Farmer sentiment jumps up in November as harvest winds down

James Mintert and Michael Langemeier, Center for Commercial Agriculture

Kylie O’Connor fills in for Jim Mintert and gives her breakdown on the Purdue/CME Group Ag Economy Barometer November results at purdue.ag/barometervideo.

Download report (pdf)

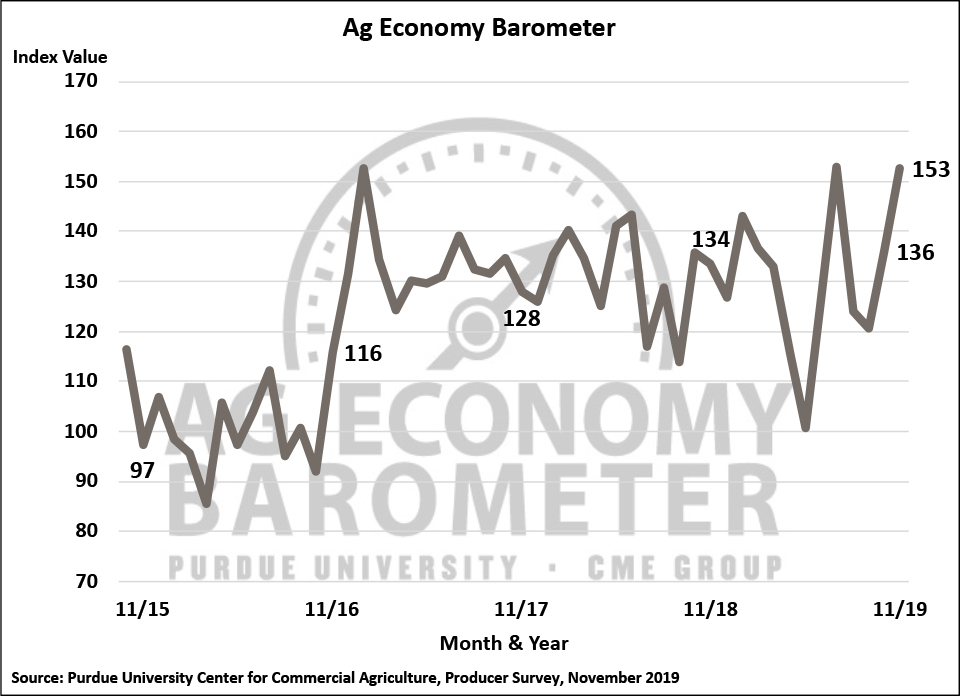

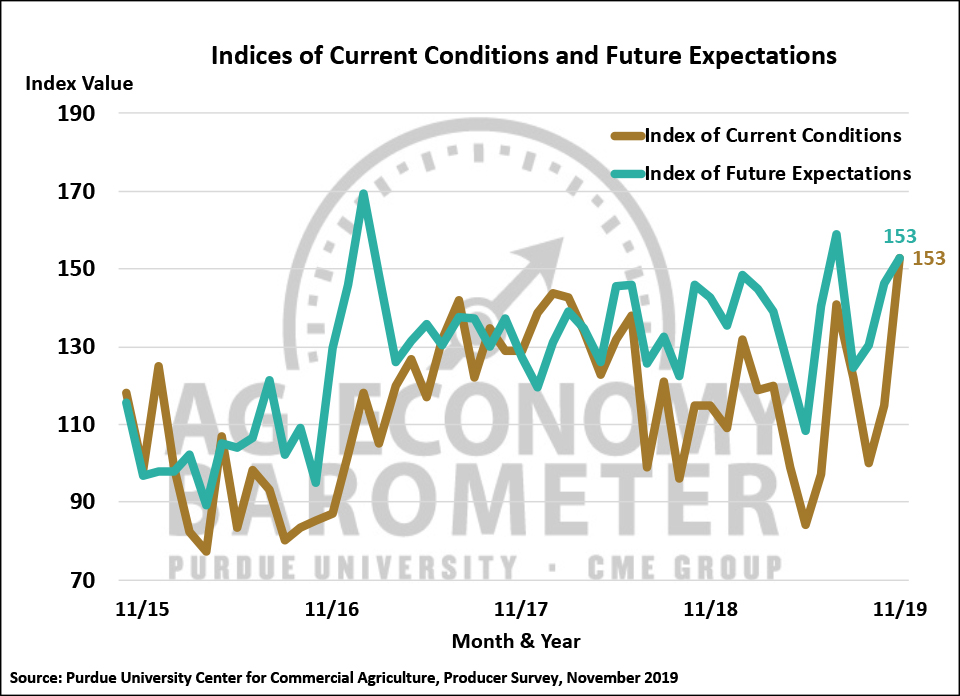

The Ag Economy Barometer rose in November for the second month in a row, climbing to 153, 17 points higher than in October when the index stood at 136. This month’s rise in the ag economy sentiment index left the barometer tied with July for the highest barometer reading of 2019. Once again, the rise in the barometer was driven by improvements in farmers’ perceptions of both current economic conditions and their belief that conditions will improve in the future, with the biggest boost coming from improved perceptions of current conditions. This month’s Index of Current Conditions rose from 115 in October to 153 in November while the Index of Futures Expectations climbed