High Grain Yields Contribute to Low Prices

December 12, 2016

PAER-2016-18

Chris Hurt, Professor of Agricultural Economics

High yields were an important part of the story for the grain sector in 2016. Corn, soybeans and wheat all had record national yields and corn and soybeans had their third consecutive year of favorable production.

In the last three years, U.S. production has outpaced usage for corn, soybeans, and wheat. This means that end of year inventory levels have steadily increased. In fact, the stocks-to-use percentage for wheat is expected to be at the highest level in 30 years. Corn and soybean stocks-to-use percentages are the highest in a decade.

Abundant inventories of grains and soybeans mean low prices. Wheat prices for the 2016 crop are expected to be at $3.70 per bushel, the lowest level since the 2005 crop. Corn and soybean prices for the 2016 crop are expected to be at the lowest level since the 2006 crops. All three are reflecting decade-low prices. Unfortunately, costs of production have not nearly dropped back to the levels they were a decade ago, so margins for the 2016 crops will be narrow or even negative for many producers.

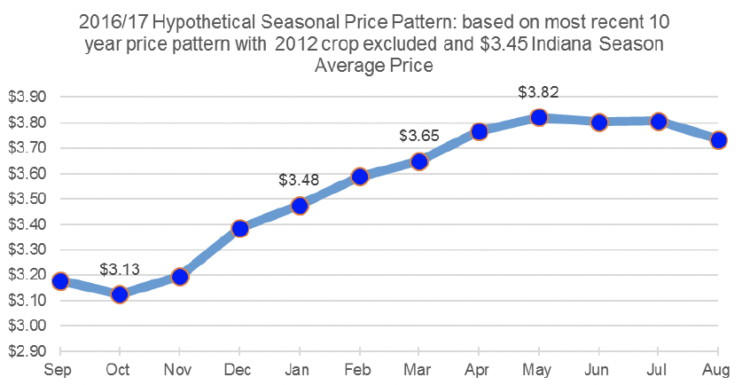

Corn prices received by Indiana farmers are expected to average $3.45 a bushel. This is down from $3.85 a bushel for the 2015 crop. The visual provides a hypothetical seasonal price pattern if Indiana prices follow a typical pattern of the past 10 years (without the 2012 crop) and average $3.45. That has January prices around $3.50 and reaching $3.70 to $3.80 in the spring or early summer.

If this were to be the price pattern, then storage into the late spring would be favorable for corn in commercial storage and especially on-farm storage. The goal is to acquire as much of the return to storage as possible. Keep in mind that these prices are averages for the state and they assume that current information does not change. Of course location has an impact on price levels, and new information can have an impact as well. As an example, a weather concern in South America’s major corn production region might provide opportunities for cash prices to rise closer to $4 or higher.

Corn acreage is expected to drop in 2017 as returns to soybeans are expected to be more favorable. Thus for the 2017 corn crop, the average p rice received by Indiana farmers is expected to be about $3.75 a bushel. Small additional price increases are currently expected for the 2018 and 2019 crops.

2016 crop ARC-County payments in Indiana are currently expected to be about $40 per corn base acre before sequestration. These would be payable in October 2017. The exact payments cannot be calculated until October 2017, so payment levels remain uncertain. In addition, my estimate is for the entire state (on average) so individual counties could be sharply different. At this point 2017 and 2018 ARC-County corn payments are expected to be zero. If there were payments from these crops, they would be made in October 2018 and 2019.

The soybean situation is different from corn and is providing stronger prices as compared to corn. The primary reason is the reduced production in South America at the end of their growing season last spring when production fell about 220 million bushels short of expectations. Many of those bushels were destined for the export market, and world buyers instead came to the U.S. for those soybeans this past summer. USDA revised the U.S. exports of soybeans upward by about 200 million bushels after May 2016. The pace of soybean exports has been robust this fall and the primary reason prices have been able to be above $10 per bushel.

Cash soybean prices in Indiana were at the higher $8 per bushel level prior to the unfavorable weather in South America. This causes us to ask the question, “If South America returns to normal production next spring will that turn soybean prices downward toward $9?

USDA’s current forecast is for 2017 South American production to increase by 253 million bushels, restoring them to normal production. If this happens, our rapid pace of exports this fall would slow sharply in the second half of the marketing year from March to August 2017. The implications for price are that cash bean prices would be stronger in the early part of the marketing year, like this fall and early winter.

South America now produces around 50% more soybeans than the U.S. so weather there is critical to U.S. prices this winter and through the first half of 2017. Brazil has had favorable weather with rain currently in the forecast. Argentina on the other hand has been dry with near-term forecast to stay dry. Weather uncertainty will likely support March futures in a range from $9.75 to $10.75 through February 2017. South American weather remains a potential wild card, as always.

If South America has normal or above yields, U.S. soybean prices could weaken into the spring and summer. U.S. acreage is expected to expand 3% to 5% for 2017 that will also provide potential downward pressure. Futures markets could drop back below $9.50 a bushel.

The current strategy favors pricing more beans this fall and winter than normal. Cash prices at $10 or higher should be considered. New crop cash bean prices at $10 or higher also look like an attractive level to start some pricing.

2016, 2017 and 2018 crop ARC-County payments from the FSA office are expected to be zero. If there were payments, they would be paid in October of 2017, 2018 and 2019.

More bean acres will likely keep 2017 crop beans at an average price around $9.50, but further acreage buildup in 2018 and 2019 could drop soybean prices back closer to $9 a bushel. Market prices in the next few years will be in the process of adjusting acreage to cause increases in corn and wheat prices but at the expense of more soybean acres and lower bean prices.

2016/17 Hypothetical Seasonal Price Pattern: based on most recent 10 year price pattern with 2012 crop excluded and $3.45 Indiana Seasonal Average Price