Understanding the Growing Climate Solutions Act

February 2, 2022

PAER-2022-10

Megan N. Hughes, Ph.D. Student Agricultural Economics; Olivia Wyrick, Student Natural Resources and Environmental Sciences; Carson J. Reeling, Associate Professor; and Meilin Ma, Assistant Professor

A recent trend in the agriculture industry is the advent of “carbon farming.” This represents an opportunity for farmers to receive payments for carbon offsets generated by adopting specific management practices that sequester atmospheric carbon in agricultural soils. There are several challenges associated with these new programs, specifically related to the generation of high-quality offsets. In order to help protect offset quality and improve accessibility to these programs, Senator Mike Braun (R-IN) has introduced the Growing Climate Solutions Act (GCSA). In this brief, we introduce the basics of carbon farming, along with some of the associated technical challenges; discuss the contents of the GCSA; and highlight comments from Senator Braun on his goals for the bill.

Carbon Farming and Offset Programs

Carbon farming is hailed as part of the solution to one of today’s biggest challenges: climate change. The basic premise is that farmers can adopt certain regenerative agricultural practices (RAPs) such as conservation tillage and cover cropping, which would pull carbon from the atmosphere and store or “sequester” it in the soil. Reducing the amount of carbon dioxide in the atmosphere would reduce the rate of climate change caused by excess carbon emissions.

No-till and cover cropping sequester an estimated .31 and .37 MT of carbon/acre/year, respectively (USDA NRCS 2021). Under current adoption levels, these practices annually sequester the equivalent of 9% of the total carbon dioxide equivalent emissions from the U.S. agriculture sector (EPA 2021). The drawback is that these practices are costly to adopt on the farm. Thus, farmers often require incentives before making these types of managerial changes.

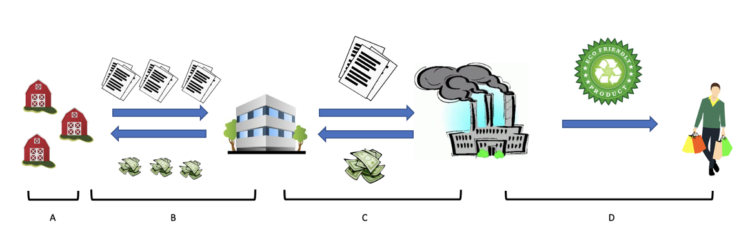

Increasingly, carbon offset programs are being created to supply these incentives. Figure 1 highlights key elements in a typical carbon offset program. Demand for offsets is driven by firms—including retailers, tech firms, and agribusinesses—that have set voluntary goals to reduce their own carbon emissions. Since carbon mitigation is often expensive, the firms may instead contract with “aggregators” to purchase offsets, which represent a quantity of carbon abated by some third party. In a similar manner to how a grain elevator aggregates the smaller quantities of corn produced by several farms into a large amount that is desired by a mill, carbon aggregators pay farmers a set price per acre or per metric ton of carbon sequestered for RAP adoption. The aggregators then combine that carbon into offsets to sell to larger firms to help them meet their sustainability goals, often driven by demand for sustainable goods from consumers.

Figure 1: Diagram of A Typical Voluntary Offset Market

Note: Farmers generate offsets via RAP adoption (A). Aggregators purchase small quantities of offsets from multiple farmers (B), then combine them for sale to downstream firms to help them meet voluntary sustainability goals (C). The firm uses these offsets to demonstrate progress in attaining sustainability goals to consumers (D).

Offset Quality

Carbon trading is not a new idea, as carbon offset programs have existed for decades. However, row crop agricultural producers have not been allowed to supply carbon offsets in previous carbon markets. This is due to concerns over the quality of offsets these producers can generate. By “quality,” we refer to the notion that offsets must represent an actual, verifiable quantity of carbon sequestered. Two key technical challenges are important for evaluating offset quality: additionality and permanence.

