Slight increase in producer sentiment despite rising costs and lower crop prices

James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

A breakdown on the Purdue/CME Group Ag Economy Barometer April results can be viewed at https://purdue.ag/barometervideo. Find the audio podcast discussion for insight on this month’s sentiment at https://purdue.ag/agcast.

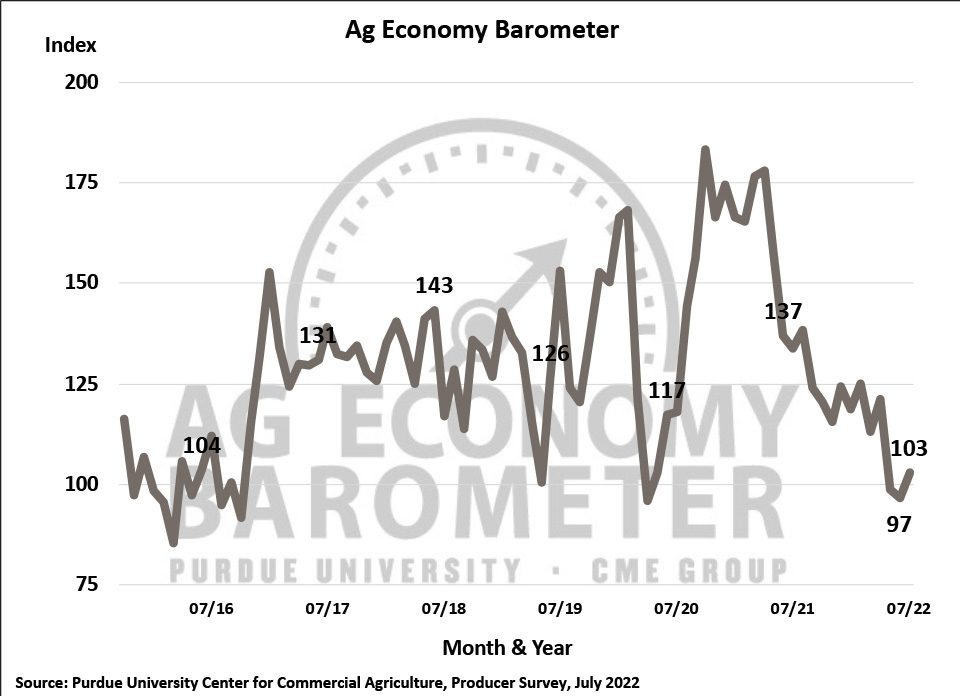

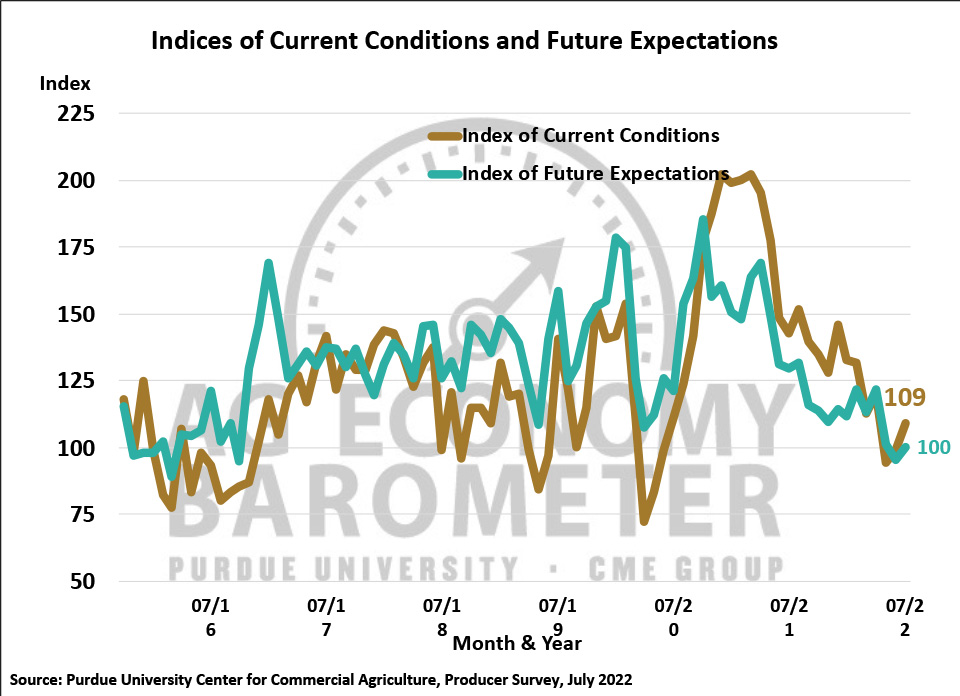

The Purdue-CME Group Ag Economy Barometer sentiment index rose 6 points in July to a reading of 103. Producers in this month’s survey were somewhat more optimistic about both current and future economic conditions on their farms than they were in June. The Index of Current Conditions rose 10 points in July to 109 while the Index of Future Expectations rose 4 points to 100. Although all three indices rose this month, they were still 23-24% lower than a year earlier. Farm operators in this month’s survey voiced concerns about several key issues affecting their operations with higher input prices (42% of respondents) receiving the number one ranking followed closely by lower crop prices (19% of respondents), rising interest rates (17% of respondents) and availability of inputs (15% of respondents). The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from July 11-15, 2022.

Figure 1. Purdue/CME Group Ag Economy Barometer, October 2015-July 2022.

Figure 2. Indices of Current Conditions and Future Expectations, October 2015-July 2022.

