Farmland Market Outlook for 2020

December 18, 2019

PAER-2019-16

Authors: Todd H. Kuethe, Associate Professor, Schrader Endowed Chair in Farmland Economics and Craig Dobbins, Professor of Agricultural Economics

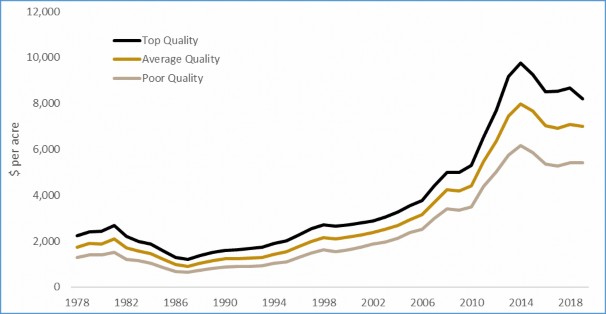

Indiana farmland prices have moderated in recent years from the historic peak in 2014. Average quality farmland prices have declined 2.5% per year since 2014. The 2019 Purdue Farmland Value Survey indicated that average quality farmland was valued at $7,011 per acre, 12.1% below the peak. Several market forces suggest that downward pressure is likely to continue in 2020, but many market participants still view farmland as a good long-term investment.

Farmland prices are determined by their stream of future returns, discounted over the life of the asset. As a result, farmland market participants closely monitor changes in farm profitability (future returns) and interest rates (or discount rates).

Farmland returns have declined in recent years in Indiana and across the Corn Belt, as the results of low commodity prices. Respondents of the 2019 Purdue Farmland Value Survey suggest that current net farm income was the primary driver of farmland prices declines in 2019. The USDA’s recent forecasts suggest that US net farm income will increase in 2019 to $92.5 billion, just above the historical 2000–2018 average. However, a significant portion of USDA’s forecasted income increase is due to Market Facilitation Program payments which were provided to offset some of the losses associated with disruption in trading relationships with China.

It is difficult to predict what will happen to interest rates in 2020. In 2015, the Federal Reserve’s Federal Open Market Committee began slowly increasing the federal funds rate, the benchmark short-term borrowing rate. The committee reversed course at the end of 2019 over fears of a potential recession and intense political pressure to reduce rates. Despite these changes to short-term rates, farm mortgage rates have remained relatively stable. The stable long-run interest rates helped buoy farmland prices despite declines in farm income.

Despite the high uncertainty related to farm returns and interest rates, many still see farmland as a good long-term investment. Optimists point toward the long-run earning (revenues minus costs) potential for farmland as a way to justify higher expected farmland prices. Long-run earning potential is supported by the growing demand for calories and proteins supplied by agricultural commodities and by the potential of emerging technological developments to boost yields and improve production efficiency. These changes, however, are not expected to impact farmland markets in the near term. At the current time, there does not appear to be anything in the market that will cause the demand for agricultural commodities to outpace supply. Therefore, earnings are likely to see only modest improvements, resulting in fairly steady farmland values in the near term.