Producer Sentiment Settles Lower; Outlook Toward Farmland Remains Favorable

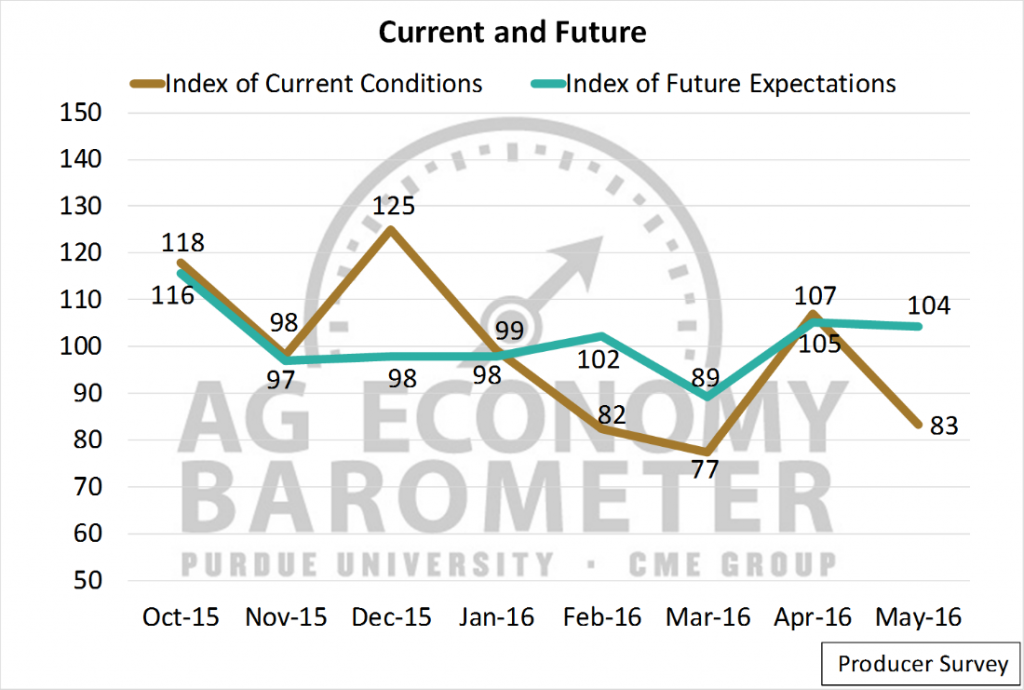

After a surge in producer sentiment in April, spurred in part by a favorable swing in commodity prices, producer sentiment settled lower in May (Figure 1). At a value of 97, the Ag Economy Barometer – which is based on a monthly survey of 400 agricultural producers’ sentiment and opinions regarding the health of the ag economy – was nine points lower than the April reading. The dip in the barometer during May brings the index back in line with readings provided by producers in January (98) and February (96) of this year.

An examination of the Ag Economy Barometer’s two sub-components – the Index of Current Conditions and Index of Future Expectations – indicates the majority of the shift in producer sentiment came from a downward adjustment in the Index of Current Conditions, which fell from 107 in April to 83 in May.

Figure 2. Producer Index of Current Conditions and Index of Future Expectations, May 2016.

Some of the decline in producers’ sentiment during May was attributable to changing perceptions about the livestock sector. During May, 36 percent of respondents reported an expectation of widespread “good times” for livestock producers over the next five years, which was well below the 46 percent expecting good times when surveyed in April. Recent declines in livestock prices, especially feeder cattle and live cattle, could help explain the decline in producers’ sentiment regarding the livestock sector. For example, June live cattle futures traded above $130/cwt as recently as mid-March and were still above $122/cwt in mid-April (Figure 3). The decline in prices continued during late-April and early May with June live cattle dipping down near $115/cwt the first week of May. Feeder cattle futures prices followed a similar price path as live cattle futures, resulting in diminished profit prospects for both cattle feeders and cow-calf producers (Figure 4). The relatively large shift in producer sentiment regarding the livestock sector stands in contrast to the sentiment regarding the crop sector, which exhibited only a modest decline from April to May. In short, the sentiment regarding the future for livestock producers, which had been strong, showed signs of eroding relative to expectations regarding the future for crop producers.

Figure 3. June 2016 Live Cattle Prices. Data Source: CME Group. (May 31, 2016)

Figure 4. August 2016 Feeder Cattle Futures Prices. Data Source: CME Group. (May 31, 2016)

Are Lower Farmland Values on the Horizon?