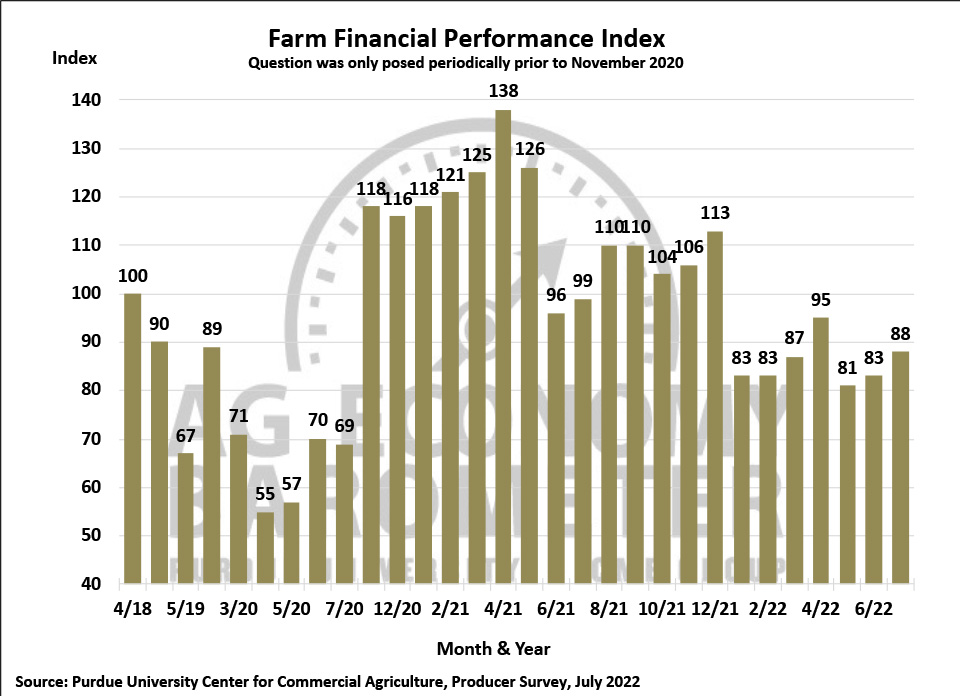

Producers’ expectations for their farms’ financial performance improved in July compared to June as the Farm Financial Performance Index rose 5 points to a reading of 88. Improvement in the index was attributable to a small shift in responses away from expecting worse performance in 2022 than last year towards expecting better financial performance than in 2021. The modest rise in the index was surprising given that key commodity prices, including wheat, corn and soybeans, all weakened during the month separating data collection for the June and July surveys. However, when asked to look ahead a year from now, there was virtually no change in producers’ responses to the July vs. the June surveys. In July, 49 percent of respondents said they expect their farm to be worse off financially a year from now, which compares to 51 percent of respondents who felt that way in June. This is a markedly more pessimistic outlook than producers provided a year ago when just 30 percent of respondents said they expect their financial condition to worsen in the upcoming year.

Although producers still expect sharp increases in crop input prices in 2023 compared to 2022, their views appear to have moderated somewhat with more producers expecting input prices to retreat in the coming year and fewer producers expecting prices to rise sharply in July than a month earlier. In July, 18% of crop producers said they expect 2023’s crop input prices to decline between 1 and 10% compared to 2022’s prices vs. just 12% of producers in June who said they expect prices to decline next year. On the other end of the spectrum, 26% of respondents in July said they expect 2023’s prices to rise by 10% or more vs. 38% of crop producers who expected a crop input price rise of that magnitude in June. Perhaps the real story is the tremendous uncertainty among producers regarding what input prices are likely to be in the upcoming year!

July marked the fourth month in a row that the barometer survey included a question asking ag producers about their expectations for the rate of inflation in consumer items over the upcoming year. Compared to responses received in April through June, producers’ expectations for inflation also showed signs of moderating in July with more producers looking for inflation to average less than 3% and fewer producers expecting inflation to exceed 10%. In July, 11% of respondents said they expect an inflation rate of less than 3% while 26% of ag producers said they think inflation will exceed 10%. These results compare to results from April through June when an average of 7% of producers said they expect the inflation rate to be less than 3% and 32% of respondents said they expect the rate of inflation to exceed 10%.

Figure 3. Farm Financial Performance Index, April 2018-July 2022.

