Farmland Values and Cash Rent

December 9, 2020

PAER-2020-19

Author: Todd Kuethe, Associate Professor and Schrader Endowed Chair in Farmland Economics

Farmland Values

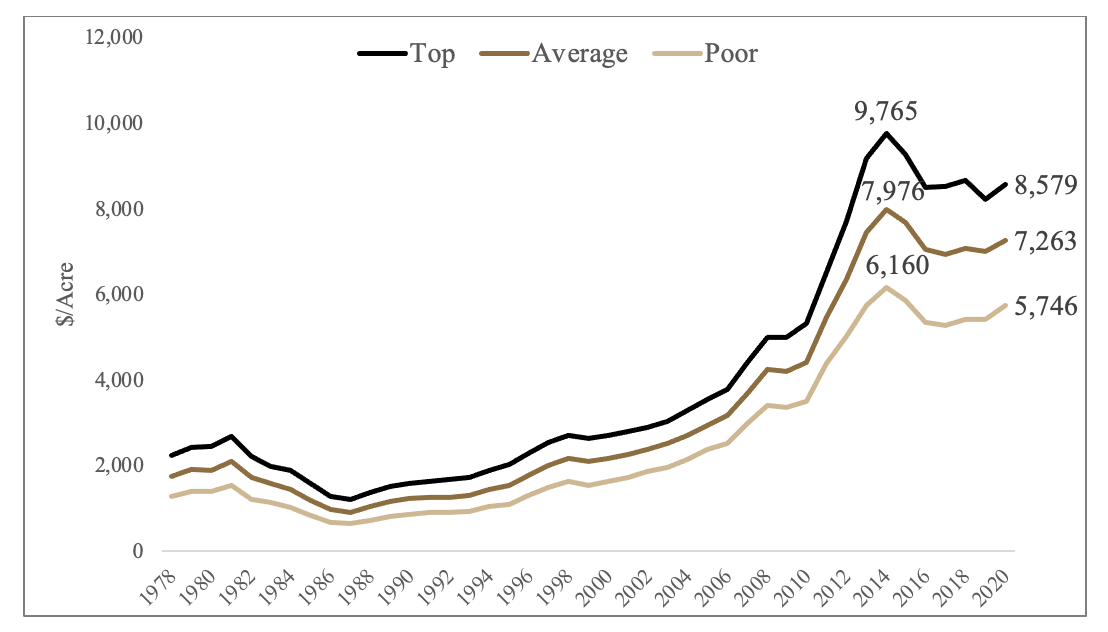

Indiana farmland prices increased in 2020, following several years of modest declines from the 2014 peak. The 2020 Purdue Farmland Values and Cash Rent Survey indicated that high quality land values increased by 4.5% to $8,579. Average quality land values increased by 3.2% to $7,236, and poor quality land values increased by 6.3% to $5,746. It is important to note that the price increases between June 2019 and June 2020 were concentrated in last half of 2019, and prices moderated slightly from December 2019 to June 2020 (Kuethe and Dobbins, 2020). The majority of Purdue Land Values and Cash Rent Survey respondents anticipated the modest declines to continue through the remainder of 2020.

Figure 1 Purdue Farmland Value Survey, 1978-2020

Farmland prices are determined by a complex set of economic forces, including expected returns from agricultural production, the cost of borrowing (or interest rates), and potential growth in future returns. As of this writing, recent results from the Purdue University-CME Group Ag Economy Barometer suggest farmers are optimistic for both current and future expectations of the agricultural economy which should place positive momentum on farmland values. In addition, the current economic certainty should ensure that interest rates and the costs of borrowing remain low. Low interest rates also provide support to farmland prices. Finally, given the high levels of uncertainty, many prospective buyers may choose to hold current farmland investments and delay potential sales. For several years, the limited supply of farmland on the market has bolstered sales prices. Thus, a number of forces are expected to provide positive support for farmland prices which may result in higher values in 2021.

