Livestock Sector Optimism Fuels a Modest Rise in Farmer Sentiment in October

Michael Langemeier and James Mintert, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer October results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

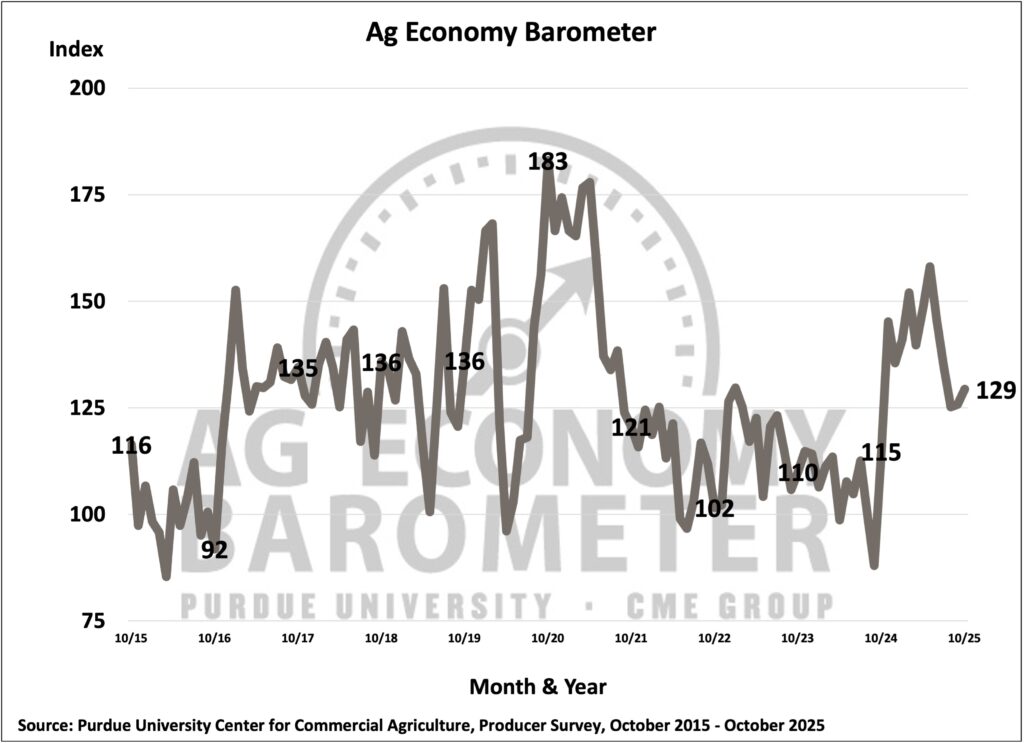

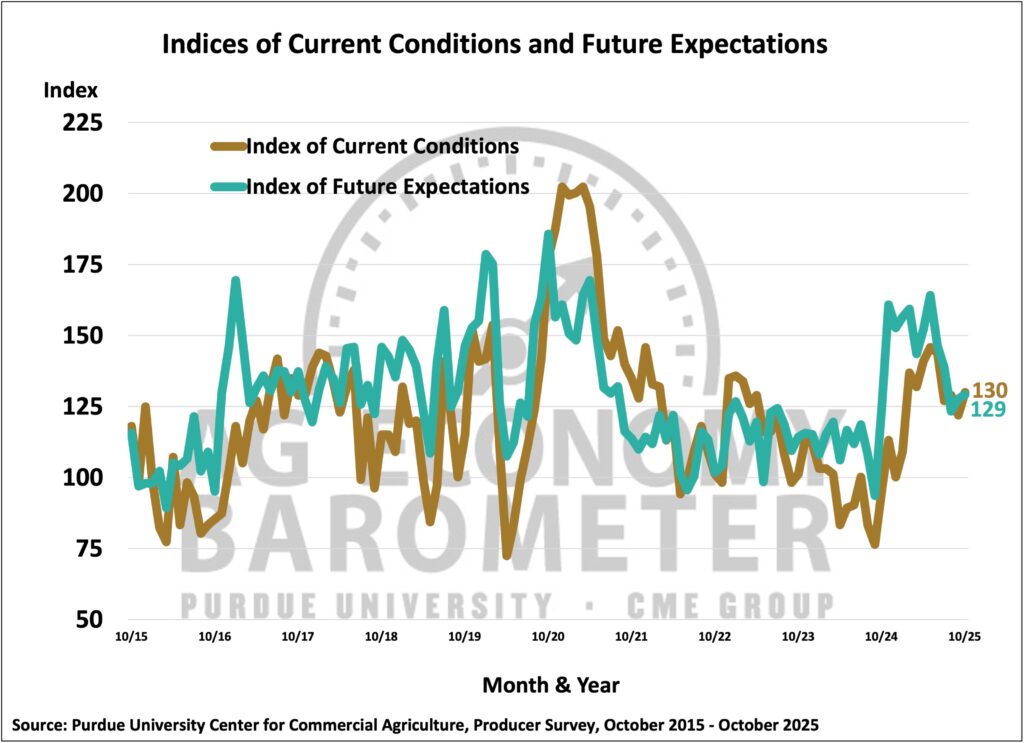

There was a modest uptick in U.S. farmer sentiment in October as the Purdue University-CME Group Ag Economy Barometer index of 129 was 3 points higher than September’s reading. The slight rise in the barometer was fueled primarily by an increase in the Index of Current Conditions to 130, which was 8 points above September’s index. Meanwhile, the Index of Future Expectations was virtually unchanged, rising just 1 point to 129. Farmer’s appraisal of current conditions on their farms continues to be a tale of two economies. Livestock producers remain very optimistic about conditions on their farms, fueled in part by record-high profitability in the beef sector. At the same time, poor profit margins across all major crop enterprises lead crop producers to provide a notably more pessimistic view of the current situation on their farms. The October barometer survey took place from October 13-17, 2025.

