Producers Bullish About Farmland Values Amid Strong Current Conditions

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer February results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

Download report (pdf)

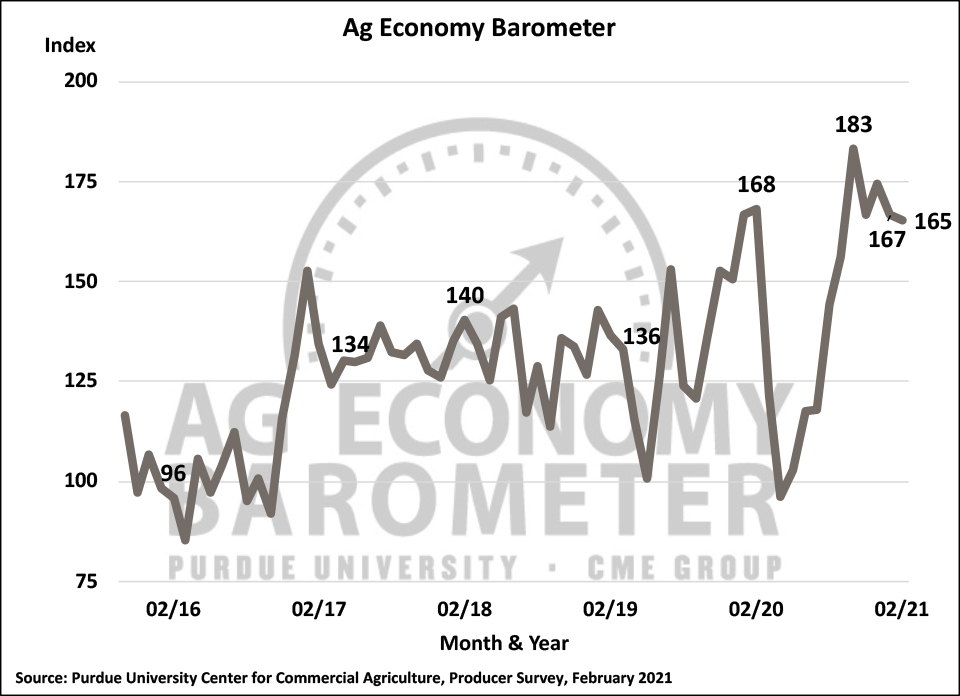

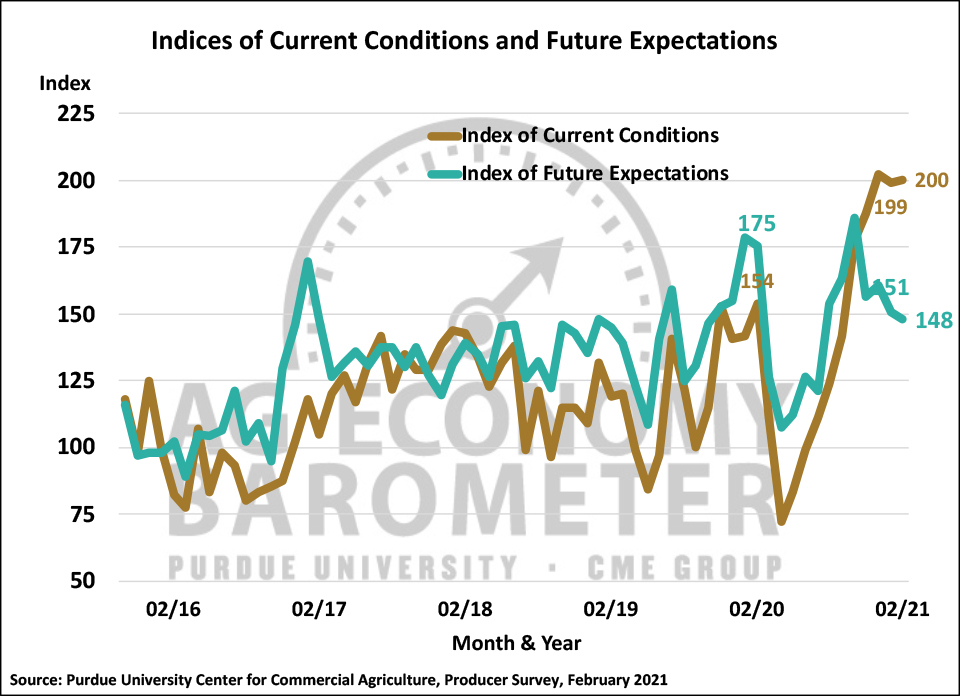

February’s Ag Economy Barometer reading of 165 changed little compared to January when the index stood at 167. Producers continue to report strong current conditions on their farms as February’s Current Conditions Index value of 200 is near its all-time high. Continuing a trend that got underway last fall, however, the Index of Future Expectations drifted lower to a reading of 148, 3 points below its January reading. February marked the third time in the last 4 months that the Future Expectations Index declined, leaving it 20 percent below its October peak. Ongoing strength in ag commodity prices and farm income continue to support producers’ perspective on current conditions while concerns about possible policy changes affecting agriculture and eroding confidence in future growth in ag trade continue to weigh on producers’ future expectations. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from February 15-19, 2021.