However, one of the key lessons of 2020 is that many expectations will go unrealized and economic conditions can change quickly. The high degree of economic uncertainty will likely remain as long as the nation and our economy struggles with COVID-19. In addition, a change in Presidential Administration and Congress in early 2021 may impact a number of important policy decisions related to agriculture, the environment, energy, and trade. It is still far too early to tell how these changes will work their way through the land market.

There is a belief that farmland is the residual claimant of the farm sector. That is, the economic returns to agricultural production accrue to farmland. As shown in Figure 1, farmland prices rise and fall according to general trends in commodity prices and the cost of production. If our relationships with major trading partners and the demand for fuel, food, and fiber provided by agricultural commodities continues to improve, farmland prices will capture these changes. However, if trade and consumption patterns are adversely affected by broader economic uncertainty, farmland prices would also be expected to decline.

Cash Rental Rates

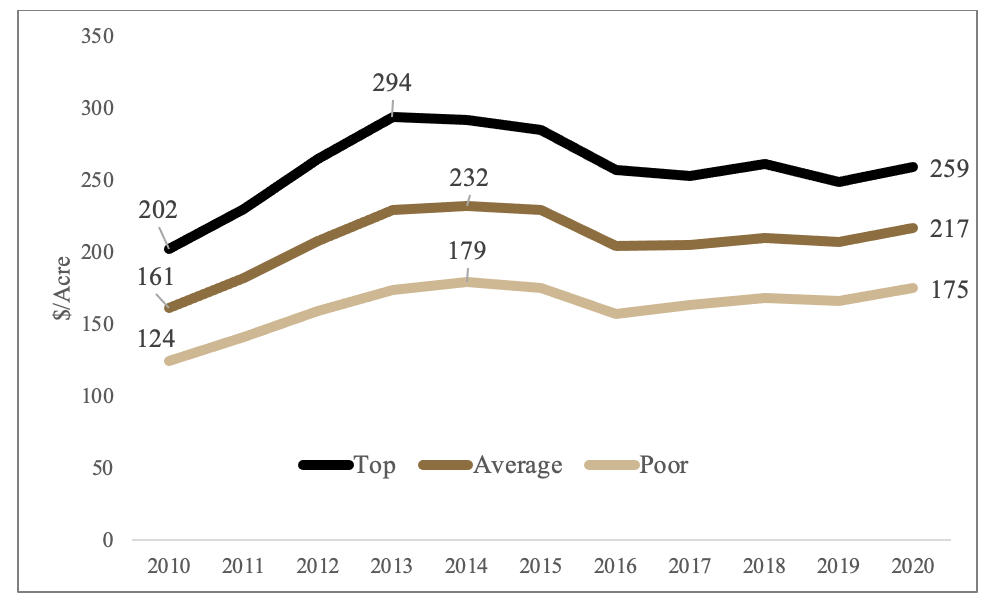

Over the last decade, cash rental rates across Indiana increased dramatically during the commodity price boom but then moderated as operating margins tightened. Since 2016, cash rental rates have held relatively steady, yet the most recent Purdue Land Values and Cash Rent survey reported an increase in cash rental rates from 2019 to 2020 (Kuethe and Dobbins, 2020). When 2020 cash rental rates were set, many farmers and landowners justified higher rental rates given decreasing variable costs of production and an optimistic view of the agricultural sector going into the 2020 growing season. For example, the Purdue Ag Barometer suggested more optimistic future expectations coming out of the 2019 growing season. However, as we all know, the economic conditions of 2020 were made surprisingly difficult following the emergence of COVID-19 in early Spring.

