of solar panels and contracting fuel needs.

Wrapping Up

Farmer sentiment was unchanged in November compared to October, with the Ag Economy Barometer Index remaining at 102. The Farm Financial Performance Index rose 5 points this month and just over two-thirds of respondents said they expect their farms’ financial performance in 2022 to equal or exceed that of the prior year. A large majority of farmers think high prices for farm machinery and new construction make now a bad time to make large investments in their farming operations. Although most producers expect farmland values to rise over both the next 12 months and the next five years, the percentage of producers who think values will decline in the year ahead has been rising. Looking ahead to 2023, producers continue to cite high input costs as their number one concern. Finally, just over one- fourth of respondents said they’ve made changes in their farm operation in response to a sharp rise in energy costs.