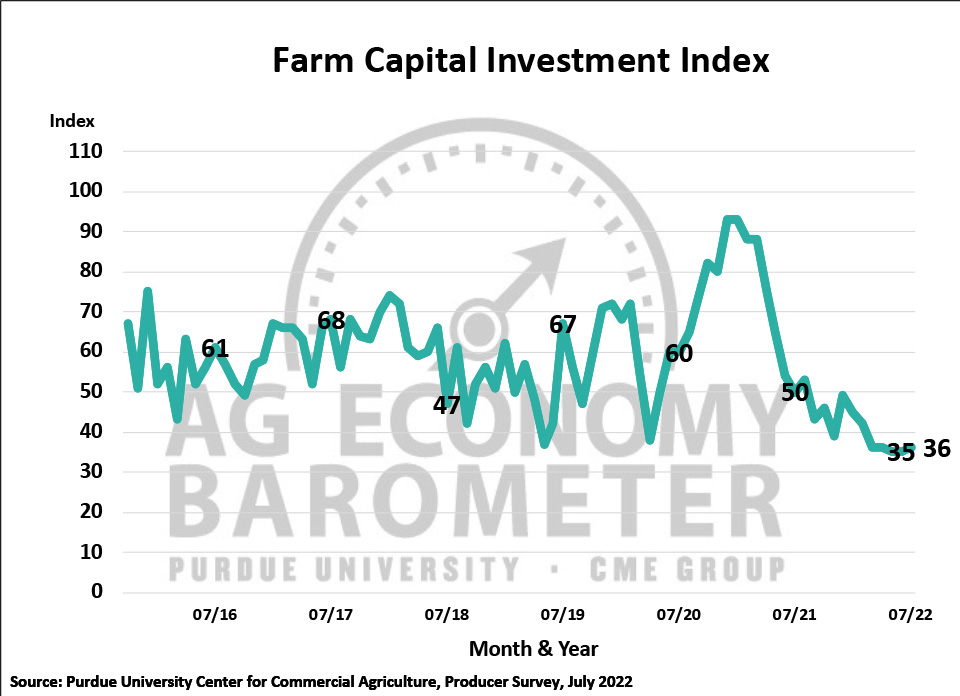

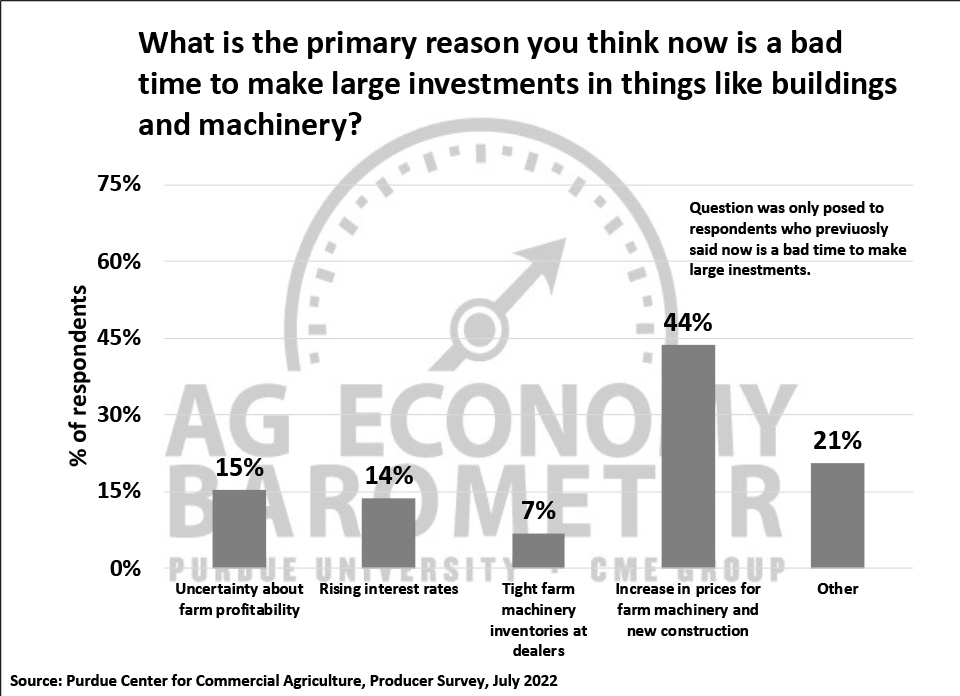

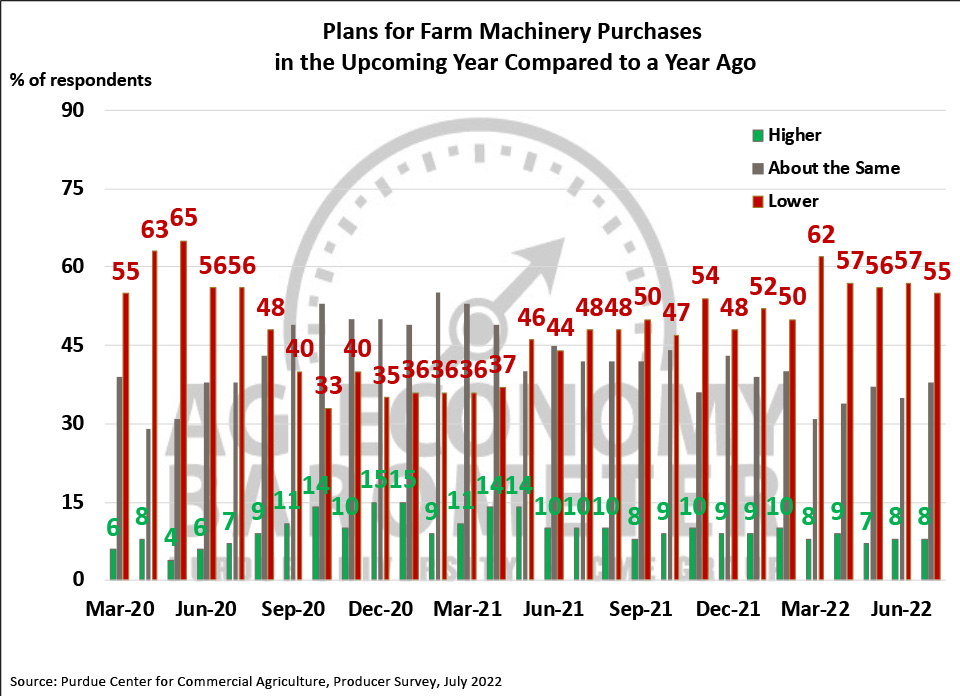

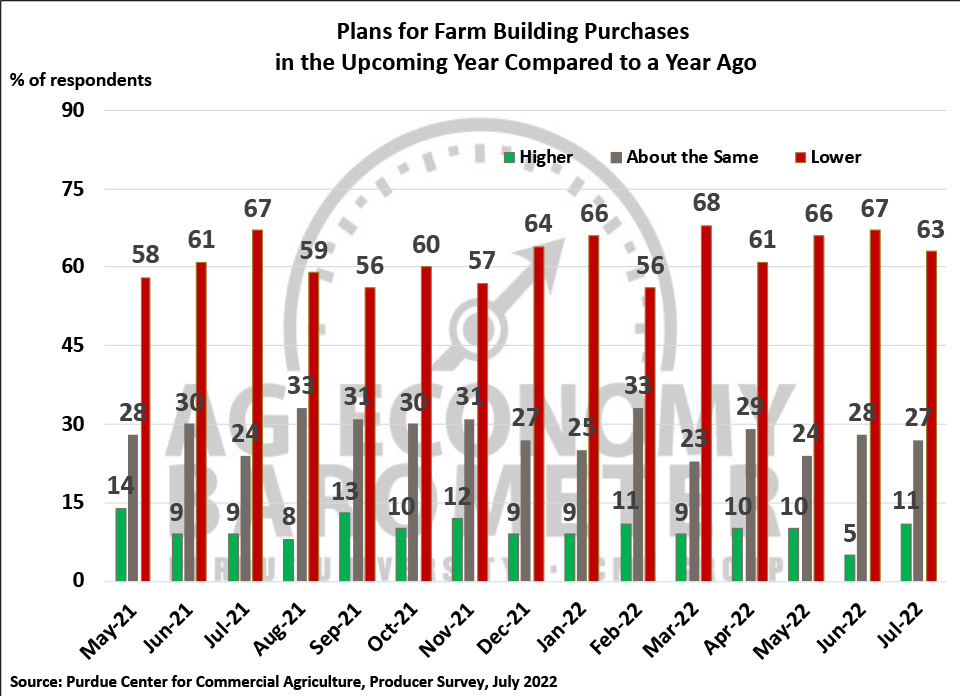

The Farm Capital Investment Index was virtually unchanged in July with a reading of 36 compared to 35 in June. This month’s reading, the fifth month in a row that the investment index was mired in the mid-30s, was 28% lower than a year earlier. Results from a new question included in this month’s survey shed some light on why producers view now as a poor time to make large investments in their farming operation in the face of strong farm machinery, building, and bin sales. Respondents who said now is a bad time for large investments were asked for the primary reason they felt that way. The most common response, chosen by 44% of those respondents, was “increase in prices for farm machinery and new construction”. Uncertainty about farm profitability was chosen by 15% of respondents while 14% of respondents chose rising interest rates as the primary reason they viewed now as a bad time for large investments. Somewhat surprisingly, only 7% of respondents chose “tight farm machinery inventories at dealers” as their primary reason for responding negatively to the investment question

Figure 4. Farm Capital Investment Index, October 2015-July 2022.