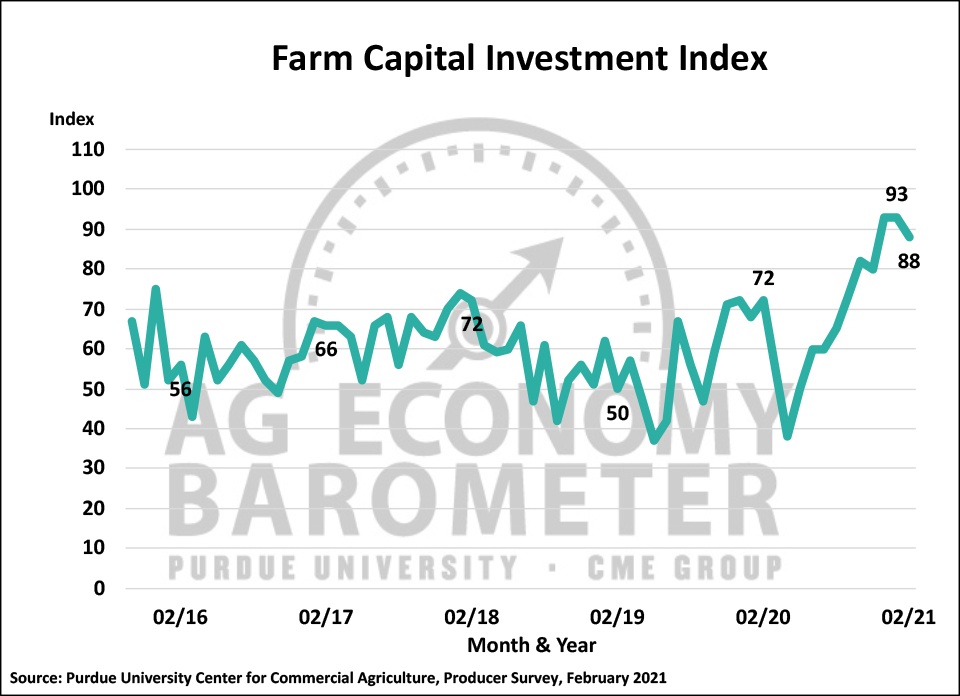

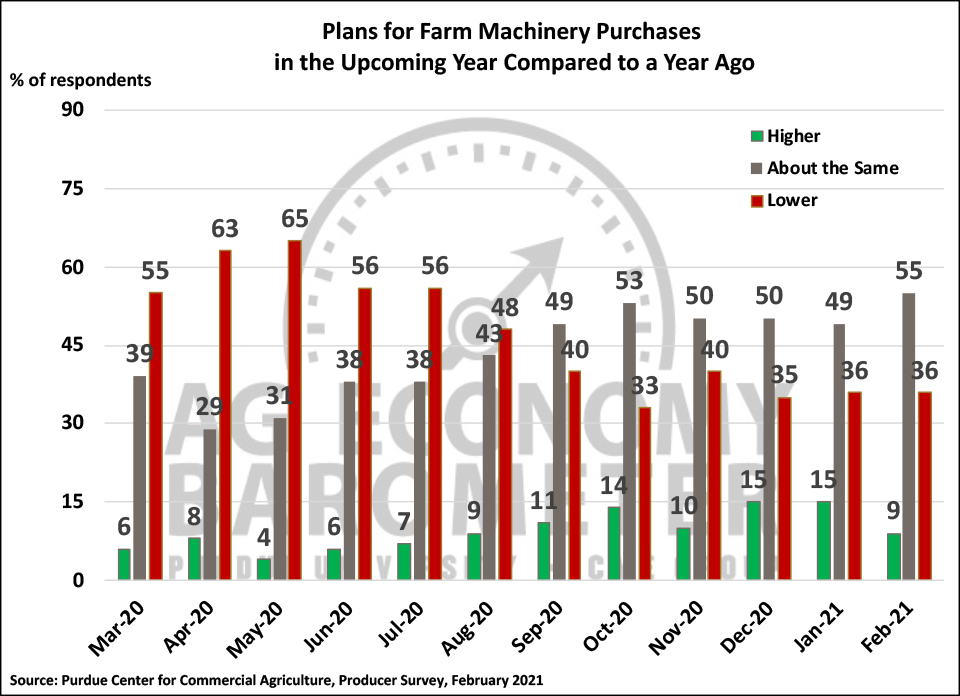

The Farm Capital Investment Index drifted lower in February to a reading of 88, 5 points below both its December and January readings. Still, the index in February stood at its third-highest reading since data collection began in 2015 and was 16 points higher than a year earlier, just before the pandemic got underway. Farmers in February were a bit less optimistic regarding their upcoming farm machinery purchase plans than they were the last couple of months as the percentage of producers’ intent on raising their machinery purchases in the upcoming year dipped to 9 percent, compared to 15 percent who expected to increase purchases when surveyed in both December and January.

