Views on Fairness in Family Businesses and Financial Performance

August 16, 2017

PAER-2017-12

Author: Renee Wiatt, Family Business Specialist and Maria Marshall, Professor of Agricultural Economics

Fairness should be important in any business, but does a family’s definition of fairness affect income, profit, and tension in the business? The Purdue Initiative for Family Firms recently posed a question in their question of the month to family businesses: “Which of the following best describes how you define fairness in your family business?” We asked the same question in the 2012 Family Business Succession Survey. We then examined the relationship of how their definition of fairness was related to business incomes, profits, and the level of tension.

Family businesses can define fairness in one of four ways:

-

- Treat each member according to their needs

- Treat each member according to their contribution

- Treat each member the same regardless of their need or contribution

- Do not have a definition of fairness

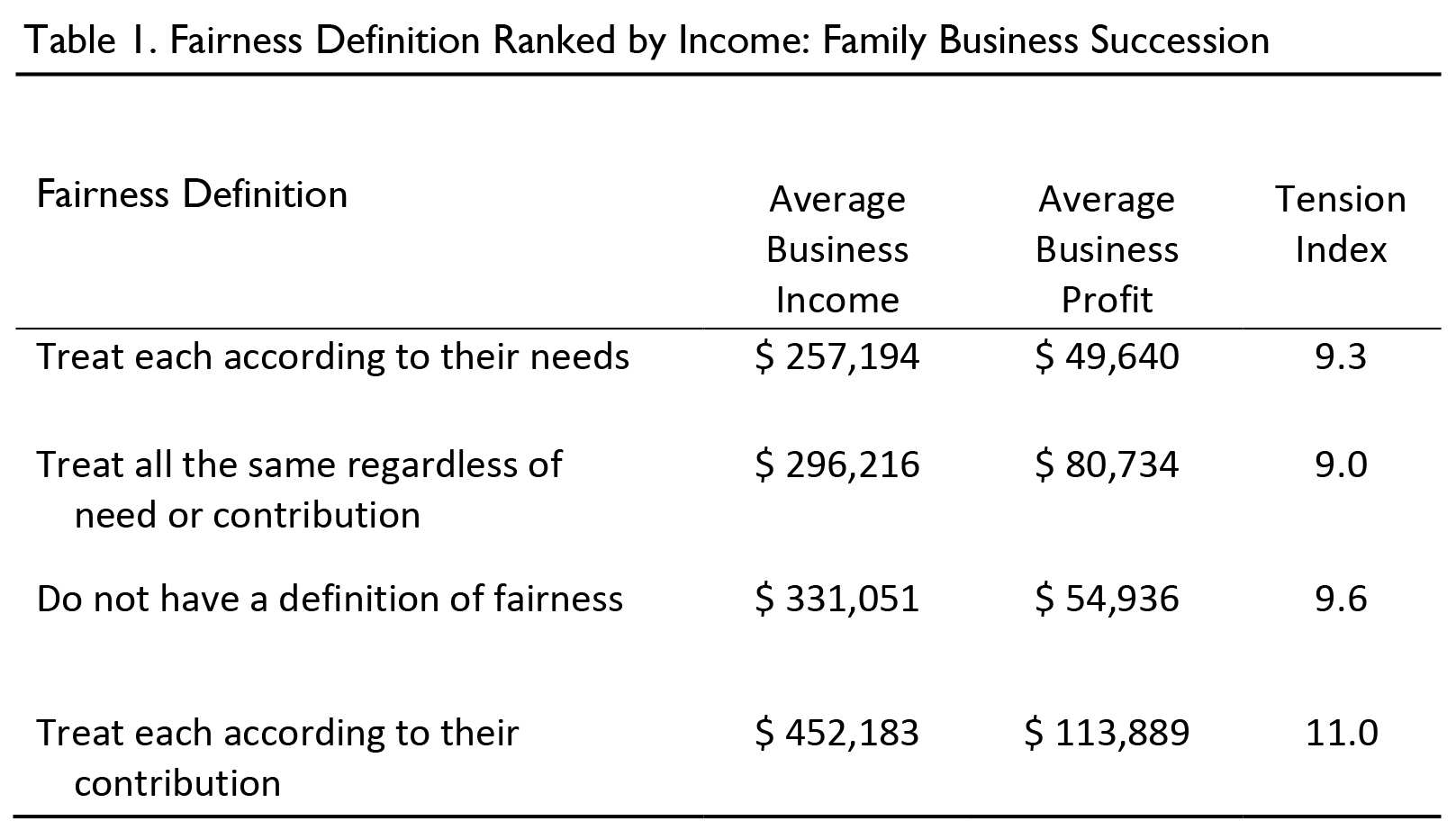

How were families divided among these four definitions? In the question of the month survey, 50% said they treated members according to their needs. The second strongest was treating members the same at 25%, (Figure 1).

Figure 1. Defining Fairness in the Family Business. Family Business Succession Survey and Question of the Month.

Responses were different in the Family Business Succession Survey where 34% said they treated members the same. Then, 25% said they had no definition of fairness, and 22% treated members according to their needs.

