Farmland and Cash Rent Outlook

December 13, 2014

PAER-2014-20

Craig Dobbins, Professor of Agricultural Economics

Farmland Values

The large positive margins that existed in crop production for the last several years have disappeared. Falling prices of corn, soybeans and wheat have dropped well below the full-cost breakeven point of most producers. Will these negative margins lead to a decline in farmland values comparable to recent increases? Using history as a guide, such a decline seems unlikely in the short term.

While grain prices have fallen sharply, most of the other factors influencing the farmland market still remain positive. Interest rates still remain at historical lows. The amount of land offered to the market still remains small and the prospects of a sharp increase in farmland for sale because of financial stress like the early 80s seems unlikely. Farmland as an investment is still attractive; providing a competitive annual return and over the long-run a positive capital gain. While the cropping sector will be under stress, the livestock sector has found renewed strength as a result of strong livestock prices and lower feed costs.

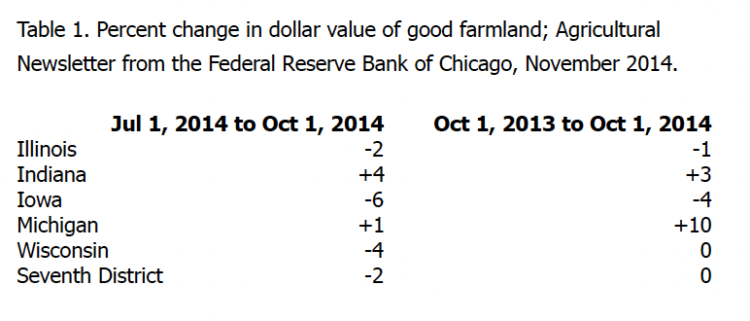

Data from the quarterly survey of farmland values con-ducted by the Chicago Federal Reserve Bank indicates that farmland values are softening. Changes in farmland values from July 1 to October 1, 2014 were generally down. The exceptions were Indiana and Michigan where farmland values were up. Farmland values from year to year, showed the same pattern.

Table 1. Percent change in dollar value of good farmland; Agricultural Newsletter from the Federal Reserve Bank of Chicago, November 2014.

There is no doubt that the current crop price situation is a large negative when it comes to the farmland values. Given the current price prospects, this will leave the direction of the farmland market uncertain with the likelihood of a modest decline, 0% to 5%, more likely than an in-crease. If the forecasts of tight margins in 2016 and 2017 materialize we could be in for a series of small declines in farmland value.

Cash Rent

Negative crop margins are also putting strong downward pressure on cash rents. Given the decline in crop prices, the overall cost of producing corn, soybeans, and wheat needs to be reduced. It is difficult to know exactly how this adjustment will materialize, but it is likely to be a shared reduction across several inputs. With the concern about margins in 2009, there were reductions in fertilizer and other annual inputs that occurred. However these tight margins were temporary because crop prices quickly rebounded. It does not appear a quick increase in crop prices is likely this time.

In lowering the per bushel cost of production, operating costs receive much of the attention, but there are also fixed costs. These labor and machinery and facility owner-ship expenses can be lowered by spreading these costs over more acres. Custom work, custom farming, and rent-ing additional land are all common strategies for lowering the per unit fixed cost. These dynamics lead to keeping the farmland rental market very competitive in spite of the current negative crop margins.

Looking at the year ahead, it will be important to explain to landowners the productivity of their farm, how farm productivity influences per unit costs, and the new economic environment of crop production. The probability of a decrease in average rent values seems likely, but the competitiveness of the rental market will make achieving a reduction difficult. Like the farmland market, a modest change in cash rents is expected, declining 1% to 5%.