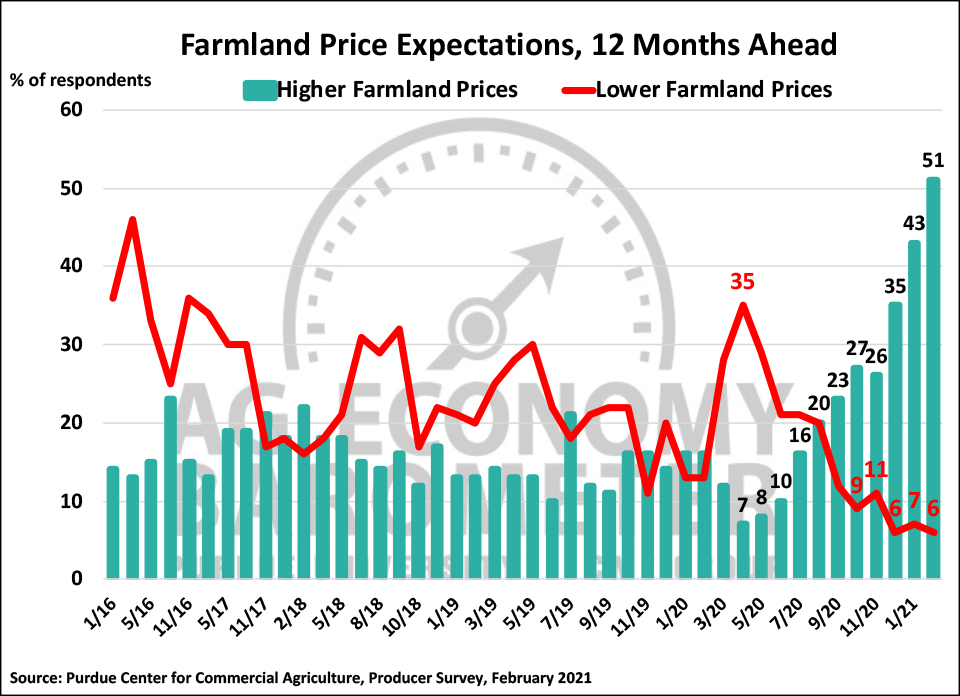

Producers are very bullish about farmland values. Fifty-one percent of respondents in February said they expect to see farmland values rise during the next year, up 8 points from the January survey. February marked the first time in the survey’s history that more than half of respondents said they expected a short-run increase in farmland values. U.S. farmers are also optimistic about the long-run trend in farmland values as 62 percent of respondents indicated farmland values are likely to rise over the next five years. This was the third month in a row that over 60 percent of respondents said they expect to see a long-term rise in farmland values.

Bullishness regarding farmland values spilled over into expectations for rising farmland cash rental rates. The percentage of producers expecting to see higher rental rates has been increasing the last several months, primarily because the percentage of producers expecting rates to remain about the same has been declining. For example, in December three-fourths of respondents said they expected rental rates in 2021 to be about the same as in 2020 with 18 percent of respondents expecting higher rental rates. By February the percentage of producers expecting rates to be unchanged fell to 61 percent as the percentage expecting higher rates rose to 36 percent.

Optimism about farmland values and confidence that now is a relatively good time to make large investments are being fueled by expectations for improved financial performance. The percentage of farms expecting to see a better financial performance in 2021 compared to the prior year has been rising since last summer and on the February survey reached 37 percent, up 4 points from January and 25 points higher than last July. This was also reflected in producers’ perception of the most critical risk facing their operation in the next 12 months. The percentage of producers citing financial risk as most critical in February 2021 declined to just 18 percent, compared to 26 percent when the same question was posed a year earlier. Interestingly, in light of pandemic-related disruptions this past year, 29 percent of producers ranked production as their most critical risk this year, up from 22 percent who felt that way a year ago and just 17 percent two years ago.