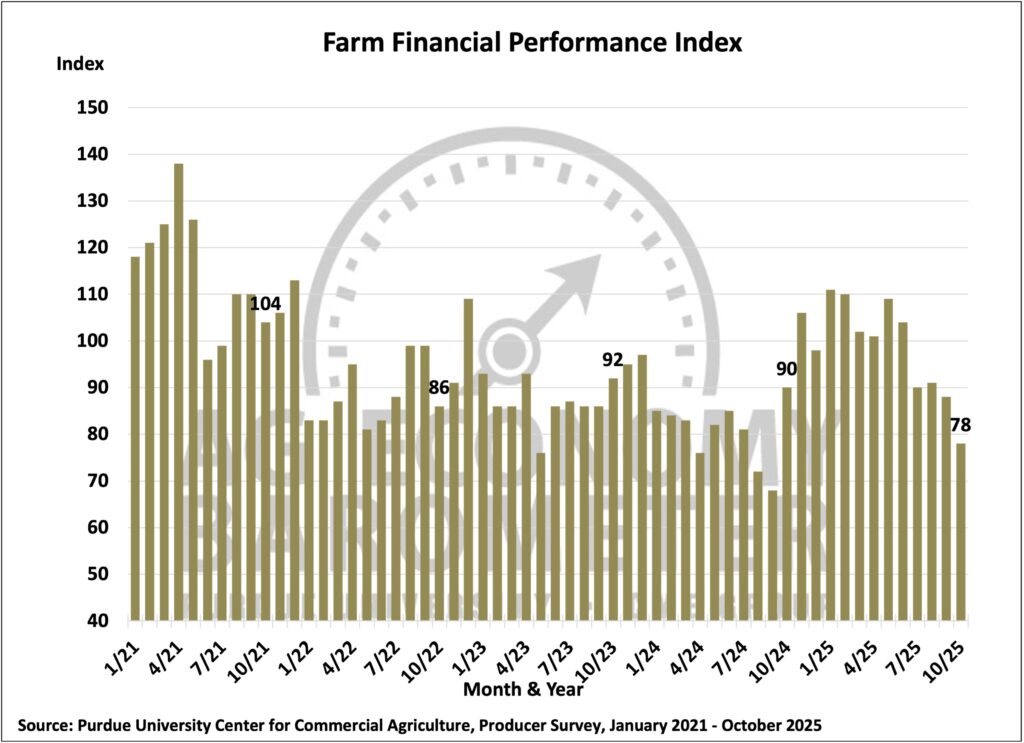

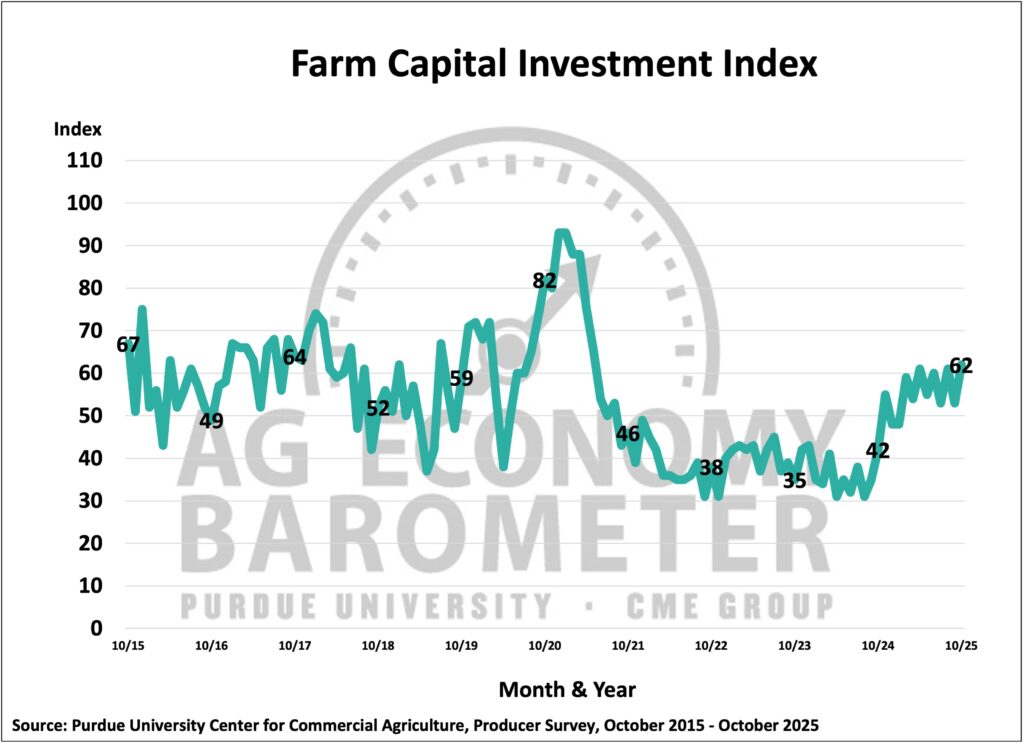

The Farm Financial Performance Index fell to 78, 10 points lower than in September. Farmers’ financial performance expectations fell sharply over the course of the late spring and summer. In May, the financial index stood at 109, 31 points higher than in October, and proceeded to fall throughout the rest of the spring and summer. Similar to results for the Current Conditions Index, there was a big disparity in financial performance expectations among crop and livestock producers. Crop producers expect financial performance on their farms to fall well below that of a year ago, while livestock producers look for their farms’ financial performance to mirror that of one year earlier. Despite weakening financial expectations, the Farm Capital Investment Index rose 9 points this month to 62. Once again, a more optimistic view was provided by livestock producers than crop producers, thereby providing a boost to the investment index.

