Producer sentiment down slightly as commodity prices weaken

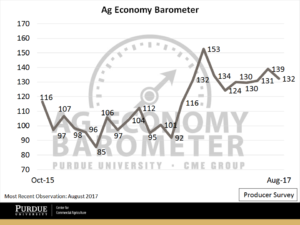

WEST LAFAYETTE, Ind. and CHICAGO – Farmer sentiment dropped seven points in August as both grain and oilseed prices fell, according to the Purdue University/CME Group Ag Economy Barometer.

The Purdue/CME Group Ag Economy Barometer climbed to 139 in July as stronger commodity prices led to more optimistic producer sentiment. (Purdue/CME Group Ag Economy Barometer/David Widmar)

While the barometer, which is based on a survey of 400 U.S. agricultural producers, showed a decrease in optimism, the August reading of 132 is still stronger than a year ago when the index read 95. Since hitting a peak of 153 in January, the barometer’s monthly readings have ranged from a low of 124 in March to a high of 139 in July.

The change in sentiment was primarily driven by the Index of Current Conditions, which fell to 122 in August after reaching an all-time high of 142 in July. The Index of Future Expectations held fairly steady, dropping just one point from 138 in July to 137 in August.

“Weakness in the Index of Current Conditions compared to July wasn’t unexpected given the recent downtrend in grain and oilseed prices,” said Jim Mintert, director of Purdue’s Center for Commercial Agriculture and principal investigator for the barometer. “For example, from July 17 to August 21 – the first days of the July and August sentiment surveys, the December corn futures contract price declined 6 percent. Prices for wheat and soybeans also weakened, generating additional concern about farm revenues and profitability.”

In the August survey, producers were asked if the best opportunity to market grain occurred over the last six months or would be in the upcoming six months. A majority (59 percent) thought the best opportunity took place during the last six months, which Mintert said suggests there is some concern that prices are not likely to recover soon.

Researchers also sought to understand the overall mood in the agricultural community. The August survey included a question that asked producers about their neighbors’ sentiments regarding the current agricultural economy. Most – 71 percent – said that farmers in their areas were pessimistic.

The August report also includes information about shifts in farmer responses to key survey questions over the last year. In particular, the report notes that, although there has been an improvement in producer sentiment since summer 2016, conditions in production agriculture are still challenging for many farm operations. Read the full report at http://purdue.edu/agbarometer.

The Ag Economy Barometer, Index of Current Conditions and Index of Future Expectations are available on the Bloomberg Terminal under the following ticker symbols: AGECBARO, AGECCURC and AGECFTEX.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) is where the world comes to manage risk. Through its exchanges, CME Group offers the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. CME Group provides electronic trading globally on its CME Globex platform. The company also offers clearing and settlement services across asset classes for exchange-traded and over-the-counter derivatives through its clearinghouses CME Clearing and CME Clearing Europe. CME Group’s products and services ensure that businesses around the world can effectively manage risk and achieve growth.

CME Group, the Globe logo, CME, Chicago Mercantile Exchange, Globex and E-mini are trademarks of Chicago Mercantile Exchange Inc. CBOT, Chicago Board of Trade, KCBT and Kansas City Board of Trade are trademarks of Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. Dow Jones, Dow Jones Industrial Average, S&P 500 and S&P are service and/or trademarks of Dow Jones Trademark Holdings LLC, Standard & Poor’s Financial Services LLC and S&P/Dow Jones Indices LLC, as the case may be, and have been licensed for use by Chicago Mercantile Exchange Inc. All other trademarks are the property of their respective owners.

Writer: Jennifer Stewart-Burton, 765-496-6032, jsstewar@purdue.edu

Sources: Jim Mintert, 765-494-4310, jmintert@purdue.edu

David Widmar, 765-494-0848, dwidmar@purdue.edu

Chris Grams, 312-930-3435, chris.grams@cmegroup.com

Related website:

Purdue University Center for Commercial Agriculture: http://purdue.edu/commercialag

CME Group: http://www.cmegroup.com/