Weak crop prices lead to sharp decline in producer sentiment

WEST LAFAYETTE, Ind. and CHICAGO – After months of increases in producer sentiment toward the U.S. agricultural economy, the August reading of the Purdue/CME Group Ag Economy Barometer showed that declining commodity prices are weighing on the minds of producers.

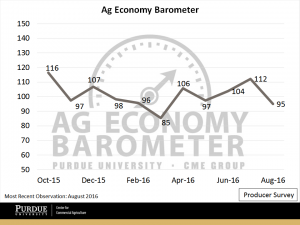

Producer sentiment declined sharply to 95 – a 17-point drop from the July reading. The barometer is based on a monthly survey of 400 U.S. agricultural producers and includes measures of sentiment toward current conditions and future expectations.

The Index of Current Conditions fell from 93 in July

The August Producer Sentiment Index fell sharply as corn and soybean yield projections soared and futures prices tumbled. (Purdue/CME Group Ag Economy Barometer/David Widmar)

to 80 in August, while the Index of Future Expectations dropped to 102 from July’s 121.

“This was in sharp contrast to July when farmers’ optimism about future prospects pushed the barometer up, despite their concerns about current economic conditions,” said Jim Mintert, the barometer’s principal investigator and director of Purdue’s Center for Commercial Agriculture. “Farmer sentiment in late spring and early summer was buoyed by a spring rally in key commodity prices, but near-ideal growing conditions for corn and soybeans this summer helped push yield prospects up and crop prices down sharply.”

Since the peak of the price rally in mid-June, December 2016 corn futures have fallen by more than $1 per bushel and November soybean futures by $1.75 per bushel.

In its August Crop Production report, the U.S. Department of Agriculture indicated that record corn and soybean yields are expected this fall. If that’s the case, carryover stocks for both crops will grow, potentially resulting in the lowest corn prices in a decade.

Unsurprisingly, the resulting tighter operating margins are leading to adjustments in production costs, said David Widmar, senior research associate who works on the barometer.

“What is somewhat surprising is that more producers expect input prices to rise in 2017 than decline,” he said. “This was especially true for crop protection products, as nearly one-third of respondents expected prices to increase for herbicides, insecticides and fungicides. The long-term trend for crop input prices to rise seems to be leading to skepticism regarding prospects for input prices to decline, despite the lack of profitability among crop producers.”

Read the full August report, find additional resources and sign up to receive monthly barometer email updates athttp://purdue.edu/agbarometer.

About the Purdue University Center for Commercial Agriculture

The Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within Purdue University’s Department of Agricultural Economics, the center’s faculty and staff develop and execute research and educational programs that address the different needs of managing in today’s business environment.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) is where the world comes to manage risk. CME Group exchanges offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. Around the world, CME Group brings buyers and sellers together through its CME Globex® electronic trading platform and its exchanges based in Chicago, New York and London. CME Group also operates one of the world’s leading central counterparty clearing providers throughCME Clearing and CME Clearing Europe, which offer clearing and settlement services across asset classes for exchange-traded and over-the-counter derivatives. CME Group’s products and services ensure that businesses around the world can effectively manage risk and achieve growth.

CME Group is a trademark of CME Group Inc. The Globe Logo, CME, Globex and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. CBOT and the Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are registered trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. All other trademarks are the property of their respective owners. Further information about CME Group (NASDAQ: CME) and its products can be found at www.cmegroup.com.

Writer: Jennifer Stewart-Burton, 765-496-6032, jsstewar@purdue.edu

Sources: Jim Mintert, 765-494-4310, jmintert@purdue.edu

David Widmar, 765-494-0848, dwidmar@purdue.edu

Chris Grams, 312-930-3435, chris.grams@cmegroup.com