Modest Improvement In Farmer Sentiment, Yet Financial Concerns Loom

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer February results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

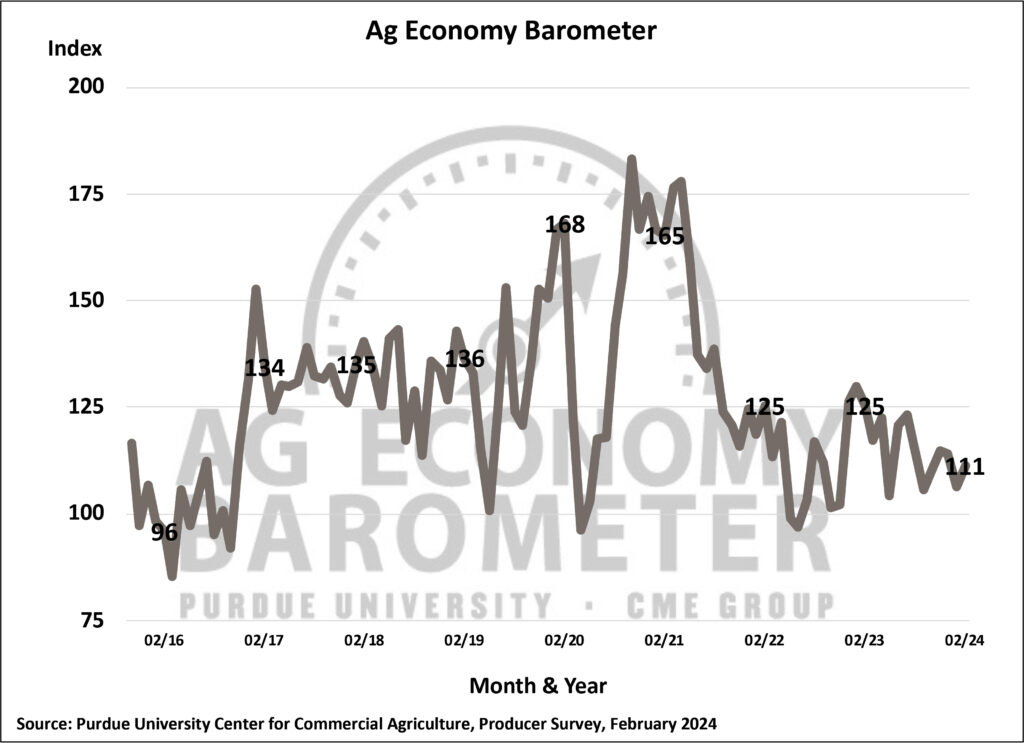

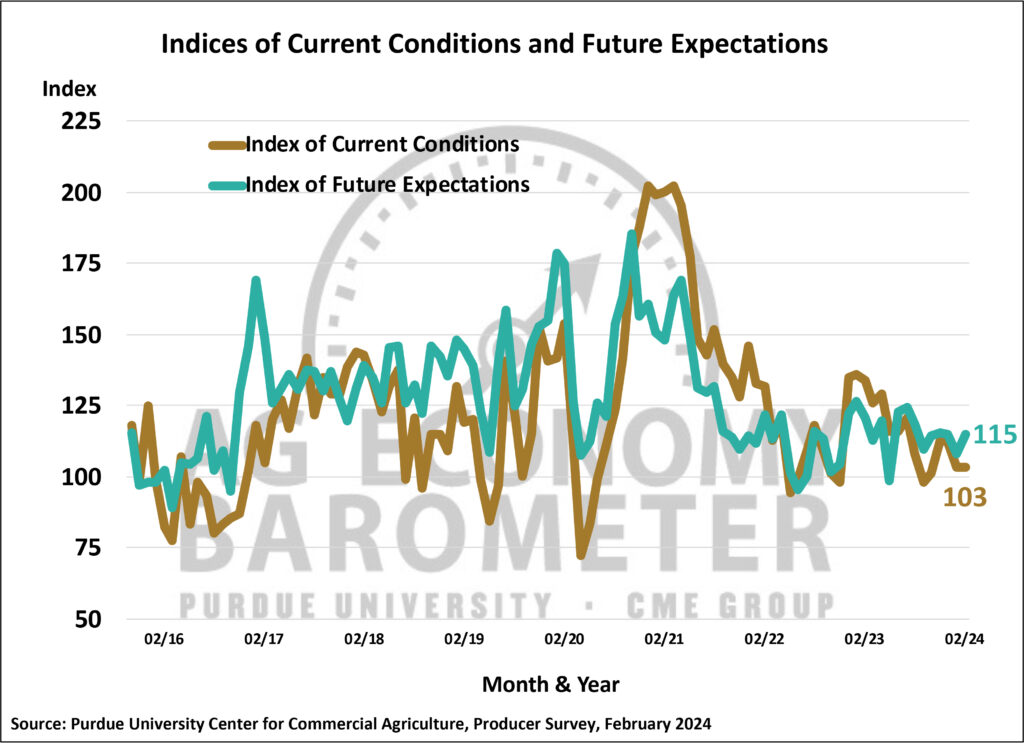

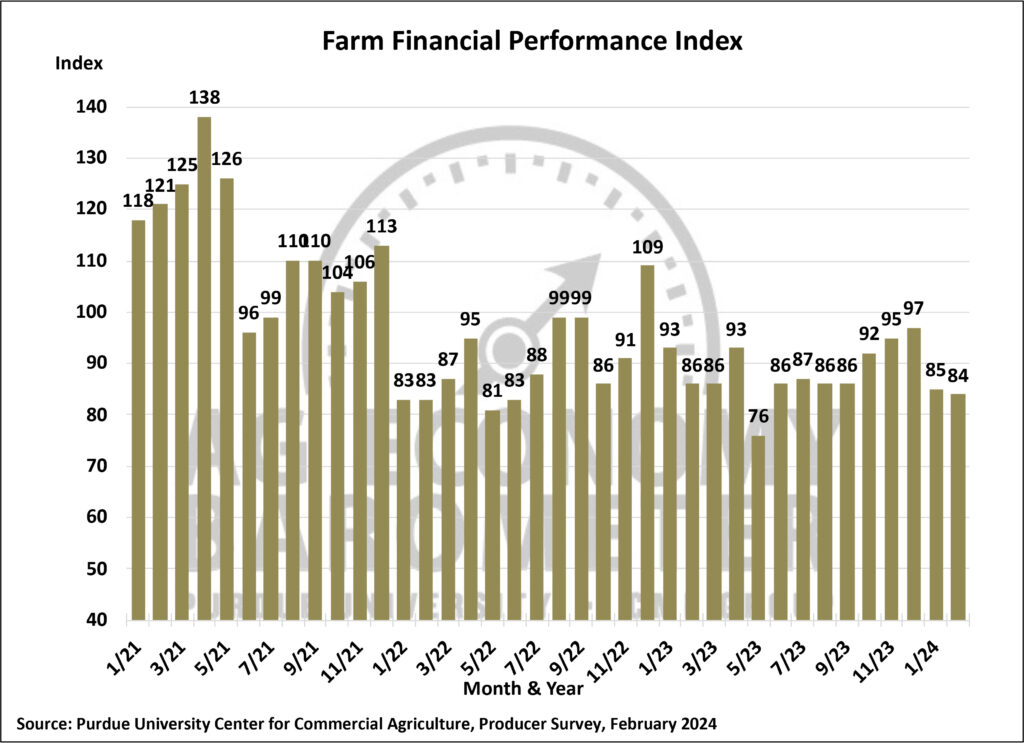

The Purdue University-CME Group Ag Economy Barometer rose modestly in February posting a reading of 111, 5 points higher than a month earlier. The modest rise in the barometer was attributable to producers expressing somewhat more optimism about the future as the Future Expectations Index rose 7 points to a reading of 115 while the Current Conditions Index was unchanged, both compared to a month earlier. Although farmers’ expectations for the future improved in February, their financial performance expectations did not. February’s Farm Financial Performance Indexreading of 85 was 1 point lower than in January and 13 points below its most recent peak in December. Weak crop prices continue to weigh on financial expectations as mid-February Eastern Corn Belt cash prices for corn and soybeans were 7 and 8% lower, respectively, than two months earlier when the December survey was conducted. The February Ag Economy Barometer survey was conducted from February 12-16, 2024.