just 7 points to reach a reading of 153. The Ag Economy Barometer and related indices are all based upon results from a nationwide telephone survey of 400 U.S. crop and livestock producers. This month’s survey was conducted from November 11-15, 2019. As a result, most survey responses were received before USDA’s announcement on November 15th that the second round of 2019 Market Facilitation Program (MFP) payments would be made to farmers in November.

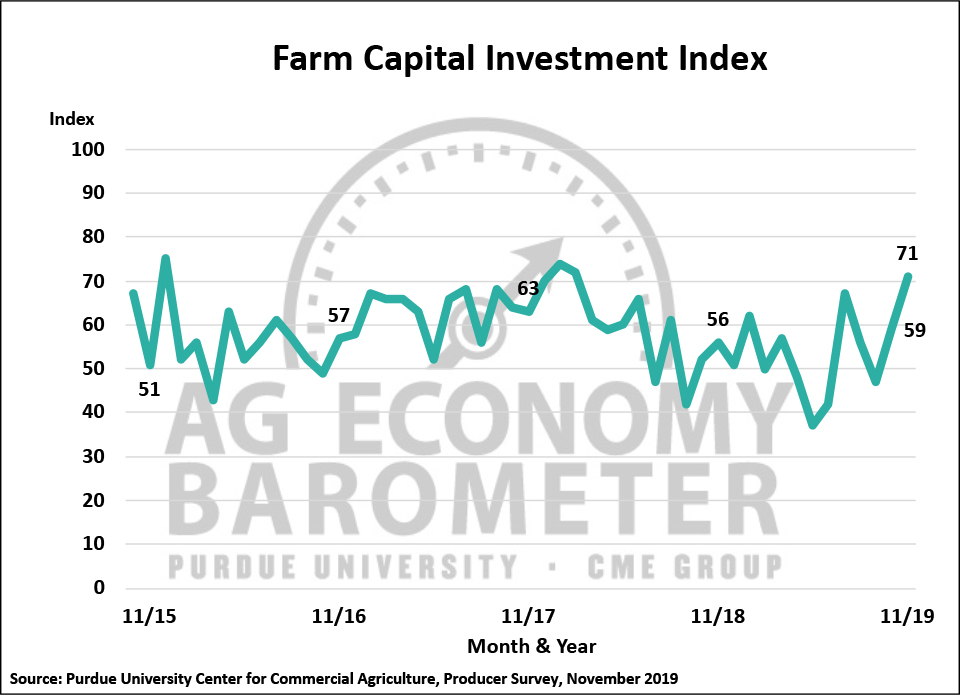

The Farm Capital Investment Index rose to a reading of 71 in November, up 12 points from a month earlier and 24 points higher than in September. This month’s rise in the investment index coincided with a sharp upward move in the Index of Current Conditions, suggesting that, as producers’ perspective regarding their farm’s current situation improved, they were more favorably inclined toward making farm capital expenditures. This month’s investment index reading was not only the highest of 2019, but the Farm Capital Investment Index’s highest value since February 2018.

