2024 Purdue Crop Cost & Return Guide

January 16, 2024

PAER-2024-11

Michael Langemeier, Professor of Agricultural Economics

The 2024 Purdue Crop Cost and Return Guide, which is available for free download from the Center for Commercial Agriculture website, gives estimated costs for planting, growing and harvesting a variety of crops, as well as estimated contribution margins and earnings. The guide is updated frequently as grain futures prices change and the costs of inputs, such as seed, fertilizer, pesticides and fuel, fluctuate. This paper discusses estimates made in early December.

The guide presents cost and return information for low, average, and high productivity soils. The discussion in this paper will focus on the estimates for average productivity soil. Table 1 presents crop budget information for continuous corn, rotation corn, rotation soybeans, wheat, and double-crop soybeans for average productivity soil. Double-crop soybeans are typically planted after wheat so it is typical to combine the contribution margin for these two crops when comparing to continuous corn, rotation corn, and rotation soybeans. The yield estimates reflect trend yields for Indiana for each crop. The contribution margin, obtained by subtracting total variable cost from market revenue, ranges from $217 per acre for continuous corn to $442 per acre for wheat/double-crop soybeans. The contribution margins for rotation corn and rotation soybeans on average productivity soil are $306 and $384 per acre, respectively. The contribution margin is used to cover overhead costs such as machinery ownership costs, family and hired labor, and cash rent. Failure to adequately cover these overhead costs typically puts downward pressure on cash rent and land values.

From 2007 to 2013, the contribution margin for rotation corn on average productivity soil was higher than the contribution margin for rotation soybeans. The average difference in the contribution margin was $38 per acre during the 2007 to 2013 period. The situation was considerably different from 2014 to 2023. The average difference in the contribution margin during this period was an advantage for soybeans of $55 per acre. The projected difference in contribution margins between corn and soybeans for 2024 is $78 per acre in favor of rotation soybeans.

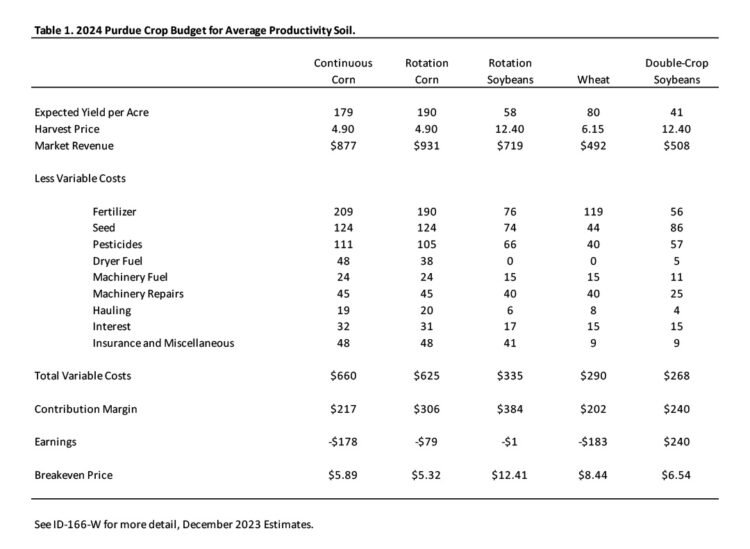

Figure 1 illustrates the trends in fertilizer, seed, pesticide, and cash rent costs for rotation corn on average productivity soil from 2015 to 2024. Fertilizer costs in 2024 are expected to be approximately 19 percent lower than what they were in 2023. However, fertilizer costs are still expected to be $39 per acre ($0.21 per bushel) higher than costs in 2021. Cash rent per acre in 2024 is expected to be $253 per acre ($1.33 per bushel), which is similar to the 2023 cash rent per acre. Herbicide and seed costs are expected to be similar to 2023 levels.

