What factors will shape a 2023 Farm Bill

January 10, 2023

PAER-2023-03

Roman Keeney, Associate Professor

At the end of September 2023, the most recent omnibus “Farm Bill” (passed in 2018) will expire. This deadline for reauthorization is one of a number of factors that promise an interesting 2023 for farm policy watchers. The short timeline for replacing (or extending) the 2018 farm bill is set against a backdrop of politically divided government and the lingering effects of economic shocks that have triggered tens of billions in ad hoc and emergency transfers to agricultural households.

Farm support in the current economy

The period covered by the 2018 farm bill (crop years 2019 – 2023) have yielded some of the largest direct government transfers to agriculture this century. Trade adjustment payments for crop producers followed by multiple COVID relief spending bills have made clear that factors outside of the agricultural economy and policies that directly target agriculture are largely determining how government impacts US farm fortunes.

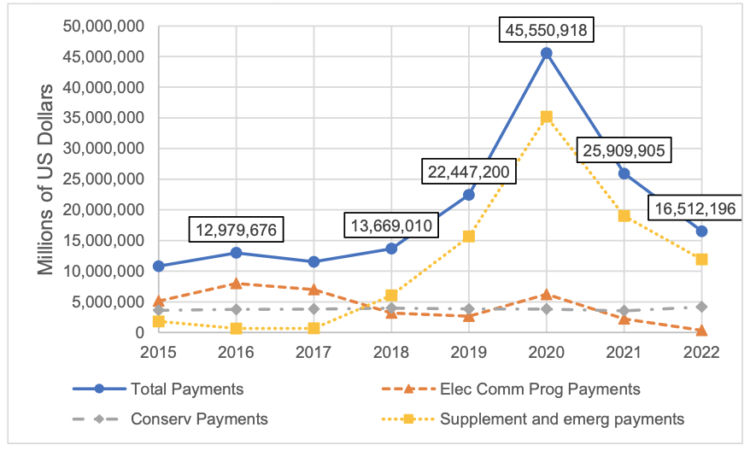

Figure 1a. Farm direct payments (in millions of US dollars) from 2015 to 2022

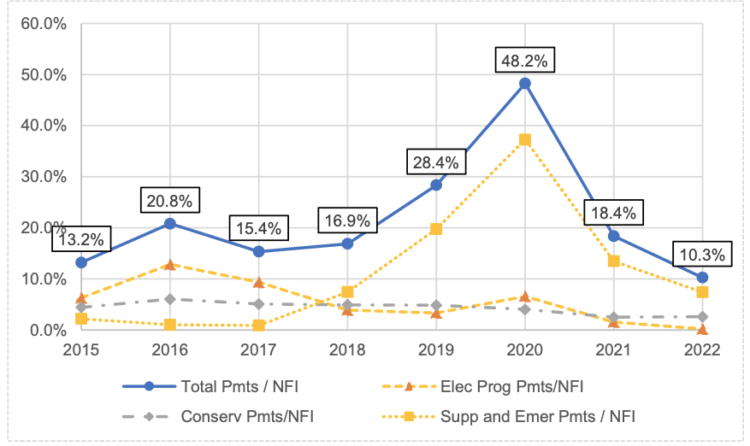

Figure 1a shows that peak payments to producers occurred during 2020, when government direct support to agriculture totaled more than $45 billion while accounting for nearly one half of national net farm income (see figure 1b). These graphs (figure 1a & 1b) make clear the role of ad hoc and emergency programs, temporary government relief efforts, in supplementing farm incomes. As we near the close of the current farm bill’s authority, we see that total payments to farms have declined and are near the levels from before the Trade War. Importantly, high expected prices (relative to the previous five years) are well above payment triggers for most commodities causing expected 2022 and 2023 program payments under either of the elective commodity programs[1] to be very low (under $1 billion in aggregate for 2022).

Figure 1b. Farm direct payments (as percent of net farm income) from 2015 to 2022. Source: Author’s calculations using current USDA farm support and income data.

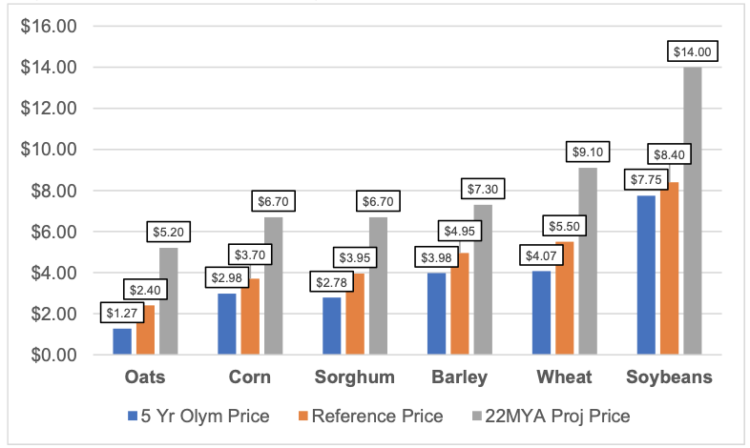

The disappearance of commodity program payments is illustrated in figure 2, where we compare marketing year average prices to the five-year Olympic average and reference prices that set levels for triggering payments. Increasing prices over time make it less likely that producers will qualify for payments by design. The large difference between 2022 marketing year average (MYA) and reference prices codified into the farm bill’s commodity title indicates that prices (and the current cost of production) are well above the expected output and input pricing at the time the 2018 farm bill was passed. The costs and returns in agriculture of the current inflationary environment highlight a limitation of using output prices in isolation for program triggers in basic farm safety net programs – namely that payments can disappear while real returns are declining.