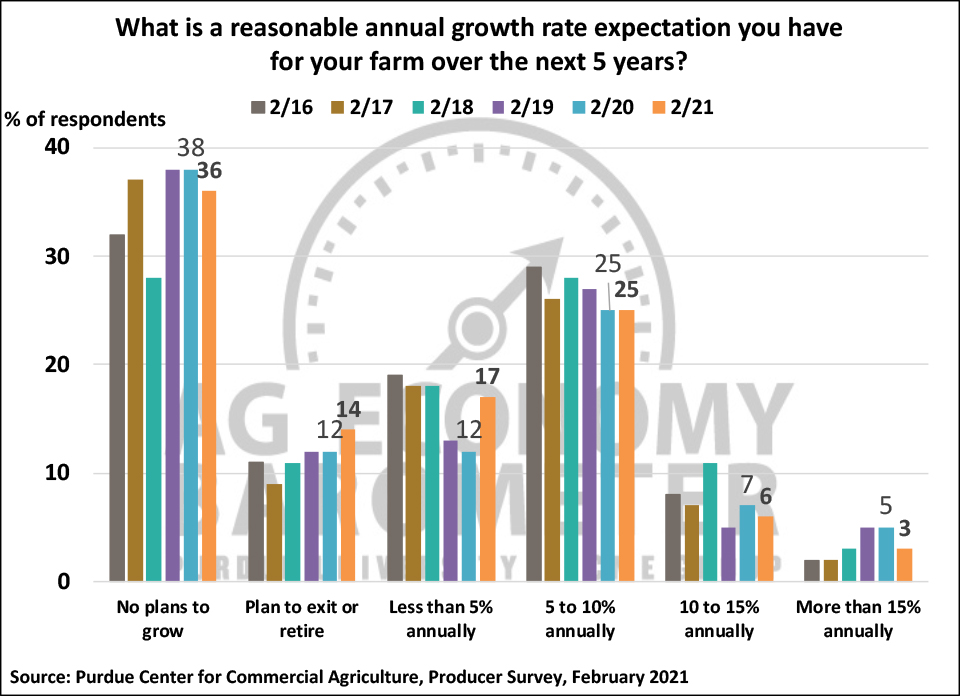

Each winter we ask survey respondents about their farms’ plans for growth. Responding to this year’s survey question, 50 percent of commercial-scale farms reported that they either have no plans to grow or plan to exit/retire in the next five years. Seventeen percent of this year’s respondents, up from 12 percent a year earlier, said they expect their farm operation to grow, but at a slow pace of less than 5 percent annually. Twenty-five percent of farms said they expect to increase in size a bit more rapidly, 5 to 10 percent annually, which was unchanged from last year’s survey. Finally, farms that expect to grow relatively rapidly, more than 10 percent per year, declined from approximately 12 percent on the 2020 survey to about 9 percent on the 2021 survey. Overall, these results point towards continued consolidation in the farm sector.

Although ag producers are optimistic about the current situation on their farms, confidence in the future continues to erode, especially when compared to the strong expectations that many producers had back in October. Reasons behind the 20 percent decline in the Index of Future Expectations that’s taken place since October appear to be centered on concerns about the long-term future for agricultural trade and uncertainty about a variety of policies affecting agriculture. For example, the percentage of producers who expect ag exports will increase over the next five years stood at 65 percent in October. That percentage has been declining continuously over the last four months and in February was down to just 45 percent. Similarly, the percentage of producers who expect a favorable outcome to the trade dispute with China fell from 65 percent in October to 37 percent in February. Interestingly, this has taken place despite the recent ramp-up in ag exports to China. Still, worries about the future of ag trade combined with concerns about the possibility of more restrictive environmental regulations, estate and income taxes, all expressed on previous surveys, appear to be the motivation for the divergence between farmers’ perspective on the current vs. the future situation.