Figure 5. Why is now a bad time to make large investments?, July 2022.

Figure 6. Plans for Farm Machinery Purchases in the Upcoming Year Compared to a Year Ago, March 2020-July 2022.

Figure 7. Plans for Constructing New Farm Buildings and Grain Bins, May 2021-July 2022.

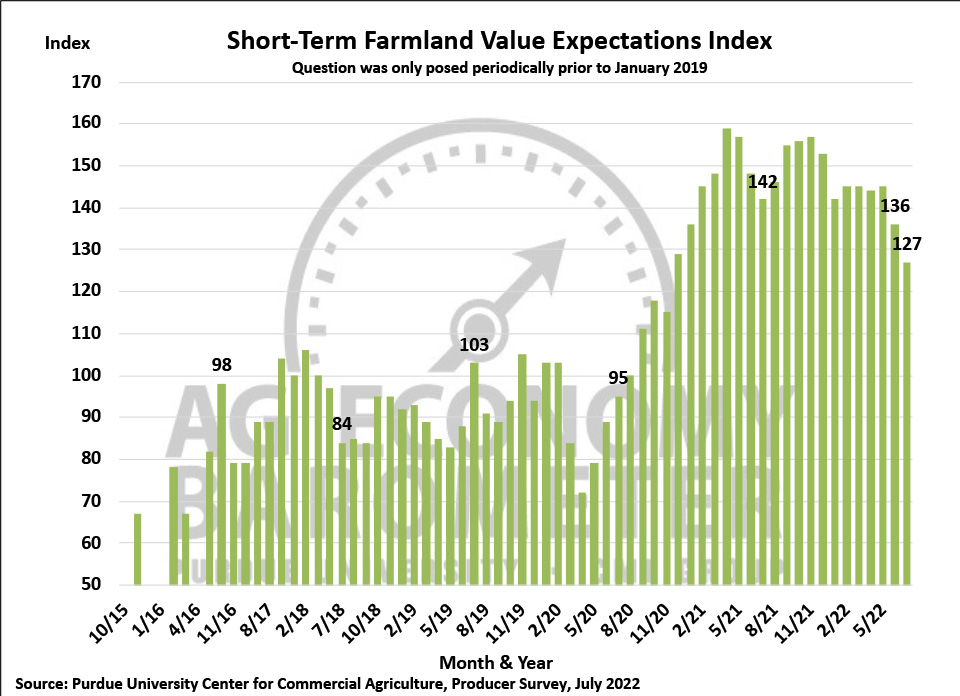

Figure 8. Short-Term Farmland Value Expectations Index, November 2015-July 2022.

Forty-two percent of corn and soybean producers in the July survey said they expect cash rental rates to rise in 2023, down from 52% of respondents who said they were looking for rates to rise in the June survey. The magnitude of the rental rate increase expected by those respondents who think rates will rise was smaller than revealed in the June survey suggesting that weaker commodity prices and high input costs could hold back rental rate increases. Among those respondents expecting rental rates to rise, 23% expect an increase of less than 5% and 34% expect the rate increase to exceed 10%. In June, 18% expected a rental rate increase of less than 5%, while 42% said they thought rates would rise by more than 10%.