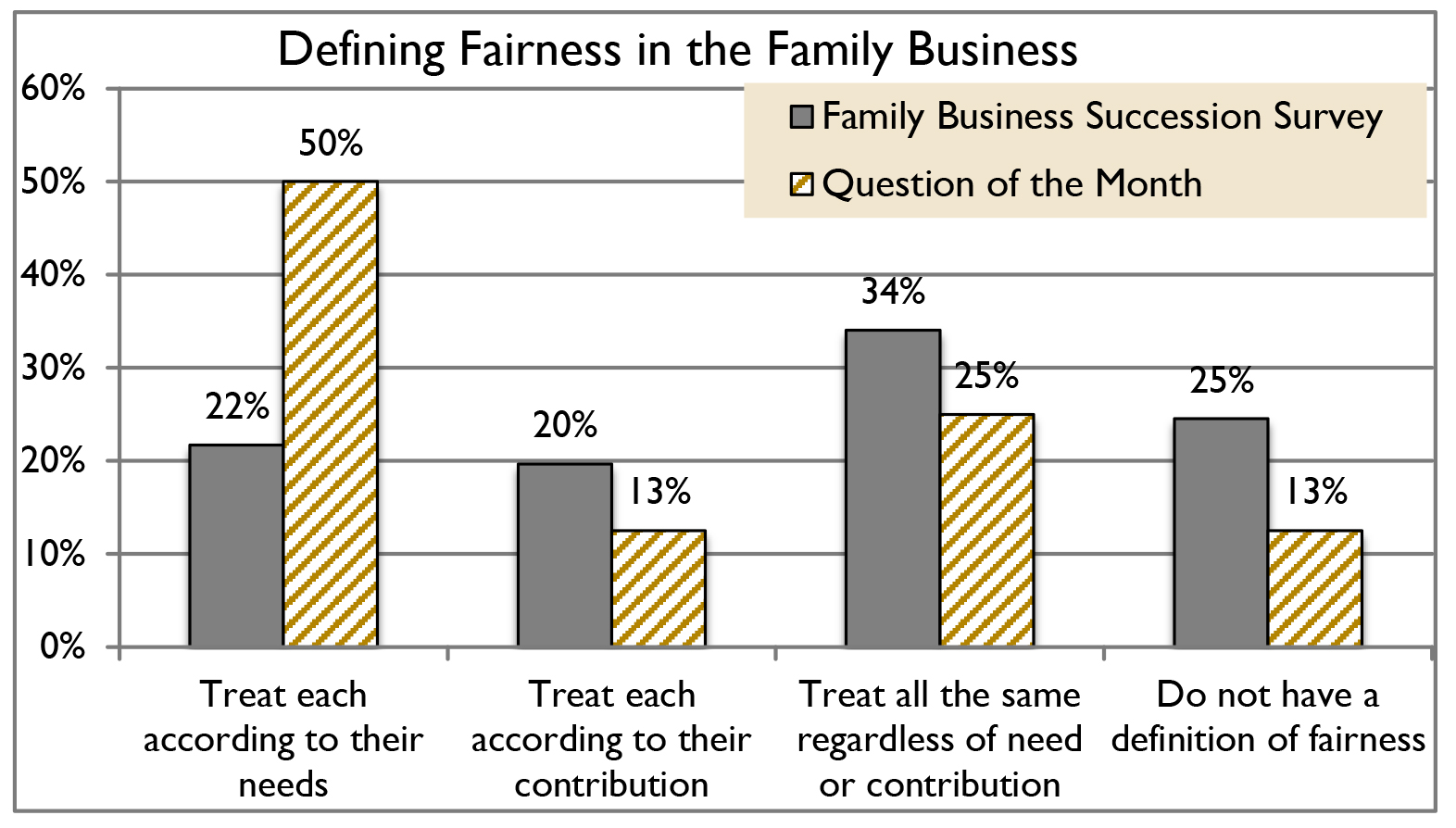

What is the relationship of how families defined fairness and income? That data comes from the Family Business Succession Survey. Table 1 ranks the four fairness definition groups from the lowest income to the highest income.

The group of families that treated each member according to their contribution reported the highest incomes. These are likely firms that are driven by the facts of the business and not just by emotions of the family members. They likely chose managers who are the most capable family members and give them more responsibility and compensation.

While family businesses that have the philosophy of treating each according to their contribution had the highest incomes, they also had the greatest internal tensions as measured in our survey. These high levels of tension could come from resentment that everyone is not treated equally.

Which definition of fairness group had the lowest incomes? Treating each according to their needs was the definition of fairness that proved most problematic for family businesses. Although tensions under this definition were fairly low, so were business incomes and profits.

Treating each member according to their needs could mean lower efficiency, reduced productivity, making less than optimum decisions for the business, and putting individual family member needs in front of the business needs. These could impose a drain on the family business, leading to lower incomes and profits.

We can infer from these findings that how a family defines fairness may impact financial performance. Businesses who put the most qualified family members in positions of responsibility and then reward them according to their contribution had the highest incomes and profit. Those businesses who defined fairness as treating each member according to their needs had the lowest incomes as a group. Secondly, higher tension may actually have positive impacts on the financial performance of family businesses.