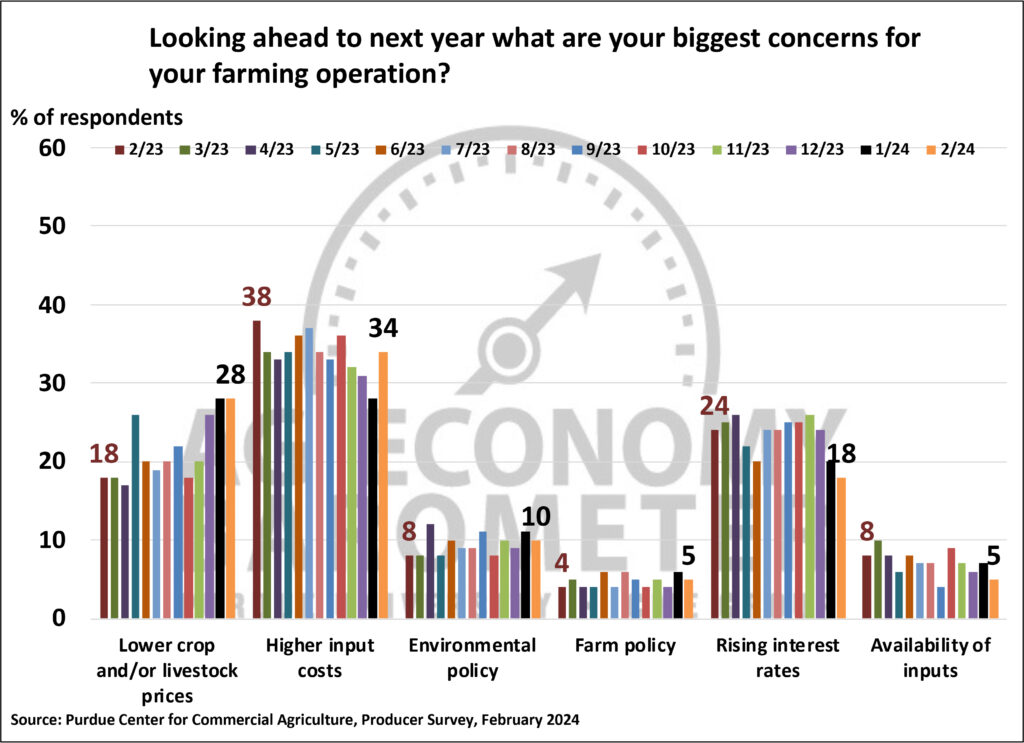

When asked about their biggest concerns for their farm operation in the upcoming year, producers in this month’s survey continued to point to “high input costs” (34% of respondents) and “lower crop/livestock prices” (28% of respondents) as their top two concerns. Interest rate worries among agricultural producers might have peaked as just 18% of February respondents cited “rising interest rates” as a top concern, down from 26% as recently as last November.

