Farmer sentiment rises as producers report improved financial conditions on their farms

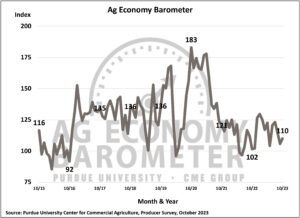

There was a slight uptick in agricultural producers’ sentiment in October, as the Purdue University/CME Group Ag Economy Barometer index rose 4 points to a reading of 110. The modest improvement in farmer sentiment resulted from farmers’ improved perspective on current conditions on their farms as well as their expectations for the future. The Index of Current Conditions rose 3 points to 101 while the Index of Future Expectations rose 5 points to 114. This month’s Ag Economy Barometer survey was conducted from October 16-20, 2023.

Farmer sentiment rises as producers report improved financial conditions on their farms (Purdue/CME Group Ag Economy Barometer/James Mintert).

“Farmers in this month’s survey were slightly less concerned about the risk of lower prices for crops and livestock and felt somewhat better about their farms’ financial situation than a month earlier,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

Farmers’ more optimistic view of their farms’ financial situation was reflected in the Farm Financial Performance Index, which rose 6 points in October compared to September. This month’s index value of 92 was the highest farm financial performance reading since April and pushed the index 7% above its reading from a year ago. The index’s rise stood in contrast to USDA’s’ forecast for 2023 net farm income to fall below 2022’s income level.

“Reports of higher-than-expected corn and soybean yields in some Corn Belt locations, along with a modest rally in corn prices, likely contributed to this month’s rise in the financial conditions and the barometer indices,” said Mintert.

Despite the perception that financial conditions were stronger than a month earlier, the Farm Capital Investment Index fell 4 points in October to a reading of 35. This was the lowest reading of the year for the investment index. In October, nearly 8 out of 10 (78%) respondents said it was a bad time to make large investments in their farm operation, while just 13% of farmers said it was a good time to make large investments. Among those who said it’s a bad time to invest, the most commonly cited reason was rising interest rates, chosen by 41% of respondents, up one point from September. Of those who said it is a good time to make large investments in their farm operation, 24% stated “strong cash flows,” down from 32% who felt that way in September, and 20% pointed to “expansion opportunities” up from 6% in September.

Just over one-third (35%) of producers in this month’s survey said they expect farmland values to rise in their area in the upcoming year, while nearly two-thirds (65%) of survey respondents expect farmland values to rise over the next 5 years. As a result, the Short-Term Farmland Value Index changed little, dropping just one point compared to a month earlier, while the Long-Term Farmland Value Expectations Index rose three points. Key reasons cited by producers for optimism about farmland values over the next five years continue to be non-farm investor demand, followed by inflation.

Dry weather this past spring and summer stimulated discussions among producers about shifts in long-term weather patterns. This month’s survey asked corn and soybean producers if they have explicitly made any changes in their farming operation in response to changes in long-term weather patterns in their area. Nearly one out of four corn/soybean farmers (24%) in the October survey indicated they implemented changes in their farm operations to better deal with shifting weather patterns. A follow-up question posed only to farmers who said they’ve made changes, asked them to identify the biggest operational changes they’ve made to date. Responses indicated farmers are choosing from among a broad mix of technologies and capital investments to adapt to changing weather patterns, including: increased use of no-till (25% of respondents); changed mix of crops planted (23% of respondents); planted more drought resistant varieties (20% of respondents); installed tile drainage (9% of respondents); and installed irrigation (9% of respondents).

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading derivatives marketplace, CME Group (www.cmegroup.com) enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex, and, E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT and Chicago Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. BrokerTec and EBS are trademarks of BrokerTec Europe LTD and EBS Group LTD, respectively. The S&P 500 Index is a product of S&P Dow Jones Indices LLC (“S&P DJI”). “S&P®”, “S&P 500®”, “SPY®”, “SPX®”, US 500 and The 500 are trademarks of Standard & Poor’s Financial Services LLC; Dow Jones®, DJIA® and Dow Jones Industrial Average are service and/or trademarks of Dow Jones Trademark Holdings LLC. These trademarks have been licensed for use by Chicago Mercantile Exchange Inc. Futures contracts based on the S&P 500 Index are not sponsored, endorsed, marketed, or promoted by S&P DJI, and S&P DJI makes no representation regarding the advisability of investing in such products. All other trademarks are the property of their respective owners.

Writer: Kami Goodwin, 765-494-6999, kami@purdue.edu

Source: James Mintert, 765-494-7004, jmintert@purdue.edu

Media Contacts:

Aissa Good, Purdue University, 765-496-3884, aissa@purdue.edu

Dana Schmidt, CME Group, 312-872-5443, dana.schmidt@cmegroup.com

Related websites:

Purdue University Center for Commercial Agriculture: http://purdue.edu/commercialag

CME Group: http://www.cmegroup.com/

Photo Caption:

Farmer sentiment rises as producers report improved financial conditions on their farms (Purdue/CME Group Ag Economy Barometer/James Mintert). https://www.purdue.edu/uns/images/2023/ageconomy-barometer2310LO.jpg