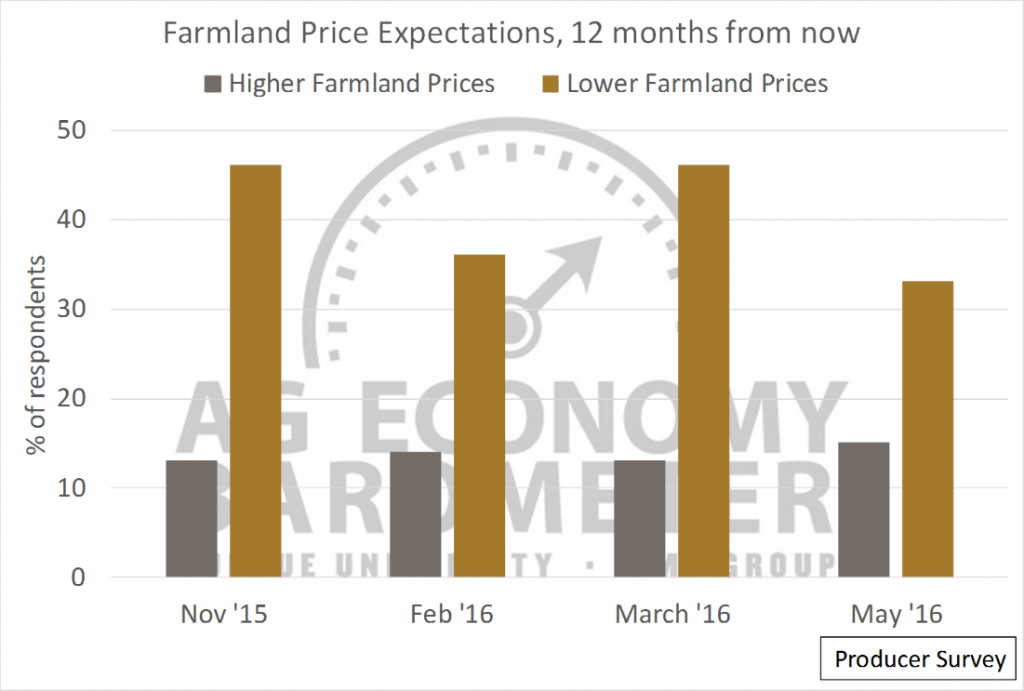

For the May survey, producers were also asked whether they expect farmland values to increase, decrease or remain about the same over the next 12 months. We also asked this same question last November, as well as February and March of this year. Examining the results over time provides an interesting perspective into producers’ views regarding farmland. The percentage of producers that expect farmland prices to increase in the next year has been quite small, but remarkably stable going back to last fall, consistently falling in a range of 13-15 percent. In contrast, the percentage of producers expecting farmland prices to decline over the next year has fluctuated much more. Producers were most pessimistic regarding farmland prices in November and March, when 46 percent expected a decline and noticeably less pessimistic in May when 33 percent of respondents reported that they expect farmland prices to decline over the next year. The reduction in pessimism regarding near-term farmland prices is likely attributable to the improvement in crop prices the last couple of months. .

In a separate question, producers were asked about farmers’ profitability over the next 12 months. Only 10 percent reported that they expect profitability to improve in the next year. The relatively small percentage of respondents who expect improved profitability in the next year (10 percent) could explain why some (15 percent) respondents expect farmland prices to increase in the near future.

Figure 5. Producer Farmland Price Expectations, 12 months from respective month. May 2016.

Farmland Generally Viewed as a Favorable Investment

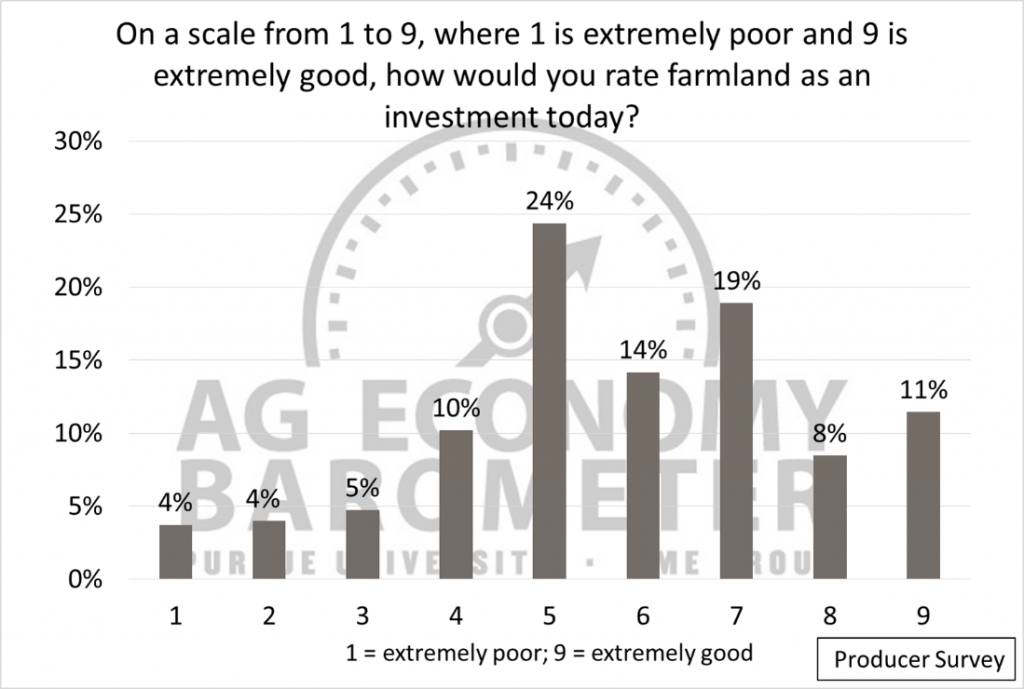

While a small percentage of survey respondents, just 15 percent in May, reported that they expect farmland prices to be higher in May 2017 than a year earlier, a majority of producers still view farmland as a favorable investment. When asked to evaluate farmland as an investment on a scale of 1-9 (1 being ‘extremely poor’ and 9 being ‘extremely good’), 52 percent of respondents scored farmland favorably (e.g., reported a score greater than 5) and nearly one-quarter of survey respondents provided a neutral rating (e.g., score equal to 5) for farmland as an investment. Conversely, 23 percent of the farmers viewed farmland as a poor investment (e.g., reported a score below 5). While it might seem paradoxical that a majority of farmers continue to view farmland as a good investment when so few producers expect farmland values to increase over the next 12 months, it’s likely attributable to the time horizon. Although most farmers do not view the short-run prospects for farmland prices favorably, their long-run perspective continues to be relatively positive.

Figure 6. Distribution of Producers’ Rating of Farmland as an Investment (1 being “extremely poor,” 9 being “extremely good”). May 2016.