Increase in Indiana cash rent seems unlikely in 2020

December 18, 2019

PAER-2019-17

Authors: Craig Dobbins, Professor of Agricultural Economics and Todd H. Kuethe, Associate Professor, Schrader Endowed Chair in Farmland Economics

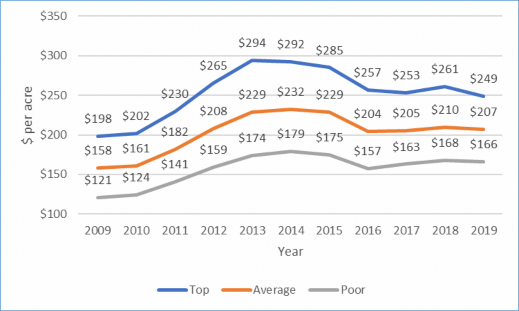

The 2018 Purdue Farmland Value Survey reported an increase in Indiana cash rent; however, the 2019 Purdue Farmland Value Survey reported a decline. Since the significant decline in ethanol production growth and a downward adjustment in cash rents from 2014 to 2016, Indiana’s cash rent market has remained fairly stable (2016 to 2019) across all three farmland qualities, as shown in the following figure. While cash rents have been fairly stable, variations in other items have provided producers continued challenges.

As 2019 draws to a close, it is likely many Midwest producers are hoping 2020 will be a more normal weather year. With 2019 resulting in record planting delays for the 2019 crop, yield results were better than many expected. The state average yield for both corn and soybeans were down from 2018 levels. The estimated 2019 yield for Indiana corn of 165 bu. per acre and the estimated yield for Indiana soybeans of 45 bu. per acre represent a decline of 15% for corn and soybeans. While yields at the 2019 level are not a production disaster, the decline from 2018 to 2019 is one of the largest year to year declines over the past 20 years.

With a decline in production and the supply of U.S. corn and soybeans, it seems reasonable to expect an increase in price. However, even with lower yields, world stocks of corn and soybeans are still larger than demand. This supply-demand situation continues to place downward pressure on the contribution margin (money left for unpaid family labor, return on the investments in machinery and storage facilities, and land). With limited price enhancement opportunities, that leaves reducing per unit costs of production as a way to improve margins.

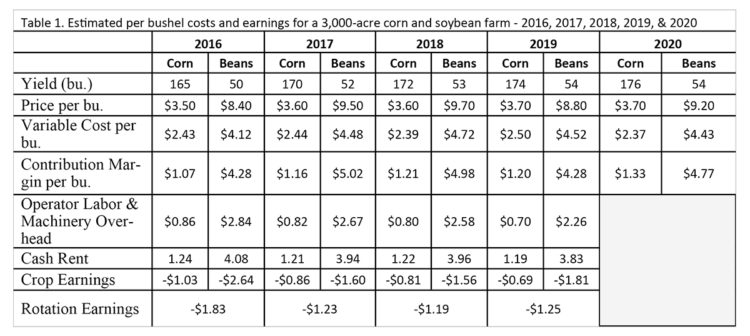

Comparing annual per bushel production costs from the Purdue Crop Cost and Return Guide indicates progress in lowering per unit costs of corn production have been made. In 2013, per unit variable costs for rotation corn was $2.83 per bushel on average farmland. In 2016, this cost was $2.43, a decline of 16%, Table 1. From 2016 to 2019, per unit cost has declined by only an additional $0.06 per bushel.

Table 1. Estimated per bushel costs and earnings for a 3,000-acre corn and soybean farm – 2016, 2017, 2018, 2019, & 2020

The change in per unit production cost for rotation soybeans has been different. In 2013, rotation soy-bean production costs were $4.43 per bushel. These costs declined to $4.12 in 2016, a decline of 7%. Since 2016, there have been increases in the per unit production costs to $4.77 in 2020, an increase of 11%.

Subtracting per unit production costs from the price of corn and soybeans provides the contribution mar- gin, the return to pay rent, unpaid family labor, and our investment in machinery and facilities. This estimated margin is $1.33 per bushel of corn and $4.77 per bushel of soybeans, an increase over 2019. Based on a corn and soybean rotation, this margin averages $3.05 per bushel or $246 per acre. In 2019, cash rent was $1.18 per bushel of corn or $207 per acre. After rent, this leaves only $39 per acre. While this is an improvement over 2019, a number this size indicates the likelihood of cash rent increasing is small and there is still downward pressure on cash rents. Additional adjustments to the cost structure of corn and soybean production in Indiana may still be needed.

Each analysis of this type will result in a different contribution margin. Each party to the cash rent lease will have a different opinion about the adjustments to make and the size of an adequate contribution number for unpaid labor, machinery and facilities investment, and the risk the tenant is taking. Getting to an agreement will take open and frank discussions.