Lower Grocery Store Food Prices: Good for Consumers and Bad for Farmers

December 12, 2016

PAER-2016-14

Ken Foster, Professor of Agricultural Economics

In the most recent (November 2016) report on food prices by the U.S. Department of Commerce, monthly year over previous year average retail grocery store prices for food consumed “at home” were down for the eleventh straight month. This is the longest such streak of declines since 1959-60 and tells a dramatic story of agricultural supply response.

It was less than a decade ago that many were expressing dire food security concerns as food prices rose strongly on demand from biofuel production and food demand in other parts of the world. Farmers and other participants in the food and agricultural industry responded with increased supply and now, after several good grain harvests in the U.S, agricultural commodity prices have fallen dramatically. Thus, the most important reason for lower grocery store prices this year are lower farm prices. Abundant harvests over the past three years have reduced the prices farmers receive.

In addition, lower prices for feed items like corn and soybean meal have increased animal production and lowered animal product prices from beef to milk. Food consumers are the benefactors this year. Record U.S. yields for corn, soybeans, and wheat in 2016 should keep grocery store food price increases at modest levels into 2017 with perhaps continued declines in the near term.

Lower farm prices filter through the supply chain in the form of lower grain-based food products. Retail food products in the Cereals and Bakery Products category, for example, were down 1.2% in October 2016 versus the same month the previous year. The year to date average decline in prices of those items has been 0.5% suggesting that the record 2016 corn, wheat, and soybean yields have already impacted retail prices.

The story is even more dramatic when looking at the category of meat, poultry, fish, and eggs. Those prices are down almost 5% so far in 2016 with beef and pork leading the way with 6% and 4% declines so far this year, respectively. Likewise, dairy product retail prices are down 2.5% so far this year compared to last. These animal-derived food proteins are partial substitutes for each other and thus a relatively large supply of one weighs down the prices of others. When there are relatively high supplies, such as now, then prices tumble to clear markets for these perishable products.

For the year to date, through October, only fruit and vegetable prices have increased on average since last year (about 1.4%) and even those are softening this fall with average prices for that category down 0.7% and 0.8% for September and October 2016 versus the previous year.

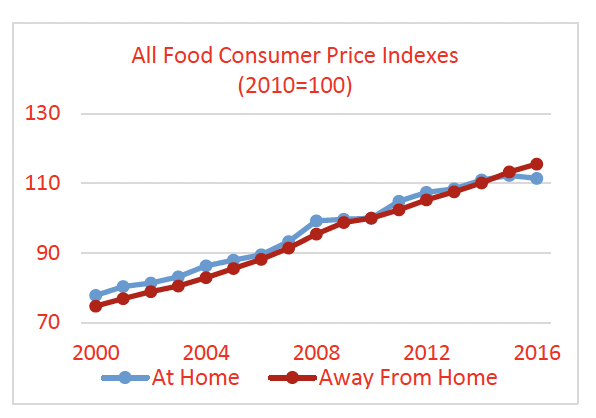

While grocery store prices are down, we also purchase food at fast food outlets and restaurants, a category called “away from home.” Prices in that category of food purchases have risen 2.6% with steady increases in each month this year versus the corresponding month in 2015. This suggests that while the commodity, or the farm portion, of food prices are declining, the cost of delivering marketing services is increasing as unemployment in the labor market rapidly declines. There is no reason to expect that this trend will change and is likely to continue into 2017.

All food costs, a combination of at home and away from home, will rise by only .5% in 2016. In 2017, USDA expects the increase to be 1.5% to 2.5%. The figure shows the trend in “at home” and “away from home” prices. Clearly, the level of prices has been steadily rising until this year for at home purchases. In the longer term, this overall upward trend is likely to continue as food marketing costs like labor, packaging, utilities, and transportation continue to rise.

All Food Consumer Price Indexes (2010=100)