Financial Outlook Continues to Weaken

December 12, 2016

PAER-2016-22

MICHAEL BOEHLJE, PROFESSOR OF AGRICULTURAL ECONOMICS AND MICHAEL LANGEMEIER, PROFESSOR OF AGRICULTURAL ECONOMICS

U.S. net farm income is projected to drop approximately 17% in 2016 according to USDA. Incomes are expected to be lower for both crop and livestock farmers in 2016 compared to 2015. Farm asset values in the U.S. are projected to fall approximately 2% in 2016, and farm debt is projected to increase approximately 5%. The drop in farm income and corresponding increase in farm debt will put additional pressure on working capital. Surveys from the Federal Reserve Banks indicate that land values in the Corn Belt continue to show softer values, and debt servicing challenges are increasing.

Let’s now turn to prospects for farm income and the financial challenges for Indiana crop producers for the upcoming year. Using the 2017 Purdue Crop Cost & Return Guide, the contribution margin for rotation corn and rotation soybeans on average productivity land is projected to be $211 and $261 per acre, respectively, in 2017. Government payments per acre for the 2017 crop year are projected to be zero. Government payments for the 2016 crop year, which will be paid in the fall of 2017, are likely to be considerably smaller than those for the 2015 crop year, and are a very sensitive to changes in crop prices during the next few months. The payments for the 2016 crop year will also be impacted by 2016 county crop yields.

The contribution margin is used to cover machinery ownership costs, operator and hired labor, and cash rent and land ownership costs. These costs are often referred to as overhead costs or fixed costs. For average productivity land, overhead costs for 2017 are projected to be $333 per acre. After subtracting overhead costs from the contribution margins for corn and soybeans, the earnings per acre for a corn/soybean rotation in 2017 is projected to be a negative $96 per acre. This is the fourth year in a row for which budgeted earnings per acre were projected to be negative. Though actual earnings have differed from budgeted earnings for the last three years, actual earnings were negative in each year since 2014.

Low earnings will put pressure on working capital. A commonly used benchmark for the working capital to value of farm production is 35% or higher. The median value for Illinois FBFM farms was 52% in 2014, dropping to 45% in 2015. Even if the working capital to value of farm production declined another 7 percentage points in 2016, the average farm will still be above the 35% benchmark. However, Illinois FBFM farms in the lower quartile had an average value of just 9% in 2015. These farms will have very little maneuvering room to deal with low earnings in 2016 and again in 2017.

What about the longer term – when will this downturn end and farmers’ incomes improve. No one knows for sure, but three studies at Purdue provide some useful insight. The first looks at the farm safety net and its effectiveness in buffering crop farmers from the downturn – the farm commodity program through FSA and crop insurance.

The majority of Midwest corn and soybean farmers chose the Agricultural Revenue Coverage – County Option (ARC-CO) farm program option that in essence provides a payment per base acre of corn and soybeans that depends on the level of yields and prices. The crop insurance program provides an indemnity payment to farmers if prices and/or yields decline, depending on the program and coverage level chosen. The most common program choice is revenue protection (RP) which buffers gross revenue from price and/or yield reductions – coverage level choices range from 50% to 85% of market revenue.

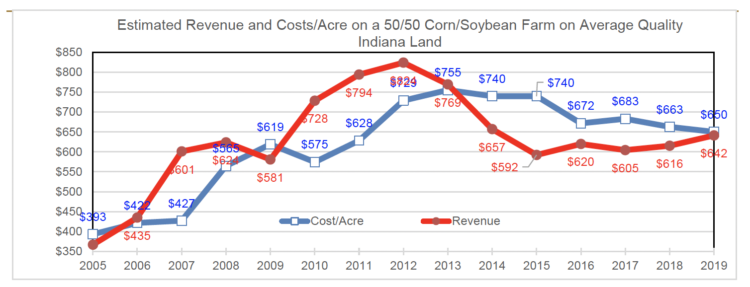

Figure 1: Estimated Revenue and Costs/Acre on a 50/50 Corn/Soybean Farm on Average Quality Indiana Land

When the crop insurance and farm programs were initiated, it was anticipated that they would provide an effective safety net for farmers who might encounter significant price and/or yield reductions due to changing market conditions or weather/disease events. But crop insurance indemnities adjust to market conditions over time. If prices systematically decline, the potential indemnity also declines. Farm program payments under the ARC-CO program are capped, and the level of support declines as market prices increase.

Budgeting analysis using price forecasts from FAPRI, and trend yields from WASDE for a 50/50 corn/soybean rotation on a White County case farm indicate that ARC-CO payments and crop insurance implements are projected to be zero or less than $10 per acre for even a low price scenario in 2017 and 2018. Given that government program payments account for almost 20% of the expected net farm income in 2016, these numbers suggest that the government safety net is not going to be a very effective buffer from the downturn in the longer run.

The second study uses budgeted data to project expected cost and returns per acre for a 50/50 corn/soybean rotation on average quality land in Indiana. A summary of this analysis is presented in the figure. The base assumptions for costs, prices and yields for these estimates come from Purdue University budgets for past years; and projections of trend yields, prices as reflected in futures markets and a 5% per year reduction in costs for future years. The bottom line of this analysis is that crop costs are expected to exceed revenues in 2017 and 2018, and then crop farmers have the potential to see costs and revenues back in balance by 2019. But notice a very important take-way – positive incomes in the longer run will primarily result from cost reductions rather than yield or price increases based on these current projections.

A third study looks at the financial vulnerability of farmers using a broader set of financial measurements than income. The focus of this study was to assess the financial performance of illustrative Midwest grain farms with different size, tenure status, and capital structures over a three-year period under the shocks of volatile crop prices, fertilizer prices, farmland values and cash rent.

These “stress test” results suggest that the financial vulnerability and resiliency of Midwest grain farms to price, cost, yield and asset value shocks are, not surprisingly, dependent on their size, tenure and leverage positions. Farms with modest size (i.e. 550 acres) and a large proportion of their land rented are very vulnerable irrespective of their leverage positions unless they have significant income from off-farm sources. These same modest size farms are more financially resilient if they have a higher proportion of their acreage that is owned rather than rented.

Larger size farms (2500 acres) with modest leverage (25% debt-to-asset ratio) that combine rental and ownership of the land they operate have relatively strong financial performance and limited vulnerability to price, cost, yield and asset value shocks. In addition, these farms can increase their leverage positions significantly (from 25% to 50% in this study) with only modest deterioration in their financial performance and a slight increase in their vulnerability.

These results suggest that farmers are resilient to price, cost, yield and asset value shocks because of the current low use of debt in the industry (currently a 13% debt-to-asset ratio for the farming sector) does not adequately recognize the financial vulnerable of many typical family farms to those shocks. Not nearly as many farmers are expected to face bankruptcy compared to the 1980s bust, but many will still face cash flow and debt servicing problems and will need to make major adjustments to reduce their costs or extend their loan repayment terms.

References:

Illinois Farm Business Farm Management. “Financial Benchmarks.” http://farmdoc.illinois.edu/finance/benchmarks.asp

Langemeier, M. and M. Boehlje. “An Update on the Farm Safety Net.” Farmdoc daily (6): 190, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 7, 2016.

Boehlje, M. and Li, S. “Financial Vulnerability of Midwestern Grain Farms: Implications of Price, Yield, and Cost Shocks.” Forthcoming in the Journal of Applied Farm Economics.