Figure 2 Indiana cash rents from the Purdue Farmland Value Survey for 2010 – 2020 by land quality

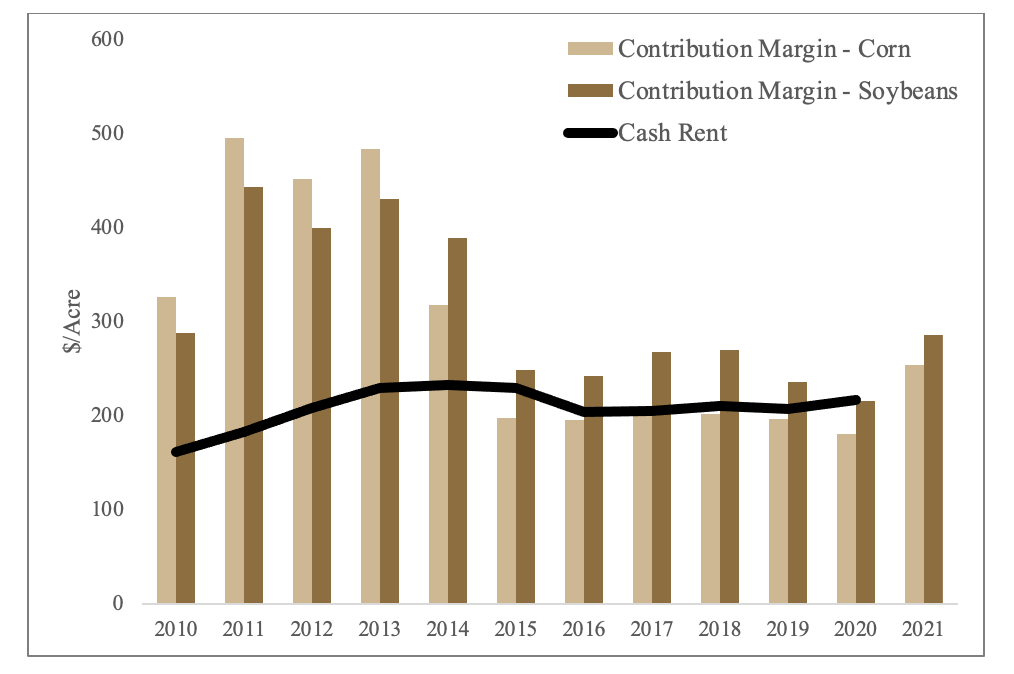

Cash rental rates are typically negotiated well in advance of the growing season, and as a result, rental rates reflect the expected costs and returns to production. For 2021, Purdue’s Crop Cost and Return Guide suggests and expected corn yield of 180 bushels per acre for rotation corn on average quality farmland. With an expected harvest price of $3.65, the anticipated market revenue is $657 per acre. The Guide also reports expected variable costs of $403 per acre. The difference between the market returns and variable costs is called the contribution margin or operator and land return. Thus, for 2021 the expected contribution margin for rotation corn on average quality farmland is $254 per acre. Thus, farm operators are expected to obtain $254 per acre to allocate to unpaid labor, investment in machinery and facilities, and cash rent. For average productivity farmland, rotation soybeans are expected to provide a contribution margin of $286 based on expected yield of 55 bushels per acre, $9.45 harvest price, and variable costs of $234 per acre.

As shown below, the expected 2021 contribution for both (rotation) corn and soybeans is above those of 2020. The contribution margin for rotation corn is 41% higher than 2020 and for soybeans is 32% higher than 2020. Increasing margins generally signal an upward pressure on cash rental rates, as farm operators will have additional revenues to allocate to labor, investment, and land. However, the figure also shows that for a number of years, the contribution margin for corn has been below the cash rental rate for average quality land. In addition, the 2020 cash rental rate of $217 per acre was above the contribution margin for both corn ($180 per acre) and soybeans ($216 per acre). As a result, farm operators will likely seek to reduce cash rental rates for the coming year, based on the experiences of 2020.

Figure 3 Cash rental rate and contribution margin for corn and soybeans for average quality land, 2010-2021

It is important to note that cash rental rates are determined by the marketplace. Thus, an agreement must be reached by the competing interests of landowners and farm operators. Both landlords and tenants should consider the potential for variation in costs and returns of agricultural production given current uncertainties. It is likely that in the current environment differences in contribution margins across farms will be significant. Reaching an agreement will take open and frank discussions on both sides of the lease agreement.

References

Kuethe, T.H. and C.L. Dobbins (2020) “Indiana farmland values increase but signal concern of potential COVID-19 slump” Purdue Agricultural Economics Report.