Food Price Outlook for 2023

January 10, 2023

PAER-2023-04

Jayson L. Lusk, Distinguished Professor and Department Head of Agricultural Economics

Last year’s food price outlook, which took a look back at prices over the course of 2021, was titled “The Year of Food Price Inflation.” Little did we know what was in store, because that title would have been more apt for 2022. Grocery prices rose 12% from November 2021 to November 2022 (November price data from the Bureau of Labor Statistics are the most recent data available at the time of this writing). Grocery prices “only” rose 6.4% over the same time period in 2021. It has been more than 40 years (dating back to the late 1970s) since grocery prices rose at rate now being experienced.

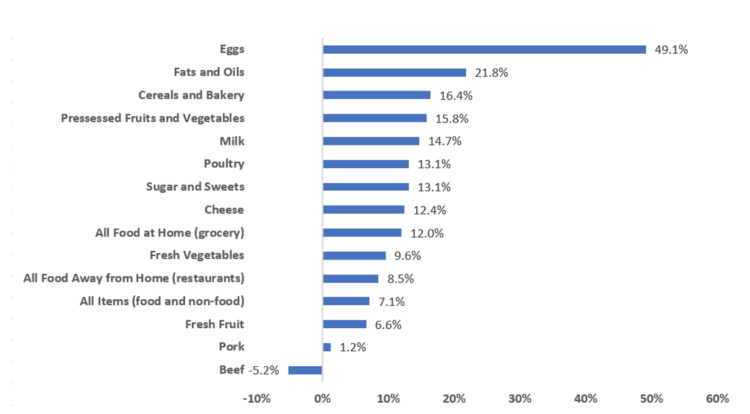

Figure 1. Annual Change in Food and Non-Food Prices (November 2021 to November 2022)

Figure 1 shows the annual increase in prices of major food items. Eggs have experienced the largest annual increase, rising more than 49% over the course of the past year. Avian influenza is the primary culprit for the hike in egg prices. More than 43 million egg-laying hens, representing about 11% of the total number of laying hens in the United States, have been depopulated in 2022 as a result of the disease.

Fats and oils have also experienced a significant rise in prices, increasing 21.8% of the course of the past year. Some have pointed to the rising share of soybean oil going into biofuels as a possible explanation for the increase, but analysis by the Center for Food Demand Analysis and Sustainability at Purdue University suggest this is only a minor contributor, and as such other factors beyond biofuels are the main drivers.

As shown in figure 1, most food items experienced higher rates of price inflation than did overall prices in the economy. Overall prices in the economy (food and non-food) increased 7.1% from November 2021 to 2022. The only food categories shown in figure 1 that experienced lower rates of food price increases were fresh fruit, pork, and beef. In fact, retail beef prices fell over the course of 2022, as producers liquidated breeding stock in response to high feed prices and drought in many parts of the country that affected availability of forage.

Although consumers were initially paying these higher prices without much pushback, there are several lines of evidence that consumers are beginning to tighten their belts. The monthly Consumer Food Insights Survey conducted by the Center for Food Demand Analysis and Sustainability at Purdue showed that back in February 2022, consumers most commonly said they were doing nothing different in response to the higher prices, but by the fall, the most common answers were that consumers were using coupons and switching from brands to generics. By August 2022, consumers reported that food spending was the household budget category causing the most stress. Moreover, an analysis of retail pork grocery scanner data shows that consumers’ pork purchases became more sensitive to price changes in 2022 relative to the past five years.

The U.S. Department of Agriculture Economic Research Service is forecasting a return to something closer to “normal” for food prices in 2023. At present, they are projecting grocery prices to increase between 3% and 4% over the course of 2023. Respondents to our Consumer Food Insights Survey also expect a decline in the rate of inflation during 2023. Whether these forecasts bear out remains to be seen. The Federal Reserve interest rate hikes to appear to have had some impact on the overall inflation rate, although this does not appear to have yet trickled down to food. Many analysts are projecting a recession during 2023, which would likely put downward pressure on spending and prices. According to our analysis, spending on fresh fruits and vegetables, and especially on food at restaurants and alcoholic beverages would likely to take the biggest hit if consumer incomes fall. While predicting individual food prices is always risky business, we are likely to see higher beef prices in the years ahead when the current reductions in breeding stock ultimately dent fed cattle inventories.