COVID-19 Disruptions to Indiana Food Supply Chain

April 20, 2021

PAER-2021-2

Authors: Kendra Morrissette, Ph.D. Candidate; Jayson Lusk, Distinguished Professor & Purdue Ag Econ Department Head; and Brian Bourquard, Senior Director at EY-Parthenon, Food and Agriculture Strategy

Background

The past year has been nothing short of record-setting, not only in the United States, but around the world since the outbreak of the coronavirus. March 2021 began a year of disruption, change, and shifting of not only how we live and operate in our daily lives but how our food is produced, transported, and sold. The coronavirus did not spare any industry, and agriculture is not exception. This paper aims to discover the impact that the coronavirus had on revenues from major commodities in Indiana.

The largest crops produced in Indiana are corn and soy, whose production total over 10 million acres combined. Indiana farmers produced $3.3 billion in corn and nearly $2.5 billion in soybeans in 2019, which in total represents half of Indiana’s farm commodity sales. Indiana is home to two large pork processing plants, and as a result, export a significant amount of pork each year. Because pork processors were significantly impacted by the coronavirus, this report investigate the impacts of COVID19 on this industry. Additionally, Indiana is the 2nd largest egg producing state in the country producing 847 million (measured in dozens) eggs in 2020.

Data & Analysis

To determine impacts of COVID-19 on revenues for corn, soybeans, hogs, and eggs, we relied on monthly price and production data supplied by the U.S. Department of Agriculture. In each case, 2019 data were used to extrapolate the the quantities and prices that would have been witnessed had COVID-19 not occurred, and these values were compared to the revenues and production values actually witnessed in 2020. The difference between these two values is the estimate of change in revenue or production from COVID. Because not all price changes are a result of COVID, for corn and soy, we calculated a range of economic damage attributed to COVID-19 using three different values: 50%, 75%, and 100%.

Results

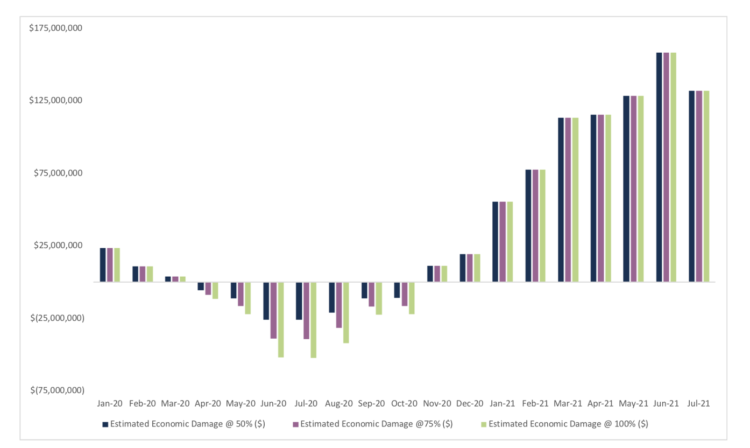

Figure 1 shows the estimated monthly economic impact to the corn crop in Indiana due to the coronavirus. There were revenue losses beginning in April 2020 and continuing late into the year; however, a recovery began as 2020 came to an end. The estimated losses to corn production in Indiana from January to December 2020 due to COVID-19 were between $42 and $155 million. A significant driver behind this reduction in corn prices is the decrease in demand for ethanol and corn as animal feed as the stay-at-home orders went in effect throughout the United States forcing consumers to stay home and food service industries to close. A similar analysis was done estimating the impact of COVID-19 on the soybean crop in Indiana; however, March was the only month of 2020 to see a decrease in the price of this commodity.

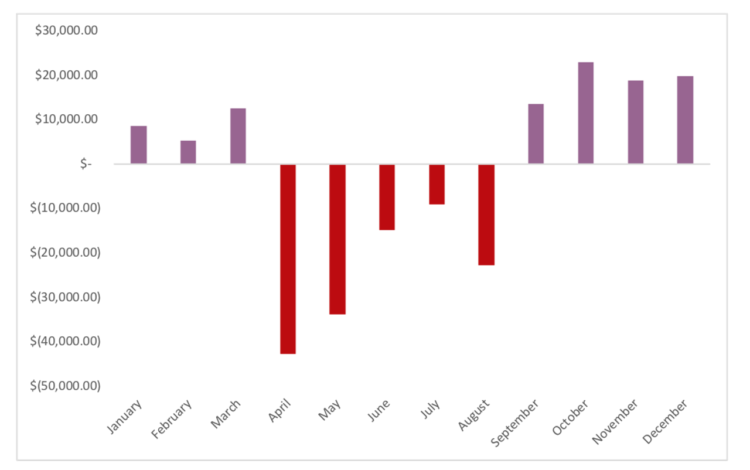

Revenue losses to the hog industry in Indiana due to COVID-19 are about $21 million from January through December 2020. The estimated monthly losses are shown in Figure 2. The red bars show the months with estimated losses to the industry. April through August show losses to pork production; however, the industry recovered to pre-coronavirus production levels by September 2020.

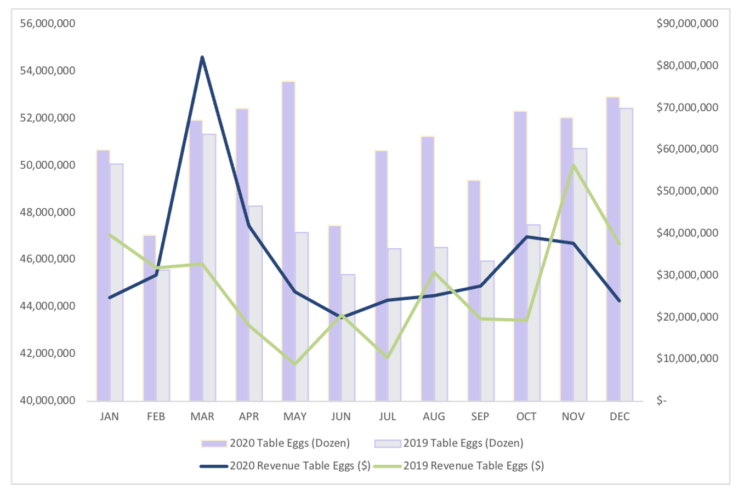

Estimates show a significant increase in table egg revenue at the beginning of the pandemic followed by a quick price drop off as supply chains adjusted. For the 2020 (as compared to 2019) production of table eggs were higher month over month for the entire year (Figure 3). We see a similar pattern with breaker egg prices (Figure 4) increasing in revenue during March 2020 but dropping back to historic levels in April 2020.

Summary

Overall, there were significant impacts to the agriculture industry in Indiana because of the ongoing pandemic with the largest impacts seen in the corn and hog industry; however, both industries recovered by late summer. Fast adjustments along the food supply chain paired with a recovery in commodity prices, led by an increase in exports to China and adverse weather condition in parts of the Midwest, helped agricultural markets recover by the end of 2020.

Figure 1: Estimated Monthly Economic Damage to Corn Crop in Indiana Due to COVID-19

Figure 2: Estimated Loss for Indiana Hog Production Per Month

Figure 3: Indiana Table Egg Production and Estimated Revenue Losses

Figure 4: Indiana Breaker Egg Production and Estimated Revenue Losses