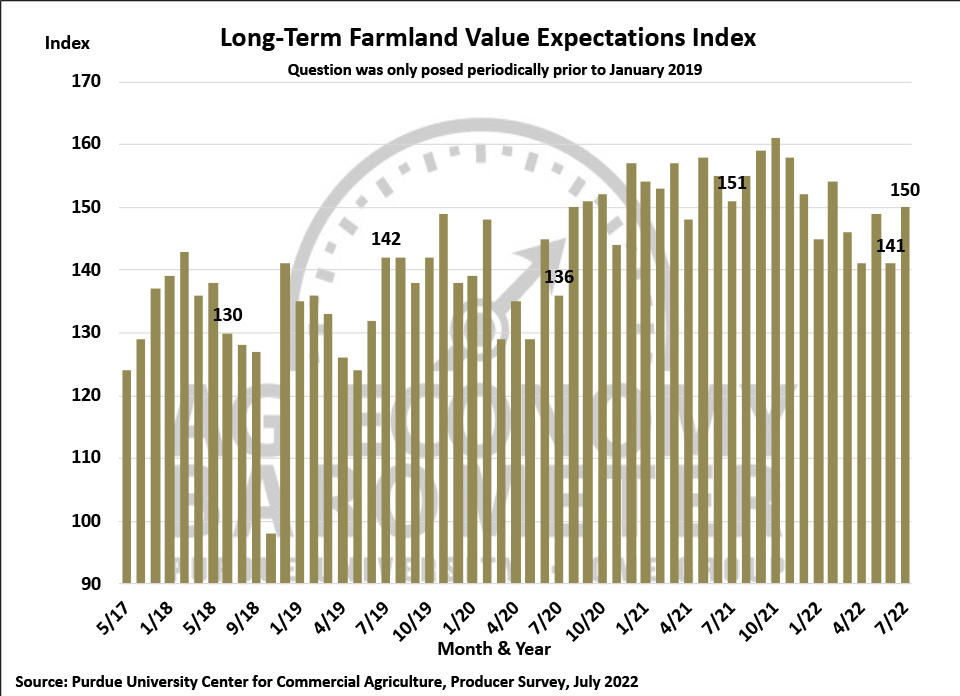

Producers’ views on farmland values diverged this month as the Short-Term Farmland Value Index declined 9 points to 127 while the long-term index rose 9 points. July marked the second consecutive 9-point decline in the short-term index leaving it 20% below its 2021 peak reading. Weakness in the short-term index the last two months was primarily attributable to a shift away from expecting higher farmland values to expecting values to remain about the same. The rise in the long-term index occurred because of a shift away from expecting values to decline to values rising over the next five years. The farmland indices don’t always move in tandem, but the magnitude of this month’s divergence between the short and long-term indices is unusual. Producers who expect values to rise over the upcoming 5 years continue to say that non-farm investor demand and inflation are the two primary reasons they expect values to rise.

Figure 9. Long-Term Farmland Value Expectations Index, May 2017-July 2022.

The rise in input costs is leading some producers to reassess their cropping plans for the upcoming year. In this month’s survey, nearly one out of four (24%) of crop producers said that as a result of the rise in input costs they plan to change their farm’s crop mix in 2023. This was up from a month earlier when 19% of producers said they planned to make changes in their crop mix for 2023. In a follow-up question, which was posed only to producers planning to adjust their crop mix, regarding what will be the biggest change in their crop mix, over half (53%) of respondents said they plan to increase the percentage of their cropland devoted to soybeans. In a separate set of questions, 26% of producers who told us they planted winter wheat last year said they plan to increase their wheat acreage this fall. This changed little from last month when 24% of winter wheat producers in our survey said they planned to increase their wheat acreage for harvest in 2023.

Wrapping Up

Farmer sentiment improved modestly in July as the Ag Economy Barometer rose 6 points above its June reading. The sentiment improvement occurred primarily because producers felt better about their current situation as the Index of Current Conditions rose 10 points. Producers’ assessment of their current financial situation improved as the Farm Financial Performance Index rose 5 points in July, but when asked to look ahead one year nearly half of all respondents said they expect their farms’ financial condition to worsen in the upcoming year. Producers’ top concerns for the upcoming year continue to focus on the rise in input prices followed closely by lower crop prices, rising interest rates and availability of inputs. All of these factors point to a high level of uncertainty among ag producers which helps explain why farmer sentiment remains weak.