Figure 2. Price loss coverage reference price levels vs MYA, 2022

Source: USDA Price loss coverage program data sheet for 2022 crop year

Dimensions of the farm bill debate

Policy-makers have signaled some priorities for new farm bill legislation in the past year of legislative action and hearings. Already, incoming Republican leadership for the US House of Representatives has indicated a desire to deemphasize climate policy within the farm bill relative to e.g. its significance in 2022’s inflation reduction bill passed by Democrat controlled government. Political debate is unlikely to focus on specifics of the commodity title which now has a diminished role in favor of crop insurance in protecting farm incomes. However, producers may expect to see some incentivized production practices (either in the commodity title or elsewhere) for voluntary practices viewed as regenerative or environmentally friendly in a manner that furthers climate goals if they can be made consistent with other priorities of the legislation.

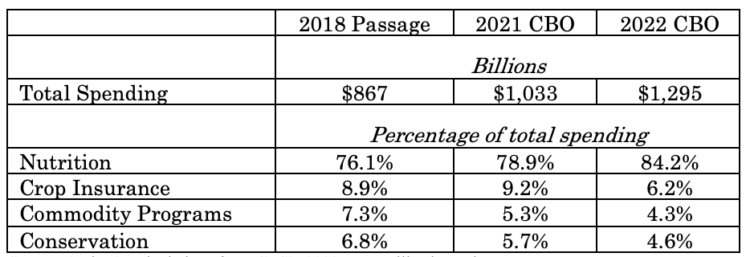

The overall budget, and particularly spending on the nutrition title (primarily food assistance for low-income households) should continue to be the most politically divisive component of the farm bill debate. In table 1, the final column indicates that the most recent congressional budget office (CBO) baseline[2] for farm bill spending totals nearly $1.3 trillion over ten years with approximately 84% of that money spent through the nutrition title. The first column of table 1 indicates that at the time of passage it was estimated that nutrition programs were expected to command only about three-fourths of the farm bill budget.

Table 1. Budget estimates for 2018 Farm Bill programs, ten years

Source: Author’s calculations from CRS’s 2022 Farm Bill Primer sheet

The performance of the economy and the increasing economic stress on households at the low-income margin in the past two years has dramatically changed the shape of the farm bill spending pie. We can see just how recent this shift in the economy occurred by comparing the 2nd and 3rd columns of table 1 which indicate that most of the adjustment in expected total and nutrition spending occurred in the twelve months between spring 2021 and 2022.

The remaining entries in table 1 indicate a declining role for other major spending categories (commodity programs, conservation, and crop insurance). The relative strength of the agricultural economy (net cash farm incomes are trending up relative to twenty year averages) would cause farm bill spending to shift away from agriculture programs through normal economic mechanisms (high commodity prices, land rents that disincentivize conservation enrollment) even if there weren’t such rapid increase in nutrition spending.

Looking back on the past five years of pertinent policy debate, the role of eligibility and limits on total support have surfaced with political champions for reform in farm commodity and nutrition spending. The pressure to enact new law that spends less than the estimated budget heightens the role of payment limits and eligibility requirements in the debate. The setting of income thresholds and establishment of required practices[3] by payment beneficiaries are both qualifiers that could be adjusted to more narrowly define target recipients in the name of farm bill reform (and deficit reduction).

Concluding remarks

As 2023 unfolds the first signpost on the road to a new farm bill will be the release of an updated baseline for the Congressional Budget Office. Once that is available, the total estimated mandatory spending over a ten-year horizon of current law will set the limit for any changes and allow debate to begin on what the target spending level should be (i.e., whether and how much the farm bill should contribute to deficit reduction). Competing bills from House and Senate Ag committees will be scored relative to that baseline and we will see side-by-sides comparing the bills in terms of their primary agenda items and priorities. From there, it’s a race against the end of fiscal 2023 clock to complete the work to find a compromise that merits passage and sets the ground rules for farm support and food assistance.

The politics of farm bill passage are not always obvious from basic partisanship. The marrying of commodity and nutrition programs have long supported a rural-urban coalition that has allowed all sides to claim farm bill passage as a “win”. The timing of the current bill – during a 2023 that could see several presidential campaigns launch and new Republican leadership in the House looking to advance its agenda as a governing alternative – is not ideal for the pace of passage that would meet the October 1 expiry of the current farm bill. Any emerging political complications during 2023 will only be amplified next year such that as we get closer to October 1 in 2023 the more likely we are to get a direct extension of current programs. While this would alleviate uncertainty about mechanisms for support it would do very little to deal with total spending growth in the bill and the inability of commodity programs to assist farmers when price increases are met with faster rising costs, or when shocks from the broader economy put agricultural incomes in peril.

[1] Price loss coverage (PLC) and Agricultural Risk Coverage (ARC) are the two programs farmers must make an ‘election’ for their participation. These have been the primary commodity payment programs providing direct support to producers since the elimination of the direct payment programs that were replaced in the 2014 farm bill.

[2] New 2023 farm legislation will not be written using the 2022 CBO baseline – this is just the most recent baseline available at the time of this writing. A new CBO baseline for the farm bill will be produced in spring 2023 and will set the budget limits on the overall bill as well as the expected allocation between titles and programs that would occur if the 2018 law were to continue unchanged 10 years into the future.

[3] Commodity program recipients must comply with certain conservation planning and many low income

households must demonstrate efforts in gaining employment or training to qualify.