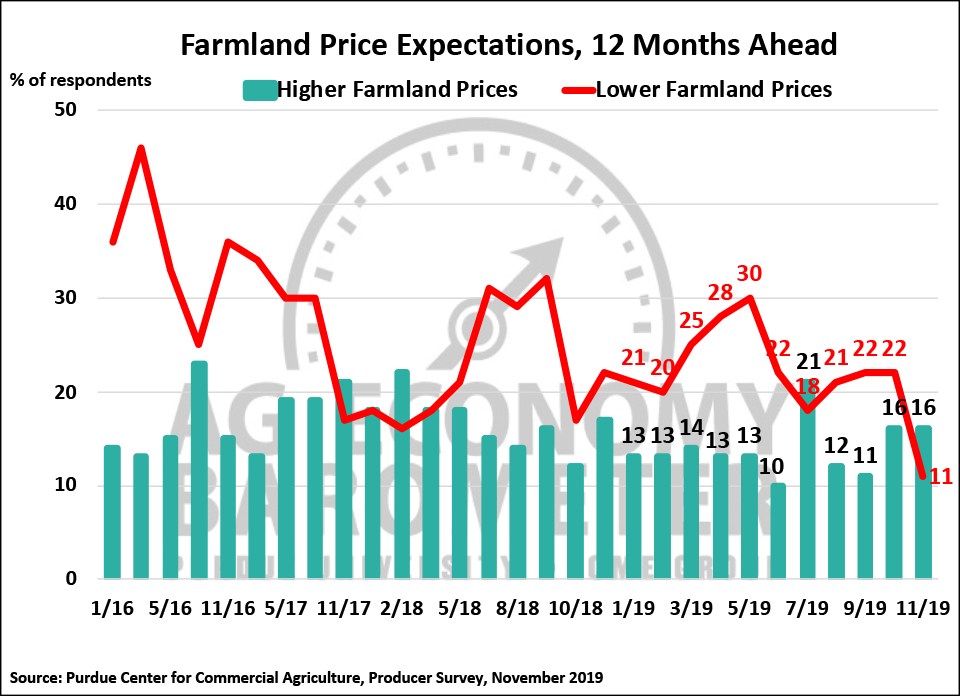

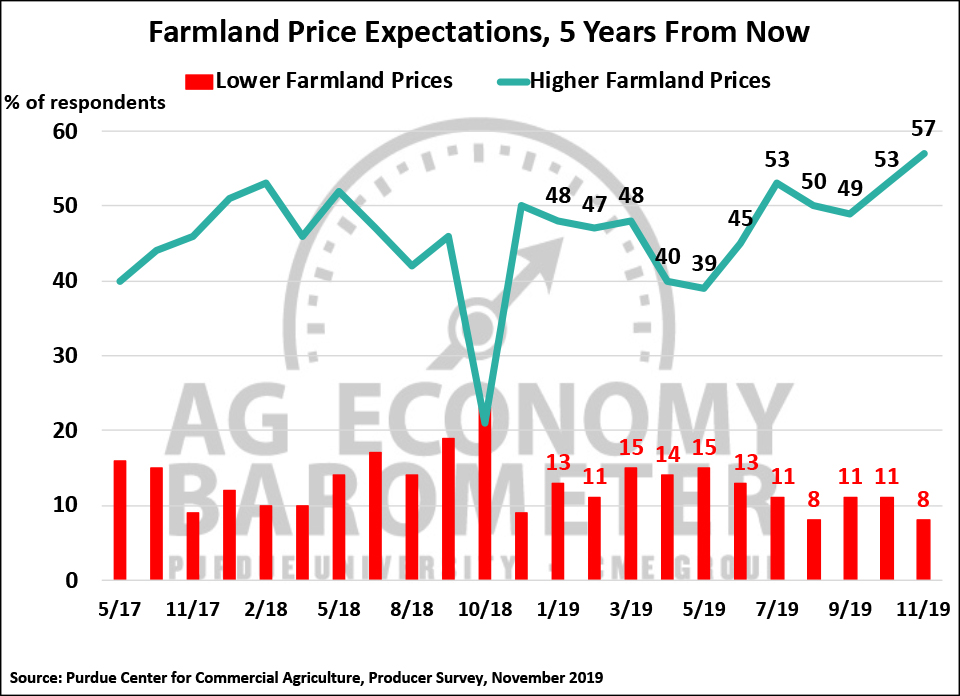

Producers had a more optimistic view regarding farmland values this month than in October. Although the percentage of farmers reporting that they expect to see higher farmland values in the upcoming 12 months did not change, the percentage expecting values to fall declined from 22 percent to just 11 percent. As a group, the shift among respondents was from expecting lower farmland values in the year ahead to expecting farmland values to remain unchanged. When asked for their perspective on farmland values five years ahead, fewer farmers said they expected values to decline than a month earlier and that shift nearly matched the increase in the percentage of farmers expecting farmland values to increase. So, looking at both time frames, producers were more optimistic about farmland values when queried in November than in October, but there was a bigger increase in confidence that farmland values would rise over the next five years than over the upcoming 12 months.