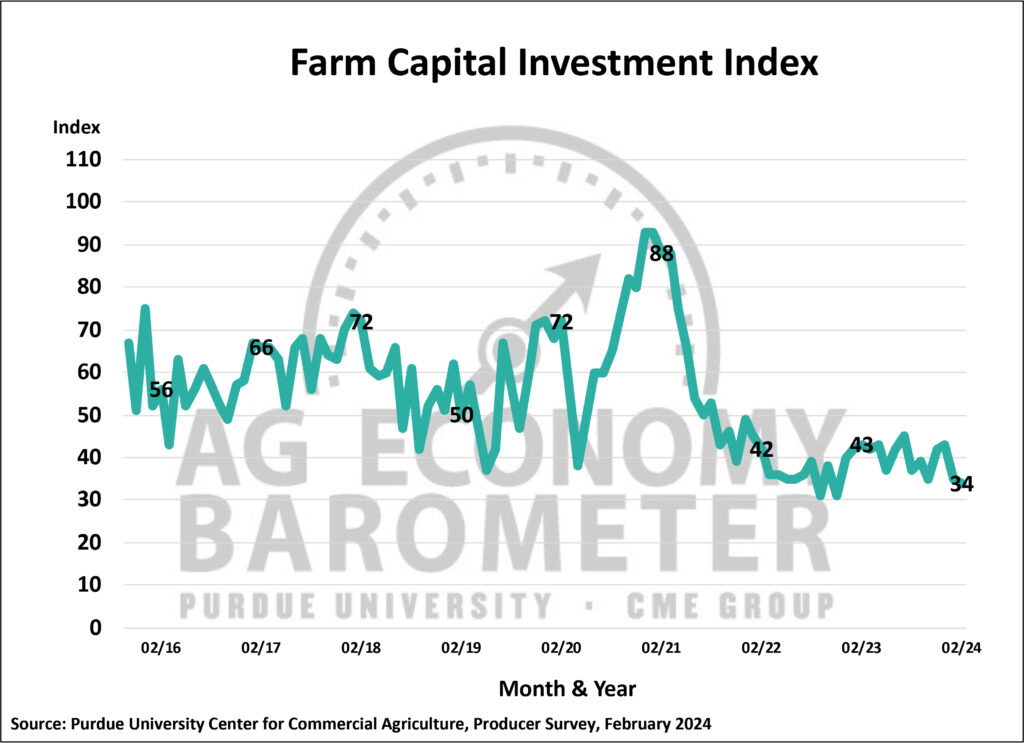

The Farm Capital Investment Index remained weak in February, declining 1 point to a reading of 34 which was 9 points lower than a year earlier. Responses from producers who said now is a bad time to make large investments reflected their concerns about high production costs and weak output prices. The percentage of farmers who said it’s a bad time because of “uncertainty about farm profitability” has tripled since last October. This month 22% of respondents pointed to farm profitability concerns compared to just 7% who cited that as a key reason to hold back on investments last fall.