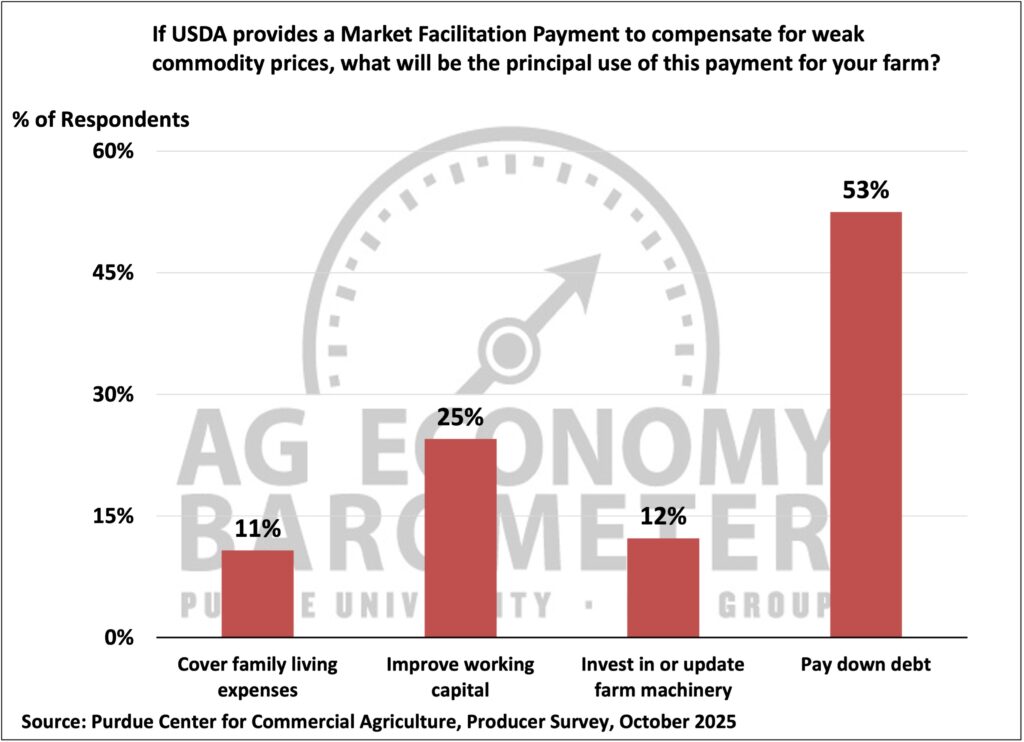

In previous barometer surveys, producers overwhelmingly said they expect the USDA to provide compensation for weak commodity prices, similar to the 2019 Market Facilitation Program (MFP). This month’s barometer survey asked producers how they planned to use a supplementary payment from the USDA on their farms. Over half of respondents (53%) said it would be used to pay down debt, while one-fourth (25%) said it would be used to strengthen their farm’s working capital position. A small minority of farmers said they would use a payment from USDA to invest in farm machinery (12%) or to cover family living expenses (11%).