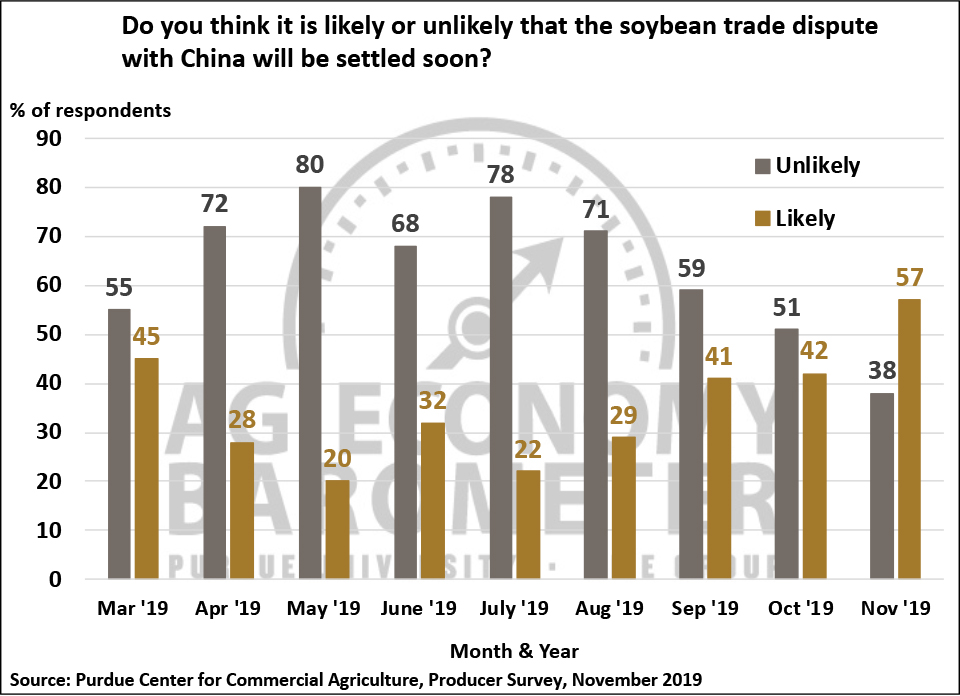

Producers in November became much more confident that the trade dispute with China will be settled soon than at any time since we started asking this question in March 2019. On the November survey, 57 percent of respondents said they expect a resolution to the trade dispute soon, up from 42 percent in October. This represented a marked shift in expectations compared to this past summer. As recently as August, just 29 percent of respondents said they expected a quick resolution to the trade dispute. Along with a rise in expectations that the trade dispute would be settled quickly, came an increase in the percentage of producers who expect the trade dispute to ultimately be resolved in a way that favors U.S. agriculture. In November, 80 percent of respondents said they expected a beneficial outcome to the trade dispute with China, up from 75 percent in October. The November survey provided the most positive response we’ve recorded for this question since we began posing it back in March of this year.