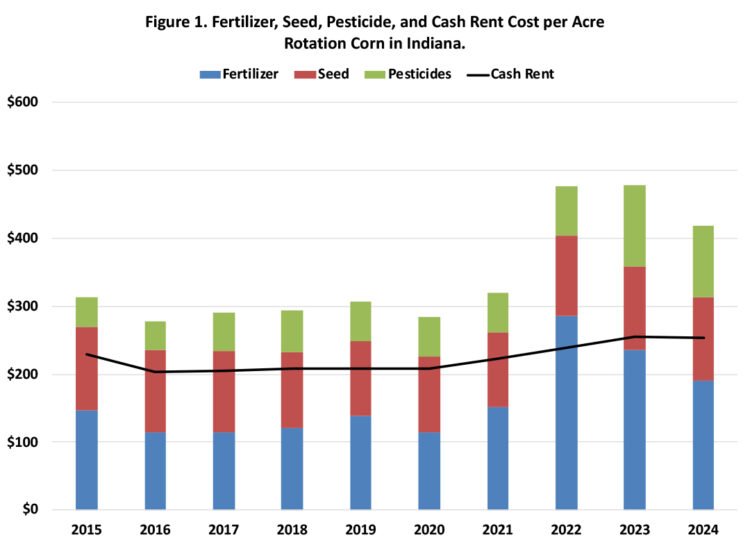

Gross revenue (market revenue plus government payments), variable cost, and overhead cost per acre for rotation corn on average productivity soil is illustrated in figure 2. Government payments are expected to zero in 2024. Variable cost per acre in 2024 is expected to be $58 lower than it was in the 2023 budget, which represents an 8.5 percent decline. Variable cost per bushel in 2024 is estimated to be $3.29. Fixed cost (overhead cost) per acre is projected to be $385, which is similar to last year’s cost. The breakeven price needed to cover variable and fixed costs varied from $4.89 to $4.98 per bushel from 2013 to 2015. In 2016 and 2017, the breakeven price declined to approximately $4.55 per bushel. The breakeven prices in 2018 and 2019 were approximately $4.45 per bushel, respectively. Breakeven prices in 2020 and 2021 were approximately $4.20 and $4.45, respectively. The breakeven price for 2022 was $5.60 per bushel, which was 25.6 percent higher than the 2021 breakeven price. In 2023, the breakeven price was $5.82 per bushel or 3.8 percent higher than the 2022 breakeven price. In 2024, the projected breakeven price is expected to decline to $5.32, which is above projected fall 2024 corn prices. Gross revenue for rotation corn in 2024 is expected to be $931 per acre or 3.6 percent lower than gross revenue in 2023. Combining the expected gross revenue for 2024 with total production costs (variable plus fixed costs) results in an expected loss for rotation corn of $79 per acre.

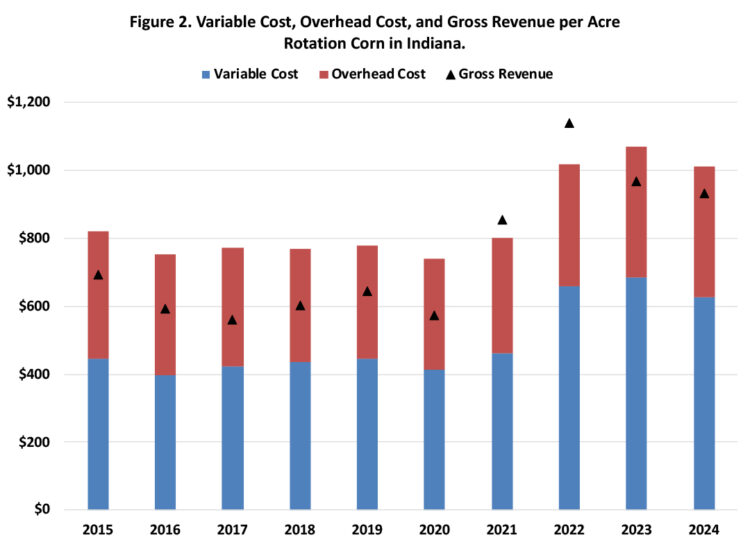

Figure 3 illustrates the trends in fertilizer, seed, pesticide, and cash rent costs for rotation soybeans from 2015 to 2024. Fertilizer and herbicide costs in 2024 are expected to be approximately $10 per acre lower to costs in 2023, but still substantially above those experienced in 2021.