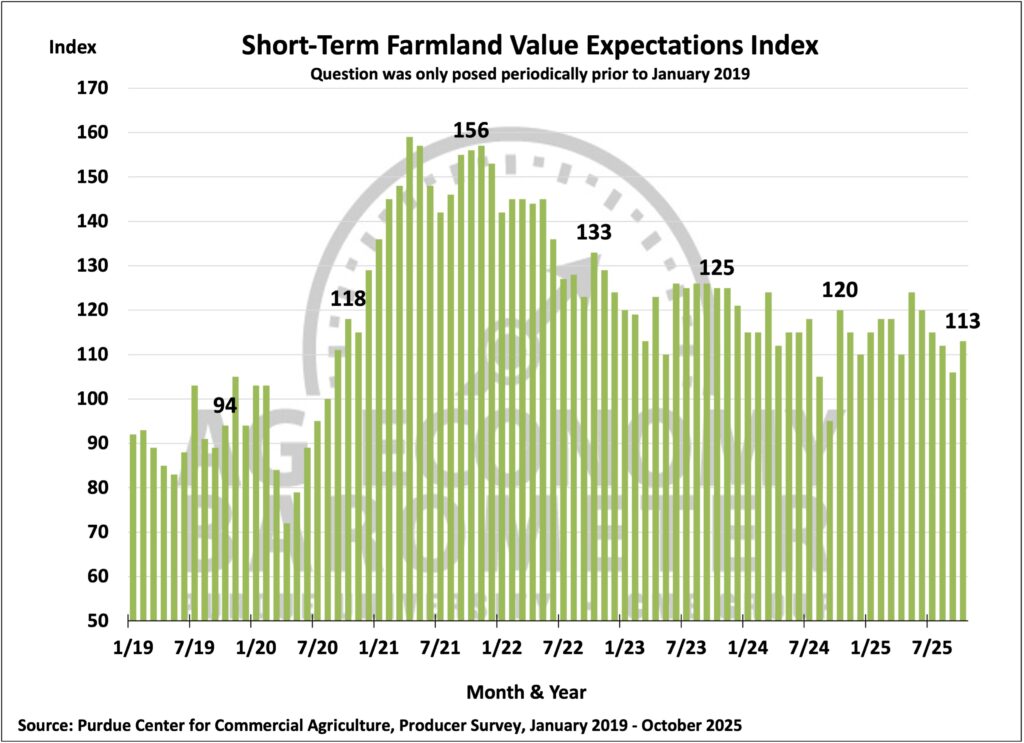

The Short-Term Farmland Value Expectations Index rose 7 points in October to 113. October’s rise in the index followed 4 months of index declines. This month’s sentiment shift was driven by producers moving away from expecting values to hold steady to expecting values to increase, the opposite of what took place in September. This month, 30% of respondents said they expect farmland values to rise in the upcoming year, up from 24% who felt that way a month earlier. There was little change in the percentage of respondents who said they look for values to fall, with just 17% saying they expect weaker farmland values in the year ahead, compared to 18% of respondents in September.