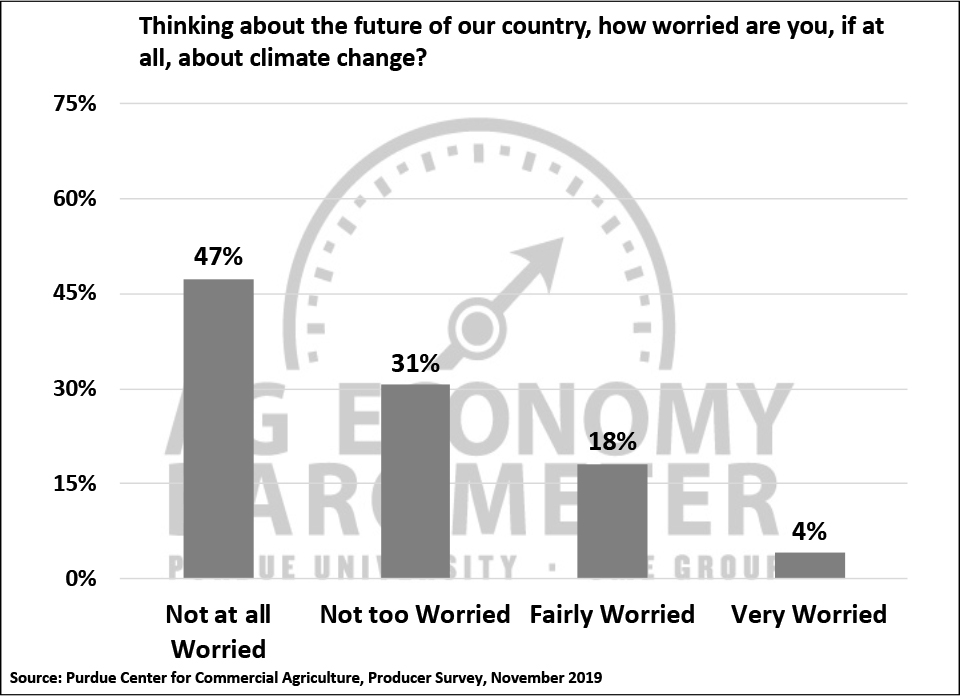

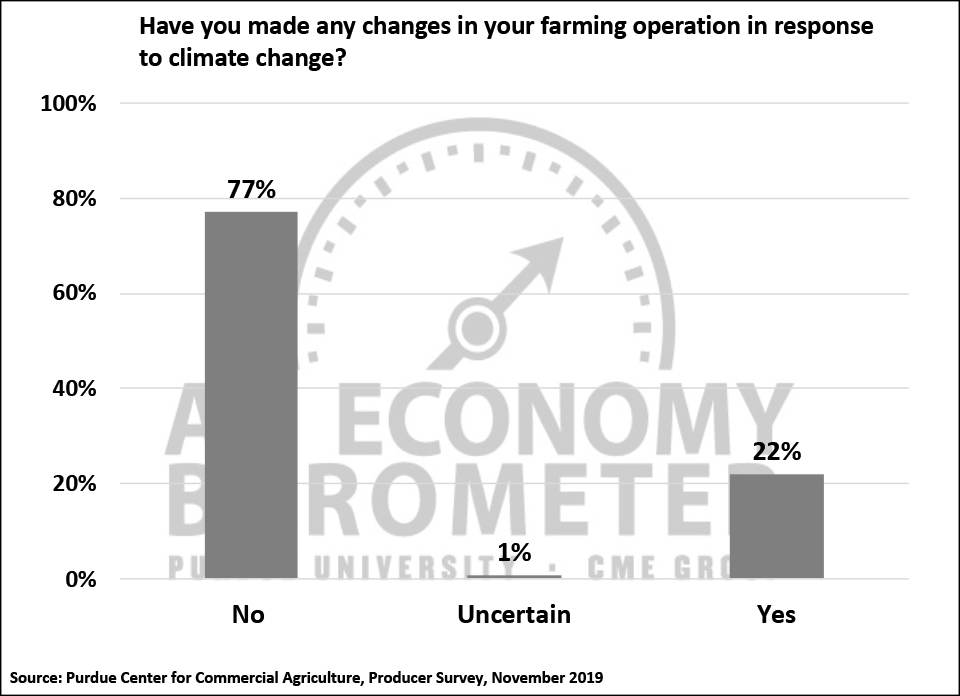

Recently the topic of climate change has made its way into agricultural group discussions, drawing questions on whether or not, producers are concerned about climate’s impact at the farm level and if they are making changes in response to those concerns. While much research has been conducted on consumers’ attitudes towards climate change, little research is available on producers’ perspectives on the issue. As a result, two climate-related questions were added to the November survey. Early responses will be used to confirm whether producers are concerned and making changes as well as monitor whether their perceptions change over time. In the first question, we asked producers how worried they are about climate change. Nearly eight out of ten respondents said they were either “not at all worried” (47 percent) or “not too worried” (31 percent) about climate change. On the other end of the spectrum, just over two out of ten respondents said they are either “fairly worried” (18 percent) or “very worried” (4 percent) about climate change. In a follow up question, we asked if respondents have made any changes to their farming operation in response to climate change. Just over three-fourths (77 percent) of producers in our survey said they had made no changes in their farming operation in response to climate change whereas 22 percent of respondents said they had made changes.

Wrapping Up

The Ag Economy Barometer rose 17 points in November compared to a month earlier, as the farmer sentiment index climbed back to the high established back in July of this year. Agricultural producers’ sentiment became markedly more optimistic about current economic conditions in agriculture and that, along with a small increase in optimism about the future, led to the barometer rising substantially from October to November. Farmers improved sentiment regarding the ag economy was also evident in that they were more favorably disposed towards making large investments in their farming operation and they were more optimistic about farmland values. When queried about climate change, a large majority of U.S. producers (78 percent) indicated that they were either “not worried at all” or “not too worried” about climate change and 77 percent of respondents said they had made no changes to their farming operation in response to climate change.