In order for sequestration funded by carbon offsets to be considered additional, the sequestration activity must result in abatement that would not have occurred without the offset payment (Thamo 2016). Anecdotally, we often hear farmers claim that they enrolled in carbon offset programs because they were planning to adopt some RAP anyway, and were happy to take the resulting offset payments as a windfall. Farmers who enroll in a carbon offset program under these circumstances are likely not generating additional sequestration as a result of the offset payment they receive—effectively, society could have received that sequestration for free. This is inefficient since offset payments could instead be used to fund more sequestration elsewhere.

In order for sequestration funded by carbon offsets to be considered permanent, the carbon must remain sequestered in the soil forever. This means that any carbon sequestering RAPs that generate offsets must be maintained indefinitely. If the sequestered carbon is released, the corresponding offset becomes effectively worthless. Participation in carbon offset programs—both for offset buyers and offset suppliers—is currently entirely voluntary, and hence there is no regulatory oversight of these programs. As a result, each aggregator is able to establish their own standards and protocols for calculating the total carbon sequestered by farms’ RAP adoption and for verifying the permanence and additionality of that sequestration. There are serious concerns that this regulation-free, “Wild West” environment creates a substantial amount of variation in the quality of credits available in carbon offset programs as they operate today (Thamo 2016; Ramseur 2009). This is important because concerns about offset quality may lead the firms that demand these offsets to seek alternative means of meeting their sustainability goals in the long-run. Establishing a transparent and consistent set of standards and protocols for quantifying and verifying carbon offset generation could increase confidence in offset quality and improve the long-run sustainability of carbon offset programs.

Policy Action for Improving Offset Quality

There is ongoing federal-level effort to improve offset quality by standardizing and improving transparency in voluntary offset calculation and verification. Senator Mike Braun (R-IN) introduced the Growing Climate Solutions Act (GCSA) in Spring 2021. The GCSA —which is currently awaiting committee assignment in the US House of Representatives—would establish both the Greenhouse Gas Technical Assistance Provider and Third-Party Verifier Certification Program as well as an advisory council to direct the Secretary of Agriculture on the program’s establishment. The program would allow the USDA to provide an informal endorsement of private sector technical assistance providers and third-party verifiers through USDA Certification. Third parties would then be listed on a USDA website so that they are easy for farmers to identify and access.

Additionally, the bill aims to reduce barriers to entry for farmers, ranchers, and private landowners into voluntary environmental offset markets, including carbon programs. The GSCA will accomplish this by publishing lists of recognized protocols relating to offset calculations, accounting principles, sampling methods, verification systems, and methods to account for common concerns with environmental credits (e.g., additionality and permanence). It will also establish an online database of self-certified third-party verifiers and technical assistance providers along with protocols and qualifications for self-certification.

While the GCSA had significant bipartisan support and passed swiftly through the Senate (92-8), it has been held at the desk of the House for nearly five months awaiting further action. The GCSA’s passage has the potential to benefit Hoosier farmers by creating a voluntary standard for the verification of carbon sequestration practices (i.e. planting cover crops, habitat restoration, reforestation) and the monetization of its benefits.

We sat down with Senator Braun to discuss his motivations for introducing this bill (full interview is available above and at https://youtu.be/OcP3Jygh32Q). The senator has been involved with farming and interested in conservation since his high school days. In fact, his own farm has been enrolled in the Conservation Reserve Program (CRP) and wetlands reserve programs for several years. Issues of climate change and how agriculture can play a role in carbon sequestration have not escaped his attention.

During our interview, Senator Braun emphasized the two primary objectives for this bill: keeping markets simple and ensuring market access for participants of all sizes. Regarding the enrollment and verification processes, he says, “the simpler you make it, the more understandable it is, and in this case, the more standardized it might be…” He maintains, “the last thing farmers want to do is go in and see this is more confusing than any program I’ve ever seen before.”

His vision would be that stakeholders could use pre-existing systems that they are already familiar with, such as the FSA, to access these markets that they may not have the resources to enter otherwise. These markets will continue to grow, and as it stands, the stakeholders are ahead of the politicians. The government should not stand to inhibit the development of the private markets, rather, according to Senator Braun, the role of the government should be to accommodate what is already in motion. He anticipates that these markets could one day be as sophisticated as the Chicago Mercantile Exchange. Generating standards today can help protect both the farmers generating offsets and the companies looking to purchase them as we move into the future.