Indiana Animal Agriculture: On the Grow!

June 15, 2018

PAER-2018-07

Author: Chris Hurt, Professor of Agricultural Economics

Animal agriculture is making a comeback in Indiana. The long run trends in the state have been for crop agriculture to become more economically important relative to animal agriculture, but there are some signs of reversal in the past 10 years.

Prior to 1970, the dollars of receipts from Indiana animals exceeded the dollars of receipts from crops. In those earlier years, most Indiana farms were diversified having both grain and animal enterprises. Much of the corn and forages produced on the farms was fed to animals and the animals were the cash generating enterprise. In addition, farms tended to be more similar in size than today.

The 1970s grain price boom helped foster rapid changes on farms. Some farms began to specialize in grain production and to exit their animal enterprises. Technologic changes were rapid in both grain and animal agriculture in the 1980’s and 1990’s requiring more intensive management skills thus favoring more specialization in either grain or animal production. Economies of size favored larger specialized operations which tended to cause some families to allocate their capital to either grain or animal production. The movement to the industrial production model (large scale) was also an influence in more specialized animal farms. Poultry and cattle feeding had shifted heavily toward the industrial model in the 1950’s and 1960’s and dairy and pork production began shifting to the 1990’s.

Indiana reached a low point in animal production about the year 2000 when the states sales receipts from animals fell to just 1.7% of U.S. animal receipts. More recently Indiana animal receipts have risen to around 2.2% of the U.S. in recent years. This means that Indiana animal agriculture has been in- creasing more rapidly than the country as a whole.

Source of Indiana Animal Expansion

So what is the source of the rise in Indiana animal agriculture? Data from the USDA’s National Agricultural Statistics Service (NASS) is used to help find the answer. The four growth enterprises are turkey, pork, eggs, and dairy.

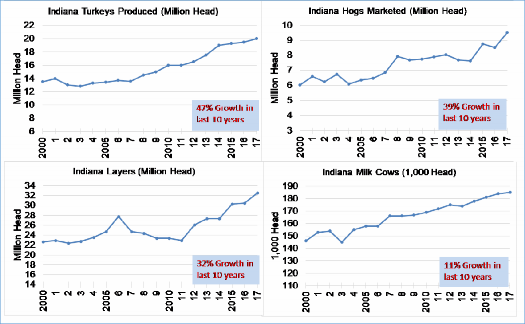

In Figure one, the four panel diagram shows the expansion of these enterprises in Indiana from 2000 to 2017. The number of turkeys produced in the state has risen to 20 million head representing a 47% increase in the past 10 years since 2007. The number of hogs marketed in Indiana rose to a record 9.5 million head in 2017. This was an increase of 39% in ten years. Egg layers rose to a record 32 million head rep- resenting a 32% increase over the past 10 years. Finally, milk cow numbers rose to 185,000 head, an 11% increase over ten years.