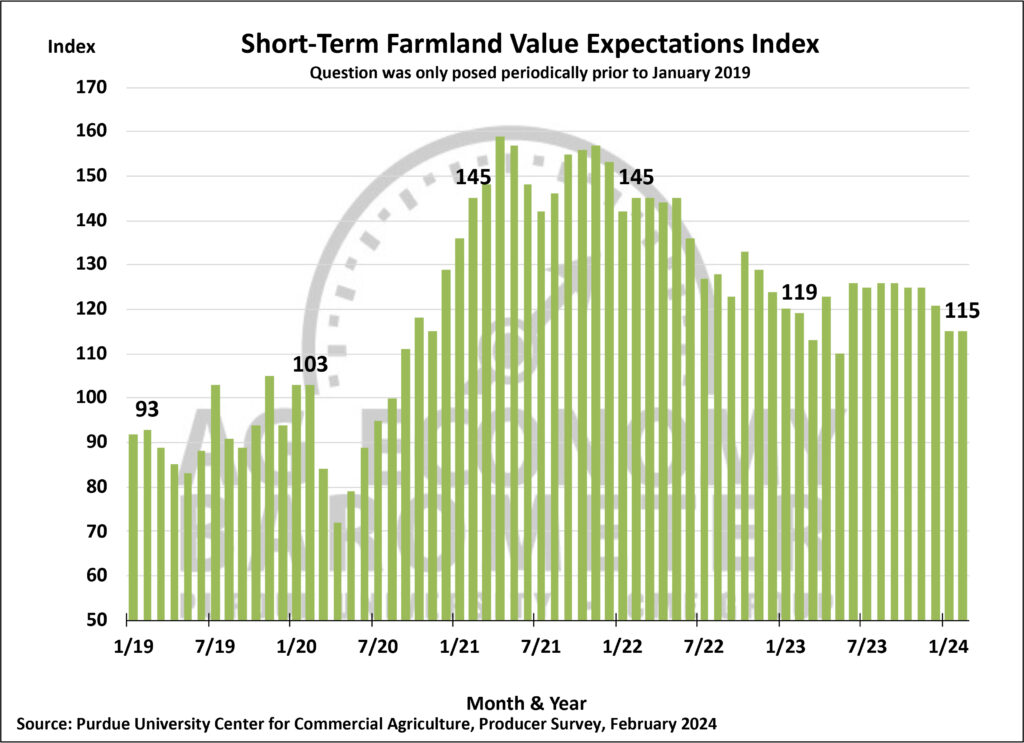

Producers’ short-run expectations for farmland values were unchanged from January’s as the Short-Term Farmland Values Expectations Index reading was 115 in both months. Compared to a year earlier, however, the index was down 4 points, and it was also 30 points lower than two years ago. Although more producers expect farmland values to rise than fall in the next 12 months causing the index value to be above 100, it’s clear that sentiment among producers about future increases in farmland values is weaker than it was a couple of years ago. The optimists in barometer surveys continue to point to “non-farm investor demand” as the primary reason they expect farmland values to continue rising.

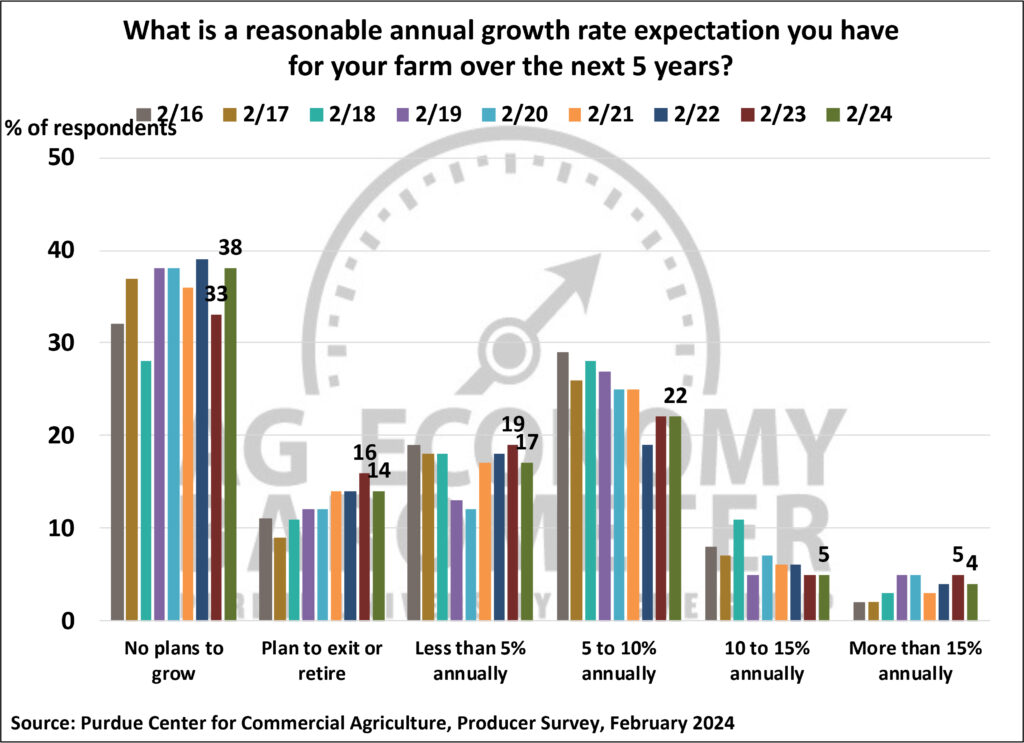

Each year in February the barometer survey queries respondents regarding plans for their farm with a question focused on their farm operation’s growth plans for the upcoming 5-year period. This year nearly 4 out of 10 (38%) producers said they have “no plans to grow” and an additional 14% of respondents said they plan to “exit or retire from farming”. On the other hand, just over 3 out of 10 respondents in this month’s barometer survey said they expect their farm’s annual growth rate to exceed 5%. To help put growth rates in perspective, consider that a farm operation growing at a 5% annual rate will double in size in about 14 years whereas a farm growing at a 10% annual rate will need just 7 years to double in size.