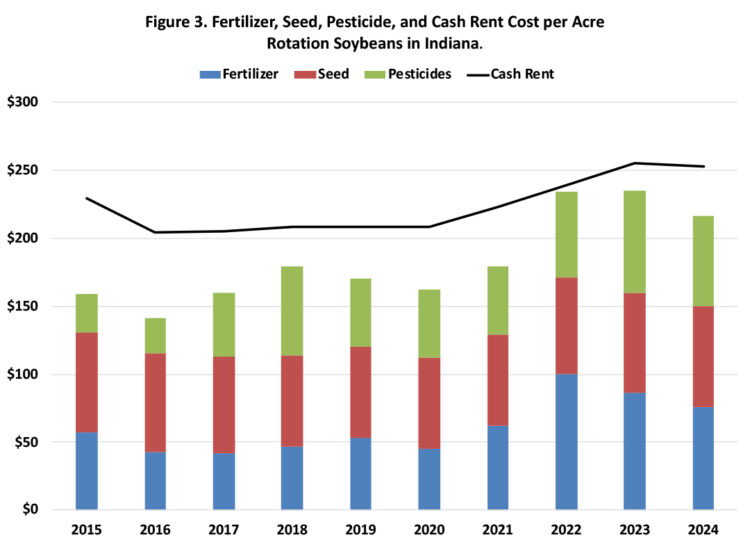

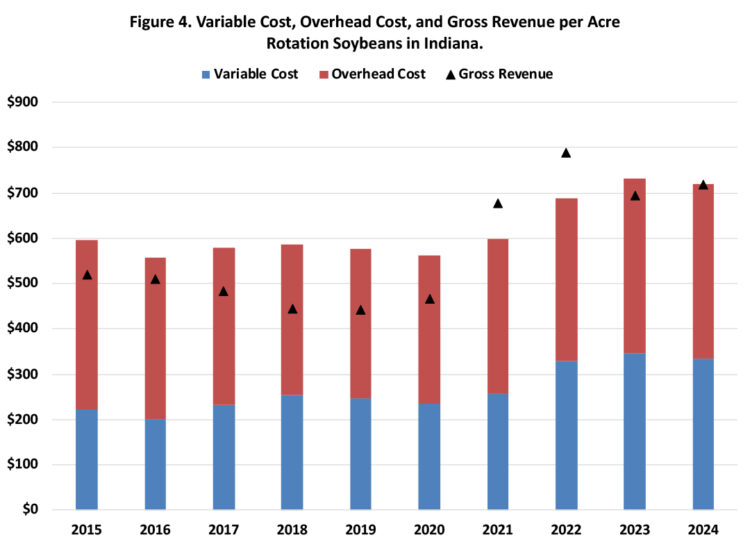

Gross revenue (market revenue plus government payments), variable cost, and overhead cost per acre for rotation soybeans on average productivity level is illustrated in figure 4. Government payments are expected to be zero in 2024. Variable cost per acre in 2024 is projected to be $335 per acre ($5.78 per bushel), or approximately 3 percent lower than they were in 2023. Fixed cost per acre is projected to be $385 per acre in 2024. The breakeven price needed to cover variable and fixed costs is expected to decrease from $13.07 in 2023 to $12.41 per bushel in 2024, which represents a 5 percent decline. The expected loss in 2024 for rotation soybeans is $1 per acre.

The breakeven prices for rotation corn and rotation soybeans discussed above were for average productivity land. For high productivity land, the breakeven prices for rotation corn and rotation soybeans are expected to be $4.93 and $11.72 per bushel, respectively. Though the difference in relative profits is smaller than it was on average productivity land, rotation soybeans are expected to be more profitable than rotation corn on high productivity land. The breakeven prices for low productivity land are expected to be $5.65 and $13.43 per bushel for corn and soybeans, respectively. Rotation soybeans are expected to be more profitable than rotation corn on low productivity soil.

In summary, despite lower production costs, margins are expected to be relatively tight again in 2024. However, margins for rotation corn and rotation soybeans are close to breakeven on high productivity soil. The relatively high-cost structure along with tight margins, increases the importance of carefully scrutinizing input and crop decisions. Producers are encouraged to create crop budgets and in general improve their record keeping.