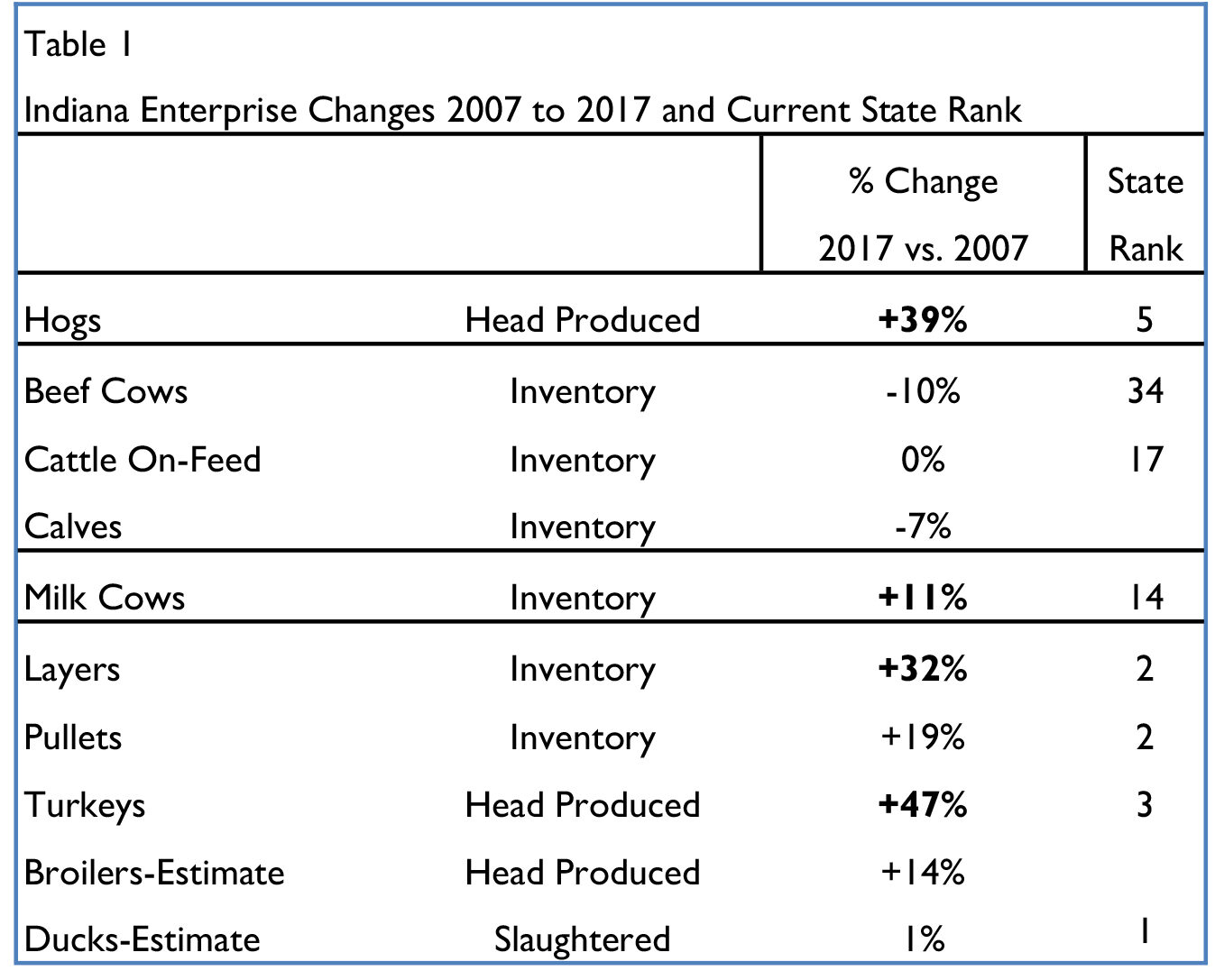

Table one shows Indiana’s rank among the states for industrial model in the each of these enterprises. Indiana ranks are as follows: Layers #2; Turkeys #3; Hogs #5; and Milk Cows #14.

There is more to the states animal industry beyond turkeys, hogs, layers, and milk cows and Table 1 provides this information. First broiler chickens and ducks are also important poultry enterprises for Indiana, but NASS does not report numbers because there is just one major producer in each category. So, broiler and duck numbers are estimates and not official USDA numbers. However, Indiana is commonly known as the #1 state for duck production.

The state’s beef sector has experienced some recent reductions, see Table 1. Beef cow numbers in 2017 at 210,000 are down 10% over the past decade and calf numbers are down 7%. Indiana’s rank among the states for beef cows has dropped to 34th. Indiana has a number of smaller animal industries that NASS tracks as well from sheep and goats to honey bees.

Summary

Indiana’s animal agriculture has been growing faster than the nation’s animal sector as a whole since 2000. The fastest growing sectors over the past 10 years have been turkey, pork, eggs, and dairy. The growth in these sectors has primarily come by the industrial model of large scale production units. The beef cow industry has never industrialized and has not shared in Indiana’s animal industry growth.

The growth can be attributed to Indiana’s natural resources and location. Indiana’s land resource is the foundation of agriculture and its location is advantageous to a large share of the country’s consumers. Indiana and western Ohio are in the surplus grain production region that is closest to the large human population base of the east coast and south- east. This provides advantages in lower transportation costs.

Indiana has been able to accommodate environmental concerns that came with industrial production somewhat more successfully than some other states. They have also been able to help Indiana leaders and citizens consider the economic advantages of expand- ed animal production and processing in adding jobs and economic activity in rural communities. In this way, livestock and livestock processing add value to the basic crop production of the state. Finally, there is a strong infrastructure and knowledge base that sup- ports our major animal industries.

References

USDA: National Agricultural Statistics Service: Vari- ous Livestock and Poultry Inventory Reports, 2017 and 2018.

USDA: NASS: Quick Stats Database: https://www.nass.usda.gov/Data_and_Statistics/index.php