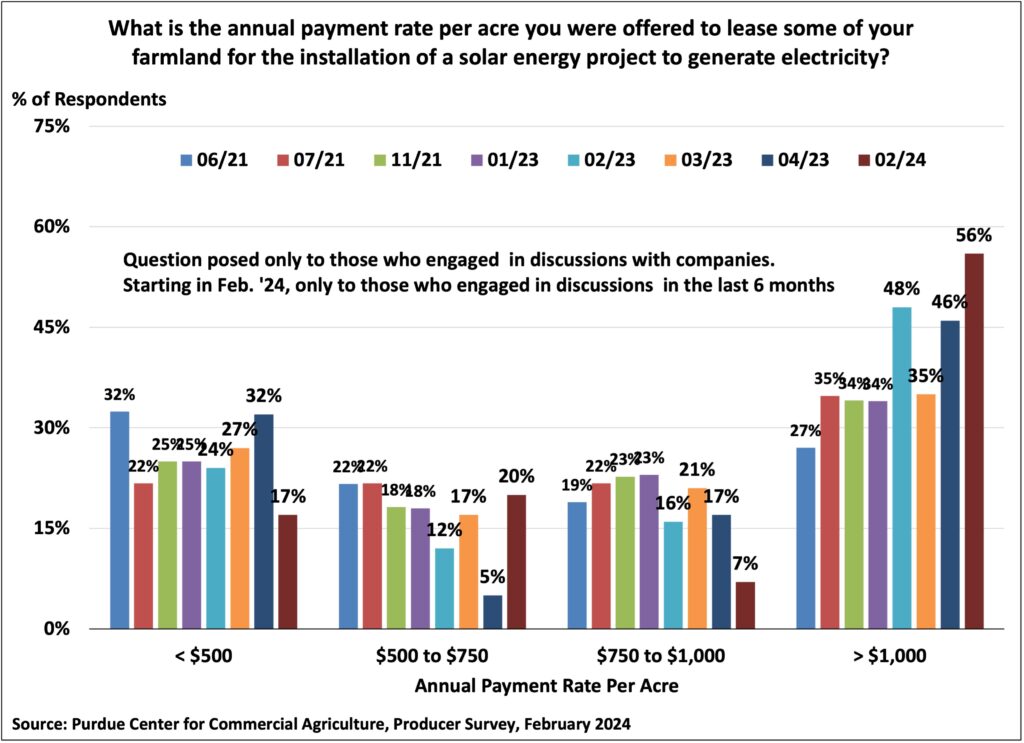

Interest in leasing farmland for solar energy development continues to be strong. The February survey queried producers regarding whether they have discussed the installation of a solar energy project with a company in the last six months. If a respondent indicated they had been involved in discussing a possible solar lease, a follow-up question asked, following the construction of the solar project, what annual payment rate per acre was offered. Ten percent of respondents this month said they had discussed a solar leasing project with a company in the last 6 months. Payment rates offered varied widely, but it was notable that over half of respondents said they were offered a lease rate of $1,000 per acre or more.

Wrapping Up

Producers expressed a bit more optimism about the future in the February survey than in January, which pushed the Ag Economy Barometer up slightly. However, expectations for their farms’ financial performance in the upcoming year did not improve as the Farm Financial Performance Index remained 13 points lower than in December. Although farmers’ short-run expectations for farmland values were unchanged compared to a month earlier, it’s clear that producers are not as confident that farmland values will continue to rise as they were two years ago when the short-run farmland index was 30 points higher than it was this month. Finally, producers who have engaged in discussions with companies about solar leasing their farmland indicate that per acre payment rates following construction have been rising with over half of them indicating they were offered a rate of $1,000 or more per acre.