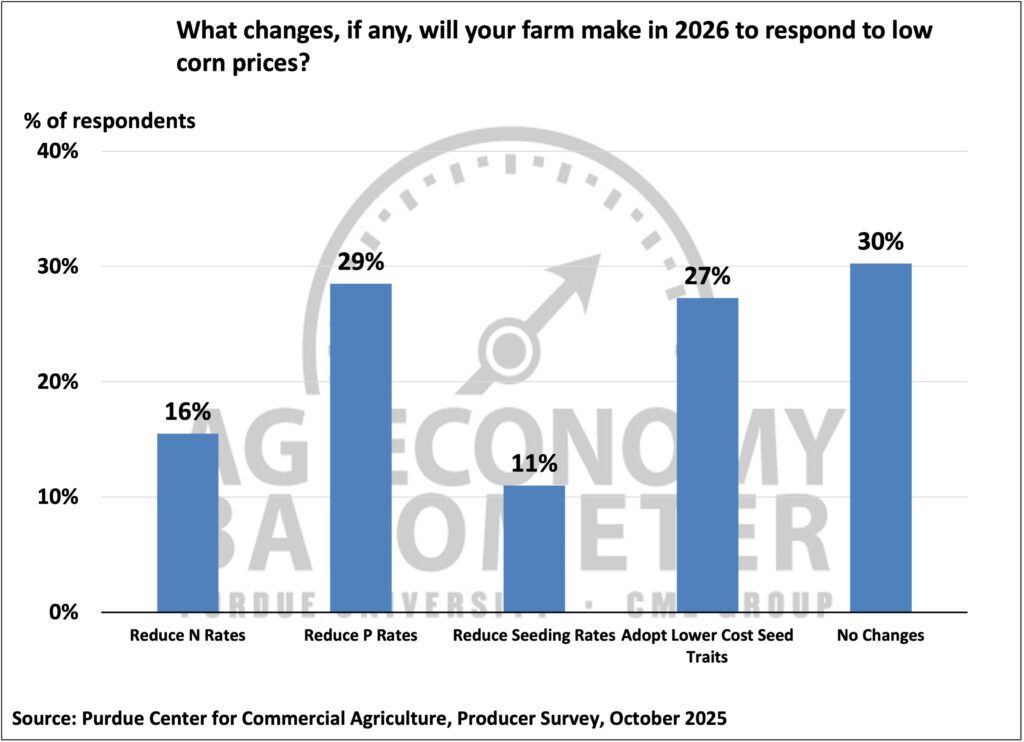

To learn more about how crop producers will respond to weak operating margins, this month’s survey asked respondents who planted corn in 2025 what crop production management changes, if any, they plan to make in 2026 in response to low corn prices. While nearly one-third (30%) of respondents said they don’t plan to make any changes in their production practices, almost as many (29%) said they plan to reduce applications of phosphorus. Twenty-seven percent of corn farmers in this month’s survey said they plan to adopt lower-cost seed traits or varieties. Fewer farmers (16%) said they plan to reduce nitrogen applications, and just 11% of farmers said they plan to reduce their corn seeding rates in 2026.

