Another Difficult Year for Beef Cattle Producers

December 12, 2016

PAER-2016-15

James Mintert, Professor of Agricultural Economics

Cattle prices fell harder, and faster, during 2016 than most beef industry participants expected. The peak in slaughter cattle prices during this cattle cycle occurred in 2014 when slaughter weight steers in the Southern Plains averaged $154 per cwt. and prices remained above or near that level through much of 2015, before dropping precipitously during the fall of 2015. At the beginning of 2016 weekly average prices for slaughter steers in the Southern Plains were 22% lower than a year earlier. Prices for slaughter steers remained below a year earlier throughout 2016 and dipped below $100 per cwt. in mid-October before recovering to about $114 per cwt. in early December. For the year, slaughter steer prices in the Southern Plains averaged about $120 per cwt. in 2016, nearly 20% lower than in 2015, when they averaged $148 per cwt.

Weaker than expected slaughter cattle prices meant most cattle feeding programs were unprofitable again during 2016. Iowa State Extension’s estimates of Corn Belt cattle feeding returns indicate that a program of routinely placing 750-pound steers on feed each month and then marketing approximately 150 days later yielded an average loss during 2016 of over $100 per head. The largest losses for this simulated feeding program took place early in the year, exceeding $300 per head in January, before briefly moving into the black in late spring. Losses began anew in the summer, and by October estimated losses were once again over $200 per head. The accumulated losses of 2015 and 2016 have placed a tremendous amount of stress on cattle feeders as equity built up in prior years has vanished.

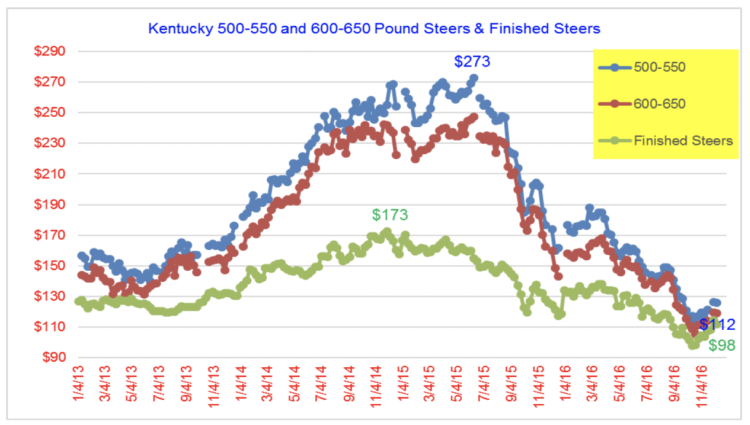

Lower prices for feeder cattle and calves reduced prices needed by cattle feeders to breakeven when selling slaughter weight steers and heifers, but not by enough to make feeding cattle profitable during most of 2016. This despite the fact that prices for 700-800 pound feeder steers in Kentucky averaged $151 per cwt. during the first quarter of 2016, more than $50 per cwt. (26%) lower than a year earlier. Similarly, prices for 500-600 pound steer calves in Kentucky averaged $183 per cwt. during January-March 2016, $80 per cwt. (30%) lower than during 2015’s first quarter. For the year, Kentucky feeder weight steers averaged about $137 per cwt. in 2016, down 32% compared to the prior year, while prices for 500-600 pound Kentucky steer calves averaged near $153 per cwt., 36% lower than in 2015.

Larger supplies of slaughter cattle and increasing beef production helped push prices lower during 2016, although the price decline was larger than expected based on the supply increase alone. Cattle slaughter totaled about 30.4 million head in 2016 and beef production exceeded 25 billion pounds, both of which were nearly 6% greater than in 2015. Although beef imports were smaller, and exports larger, than in 2015, estimated per capita beef supplies at retail were still nearly 3% larger than in 2015. Per capita supplies of other meats also increased modestly and consumers were faced with a retail meat supply of nearly 214 pounds per capita in 2016, up from 211 pounds in 2015.

Total meat supplies have rebounded sharply since bottoming out in 2014 at 201 pounds per capita and are expected to increase again in 2017, possibly reaching 217 pounds per capita. This brings total meat supplies a step closer to the record large supply levels that consumers faced roughly a decade ago when per capita red meat and poultry supplies hit 222 pounds per capita. The increase in domestic meat supplies means that prices for retail beef prices and cattle prices will both be under pressure again in 2017.

Kentucky 500-550 and 600-650 Pound Steers & Finished Steers

What’s ahead in 2017? Beef producers started expanding their herds during 2014 and continued to expand in 2015 and 2016. The expansion means that cattle slaughter and beef production during 2017 will both increase compared to 2016, but the increase is expected to be smaller than what took place in 2016, perhaps ranging between 3% and 4%. Still, the increase in supplies is expected to push prices for slaughter steers in the Southern Plains lower with an annual average near $110 per cwt. likely.

Another decline in slaughter cattle prices means downward pressure on calves and feeder cattle is likely. After averaging near $153 per cwt. in 2016, prices for 500-600 pound steers in Kentucky could average in the $120’s in 2017. Calf prices at this level are below the breakeven price on many cow-calf operations, which could bring herd expansion to a halt in 2017. Recent cattle slaughter data supports this idea as female slaughter has been rising relative to steer slaughter, which indicates the interest in expansion is waning.

The visual shows the extraordinary rise and fall of Kentucky steer calves and finished cattle prices in the past four years.