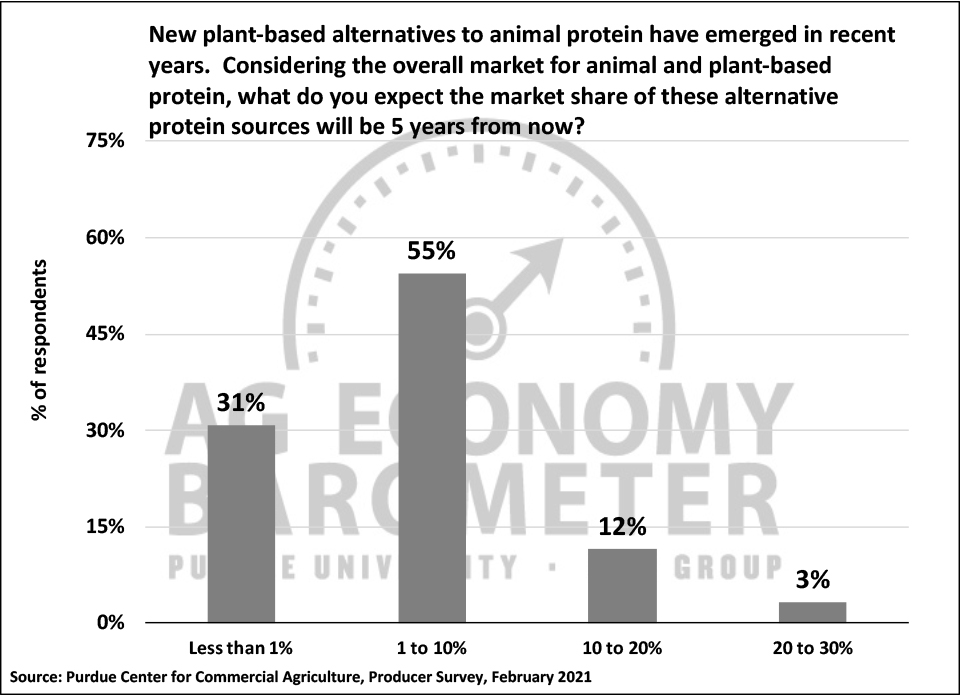

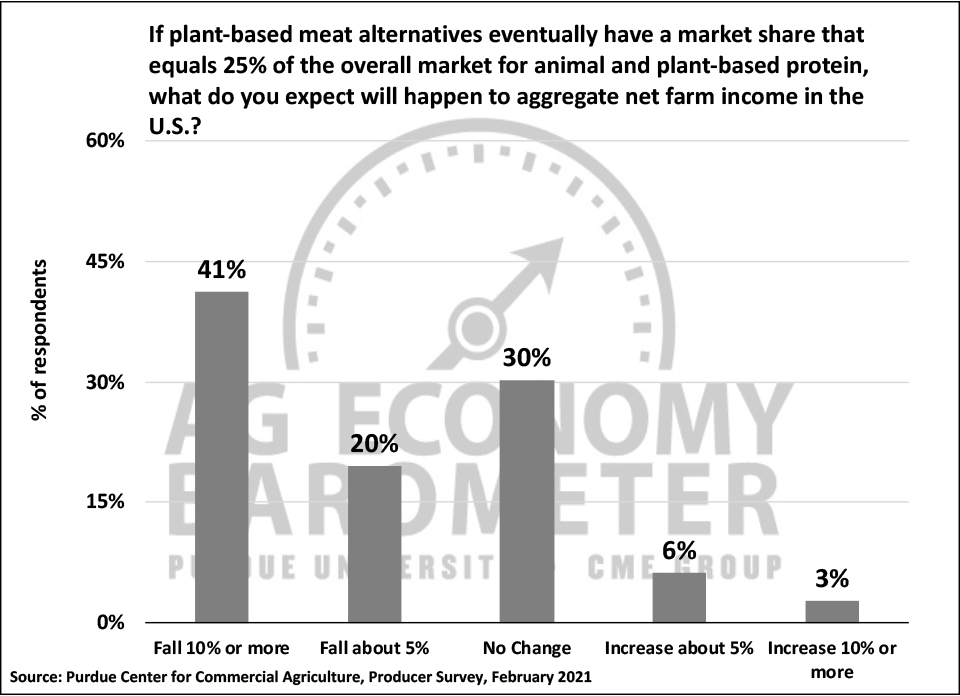

Interest in alternative protein sources has increased markedly over the last year. The February survey included several questions designed to learn more about producers’ perspectives on the possible impact of alternative proteins on U.S. agriculture. Responses suggest ag producers think alternatives to animal protein will make inroads in the total protein marketplace over the next five years. For example, over half (55%) of producers said they expect alternative protein sources to capture up to 10 percent of the combined market for animal and plant-based protein while a much smaller percentage, approximately 15%, said they expect plant-based alternatives to capture 10 percent or more of the total protein market. In a follow-up question, producers were asked what impact they would expect to see on farm income if plant-based alternatives to animal protein capture a relatively large market share (25%) of the total protein market. A majority of producers said they think the impact on farm income arising from alternative protein capturing a 25 percent share of the total protein market will be negative, with approximately four out of ten producers saying they would expect to see farm income decline by 10 percent or more under this scenario.

Wrapping Up

The Ag Economy Barometer with a reading of 165 changed little in February compared to a month earlier and was very near the reading from a year earlier, just before the pandemic’s onset, when the barometer stood at 168. U.S. farmers are very optimistic about current conditions on their farms as the Current Conditions Index remains near its all-time high. Optimism about current conditions was especially reflected in bullish expectations for farmland values and farmland cash rental rates. Although the Farm Capital Investment Index weakened slightly compared to a month earlier, it was still the third-highest reading on record indicating producers think now is a relatively good time to make large investments in their farming operations. Producers’ recent shifts in perspective regarding the future stand in contrast to their appraisal of current conditions. Since October, when the Index of Future Expectations peaked, the index has fallen by 20 percent. Relative to last fall, producers appear to be less confident about future growth in agricultural trade and are concerned about possible shifts in environmental and tax policy that could negatively impact the farm sector, leading them to be less confident about future conditions in the farm sector. Finally, producers indicated they expect to see alternative protein sources increase market share in the years ahead and, if the market share becomes significant, they think it’s likely to reduce aggregate farm income.