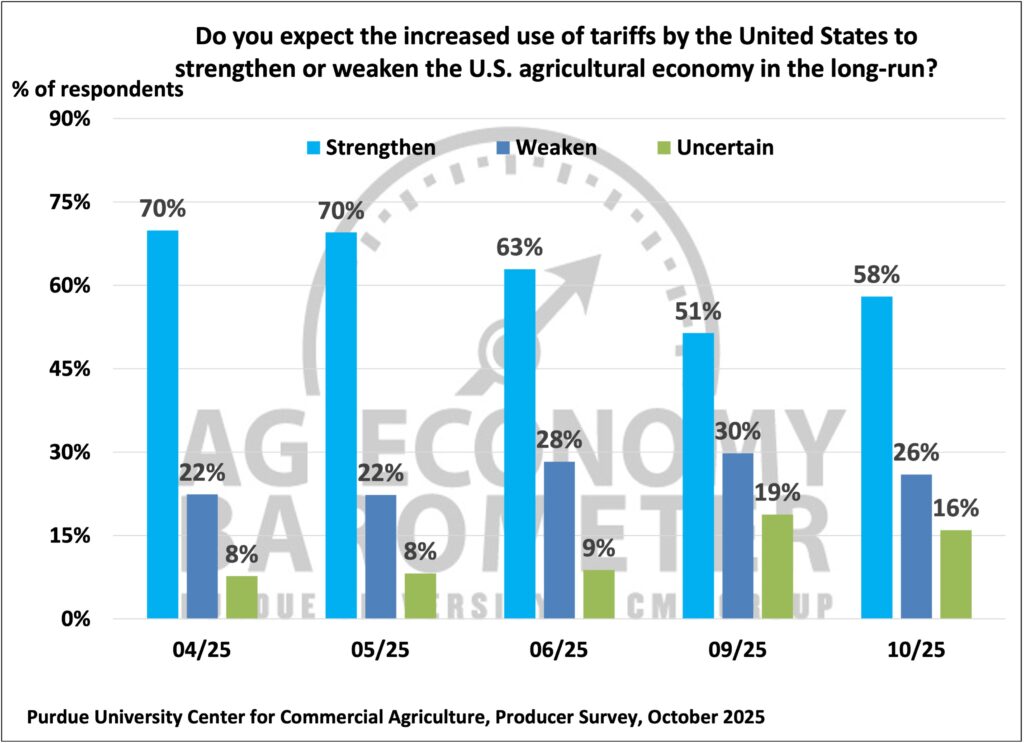

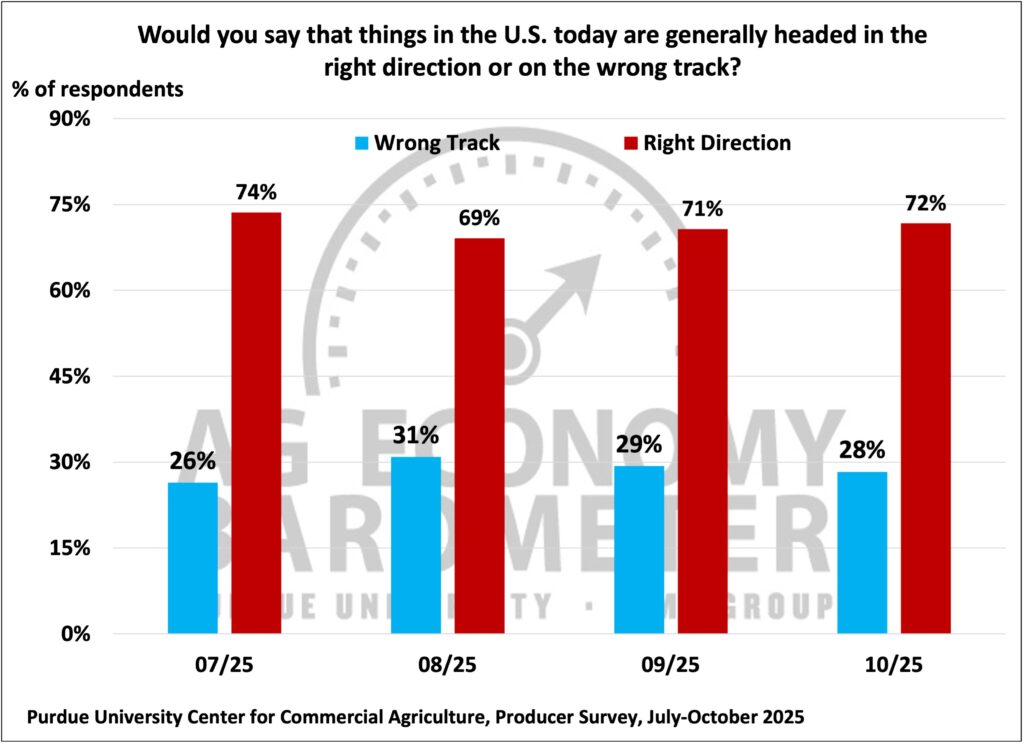

Policy uncertainty continues to impact farmer sentiment. The October survey again asked producers if they expect the increased use of tariffs by the U.S. to strengthen or weaken the agricultural economy in the long run. More producers on the October survey (58%) said they expect it to strengthen the economy than in September, but that percentage was still lower than in April and May, when 70% of respondents said they expected tariffs to strengthen the economy. Notably, the percentage of producers in October (16%) who said they were uncertain about the impact of tariff policies on the agricultural economy was double that of both April and May. Although the percentage of producers who are uncertain about the impact of tariff policies on the agricultural economy has doubled since spring, the percentage who say the U.S. is headed in the “right direction” continues to hover near 70%.

Wrapping Up

U.S.farmer sentiment improved slightly in October, with nearly all of the small rise in the barometer attributable to an increase in the Index of Current Conditions. There continues to be a big disparity between the views of crop and livestock farmers, with livestock producers much more optimistic than crop farmers. Overall, U.S. farmers expect weaker financial performance on their farms this year than last year, but crop and livestock producers’ expectations differ. Crop producers expect weaker financial outcomes than a year ago, while livestock producers look for performance near a year earlier. Although the percentage of producers who expect the U.S. tariff policy to strengthen the agricultural economy in the long run rose in October, the percentage who think the outcome is uncertain has doubled since spring. Despite the uncertainty about tariff policy, over 70% of U.S. producers still say the U.S. is headed in the “right direction”.